PRL and Total Eren announce Key Binding Terms.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 24,980,000 PRL shares, and the Company’s staff own 200,000 PRL shares at the time of publishing this article. The Company has been engaged by PRL to share our commentary on the progress of our Investment in PRL over time.

How do you create a $34BN gas asset like Woodside’s North West Shelf Project?

One that has a 17 million tonne annual gas export capacity?

Ideally you need a Joint Venture with some big, rich, powerful, global energy companies that know how to build mega projects and where to sell the product.

One of our biggest holdings, Province Resources (ASX:PRL) has just signed binding terms for a Joint Venture with a global energy major.

To fully appreciate what the news means, here’s a quick history on how shareholder value is created when building giant, multi-billion dollar projects that deliver gas for decades.

Back in 1963, a tiny, unknown company called “Woodside” secured a huge 370,000km2 landholding to explore for oil and gas off the north west coast of Western Australia - for just £100.

At the time, there were maybe two Liquified Natural Gas plants in the world, and none in Australia - developing gas projects like this was a novel and strange concept

Later that year, Woodside sealed a Joint Venture with global energy major Shell to help finance and build the ambitious natural gas project.

Over the coming years, global majors Chevron, BP, BHP also bought into the North West Shelf Joint Venture, bringing their skills and cheque books to make the project a reality.

And finally in the 80s, giant Japanese conglomerates Mitsubishi Corporation and Mitsui & Co also farmed-in to the joint venture to help secure gas offtake for Japan.

Woodside is now capped at $63BN - and its 16.6% share in the North West Shelf Joint Venture was worth around $4.4BN in the doldrums of 2020 and likely multiples of that now that the world is in the midst of an energy crisis.

So that's how £100 gets turned into multi-generational wealth - by being at the forefront of monetising new energy sources.

Fast forward to today, some 50 years since the discovery of WA’s offshore gas fields.

The year is 2022, and much like natural gas 50 years ago, “green hydrogen” is an emerging energy source that the world is starting to pay attention to.

Green hydrogen is a clean burning gas made using clean electricity from renewable energy technologies. The renewable energy is used to electrolyse water, separating the hydrogen atom within it from its molecular twin, oxygen.

Green Hydrogen’s adoption has been sped up by the global energy crisis, with Germany signing two green hydrogen deals to replace its use of natural gas from Russia - the most recent being signed this week.

One of our Portfolio companies is at its forefront of this new industry in Australia.

In February 2021, just a few hundred kilometres from Woodisde’s North West Shelf Joint Venture, our 2021 Small Cap Pick of the Year, Province Resources (ASX:PRL), secured a giant land holding in WA, with a view to developing a large scale green hydrogen project.

Like the then-microcap Woodside did in the 60s by signing a joint venture with energy major Shell, PRL is the closest it has ever been to securing a joint venture with its own major partner, Total Eren, which is partly owned by French energy major, the $145BN TotalEnergies SE.

Total Energies is one of the biggest energy companies in the world, on par with the likes of Exxon Mobil, BP and Chevron. Like all traditional oil companies, it is seeking to diversify its energy production and generate from renewables. To achieve these goals it's got a majority ownership of Total Eren.

The final execution of a joint venture with Total Eren would bring a significant amount of credibility to PRL’s green hydrogen project, and we hope this event can be the “de-risking” trigger for larger funds to invest in PRL.

This week PRL provided a long awaited update on the deal with Total Eren.

PRL announced a BINDING term sheet on a deal (a “Joint Development Agreement”) with Total Eren.

However it still needs a bit more time to fully complete the deal cementing a 50:50 joint venture for the ENTIRE project.

PRL reckons 8 more weeks...

It appears many traders and short term PRL holders who were hoping to sell on this news for a quick win have now had a chance to wash out post the announcement (the “buy the rumour, sell the news” crowd).

This hopefully gives us a base for the next leg up.

This new 50:50 JV format gives PRL a 50% share in a separate joint venture entity holding the ENTIRE project (the upstream clean energy plant AND the downstream green hydrogen plant), as opposed to the original deal where PRL would own 50% of only the hydrogen plant.

We also note that according to the binding MoU, Total will “lead the arrangement of long term project financing”.

Given the proposed scale of the project, as PRL investors we like that a big deep pocketed major can eventually assist with getting big ticket items like construction financing tucked away.

Housing ALL of the upstream and downstream project assets in a 50:50 joint venture entity is a typical way to structure a big oil & gas project - and green hydrogen is of course a gas.

A separate 50:50 joint venture entity containing all the project assets is a well trodden value creation path that has been done many many times in the past for giant oil and gas projects all over the world.

This is how the North West Shelf Joint Venture was started by Woodside, which later attracted six household names as project partners.

A Joint Venture Entity is an ownership structure that giant energy companies, off takers, financiers, technology providers and governments are familiar with, and will be comfortable to engage with.

After more development and funding partners are brought in, PRL should retain a slice of a much bigger, more mature and more valuable project.

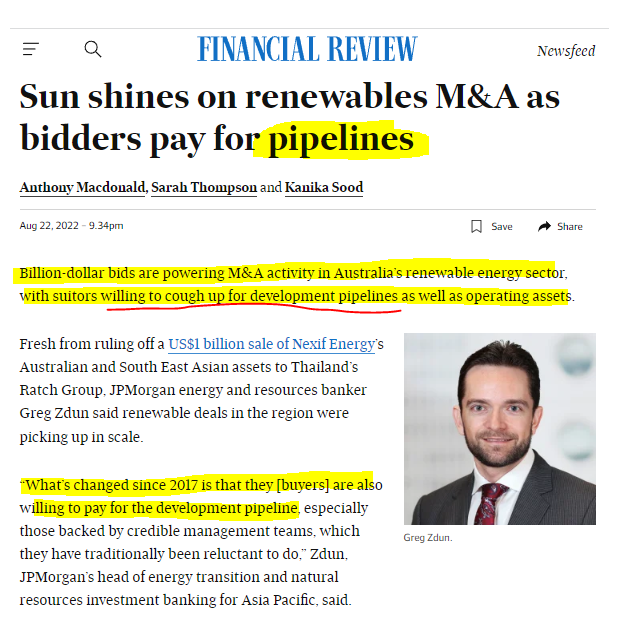

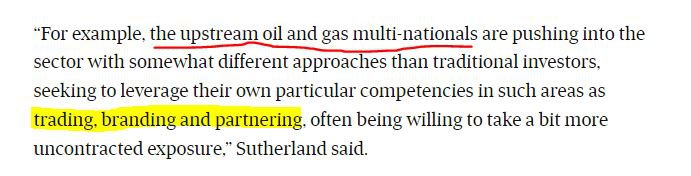

With Total Eren close to signing on as the initial joint venture partner with PRL, media coverage this week suggests there is increasing interest in acquiring stakes in large green energy projects at development stages:

Source: AFR - Sun shines on renewables M&A as bidders pay for pipelines

That article also talks about a series of renewables deals, which we will go into in more detail on later in this note.

With the proposed new 50:50 joint venture structure over the entire project, PRL and Total Eren will be in a position to neatly bring on new development partners.

After studying the history of the North West Shelf Joint Venture, we think a project of this scale roughly has 5 important stages:

- Acquire a promising set of permits or licences for a project.

- Progress studies (Scoping, PFS, DFS) enough to attract initial Joint Venture partner

- Continue studies and establish project economics.

- Shop project to large companies with expertise in financing, offtake and project development.

- Bring on other value adding Joint Venture partners at much higher valuation.

After its agreement with Total Eren on key terms, PRL is now getting closer to Step 2 of the above process.

PRL has achieved a huge amount in the last 18 months.

We’ve created a Progress Tracker for PRL, which can be accessed by clicking the image below.

The Progress Tracker provides a summary of just how much has been achieved by PRL to reach this point:

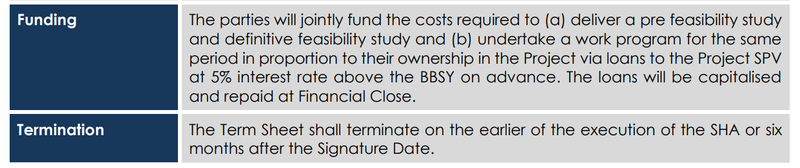

Key terms between PRL and Total Eren explained

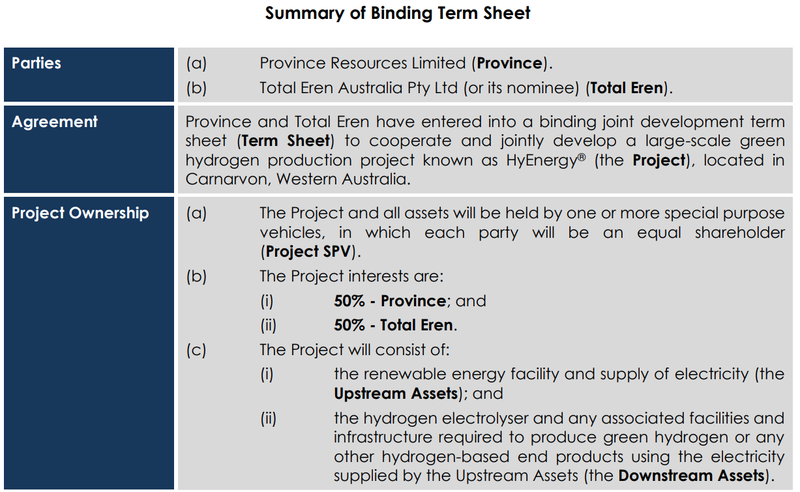

On Monday, PRL announced a binding agreement on the key terms with Total Eren to develop PRL’s HyEnergy green hydrogen project.

Our interpretation is that Total Eren and PRL have agreed on key terms (that are binding) on creating a new company (also known as a special purpose vehicle) which will house all the HyEnergy project’s current and future assets.

PRL and Total Eren will own 50% each in the new Joint Venture company.

This kind of Joint Venture structure is the usual way to partner on large gas projects.

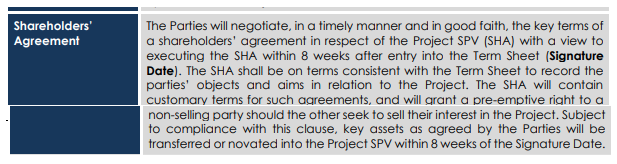

So while key terms have been agreed and revealed, there is an important document that solidifies the key terms, responsibilities and corporate governance that still needs to be finalised - “the shareholders agreement” for the joint venture company.

We think that given that the key terms have already been agreed and are binding, the shareholders agreement should just be a drafting formality. But we note that the document drafting process is where the fine details come out and can cause some prickly discussions between parties and possibly cause delays.

The new 50:50 joint venture company, combined with the shareholder agreement being signed, is effectively the “joint development agreement”.

In the binding term sheet, PRL and Total Eren have committed to 8 weeks for the shareholder agreement to be executed.

... which in our view is when Total Eren is locked in as a project partner and committed to finance 50% of the “costs required to deliver a pre feasibility study and definitive feasibility study”

While we don’t have visibility on exactly what is in the more comprehensive shareholders’ agreement, the key terms announced by PRL this week give us all the material terms, so we see this week’s news as a significant de-risking event for PRL.

Here are our top three reasons why we think this week’s announcement is significant:

- The market is watching to see if Total Eren will make a firm commitment to this green hydrogen project. This agreement is evidence of a strengthened relationship between the two parties, pending only the formality of converting the binding term sheet to a shareholder agreement in the new joint venture entity.

- 50:50 joint venture structure for the entire project is more common in developing large gas projects than the previous terms.

- Companies and governments are aggressively chasing green hydrogen projects. The agreement provides an ownership structure that allows for multiple partners to get involved and cleaner financing structures (similar to how major oil and gas projects work).

We also note that during the development of the North West Shelf Joint Venture, major companies that wanted exposure to the joint venture built large positions in the smallest joint venture partner - Woodside.

For the rest of this note, we’ll go into (even more) detail on what the binding term sheet released this week means for PRL, and how it fits in with significant deals for renewable energy projects in Australia and key risks.

Monday’s announcement moves PRL closer to completing Objective #4 from our PRL Investment Memo:

What does this agreement mean for PRL?

As we said above, this week PRL shared the binding key terms for a shareholders agreement that will govern the new joint venture entity housing all the project assets.

Now that the key terms are agreed, lawyers can get to work to create a full form agreement for both parties to sign - this is the document that gets into the fine detail of each key term and can be complex.

Part of the deal is that this shareholder agreement is nailed within 8 weeks.

Here is our commentary on some of the key terms agreed by PRL and Total Eren:

These terms are new information, given that the original terms saw PRL own 50% of just the downstream assets, which was basically the hydrogen electrolyser plant.

The new terms see PRL secure 50% ownership BOTH downstream AND upstream assets - basically they will now also own 50% of the green energy plant.

While the original deal terms meant a lower funding requirement from PRL, the new deal sees the entire project housed in a single Joint Venture entity, similar to traditional large scale project developments like the North West Shelf.

Observing how the North West Shelf project played out for Woodside who ended up holding 16.6% of the Joint Venture after funding and construction, it looks like under this new deal that PRL may ultimately end up holding a smaller slice of a much bigger pie as the Joint Venture holders dilute to bring on funding.

We also note from recent media reporting that large pools of capital are becoming available to fund green energy projects. This provides a good competitive funding environment for the Joint Venture to eventually sort out project financing at the lowest possible dilution.

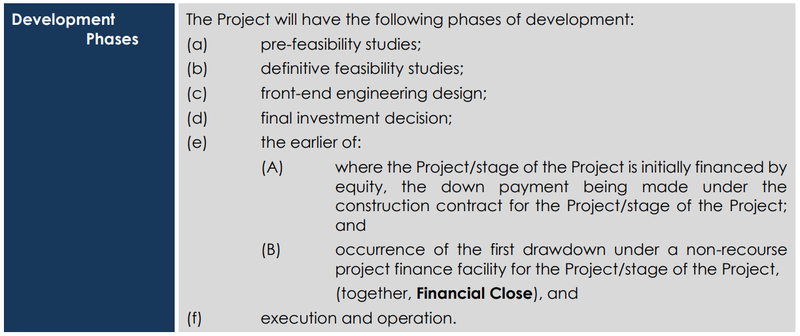

The above section outlines the key phases expected in the project, and is very typical in mining and oil & gas projects.

The only difference now is that once the Total Eren deal is signed, all the studies and work completed so far will be owned by the 50:50 Joint Venture entity, and PRL and Total will contribute cash to the Joint Venture entity to complete the development work going forward.

PRL already announced a positive scoping study and should now be in the pre-feasibility study phase, which is where we expect to get a first look at project economics.

As the project moves through the above stages and the economics become more clear, new Joint Venture partners can be introduced.

Again, this clean ownership structure will make it a lot easier to bring on new partners.

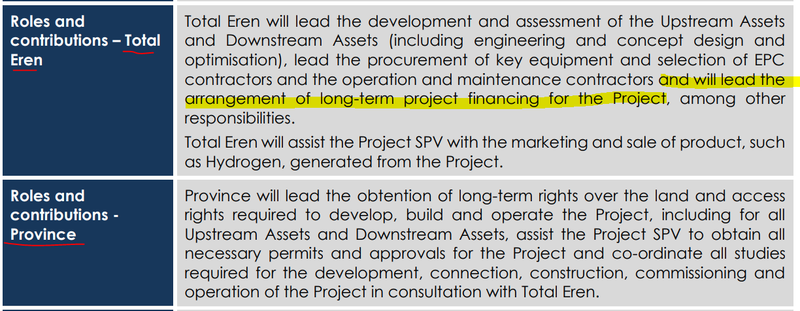

Here we see the roles and responsibilities of each of the Joint Venture partners - no big surprises here.

Total Eren is on the hook to deliver what it’s best known for - designing, funding and building mega-projects, then operating and selling the end-product.

While this sounds like doing all the heavy lifting, no project will ever see the light of day unless it has full government and community approval, especially not a giant wind and solar farm.

PRL’s main job for its 50% share is to handle all the land access, permitting, government and stakeholder relations. This is a big job, and it requires unique local skills, know-how and relationships. No large project can be built without it:

This is no easy task. To get an idea of just how much work has gone into this over the last 18 months take a look at our PRL progress tracker.

The key point in the above section is that final signing of the shareholders agreement should be within 8 weeks.

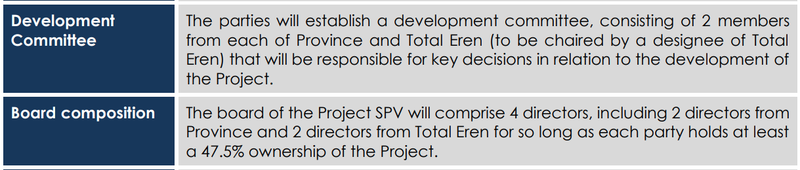

The above sections outline how the new Joint Venture will be governed and how decisions are made - including the board composition.

PRL and Total will both be on the hook to fund 50% of the PFS and DFS.

The way this works is that PRL and Total will loan money into the 50:50 Joint Venture entity to complete the work.

PRL raised $18M during the top of the market in 2021 and had a healthy cash balance of $20M at the last quarterly.

We expect that is sufficient to fund 50% of typical PFS and DFS’s that we have seen in the past, however we don’t have specific experience with studies on a green hydrogen project.

The key terms are agreed, now PRL and Total Eren need to sign them.

The next stage of the project is to convert the key terms into a comprehensive legal document that will govern the running of the new joint venture entity.

To give you an idea of what a full shareholder agreement looks like, here is a link to a typical shareholders agreement template provided by the Australian Investment Council.

If you are starting a business with a new partner it’s important to have an agreement like this in place, and PRL and Total Eren are no different.

What happens after the shareholders agreement is fully signed and ready to go?

Once the JV entity is established, together, Total Eren and PRL will work to complete a Pre Feasibility Study.

PRL will continue to secure government and community support for the project.

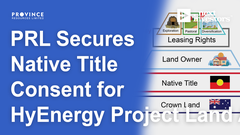

This government and community support will be formalised as land tenure in the Gascoyne region of WA - like today’s latest announcement.

PRL has just secured another section 91 licence over an additional 2,217km2 which brings the total area under license to more than 3,000km2.

Meanwhile, Total Eren is a major renewable energy project developer who will take the lead on long-term project financing of the project.

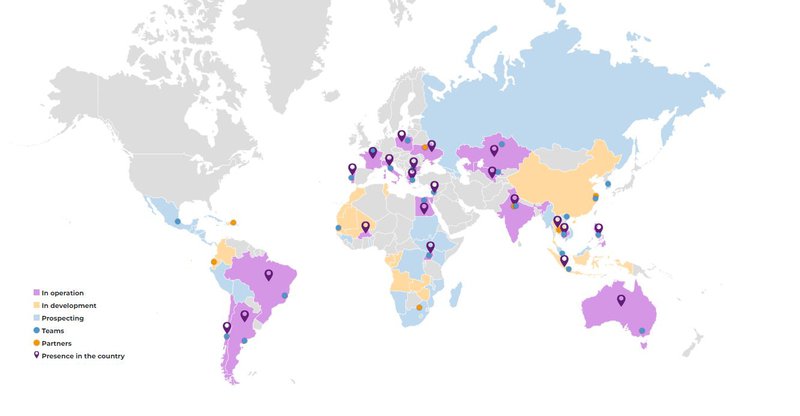

What does Total Eren bring to the project?

As we pointed out above, Total Eren has the expertise to execute a renewables project of this scale, while PRL has unique access to stakeholder relationships in the Gascoyne region.

We have already covered the contribution PRL is making (see our PRL progress tracker for more info).

Let's take a look at the experience Total is bringing to the table.

We note that Total Eren’s renewables projects consist of 3.5GW of capacity across 100 plants in 20 countries:

Total Eren is expanding its footprint in the Southern Hemisphere, having recently started engineering works on a Chilean green hydrogen project:

That project would entail 10GW of wind turbines and 8GW of electrolysers and produce 800,000 tonnes of green hydrogen and export 4.4 million tonnes of ammonia a year (a slightly larger project than PRL’s).

And Total Eren is also moving quickly to grow its presence in Australia’s renewable energy market, having recently proposed a 2GW solar farm in the Northern Territory for a 1GW hydrogen electrolyser facility near Darwin:

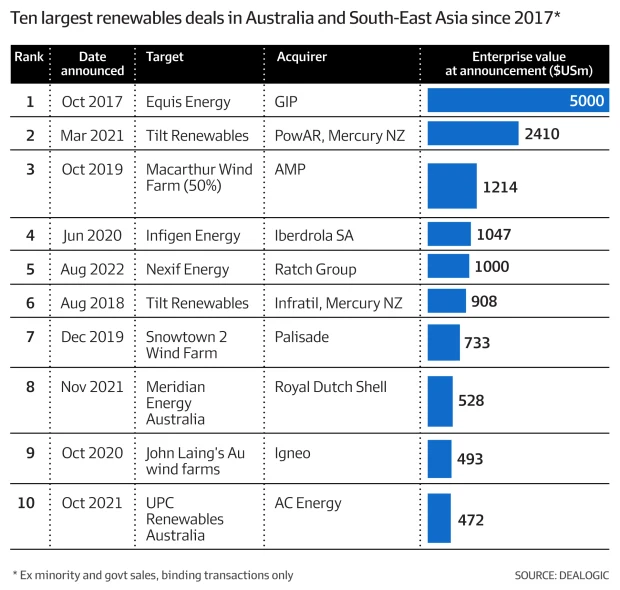

These developments on the part of Total Eren are part of a much broader trend of big deals being signed in Australia - something that promises to help PRL and Total Eren get other large energy companies interested in this green hydrogen project.

More JV partners? Renewables in Australia - big deals

M&A activity in the renewable energy market in Australia is starting to attract some large bids as this table from the AFR article demonstrates:

Source: AFR - Sun shines on renewables M&A as bidders pay for pipelines

One analyst was quoted as saying that (emphasis added), “what’s changed since 2017 is that they [buyers] are also willing to pay for the development pipeline, especially those backed by credible management teams.”

We think PRL easily ticks the “credible management team” box - and PRL’s project is at the development stage as well.

Here’s another important quote from this article:

This is much like the Shell/Woodside/natural gas dynamic that we mentioned at the start of this note.

A big company gets involved in an emerging energy source development project, takes the marketing burden off the smaller company, and helps make the new energy source an important part of the economy.

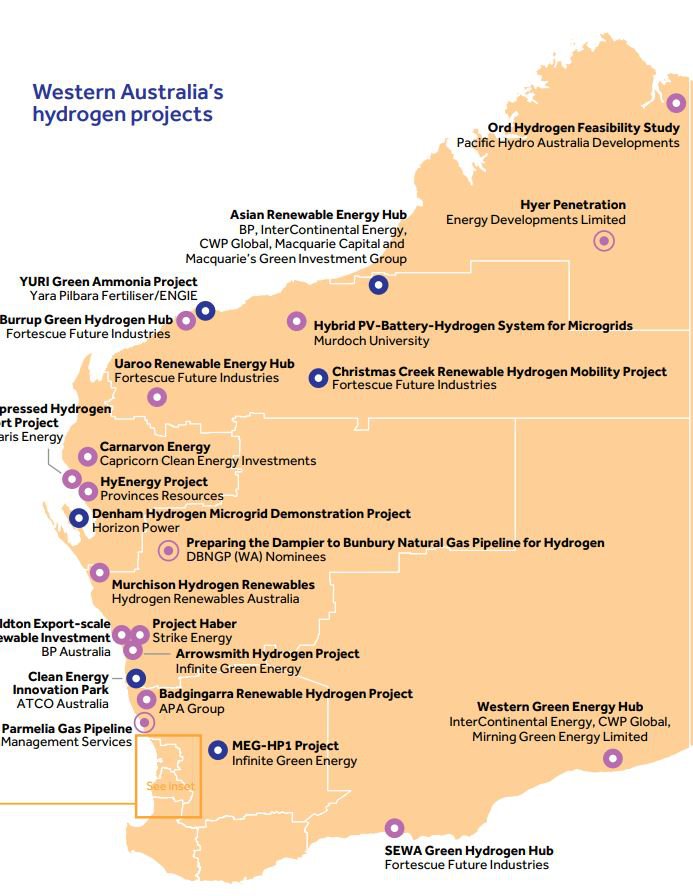

There’s plenty more examples of big oil companies increasingly looking towards Australia as part of their pivot towards renewables.

After buying a 49% stake in wind farm developer WestWind Energy Development Pty Ltd earlier this year, Shell has now confirmed it intends to expand further into wind power in Australia.

This comes after BP agreed to acquire a 40.5% equity stake in the Asian Renewable Energy Hub (Pilbara region, WA) and become the operator of the project.

More Green Hydrogen in the Media - a Wrap

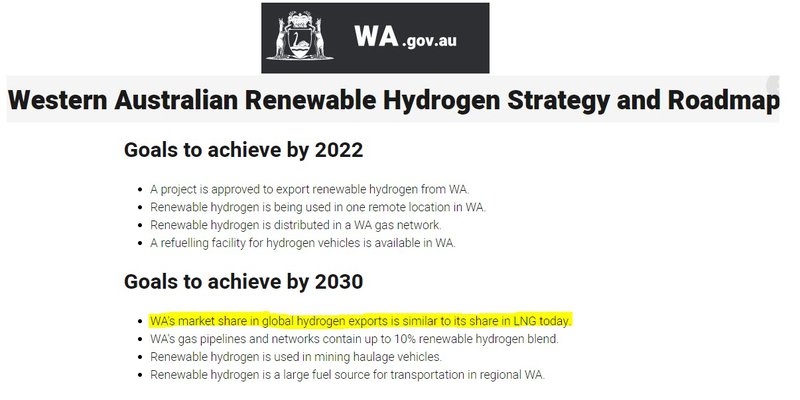

In 2019 WA laid out its Renewable Hydrogen Strategy and Roadmap:

Source: Western Australian Renewable Hydrogen Strategy and Roadmap

3 years later, hydrogen projects are popping up all across the state and you can see PRL’s HyEnergy Project in Carnarvon on the map:

And internationally, governments are pushing hard to provide a system of incentives to support major hydrogen projects.

Germany has signed a deal with Canada for hydrogen supply:

Key takeaways:

- Germany and Canada commit in the five-year hydrogen accord to creating “a transatlantic supply chain for hydrogen well before 2030, with first deliveries aiming for 2025.”

- Canada has significant wind power potential in Newfoundland and Labrador.

All of this activity in the hydrogen project space is now apparently leading to a capital race between the major powers - with Europe potentially losing out to the US if they don’t provide more incentives:

Key takeaways:

- Recently passed US climate bill/Inflation Reduction Act could see funds to finance large-scale green hydrogen projects bypass Europe and flow to the US, according to Fortescue Future Industries head Mark Hutchinson.

- The EU plans to use 20 million tonnes of the clean burning fuel by 2030 - split between 10 million tonnes of domestic production and 10 million tonnes of imports from countries like Australia, the Democratic Republic of Congo and Brazil.

- We think the Ukraine conflict has been the catalyst for the EU’s massive push on hydrogen.

- Under the EU’s Delegated Acts, by 2026, only electricity from new wind and solar plants can be used to generate green hydrogen.

We think all of this adds up to growing competitive tension around PRL’s project, which is now approaching a formalised ownership structure amenable to getting other parties involved.

That being said, like every investment, an investment in PRL still has a number of risks.

Risks

We’ve highlighted the Project Development Risk from our PRL Investment Memo below:

This strikes us as the most important risk PRL is facing right now.

Although we’re of the view that this week's binding terms move the needle in the direction of PRL and Total Eren’s relationship tightening, things could still go wrong.

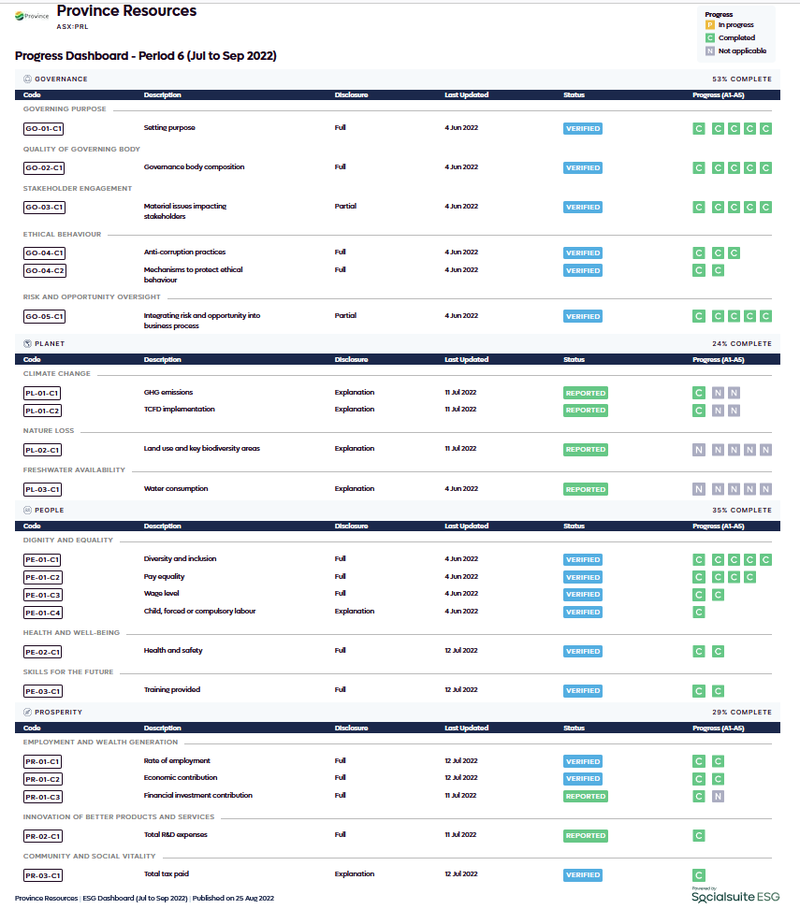

PRL is a leader in ESG practices

Aiding PRL’s cause is the company’s commitment to carrying out its business activities in a manner consistent with ESG principles.

Global fund managers, high net worth family offices and millennials are now actively seeking to invest exclusively in ESG companies. Consumers are demanding best in class ESG products and smart people only want to work with top ESG credentialed companies.

PRL uses an ESG framework to regularly report their ESG progress so they can best tell their story to international ESG investors and potential partners.

As a green hydrogen project developer - this is important to PRL’s credibility.

Below is PRL’s latest ESG disclosure:

PRL Investment Memo 2022

Our Investment Memo is a short, high-level summary of why we continue to hold a position in PRL and what we expect the company to deliver in 2022.

We use these Investment Memos as a way to assess the company’s progress and examine how our investment thesis plays out throughout the year.

In our PRL Investment Memo you’ll find:

- Our key objectives for PRL in 2022

- Why do we continue to hold PRL

- The key risks our investment thesis

- Our investment plan

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 24,980,000 PRL shares, and the Company’s staff own 200,000 PRL shares at the time of publishing this article. The Company has been engaged by PRL to share our commentary on the progress of our Investment in PRL over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.