PUR hit a significant “mineralising system” - now to find the core (and what it actually is…)

When it rains, it pours.

We don’t usually send two emails in a day.... Let alone three.

Today we have already had two great exploration results from Tempus Resources and Los Cerros and have just been hit with a third from our metals explorer Pursuit Minerals (ASX:PUR).

From their announcement released just now it looks like they may have stumbled onto something unexpected and potentially big at Phil's Hill... and now they need to figure out what it is.

Sometimes companies just get lucky in early stage exploration. Here is our quick take:

We invested in PUR and were following their 8 hole drill program where they were trying to imitate the success of Chalice’s $2.4BN Julimar PGE-Cu-Ni discovery.

PUR was targeting the same geology and copying the Chalice exploration strategy - using VTEM and MLEM surveys to find conductors to drill - in order to hopefully discover a similar, nearby, Julimar style PGE-Ni-Cu system.

It turns out that PUR has hit mineralisation - but something totally different and unexpected - a type of mineralised system that CAN’T usually be detected using VTEM and MLEM surveys - and from the reported drill results in the announcement today it sounds like they have just clipped the edge of it.

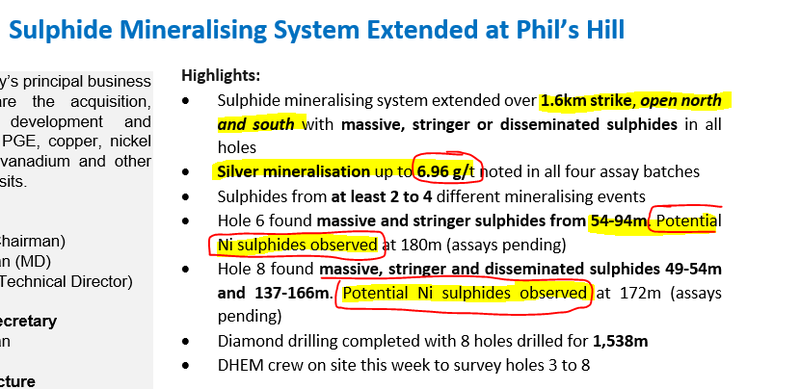

What we do know so far is that PUR has found a 1.6 km sulphide mineralisation system, open north and south (which means it's going to get bigger), with sulphides present in all holes.

So far, high grade silver was hit (up to 6.96 g/t) and gold, copper, and nickel have been detected.

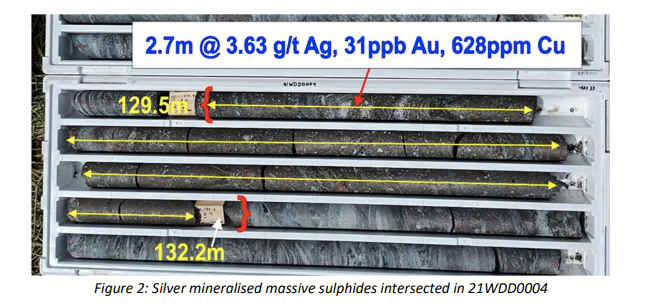

Here are some of the drill cores:

The geologists reckon these sulphides found are from at least two, but maybe up to four ‘mineralising events’.

For a maiden (first ever) drill program to hit a mineral system like this is a big deal, even just the edge of it (PUR weren’t even looking for this, they seriously just got lucky).

PUR now has its work cut out to figure out exactly WHAT they have found (and hopefully then the market will respond)... and then where the source of it is. This is when exploration geologists get very excited.

PUR is now fast tracking assay results for holes 3, 6, 7 and 8 - and the next bit or work is going to be to complete down hole EM surveys at all holes and conduct more research and analysis to plan a new drilling program to find where all this mineralisation originated from.

On 22nd July PUR had $8.7M in cash - so even with recent drilling, it sounds like PUR has plenty of funds to figure out what it is they are sitting on and pepper it with drill holes to find the source. We will get the latest glimpse of PUR’s cash balance in the next quarterly report which should be out this week.

Here is what PUR found on the last 6 holes (assays pending):

What does this mean?

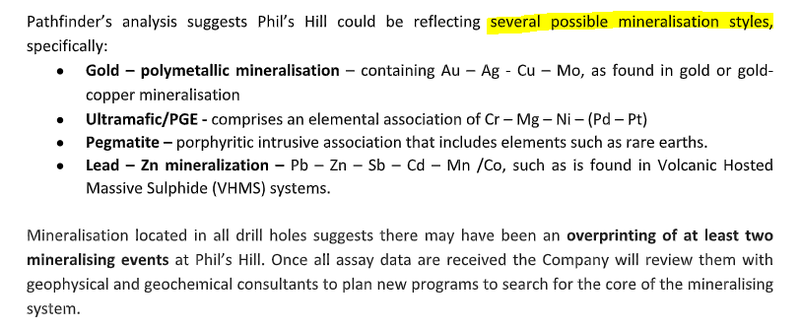

We are not sure yet - but from quickly reading the announcement, our take is that PUR have found SOMETHING, they don’t know exactly what it is yet, but they sound excited by it - they contracted expert geologists at Pathfinder Exploration to analyse the results from a couple of holes, here is what they released:

Gold?

Ultramafic PGEs?

Pegmatites?

Lead-Zinc mineralisation?

There are a few different ideas floating around here, and it could be a combination of a few of them - that's what the ‘overprinting of at least two mineralsing events’ means.

So essentially PUR got lucky with this drilling as they weren't really looking for these kinds of mineralisation styles...

PUR will now be working hard to locate the core - trace it back to find the source or “motherlode” of precious metals

What are we looking out for next from PUR:

- Assay results from four holes: Next we are watching for assay results from the remaining holes (and what they will reveal about PUR’s mysterious mineral system).

- Downhole EM surveys on all the remaining holes: - help to put together more puzzle pieces with the assay results and where to drill next to get closer to the source of this mineral system.

- Follow up aguer geochemistry to expand coverage north and south

- Initial geochemical and geophysical surveys at Ablett Prospect.

We expect all this assay results and DHEM info to come in the next few weeks.

Warrior Project Milestones (PGE-Ni-CU)

Drilling Program 1

✅ Drilling Program Commenced

✅ First Two Drill Holes Complete (No Sulphides Intersected)

✅ Downhole Electromagnetic Survey 1

✅ Follow-up Drilling 1 (Sulphides Intersected)

🔲 Follow-up Drilling 2 (MLEM Plate 17A, 06A)

🔲 Downhole EM Survey 2

🔲 Assay Results 1

🔲 Assay Results 2

🔲 Assay Results 3

Next Investors Investment Milestones

Key Drilling Event 1

✅ Initial Investment: @1.35c (≈7 months before key drilling event)

✅ Increase Investment: @6.9c (≈4 months before key drilling event)

✅ Price increases 250% from investment

✅ Price increases 500% from investment

🔲 Price increases 1000% from initial entry

✅ Free Carry (prior to drilling results)

✅ Take Some Profit

🔲 Hold position for key drilling event

🔲 Decide New Investment Plan after results of key drilling event

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 4,300,000 PUR shares.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.