Primero adding value for blue-chip iron ore producers

Published 15-MAY-2020 10:29 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In choosing my stock of the week in a volatile market I looked at some of the action across different stocks and sectors to get a feel for where there was some resilience.

From a stock specific perspective it was the likes of Rio Tinto (ASX:RIO), BHP Billiton (ASX:BHP) and Fortescue Metals Group (ASX:FMG) that were largely instrumental in pulling the ASX 200 back into the black from a 100 point deficit on Wednesday.

Once again, those stocks showed resilience in the face of a 1% decline in the broader market on Thursday.

One factor they have in common is their exposure to iron ore, the metal that has experienced strong commodity price accretion in the last week particularly.

Making iron ore even more attractive is the emerging trade war with China which has the potential to significantly impact our agricultural industry, and from a mining perspective coal has the most exposure.

China can’t do without our iron ore because of the lack of domestic production, whereas it is fairly rich in thermal coal and produces a reasonable amount of coking coal.

But this week I’m not touting the prospects of iron ore stocks, but identifying a company that generates a substantial amount of revenue from servicing the likes of Rio and FMG.

Particularly impressive has been the company’s ability to do more than just pick and shovel work.

This company has presented state-of-the-art technical solutions for the processing of iron ore that have added significant value to iron ore projects in the Pilbara, particularly those operated by FMG.

The company is Primero Group Ltd (ASX:PGX), and here is an example of its technology.

Being able to provide tailored solutions for blue-chip players sets the likes of Primero apart from what is sometimes are fairly crowded space with contractors often scurrying for work and accepting low margins.

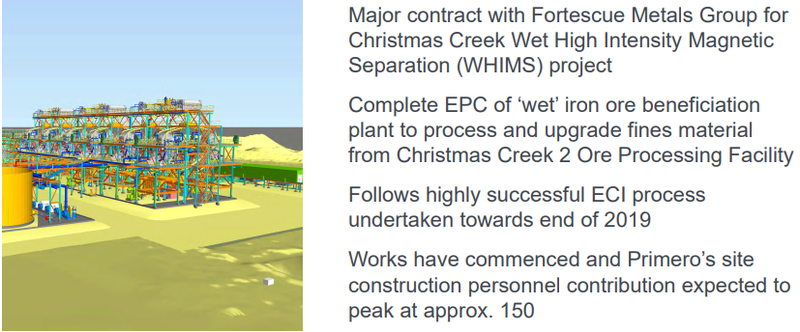

Primero undertook a major contract with FMG for its Christmas Creek wet high-intensity magnetic separation project (WHIMS).

The group provided a complete end to end solution that included a wet iron ore beneficiation plant, enabling the processing and upgrading of fines material from the Christmas Creek 2 ore processing facility.

Works are in progress and at its peak, Primero will have approximately 150 personnel on-site.

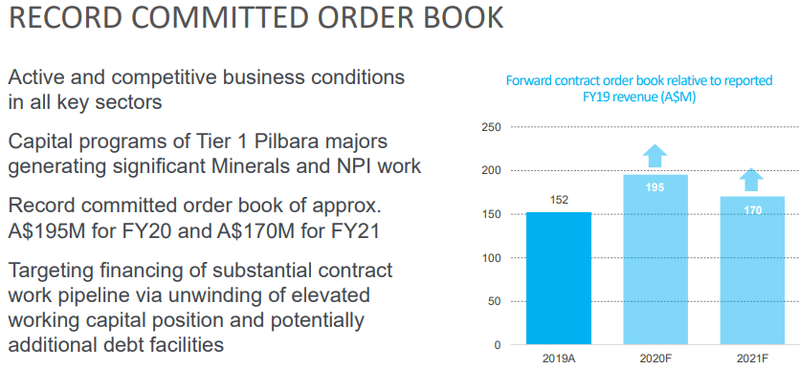

Based on Primero’s fiscal 2020 order book of $195 million, iron ore projects should account for approximately 50% of revenues.

The company has already generated $112 million in the first half of fiscal 2020, and the projects it has been working on haven’t been unduly affected by coronavirus related shutdowns.

Experienced management team

Management provided an update on Tuesday of this week which is helpful for potential investors who are wondering what other stocks will come out of the woodwork with earnings downgrades because of coronavirus related interruptions.

Primero’s managing director, Cameron Henry addressed this issue, reaffirming that the company was operating at a run rate consistent with its fiscal 2020 contracted order book guidance of approximately $195 million.

Further, he was able to inform the market that there had been no major reduction scope or contracted works volumes for the projects in hand.

Providing further medium-term revenue visibility, he said that the contracted order book for fiscal 2021 currently stood at $200 million with scope for further growth in contracted work, including that already booked for fiscal 2022.

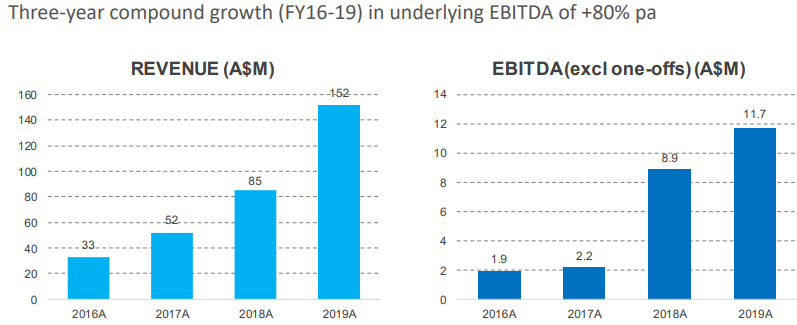

Management has a track record of under-promising and outperforming, and it is evident from the following charts that Primero has demonstrated its ability to generate significant growth.

Management’s achievements shouldn’t come as a surprise given the experience within the group.

Of particular note is the actual site experience of the chairman and the managing director.

Non-executive chairman, Mark Connelly is one of the most sought after figures for companies that are looking to build a project from the ground up.

Connelly has managed some of the world’s most prominent projects, and he has successfully negotiated challenges presented in sovereign risk regions.

Connelly was the former Managing Director and Chief Executive Officer of Papillion Resources Limited, a Mali-based gold developer which merged with Vancouver-based B2Gold Corp.

Previously, he was Chief Operating Officer of Endeavour Mining Corporation following the merger of Adamus Resources Limited where he was the Managing Director and CEO.

Connelly is a director of West African Resources (ASX:WAF), one of the fastest-growing junior gold developers on the ASX.

Since the start of 2019, its shares have increased four-fold, largely due to its quick progression from explorer to the pouring of first gold in March this year.

Consequently, Connelly’s expertise is highly sought after by mining companies that are undertaking large projects, a big plus for Primero.

Cameron Henry also has extensive experience in managing developments on-site, meaning the company is well-positioned to make decisions on industry knowledge rather than boardroom semantics.

Valuation implies share price upside of more than 100%

Leading up to the onset of coronavirus, it could be said that investors view the company positively with its shares hovering in the vicinity of 40 cents.

However, they are now trading in the vicinity of 25 cents despite any change in the company’s inherent value.

In fact, consensus forecasts which were updated post the coronavirus sell-off attributed a valuation of 54 cents to the stock.

This doesn’t seem unreasonable given that the group’s current market capitalisation of $44 million doesn’t capture Primero’s strong financial position, quality order book, revenue visibility and scope for new contract wins which theoretically would be expected to provide share price momentum.

With regard to the company’s financials, Primero had available cash of $19 million as at May 8, 2020.

Broker forecasts for fiscal 2020 are based on the company generating revenues of $207,000, broadly in line with management’s guidance.

Based on these metrics, the analyst expects Primero to generate a net profit of $6.6 million, representing earnings per share of 4.1 cents.

This implies a PE multiple of 6 based on the company’s current share price, extremely conservative given the status of its current operational and financial position.

It looks even more enticing when considering broker forecasts for fiscal 2021 which are projecting a net profit of $8.5 million, representing earnings per share of 5 cents (year-on-year growth of 22%) and a forward PE multiple of 5.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.