Pacifico progresses to new phase of metallurgical testing

Published 28-JAN-2020 10:29 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As Pacifico Minerals Limited (ASX:PMY) continues its new phase of metallurgical testing to support the optimised prefeasibility study at the Sorby Hills lead-silver-zinc joint venture project in Western Australia, management provided an update, highlighting the significant progress made during the three months to 31 December, 2019.

This was an important period for the company as it achieved a 20% increase in the global resource at Sorby Hills.

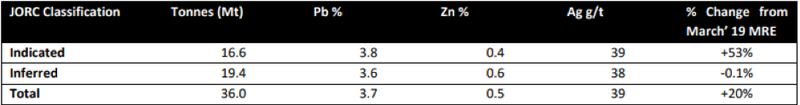

This included a 53% increase in the total indicated resource to 16.6 million tonnes at 4.8% lead equivalent and 0.4% zinc through conversion of the Inferred Resource.

The total resource now stands at 36 million tonnes at 4.7% lead equivalent and 0.5% zinc.

This significant update of the Mineral Resource Estimate came on the back of a second highly successful drilling program.

Phase II drilling targeted the Omega and B deposits, aiming to increase resources in the Indicated category.

The boost to Indicated resources from just 6,000 meters of infill drilling was viewed by management as exceptional.

The company’s other main objective was to grow and increase confidence in the Mineral Resource to underpin an increase in the mining rate and test the grade assumptions to be modelled in the upcoming Optimised PFS.

Updated MRE to assist in growing high grade zone

The updated MRE has highlighted two aspects that are likely to have a significant impact on the planned Optimised PFS.

Firstly, Inferred Resources have a high conversion rate to Indicated status through a tightening of drill hole spacing, and extension drilling allows Resources to be increased because of the predictable strata-bound nature and geometry of the mineralisation.

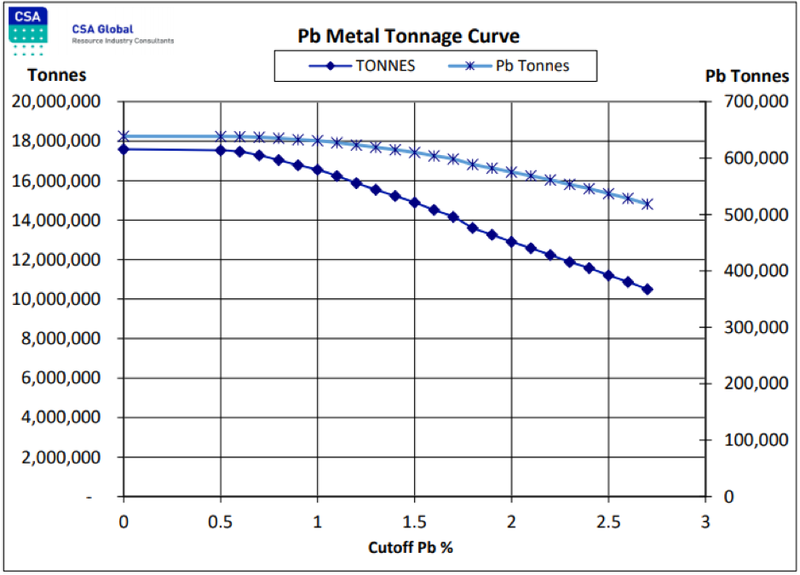

Also, mineralisation is only slightly susceptible to a significant change in cut-off grade as shown below.

At an increased cut-off grade for lead to 2.5% lead the resource retains almost 85% of the metal content despite a drop in tonnage by 35%, demonstrating the resilience of the project.

Pacifico will use these findings to further refine targeting and exploration drilling to grow the high-grade zone of mineralisation to potentially improve project economics.

Phase III drilling likely to support conversion of resources

During the quarter, Pacifico completed the Phase III drilling campaign, consisting of 49 reverse circulation drill holes for 3,265 metres.

The program was aimed at increasing confidence and increasing Inferred Resources, while also converting existing Inferred Resources to Indicated status, as well as following up on historic intercepts.

All drill holes were logged and sampled during the quarter.

Logging and pXRF testing of rock chips provided a qualitative guide to mineralisation and indicated that significant intersections were obtained, and assay results are imminent - a potential near-term share price catalyst.

Field observations were indicative of a successful drilling campaign that is likely to support further conversion of Indicated and Inferred Resources to higher classifications and to replace Inferred Resources while building on the potential of the discovery of new deposits in the west.

As well as making good progress on the exploration front, Pacifico finished the quarter with cash of $3.8 million.

This received a further boost following the end of the quarter with its joint venture partner Henan Yuguang contributing approximately $870,000 as its share of exploration expenditure.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.