Pursuit Minerals expanding its PGE-Ni-Cu exposure in Yilgarn Craton

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

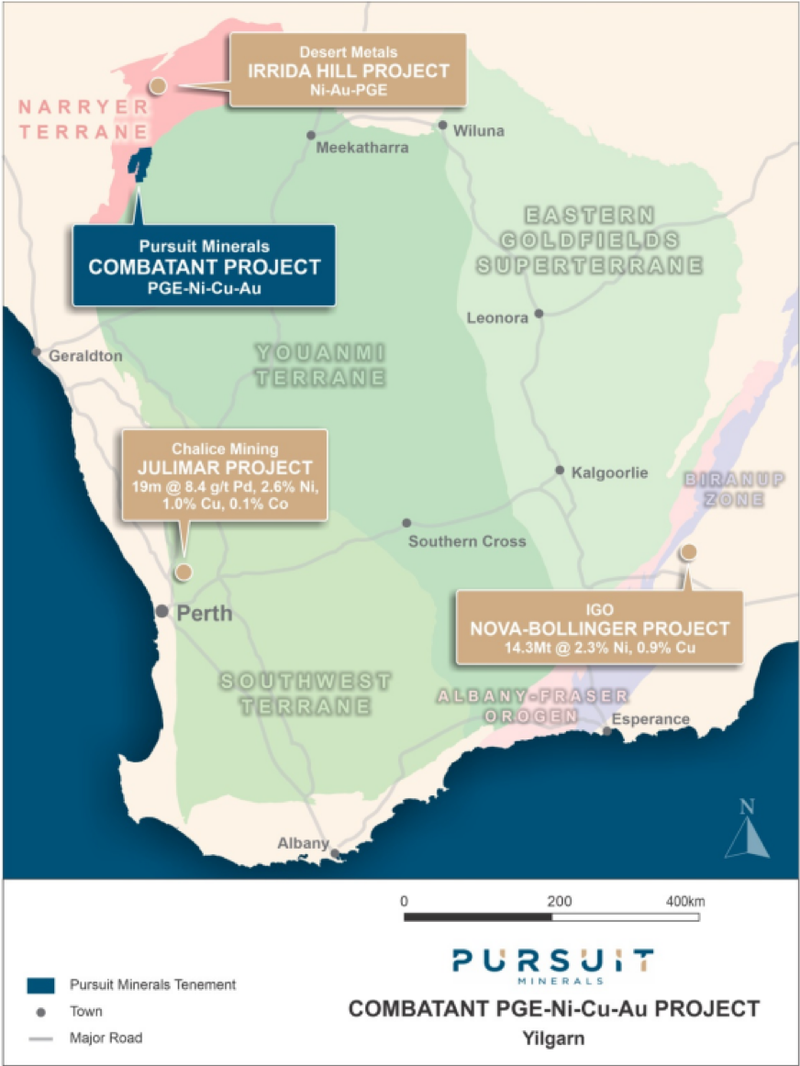

Pursuit Minerals Ltd (ASX:PUR) announced on Friday that it had applied for two exploration licences covering 404 square kilometres which comprise the Combatant PGE-Ni-Cu (platinum group elements-nickel-copper) Project.

This represents a continuation of the group’s strategy to target this type of mineralisation in a relatively low-cost way, particularly focusing on the Yilgarn Craton region which offers further potential for exploration success due to its gold endowment.

The north-western margin of the Archean Yilgarn Craton is a new frontier for PGE-Ni-Cu mineralisation associated with intrusive mafic to ultramafic rocks.

The discovery of PGE-Ni-Cu mineralisation on the Julimar Project held by Chalice Gold Mines Limited in 2020, and Sirius Resources’ Nova project demonstrated that the margins of the Yilgarn Craton hold the potential for significant new world-class discoveries.

The Combatant Project shown below occurs on the north-west margin of the Yilgarn Craton, and Desert Metals with its Nayyer project is progressing exploration following an airborne electromagnetic (AEM) survey.

Pursuit to use a Julimar/Nova type strategy at Combatant

Pursuit has already made strong progress in establishing a portfolio of projects with this underlying focus.

In December, the company entered into a binding acquisition agreement to acquire a 593 square kilometre tenement package (one granted exploration licence and three exploration licence applications known as Calingiri East, Calingiri West, Bindi Bindi and Wubin).

This comprised the Warrior Project, located 20 kilometres north and 170 kilometres north-north-east of Chalice Gold Mine’s (ASX: CHN) major PGE-Nickel-Copper discovery on the Julimar Project.

Commenting on Pursuit’s decision to apply for the Combatant tenements, as well as highlighting the group’s progress with the Warrior Project, managing director Mark Freeman said, “Following success at our Warrior project, the Combatant tenement applications represent a low-cost way to add more PGE-Ni-Cu prospective ground to Pursuit’s portfolio focused around the margins of the Yilgarn Craton, with the bonus of possible gold mineralisation.

‘’Recent success by explorers such as Chalice, Sirius and Desert Metals has demonstrated that these significantly under-explored terrains are highly prospective for significant PGE-Ni-Cu mineralisation.”

Consequently, Pursuit intends to employ a similar exploration approach on the Combatant Project to that which led to the discovery of Julimar and Nova-Bollinger.

Pursuit intends to undertake its initial fieldwork on the Combatant Project during the April-June and July-September quarters 2021.

This work will consist of prospect scale geological mapping, rock chip and soil geochemistry, along with planning for electromagnetic surveys, to be followed by an initial drill program.

Preparatory work on the project has commenced and it has focused on the interpretation of aeromagnetic data covering the two tenements in order to identify magnetic anomalies which are potentially due to mafic and ultramafic intrusions.

MLEM surveys focusing on six targets at Calingiri East

The Warrior Project covers a number of known mafic-ultramafic rock units and unexplored magnetic and gravity anomalies suspected to be mafic and ultramafic intrusive rocks.

Just a fortnight ago, moving-loop ground EM (MLEM) surveys were commenced with a view to following up six highly prospective targets on the Calingiri East Project which were identified from the airborne EM survey completed in February.

The MLEM program is designed to further refine the orientation and position of the six EM anomalies and provide targets for drill testing.

Calingiri East now has an estimated 7,000 metres of combined strike length of Airborne EM anomalies with PGE-Ni-Cu sulphide mineralisation potential.

The prospectivity of the Warrior Project for PGE-Ni-Cu mineralisation has been confirmed by previous aircore drilling at Calingiri East intersecting up to 1420ppm nickel in mafic rocks and anomalous platinum and palladium previously intersected at Wubin.

The Calingiri West tenement covers part of the Sovereign Magnetic Complex and is immediately adjacent to late-time AEM anomalies recently defined by Devex Resources (ASX: DEV) which it is planning on commencing drilling in the near term.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.