Rat's Rant: What hot, what's not and ... OPEC

Published 18-OCT-2019 10:25 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

On the 18th day of October 1973, OPEC declared an oil embargo.

The Organisation of the Petroleum Exporting Countries declared an oil embargo on any country that supported Israel during the Yom Kippur War, fought between Israel and a coalition of Arab states.

The embargo led to a massive oil shortage and had long-lasting economic effects in the United States and Europe.

The embargo was lifted in March 1974 which may or may not be the year that I was born.

What's hot

Northern Cobalt Limited (ASX:N27)

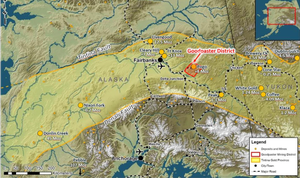

Northern Cobalt closed up 110% to finish at 8.3c on $1.1 million stock traded. The reason: an acquisition of a gold project in Alaska right next door to Northern Star's Pogo Mine which has a total endowment of 10 million ounces of gold and is currently producing at a rate of 300,000 ounces per annum.

They also announced they raised $1.5m @ 3.5c which was done through the good boys and girls at PAC Partners along with the good girls and even more girls at Taylor Collison - both were kind enough to offer me as much stock as I wanted..... (that's a joke I got peanuts and gave it all to the old man Billy who hopefully will put me back in his will).

The poor bloke has had more Hotel California type trades (that's a stock that's easy to get into and very hard to get out of for any of the newer readers) then The Eagles themselves.

The stock did actually trade as high as 12c intra day, but it seems like there must have been a few flippers in the book as it closed pretty weakly.

I dare say you will be reading about them here in the not too distant future, but some details on today's news are listed below:

Binding agreement to earn up to 80% of the Goodpaster Project, adjacent to Northern Star’s Pogo Gold Mine, Alaska. Placement and Corporate Update.

- The Company has executed a binding term sheet with Millrock Resources Inc (TSXV: MRO) to earn up to an 80% interest in the brownfields Goodpaster Project in Alaska

- The Goodpaster Project surrounds Northern Star’s (ASX: NST) Pogo Mine, which has produced 4 Moz @ 13.6g/t at 300koz pa; reserve/resource of over 6 Moz Au (ASX: NST Announcement 19/9/2019)

- Northern Cobalt has secured an exclusive option for up to 100 days to complete due diligence and provision drill access road works in preparation for the 2020 drilling program

- Drilling to begin in Q1, 2020 on high priority drill targets immediately adjacent to the recent NST announced Goodpaster Discovery “2.3km strike open in all directions” (ASX: NST Announcement 16/9/2019) within 450m of the claim boundary

- Initial exploration program will include 7,500m of diamond core drilling

- Joint lead managers PAC Partners Securities and Taylor Collison have firm commitments for a

placement of $1.5m

You can read the full announcement here.

Metalsearch Limited (ASX:MSE)

Metalsearch closed up 28% to finish at 1.6c on $200,000 stock traded. The reason: the successful acquisition of 100% of the share capital in Abercorn Kaolin Pty Ltd, which owns the Abercorn High Purity Alumina (HPA) Project located in Queensland.

Some of you would remember reading about them in August when they first announced the acquisition, the stock went from 0.006c to a high of 2.2c. At the time of the announcement, it was subject to due diligence which has now been completed.

The Abercorn Project is situated approximately 135km south of the deep-water port of Gladstone and 125km west of the deep-water port of Bundaberg in Central Queensland. Both of these major ports are connected to the project by sealed roads. The Burnett highway bisects the property.

Some details on today's news are listed below:

Acquisition of Abercorn High Purity Alumina Project Complete

- Acquisition of 100% of the share capital in Abercorn Kaolin Pty Ltd, which owns the Abercorn High Purity Alumina (“HPA”) Project located in Queensland, Australia successfully completed.

- Company well capitalised to fund planned exploration activities.

- Planning for a 2000m Reverse Circulation (“RC”) drilling program well advanced, with the objective to define a maiden Inferred Mineral Resource and further test the extent and scale of the Abercorn Project’s minerlisation.

- Mr John Goody and Mr Keong Chan appointed to the Board.

Read the full announcement here.

Mach7 Technologies Limited (ASX:M7T)

Mach7 closed up 21% to finish at 82.5c on $2.8 million stock traded. The reason: they released they're quarterly report along with a business update and clearly the market liked what they read.

The company recorded its strongest quarterly cash flow result in its history, generating $1.7 million of positive operating cash flows, taking its bank balance to $4.3 million at the end of the quarter which is almost as much as I have in my bank account at the moment (again joke - I am just a poor kid from Campbelltown who lives in a fibro shack and enjoys entertaining you in the evening or maybe even boring you depending on your personality).

Mach7 Technologies develops innovative data management solutions that create a clear and complete view of the patient to inform diagnosis, reduce care delivery delays and costs, and improve patient outcomes.

Mach7’s award- winning enterprise imaging platform provides a vendor neutral foundation for unstructured data consolidation and communication to power interoperability and enables healthcare enterprises to build their best-of-breed clinical ecosystems.

Some details on today's news are listed below:

Strongest Quarterly Cash Result in M7T History

Q1 Highlights:

- $1.7 million positive operating cash flows

- $4.7 million cash receipts from customers

- $4.3 million cash at bank

- Largest US sales order won $5.7 million

- $10.7 million service and support fees under contract, including $8.5 million CARR

You can read the full announcement here.

Ansila Energy Limited (ASX:ANA)

Ansila closed up another 15% to finish at 3.1c on $669,000 stock traded. The reason they are up is because they have changed their name from Pura Vida to Ansila Energy.

Read more in yesterday's rant: Rat's Rant: What's hot, what's not and ... Walt Disney

What's not

Zip Co Limited (ASX:ZIP) and Wise Tech (ASX:WTC)

Zip Co closed down 11% to finish at $4.64c on $52 million stock traded. There was no news, but I presume it was because of a note written by the the girls and boys at US-based J Capital Research.

They released a 31-page report accusing another software logistics company, Wise Tech of overstating profits by as much as 178 per cent, and being "more of a clunker" than a global behemoth.

Wise Tech Limited closed down 10% to finish at $30 on $53 million stock traded and they also went into a trading halt at around lunchtime because of the note that the J Capital Research girls wrote and was released overnight.

Even the old market darling After Pay took a hit ...

I won't bore you with 31 pages from some US based mob that I have never heard of, but fingers crossed they are from Colorado and have been spending too much time on the recreational marijuana rather than the medicinal stuff.

I own a few of these for clients hence why I hope they haver been on the Harry Hope!

Go Hard

The Rat

Note: The idea of this report is to be informative and hopefully point out some stocks that you wouldn't ordinarily have seen during the day. This report IS NOT personal advice. Finfeed DOES NOT PROVIDE personal advice. All advice included in The Rat’s Rant is General Advice. Please refer to the General Advice Warning below.

The views expressed in this report are The Rat's and may not necessarily reflect the same views as Finfeed. It is very important to refer to the ASX website for information on any companies / stocks that are contained in this report and as always please consult your financial adviser before acting.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.