The price is right: A definitive guide to Aussie Gold Stocks to watch Part 1

Published 21-NOV-2018 17:10 P.M.

|

21 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

When weighing up investment options in the commodities space it is easy to simply look at the headline prices, rather than take into account other factors that impact producers’ earnings.

Buying shares in a mining stock is just like buying any other stock — success or failure will generally come back to company performance and the bottom line.

The impact of foreign exchange movements consistently fails to be taken into account and depends on where the commodities are produced and where the company recognises its earnings.

The issue of FX movements is particularly pertinent for Australian gold producers who benefit when the Australian dollar weakens relative to the US dollar denominated gold price.

As a back of the envelope example, if the US dollar denominated gold price fell 2% overnight from US$1200 per ounce to US$1176 this would equate to a fall in the Australian dollar gold price from $1643 per ounce to $1610 relative to an AUD/USD exchange rate of 73 cents.

However, if the Australian dollar simultaneously fell 1.5 cents to 71.5 cents this would fully offset the 2% fall in the USD gold price.

Currency fluctuations of this magnitude aren’t uncommon, but rarely appear to be factored in by investors as the knee-jerk reaction is to sell off gold stocks after a fall of 2%, which would be viewed as fairly substantial.

Over the last six months the Australian dollar has fluctuated between 70.5 cents and 76.5 US cents and in five out of the last six months there have been monthly movements of more than 1.5 cents.

The Australian dollar is currently trading in the vicinity of 73 cents, approximately the midpoint of the six month range.

In the six months from May 2018 to November 2018, the gold price fell from around US$1300 per ounce to US$1220 per ounce, a decline of approximately 6%.

However, during that period the AUD/USD has fallen from 75 cents to 72 cents, reflecting a fall in the Australian dollar gold price from $1733 per ounce to $1694 per ounce, a decline of only 2%.

This represents a nominal fall, particularly when one considers that the cost of production for many Australian producers is less than $1000 per ounce.

The other factor to bear in mind for investors weighing up stocks in the sector is the predictable political and regulatory environment that exists in Australia, as opposed to some other jurisdictions such as Africa and parts of Asia and South-East Asia.

As we go to print, the Australian dollar gold price is just shy of $1700.

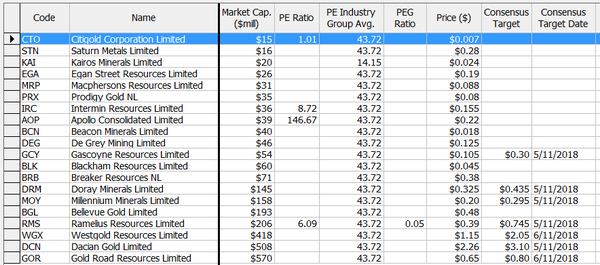

This prompted Finfeed to compile a list of 20 Australian gold companies which are at various stages of exploration, development and production.

We also covered a broad spectrum in terms of the size of the companies we examined, and their market capitalisations range between $15 million and $600 million.

The share price performances of the stocks over the six months to November certainly made for interesting reading with only four of the companies in positive territory and many of them experiencing significant share price falls for no apparent reason.

The market capitalisations are as at close of business on November 19, 2018.

Citigold Corporation Ltd (ASX:CTO)

Market Capitalisation: $15 million

Citigold is a gold mining and exploration company which operates the high-grade Charters Towers goldfield in North Queensland, 130 kilometres from the major coastal port of Townsville.

The company’s prime focus is the Charters Towers Gold Project which hosts an 11 million ounce gold deposit, with an Inferred Mineral Resource of 25 million tonnes at 14 grams per tonne (g/t) gold and 620,000 ounces of gold in the Probable Ore Reserve (2.5 million tonnes at 7.7 g/t gold at a very high 3 g/t cut-off).

The Charters Towers Project is one of Australia’s largest high-grade pure gold deposits, and the company has invested over $200 million in acquiring the gold deposit and developing mining infrastructure.

Trial mining operations have produced over 100,000 ounces of gold and the development fundamentals remain robust with targeted annual production of 50,000 ounces initially, building up to 218,000 ounces of gold production per annum.

Citigold has received increased interest from strategic partners which will be essential for funding of the project.

Given estimates that gold production should commence within 12 months of receiving the required capital, finalisation of funding is likely to be a significant share price catalyst.

Saturn Metals (ASX:STN)

Market Capitalisation: $16 million

Saturn Metals is in the process of exploring and building on its already substantial resource at the Apollo Hill Project approximately 50 kilometres south-east of the gold mining and processing town of Leonora, WA.

There are a number of multi-million ounce gold deposits in the district being operated by large players such as Goldfields (JSE:JFI), Anglo Ashanti (JSE:ANG), Dacian Gold (ASX:DCN), Saracen Minerals (ASX:SAR) and St Barbara (ASX:SBM).

Saturn is a fairly unique story in that it listed on the ASX in March 2018 as a spin-off from Peel Mining Ltd (ASX:PEX), raising $7 million with its Apollo Hill project already having a 505,000 ounce resource.

It was only this week that the company upgraded Apollo Hill’s Indicated and Inferred Mineral Resource of 20.7 million tonnes at 1.0g/t gold for 685,000 ounces reported above a cut-off grade of 0.5g/t gold.

Based on additional drilling a total of 3.3 million tonnes at 1.1g/t gold for 116,000 ounces is now classified as an Indicated Mineral Resource representing a conversion of 22% of the previous Inferred Mineral Resource.

The 36% increase in the overall contained Mineral Resource was achieved at a cost of only $9.40 per ounce, and with cash of about $4 million the company is well funded for the next phase of drilling which will be aimed at both resource discovery and expansion.

With two distinct shallow, at surface geographical areas hosting substantial material in the indicated mineral resource category there is the potential for the company to conduct scoping studies with limited lead times.

The fact that the company has been able to significantly upgrade the resource through 10,000 metres of drilling within six months of listing on the ASX is a credible achievement.

It is worth noting that the company has only scratched the surface given that its tenement package covers an underexplored 1000 square kilometres.

Patersons Securities initiated coverage of the stock in August prior to the resource upgrade, and at that stage the broker noted that it was attractively priced on a $9.00 per resource ounce basis.

At that time Saturn was priced at 17 cents per share, and is now trading at a 60% premium to that level following a substantial resource upgrade and there being more clarity around the scope for resource expansion.

Kairos Minerals (ASX:KAI)

Market Capitalisation: $20 million

Kairos Minerals is a diversified West Australian-based exploration company which is focused on the exploration and development of two key project hubs located in the state’s premier mining districts.

The company’s 100%-owned Pilbara Gold Project is about 100 kilometres south of Port Hedland in the world-class Pilgangoora district, immediately adjacent to the major lithium-tantalum projects owned by Pilbara Minerals and Altura Mining, which are both currently in advanced stages of construction and development.

Kairos received a boost this week after the company reported the discovery of exceptional new conglomerate derived gold nugget occurrences during a helicopter-supported exploration program at the Croydon Project, part of its Pilbara Gold Project in WA.

The discoveries come just two months after the company made its first gold nugget discovery at Croydon at the targeted basal unconformity between the Mount Roe Basalt and older Archaean basement rocks.

The Croydon Project is approximately 100 kilometres to the west of the Mt York Gold-Lithium Project.

These discoveries have added significantly to the rapidly emerging exploration opportunity at Croydon.

A highly promising new nugget patch is located some 2.5 kilometres south of and within the same stratigraphic horizon as the nugget patch announced just two months ago.

These new areas have yielded a total of 135 gold nuggets with patch #1 having a total of 391 nuggets with a combined weight of 19.3 ounces.

Demonstrating the near surface nature of the mineralisation, the nuggets were recovered using a metal detector over an area of 150 metres by 50 metres.

Management believes that the new discovery is analogous to the Purdy’s Reward and Comet Well discoveries, which are being explored by Novo Resources (TSX-V:NVO) and Artemis Resources (ASX:ARV).

During recent follow-up helicopter-supported exploration, the company has unearthed a potentially significant third nugget patch, this time within the lower Hardey Formation sediments.

This patch referred to as Patch #3, lies around two kilometres north-west of the original discovery and has so far only been explored over an area of some 800 square metres using metal detectors.

Importantly, this discovery was made upstream of a sample which only yielded three ‘colours’ of visible gold in the pan sample, clearly demonstrating that any indication of gold in the reconnaissance sampling is worthy of follow up.

Ongoing exploration results are the most likely near-term share price catalyst.

It is worth noting that the company’s shares traded as high as 3.1 cents on the day the recent exploration news was announced, representing an increase of about 30%.

It is possibly indicative of the fact that the stock has slipped off the radar in recent months, and perhaps has the potential to rebound on the back of further exploration success.

Egan Street Resources (ASX:EGA)

Market Capitalisation: $26 million

EganStreet is an emerging Western Australian gold company focused on the exploration and development of the 100%-owned Rothsay Gold Project, located in the Midwest region, 300 kilometres north-east of Perth.

The Rothsay Gold Project hosts a high-grade Mineral Resources of 401,000 ounces at an average grade of 8.8g/t gold and a production target of 2.1 million tonnes mined and 1.4 million tonnes processed at 6.9g/t gold for 250,000 ounces of gold produced.

Management’s near term focus is bringing the Rothsay Gold Project into production. Beyond that, there’s the prospect of utilising the cash-flow generated by an initial mining operation at Rothsay to target extensions of the main deposit and explore the surrounding tenements, including a 14 kilometre strike length of highly prospective and virtually unexplored stratigraphy.

On this note, recent drilling has confirmed extensions to high-grade mineralisation beyond the current 401,000 ounce Mineral Resource.

Results released in early November included 2.0 metres at 116.9 g/t gold from 264 metres and 2.63 metres at 57.2 g/t gold from 185 metres.

Work is to commence shortly on an updated Mineral Resource incorporating the aforementioned results generated by the successful drilling programme in the southern part of Woodley’s and Woodley’s East area.

A definitive feasibility study (DFS) has been completed which demonstrates the prospect of developing Rothsay as a low-capital-expenditure high-margin operation.

Management is targeting first gold to be produced by the fourth quarter of 2019.

The company is in a robust financial position with indicative debt funding proposals received for financing of up to $35 million, paving the way for the appointment of a preferred project financier.

MacPhersons Resources Ltd (ASX:MRP)

Market Capitalisation: $31 million

MacPhersons Resources has a number of advanced gold, silver and zinc projects in Western Australia.

The company's long term objective is the development of its existing assets and unlocking the full potential of its 100% owned highly prospective Boorara/Nimbus and Coolgardie projects.

The group has a highly promising asset in Boorara, a pure gold play with a resource of 507,000 ounces.

Its Nimbus project is located in close proximity, and it has a resource of approximately 20 million ounces of silver, 78,000 ounces of gold and 104,000 tonnes of zinc.

Its projects are located in close proximity to large producing mines, including the Kalgoorlie Super Pit.

Management recently reaffirmed that significant intersections were being encountered at the Boorara Gold Project such as 17 metres grading 4.49 g/t gold from surface including two one metre intersections with grades of 47.8 g/t and 19.4 g/t.

MacPhersons has been working on building a new gold resource block model that will be used as the basis of future open pit optimisation work and in the Boorara feasibility study.

Geological reviews combined with drilling results have given the company sufficient confidence to continue the feasibility test work.

An updated mineral resource estimate is imminent, and this is a potential share price catalyst.

Prodigy Gold NL (ASX:PRX)

Market Capitalisation: $35 million

Prodigy Gold has a mix of greenfields and brownfields exploration projects in the multi-million ounce Tanami Gold District in the Northern Territory.

The company has recently completed drilling at the Euro joint venture, and exploration is advancing as part of a farm in agreement with Newcrest Mining (ASX:NCM)

Under the terms of the joint venture agreement, Newcrest is to sole fund up to $12 million over seven years to ultimately earn up to a 75% interest in the project.

The project area hosts key targets along strike or parallel to the Trans-Tanami Trend which have seen limited or no previous exploration.

Dune is the first high priority target to be drilled on the Euro JV Project with Newcrest Mining.

The initial JV RC program was eight holes for 1466 metres of drilling, and the company is targeting a structural repeat of the Newmont-Oberon Deposit located 1.6 kilometres to the north of the Dune Target.

The prospectivity of the area is supported by gold intersections in historic aircore drilling, and a recent IP survey.

IP geophysics has also been completed at Vivitar, 20 kilometres to the east.

The interpreted data will be a step change in the quality of regional data available, and this detailed survey will enhance management’s understanding of the structures and stratigraphy, effectively refining targets for 2019 exploration programs.

The company is also active in pursuing drilling targets at the Bluebush Project, including the Capstan eight kilometre long bedrock gold anomaly.

Prodigy also has a 70/30 joint venture project at Lake Mackay where prominent gold producer, Independence Group (ASX:IGO) is the dominant stakeholder.

Intermin Resources Ltd (ASX:IRC)

Market Capitalisation: $36 million

Intermin is a gold exploration and mining company focused on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia’s richest gold deposits.

The company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions.

The Teal Gold Mine has recently been completed, and Intermin is aiming to significantly grow its JORC-Compliant Mineral Resources, complete definitive feasibility studies on core high grade open cut and underground projects and build a sustainable development pipeline.

Intermin has a number of joint ventures in place across multiple commodities and regions of Australia providing exposure to vanadium, copper, gold, nickel and cobalt.

Joint venture partners are earning in to the group’s project areas by spending over $20 million over five years, enabling Intermin to focus on the gold business while maintaining upside leverage in relation to emerging metals.

However, Intermin is still very much a gold play with the company having made significant progress during fiscal 2018 following the successful completion of its first mining operation at Teal which produced 22,000 ounces of gold at 3.2g/t and 93% recovery, coming in ahead of Feasibility Study estimates.

This delivered significant cash flow to the business with the company debt free and holding $10.3 million in cash as at June 30, as well as having holdings in ASX listed companies with a value of approximately $1 million.

Based on Intermin’s current market capitalisation, this cash position indicates that the value attributed to its highly prospective assets, a mineral resource of more than 500,000 ounces and a producing mine is only $25 million, suggesting the company could be underpriced.

No capital raisings were required during the year leaving the company in a strong financial position to fund organic growth or acquisitions without earnings per share dilution.

A fully funded 55,000 metre resource extension and new discovery drilling program continues with more than 20,000 metres drilled at the Anthill, Binduli and Blister Dam projects during the September quarter.

A very successful new discovery and resource expansion drilling campaign was completed at the Teal gold project area, 11 kilometres north-west of Kalgoorlie-Boulder.

An updated Independent Mineral Resource estimate was released for the Teal Project area and, after depletion from mining Teal Stages 1 and 2, stands at 4.25 million tonnes at 2.11 g/t gold for 289,000 ounces with over 85% now in the indicated category.

Importantly, mineralisation remains open in all directions providing the scope for further resource expansion.

Intermin’s total mineral resource after depletion increased to 8.4 million tonnes at 2.08 g/t gold for 562,000 ounces.

ERA analyst Keith Goode ran the ruler across Intermin in August when the company’s shares were trading at 16.5 cents and the group had net cash of about $8 million.

At that stage he placed a speculative buy recommendation on the stock and attributed a price target of more than 25 cents.

The company’s resource profile has improved significantly since then, suggesting that there is the potential for significant upside from its current price of about 15 cents.

Goode noted that Intermin had a target route to become a circa 100,000 ounces per annum gold producer with a mine life of more than five years by using the stepping stones of small mining projects to self-finance its exploration.

He highlighted the fact that management had demonstrated its ability to deliver on this strategy with the Teal project, as it exceeded production expectations at around 22,000 ounces, mostly from 13% higher ore tonnes mined and 5% higher recoveries of 93.6%, which increased the expected revenue by 24% from $29.3 million to $36.5 million.

When there are a number of balls in the air, it is important to get the little things right and Intermin has indicated that it can manage multiple projects while optimising shareholder value.

Apollo Consolidated Ltd (ASX:AOP)

Market Capitalisation: $39 million

The Rebecca project located 150 kilometres east of Kalgoorlie is Apollo’s most advanced project, containing three lode style prospects in Bombora, Redskin and Duke.

The company’s drilling at Bombora in recent times has delivered a series of highly-significant intercepts, establishing this prospect as the company’s priority exploration asset.

Apollo sees good potential to extend and quantify known gold mineralisation at three prospects where significant historical drill results included 11 metres at 3.24g/t gold, 30 metres at 1.39g/t gold, and 28 metres at 2.18g/t gold.

Reverse circulation and diamond drilling at the Rebecca project returned some exceptional gold intercepts from the Bombora prospect, including 17.84 metres at 15.95g/t gold and 49 metres 4.57g/t gold.

The mineralisation at Bombora extends over 600 metres of strike and is open in most directions.

Apollo will continue to explore the Rebecca Project and the Bombora gold system while also exploring for gold at its 100% owned Yindi Project.

It lies along strike from the multi-million ounce Carosue Dam group of gold deposits and has tenement applications covering promising intrusive-hosted nickel sulphide targets at Louisa.

Ongoing drill-out of the high-grade Jennifer Lode intersected wide zones of new gold mineralisation, while exploration along strike has opened a strong new gold surface named Laura Lode which is open in all directions.

The new 300 metre long ‘Laura Lode’ discovery also has a promising intercepts including 17 metres at 2.92g/t gold, 15 metres at 3.29g/t gold, 15 metres at 2.07g/t gold and 12 metres at 2.03g/t gold, and it is open in all directions.

An infill hole at southern Jennifer Lode hit 23 metres at 3.33g/t gold, providing strong confirmation of width at this location.

Apollo’s shares have increased more than 30% since June, but with exploration drilling still in progress there is the prospect of further share price upside.

Beacon Minerals Ltd (ASX:BCN)

Market Capitalisation: $40 million

Beacon Minerals achieved a major milestone in 2018, completing the prefeasibility study (PFS) at its Jaurdi Gold Project, a development which should position the company to produce first gold in the March quarter of 2019.

Debentures valued at $18 million have been issued which will leave the company well-funded to develop the project based on PFS capital cost estimates.

The PFS is based on a pre-production capital cost of $21.4 million with a payback period of 11 months.

The ore reserve provides a mine life of five years which is likely to increase with the inclusion of the Black Cat Resource, as well as other exploration upside.

Based on current metrics, the mine is forecast to generate revenues of $208.5 million and surplus operating cash flow of nearly $100 million based on an Australian dollar gold price of $1650 per ounce.

All in sustaining costs (AISC) are relatively low at $870 per ounce, providing the company with strong margins even in the event of gold price weakness.

The pre-tax internal rate of return of 75% underlines the project’s robust financial metrics.

De Grey Mining Ltd (ASX:DEG)

Market Capitalisation: $46 million

Fiscal 2018 was a stellar year for De Grey Mining with the creation of new strategic partnerships assisting the company in accelerating exploration activity, resulting in the release of numerous impressive exploration results.

These results allowed the company to establish a corporate resource gold target at year end of more than three million ounces.

The company’s strong performance was reflected in its share price which increased 420% from 4.4 cents at the start of fiscal 2018 to 18.5 cents at year-end.

With partnerships being a vital aspect of the company’s success and its future, gaining an understanding of the group’s assets and stakeholdings is important.

The company commenced fiscal 2018 by securing rights through a four year farm-in opportunity to a large parcel of land to the south of its existing tenement holdings, EL 47/2502, the Farno McMahon ground.

Farno was recently acquired by TSX-V listed Novo Resources Inc and De Grey will be working closely with Novo as its new joint venture partner.

In late November 2017, Kirkland Lake Gold (TSE:KL) invested $5 million in the company at a price of 15 cents per share.

Kirkland is a large Canadian gold producer, now listed in Australia.

The company’s initial investment was directed towards De Grey’s conglomerate gold prospectivity, but from a longer term perspective management expects that is likely to be a source of support for its broader range of projects.

DGO Gold Ltd (ASX:DGO) also invested $5 million in the group at a price of 20 cents per share, a premium to the then market price.

DGO is headed by experienced and well-known geologist Ed Eshuys who has noted DGO’s attraction to De Grey’s projects as a result of the underexplored nature and potential of the greater than 200 kilometres of prospective shear zones.

On this note, the company has recently intersected high grade mineralisation at Withnell Underground with 4.65 metres at 7.1 g/t gold, 4.13 metres at 10.23 g/t gold and 11.1 metres at 3.16 g/t gold.

The Withnell Underground exploration target is in a range between 2.6 million tonnes and 3.5 million tonnes at 4 g/t to 6.5 g/t gold, implying a resource of between 330,000 ounces and 720,000 ounces.

The economic significance of the high grade mineralisation, continuity at depth and along strike and total resources remains to be fully defined with additional drilling.

However, the lode width and tenor of grade is considered similar to other operating Australian underground gold mines.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.