Pacifico raises capital and prepares to fast track production

Published 09-APR-2019 12:24 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

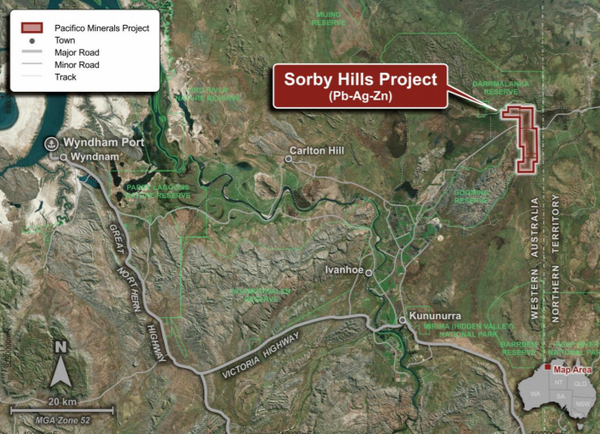

Pacifico Minerals Ltd (ASX:PMY) has ticked another important box in terms of progressing its Sorby Hills Lead-Silver-Zinc Joint Venture Project in Western Australia.

The company has received firm commitments from sophisticated and professional investors to raise $4 million for a placement of approximately 666 million shares at a price of $0.006 per share.

This provides Pacifico with the funds required to finalise its 75% acquisition of the Sorby Hills project, as well as meeting the capital requirements in terms of continuing its phase 2 infill and expansion drilling and updated mineral resource estimate.

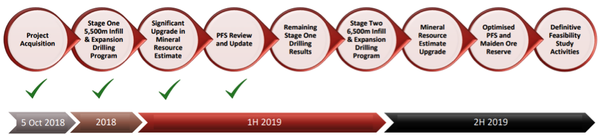

As indicated below, these are important steps to be undertaken as the company collects the data to feed into an optimised prefeasibility study (PFS) which is expected to be completed in the December quarter of 2019.

Placement oversubscribed

The placement was well supported by new and existing institutional investors, a promising sign in terms of the market’s confidence in both the project and management’s ability to execute its strategy.

Of further significance was the fact that the issue price represented a premium to the company’s 5 day and 10 day VWAPs (volume weighted average price), as placements particularly at the smaller end of the market are often completed at a significant discount.

Management saw this as a strong endorsement of the support for Pacifico’s strategy and the group’s growth plans in general.

Quickfire response to updated PFS

With mining leases and key permits in place, Sorby Hills is strongly positioned for development.

The funds raised from the placement will be used to finalise the company’s 75% acquisition of the Sorby Hills Project, continue phase 2 infill and expansion drilling and update the Mineral Resource Estimate for Sorby Hills Project to underpin an optimized PFS in 2019 and for general working capital purposes.

In conjunction with the placement, the company has received an extension on its payment for the final amount due as consideration for the Sorby Hills Project.

Settlement of approximately $2.5 million is due on or before 15 April 2019.

Established infrastructure assists in early production

Managing director Simon Noon saw the strong support for the placement as a show of confidence, and in discussing the implications for progressing to early stage production he said, “This funding will enable us to complete the acquisition of the 75% interest in the Sorby Hills joint venture and advance project development activities following the recent completion of a PFS update which confirmed the potential to establish a commercially robust mining operation.

“Further resource infill and expansion drilling will get underway in May ahead of a planned Mineral Resource Estimate update to support an increase in mining rate.

“Important metallurgical test work is also ongoing to optimise grade and recoveries as a prelude to an optimized pre-feasibility study which we expect to complete in Q4 this year.

“2019 will be an exciting and busy year for Pacifico where shareholders can expect strong news flow as we work to unlock value and position the company to be a significant new supplier of high grade, high quality concentrate into a lead market in deficit.”

The presence of established infrastructure will assist Pacifico in moving to production relatively quickly once it has completed the necessary studies, particularly given the necessary mining permits are already in place.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.