PolarX prepares for scoping study at Zackly

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

PolarX Limited (ASX:PXX) is planning a scoping study at its Zackly gold-copper-silver project in Alaska.

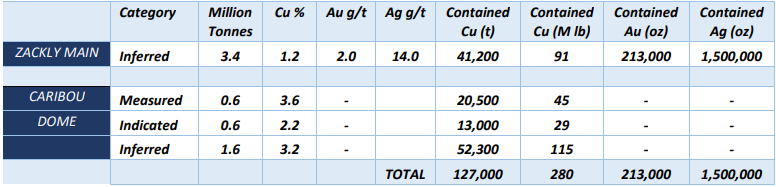

The preliminary study will assess the key economics, including costs, tonnages and recoveries and take into account Zackly Main, Zackly East and Caribou Dome.

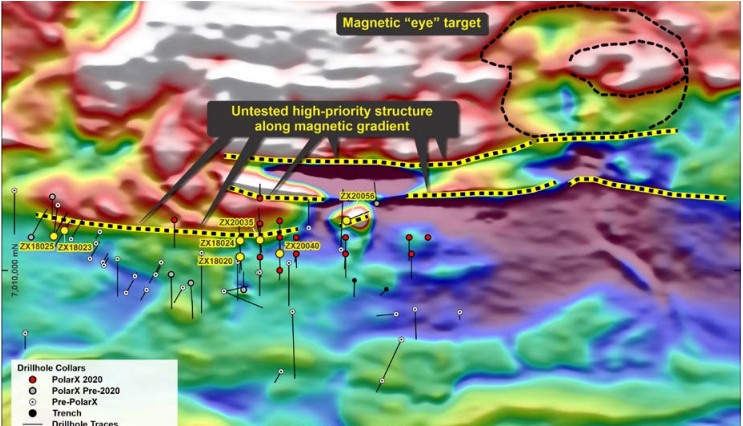

The decision follows the receipt of final drilling results from Zackly East with the final batch of results further confirming the conclusions reported in December that 4 kilometres of strongly magnetic structures at Zackly East are a high priority for further drilling as they are either known to be strongly mineralised, or have the same structure as that which hosts the known mineralisation.

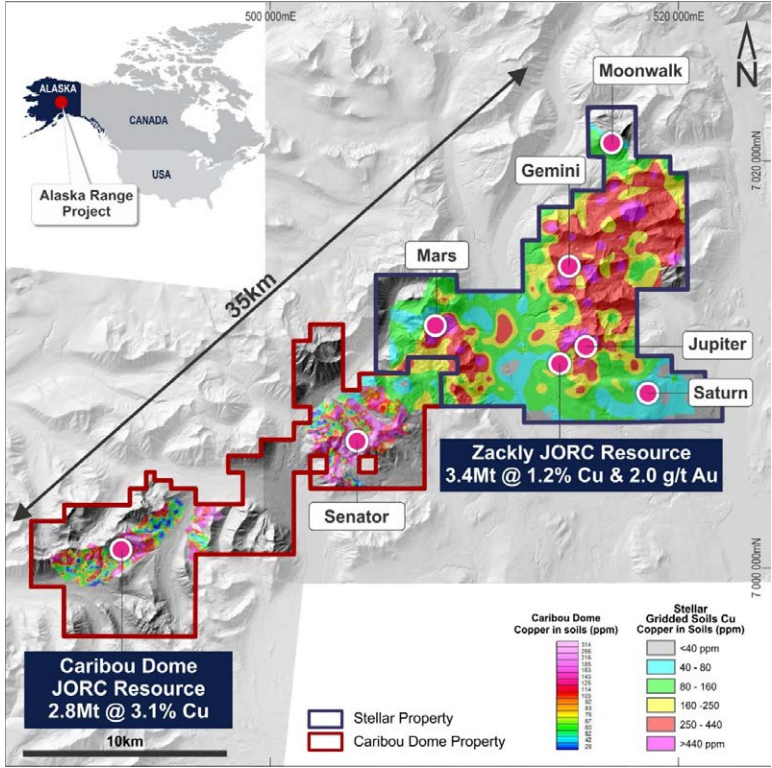

Zackly East sits immediately adjacent to the Zackly Main skarn deposit, where the JORC Inferred Resource currently stands at 213,000 ounces of gold, 41,000 tonnes of copper and 1.5 million ounces silver.

Zackly East has porphyry potential

From a geological perspective, skarn deposits such as Zackly are often found associated with or close to large porphyry deposits.

Further work is required to assess the porphyry potential of the Stellar Property, but of considerable note is the porphyry mineralisation discovered in drilling at Mars in 2019 (102m @ 0.22% Cu, 0.1g/t Au) which remains open in all directions and requires further drilling.

Additional porphyry targets at Jupiter and Gemini were identified by previous project owners through soil sampling and rock-chip sampling but have never been drilled.

These targets are shown below, and it is interesting to note their close proximity to the Zackly Resource.

Scoping study to determined project economics

A scoping study based on Zackly Main, Zackly East and Caribou Dome will provide valuable information regarding project economics.

Assays have now been received for the final seven holes from the 2020 core drilling program which focused on the Zackly East mineralisation to the east of the PolarX discovery holes which intersected 55 metres at 2.8 g/t gold and 0.6% copper, as well as 47 metres at 3.1 g/t gold and 0.6% copper.

Drilling has identified mineralisation along 2.5 kilometres of strike-length since work commenced at Zackly in 1981, predominantly along a series of strongly magnetic structures.

Drilling density in the western one kilometre section of the system is sufficient to formulate a JORC resource as outlined below.

Drilling further to the east, over another 1.5 kilometres of strike-length intersected mineralisation in most holes, but drill density is not yet sufficient for resource modelling.

PolarX has commenced the following work programs to advance Zackly to evaluate its economic viability, either as a stand-alone project, or in some form of combined operation with Caribou Dome.

It is worth noting that over 2.6 kilometres of strike-length remains untested at Zackly East, and Zackly Main remains open at depth.

In addition to the Zackly skarn mineralisation, the recently acquired ultra-high-resolution magnetic data has highlighted a potential porphyry target to the north and east of current drilling, in which a magnetic high is surrounded by a magnetic low, producing an “eye” structure consistent with geophysical models of porphyry-style mineralisation.

This target as shown below has never been drilled and is a high priority for follow-up.

In terms of funding upcoming exploration activities, management is still pursuing farm-out opportunities for its major copper-gold porphyry exploration plans and it expects this to accelerate as COVID-19 restrictions ease and vaccination programs take effect.

What could be of significance in terms of generating interest in a farm-out venture is more evidence of porphyry presence, including the Mars drill intersection (102 metres at 0.22% Cu + 0.1g/t Au), and it is worth noting that this has been demonstrated since the previous farm-out arrangement was negotiated.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.