Pacifico re-focuses its exploration ambitions: updates Resource estimate

Published 17-JAN-2019 13:43 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

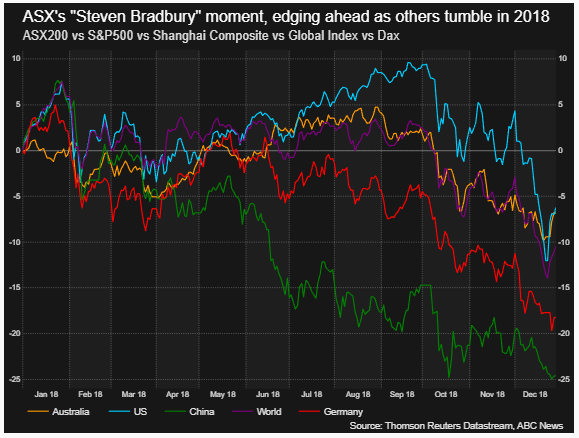

To say 2018 was a challenging year for global markets and commodities would be an understatement.

Almost A$120 billion was wiped off the ASX 200 alone, the big four scrambled to minimise fallout from the banking royal commission and the Australian economy had its worst performance in two years, slipping below 3% year-on-year growth.

Unfortunately, things were no better abroad.

Surprisingly, the ASX was one of the better performers over the past 12 months, as key markets around the world stalled.

While President Donald Trump is currently dominating headlines over his border wall conquest (which has caused the longest federal government shutdown in US history), it’s his administration’s mass tax cuts, and their fading effect on the US economy, that should be followed closely.

Commodities were hit hard: zinc, lead, nickel and silver all suffered sizeable losses.

Iron ore and gold finished the calendar year on a sour note (down 3% and 4% respectively), but fared well when compared to traditional leaders such as copper (-18%) and oil (-16%).

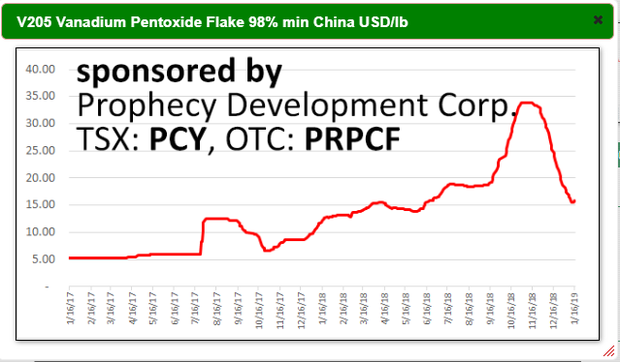

While vanadium closed the year well above it’s opening price on January 1 2018 (US$10/lb), it too was not immune.

Despite its potential battery applications, it’s strong industrial roots ensured it felt the pinch in the back half of CY18. The metal slid below US$20/lb by year’s end, well short of its inter-year high of US$35/lb.

Fledgling explorers look to re-prioritise operations

In light of the past year, junior explorers on the ASX are now looking to streamline and consolidate their assets.

Pacifico Minerals (ASX:PMY) is one such explorer that has tweaked its direction for 2019.

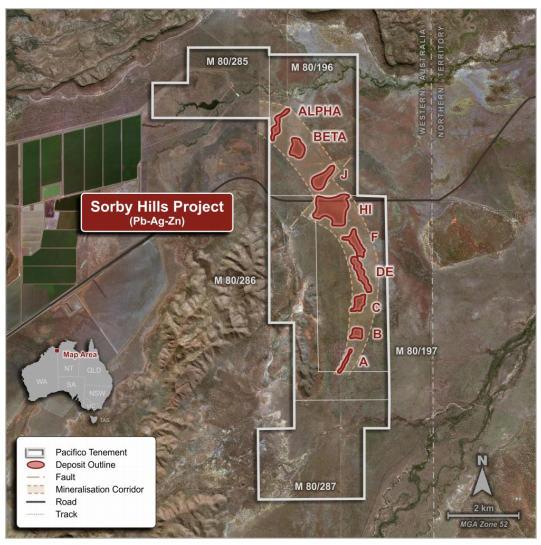

It will use the new year to re-prioritise the Sorby Hills lead-silver-zinc project in Western Australia, having informed its shareholders that it will not complete its acquisition of the Violin Project in Mexico.

Despite the highly promising results to date at the Guerrero belt site, the polymetallic explorer sighted current market conditions as a key factor for the decision.

PMY holds a 75% interest in the JV at Sorby Hills, with the remaining 25% held by Henan Yuguang Gold and Lead Co. Ltd (China’s largest silver producer).

The company has updated the resource estimate for Sorby Hills to JORC 2012, with a Global Resource of 16.5Mt at 4.7% lead, 53g silver and 0.7% zinc.

Building off this, it has since completed its phase 1 drilling program at Sorby Hills, which focused on the B, C, CD link, D, F and I deposits.

Some 3,906m of reverse circulation (RC) and 1,466m of diamond drilling (DD) was completed during the program, with visual logging completed to date already indicating strong lead mineralisation in several holes.

PMY’s strategic refocus coincided with Simon Noon’s (PMY Managing Director) meeting with JV partner Henan Yuguang, which centered around securing supply and offtake and payability arrangements.

PMY Managing Director, Simon Noon, spoke on the Sorby Hills update.

“Just 6 weeks ago we closed the acquisition of Sorby Hills and already we’ve completed a highly successful drilling campaign, results from which we are confident will materially upgrade the resource estimate (JORC) and enhance the Pre-Feasibility study which is already underway and will be completed in the first half of 2019.

“Sorby Hills has all the signs of being a company maker for Pacifico, with 2019 being a pivotal year as we focus on progressing quickly towards a definitive feasibility study scheduled for 2H 2019.”

Future activities to take place at Sorby Hills include:

1H 2019

- Assay results from Stage 1 infill and expansion drilling

- Updated Resource estimate

- Updated Pre-Feasibility study

- Stage 2 infill and expansion drilling

2H 2019

- Assay results from Stage 2 infill drilling

- Updated Resource estimate

- Definitive Feasibility Study, and a move to project financing

About Henan Yaguang Gold and Lead Co Ltd

Henan Yaguang was established in 1957 by the government of Jiyuan City, located in Henan Province in North China.

The company listed on the Shanghai Stock Exchange in 2002 (HYG – exchange code: 600531), and has been among the top 500 Chinese enterprises and top 500 manufacturing enterprises for the last five years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.