Pacifico phase 2 drilling leads to updated PFS

Published 27-MAY-2019 12:28 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacifico Minerals Ltd (ASX:PMY) has commenced its 6000 metre phase II infill and expansion drilling program at its Sorby Hills Lead-Silver-Zinc Joint Venture project in Western Australia.

Pacifico owns a 75% interest in the Joint Venture with the remaining 25% interest held by Henan Yuguang Gold and Lead, the largest lead smelting company and silver producer in China.

The current drilling program follows the highly successful phase I drilling campaign, and aims to increase indicated resources, while also gathering geotechnical information for pit designs and samples for further metallurgical test work.

Discussing the company’s achievements to date and the upcoming drilling campaign, Pacifico’s managing director, Simon Noon said, “Following the exceptional results of the Phase I drilling program, we are excited to undertake follow-up drilling.

“This drilling program represents another significant investment by Pacifico and Henan Yuguang and aims to move a portion of the resource to an Ore Reserve to enable planning for a future mining operation - 2019 is the most important and exciting year in the company’s history.”

Phase I drilling underpinned an updated MRE and PFS with highly positive results including high grade lead equivalent intercepts of more than 10 metres at multiple drill holes.

Pacifico consistently struck high grade silver, indicating that the group should benefit from silver credits, potentially driving down production costs of a lead-focused operation.

Following Phase II, a further Mineral Resource Estimate (MRE) update will be carried out to support an optimised Pre-Feasibility Study (PFS) by the December quarter of 2019 ahead of completion of a Definitive Feasibility Study (DFS) in 2020.

Transition from multiple orebodies to single deposit

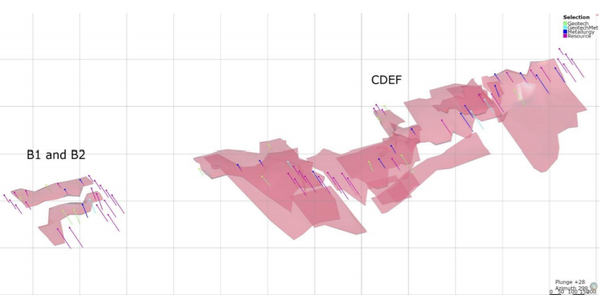

Phase I drilling results confirmed that C, DE, and F deposits as outlined below are linked and can now be referred to as a single deposit with a strike length of 1.7 kilometres.

In addition, the Phase I drilling results underpinned updates to the MRE and PFS.

The updated MRE completed in March 2019 resulted in a 123% increase in the tonnage of Indicated Resources to 10.8 million tonnes of 5.0% lead equivalent.

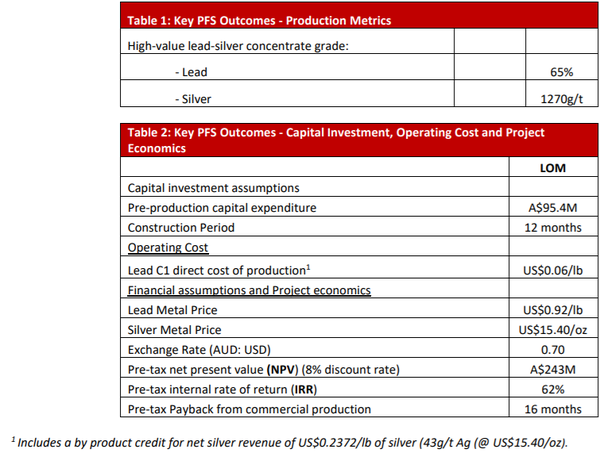

As indicated below, the updated PFS confirmed that Sorby Hills is a high-quality, high-margin base metals project and is strongly positioned for development.

Multiple near-term share price catalysts

As well as the consistent return of assays from drilling results between June and July, Pacifico is also undertaking metallurgical test work, ore sorting and optimisation studies, the results of which could point to improved commercial viability regarding the Sorby Hills Project.

The results of these initiatives may well provide share price momentum during that period.

In the December half of 2019, the updated Mineral Resource Estimate could have a significant impact on the company’s share price, and given that the optimised prefeasibility study may indicate improved financial outcomes, it is also an event to monitor.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.