Noosa Mining Conference - the family affair

Published 16-JUL-2019 11:43 A.M.

|

21 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardly a week goes by when there isn’t a mining and energy conference taking place somewhere in the world, and with Australia being central to some of the world’s biggest mining projects and extensive exploration programs we have our fair share.

However, there is something unique about the Noosa Mining and Exploration Conference which is held in July each year.

For example, the Noosa conference and the rough-and-tumble Kalgoorlie Diggers and Dealers conference are not only held thousands of kilometres apart, but the surrounds are also at opposite ends of the scale.

Granted, both venues are surrounded by plenty of sand.

However, the sandy pristine beaches of the Sunshine Coast tend to draw more accolades than the desert sands of the Kalgoorlie region.

For many years, the conference has been held at Peppers Noosa Resort which has a stunning view of Noosa and the beaches to the north.

While many of the mining executives stay at the family-friendly Peppers, others also target the plush accommodation on offer in and around the iconic Hastings Street.

And that is one of the key differences with the Noosa conference - for many, it is a family affair.

The Noosa conference is the ideal location to mix work with pleasure. At the end of each day, there is a short ‘business at the bar’ session which quickly morphs into talking tactics about where to eat and drink. or the best locations for family to spend their downtime.

Conference coordinators take care of some of those logistics, and after the major presentation day on Thursday the Noosa Surf club is packed with conference attendees as they snack on canapes and throw down a few beers.

The Noosa Surf Club with its glassed indoor area and open deck shows off the Sunshine Coast as it overlooks the renowned north facing point breaks and the National Park.

This is just another touch that sets the Noosa conference apart from many other similar events.

However, that isn’t to say that there isn’t business done at the conference and there are brokers, institutional investors and sophisticated investors that attend the presentations and then spill out to the booths where they can have a face-to-face deep and meaningful with company management.

More than 60 companies will be presenting at the conference over three days, and while it is impossible to profile all of those, Finfeed will provide a snapshot of some of the companies and the news that may be at the forefront of their presentations.

It is worth noting that Noosa distinguishes itself in another way by attributing the first half day on Wednesday afternoon to emerging microcap players with market capitalisations below $35 million.

This provides conference attendees with the opportunity to identify the next big thing, bringing good quality companies that are currently under the radar into the spotlight.

Given many of these stocks may be unknown to investors, Finfeed has compiled a comprehensive review of most of the companies presenting on Wednesday afternoon.

The other part of our coverage will be released next week as we look retrospectively at the standout stories that emerged during the conference.

25 microcaps do battle on Wednesday

The first presentation on Wednesday is at 12:30pm with Aus Tin Mining (ASX:ANW) kicking things off as managing director, Peter Williams shines some light on the company’s tin and cobalt operations.

The latter is essentially an exploration story at this stage with good nickel grades also encountered at the group’s Mt Cobalt Project at Gympie, not all that far from Noosa.

However, the tin side of the company’s operations is very interesting with cash being generated by its Granville project in Tasmania, and some of the final boxes being ticked at its Taronga project New South Wales.

What makes this story even more compelling is the historically strong Australian dollar tin price which we will go on to discuss.

The group’s Taronga Tin Project is the world’s fifth largest undeveloped tin reserve, based on a JORC resource of 57,200 tonnes of contained tin, plus 26,400 tonnes of contained copper and 4.4 million ounces of silver.

The company received its final regulatory approval for Taronga Stage I in mid-May, and the majority of expenditure for this stage is forecast for the second half of 2019, coinciding with the expected sustained cashflows from the Granville Tin Project in Tasmania.

Subsequent to the end of the March quarter, the first skarn material from Granville was mined, and blast hole drilling confirmed a zone of high‐grade mineralisation with an arithmetic average grade of 1.8% tin over a 15 metre cross‐section of the pit.

The skarn is the main type of mineralisation at the mine and is representative of material treated during Level 1 operations.

The Australian Dollar tin price has been trending upwards since 2004 and recently exceeded $30,000 per tonne, prices not seen since 2011.

While it retraced in June before rallying again in July, the commodity is still trading above $26,000 per tonne in Australian dollar terms.

Given that the prefeasibility study for the project pointed to operating costs of circa $16,550 per tonne, the margins on offer at the moment are extremely attractive.

While the prefeasibility study (PFS) was based on a 9.3 year mine life, management is confident that this can be extended through exploration.

On this note, management recently said that the company has plans to expand its resources both at the Taronga site that will be established in coming months, while also taking in the larger Taronga-Torrington Project footprint.

Moving on to new age metals such as graphite, lithium, cobalt and vanadium, commodity prices haven’t been kind to the sector, and generally speaking they are a far cry from where they were leading up to last year’s conference.

The price of cobalt has plunged more than 60%, and lithium has lost its market darling status having fallen roughly 25% in the last 12 months.

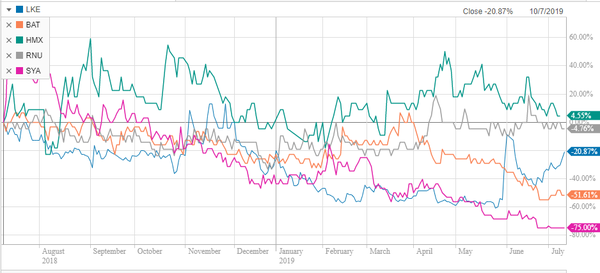

Consequently, it should come as no surprise that when piled together on a 12 month share price chart it makes for fairly ugly reading.

The five companies represented by the ASX codes in the top left corner of the chart are top to bottom Lake Resources, Battery Minerals, Hammer Metals, Renascor Resources and Sayona Mining.

These companies are exposed to a range of what has become known as battery minerals with Hammer Metals (ASX:HMX) the best performer and the only company exposed to copper and cobalt to be positioned in positive territory for the period in question.

At the tail of the field comes lithium group Sayona Mining with its shares having fallen 75% in the last 12 months.

However, it is the one in third place that has me interested.

While shares in Lake Resources (ASX:LKE) are off about 20% over the last 12 months there has been some interesting news flow, particularly since May which has triggered a sharp rebound in the company’s shares.

For example, on May 31 the company reported impressive flow rates of conductive brines from its Cauchari Lithium Brine Project, Argentina.

Recent lithium results confirmed the potential for the group’s Cauchari project to replicate the success of similar projects, and vindicate management’s long held view that the basin is fault-bounded and extends beneath thin alluvial cover.

This news triggered a doubling in the company’s share price as it increased from 5.2 cents to 10.5 cents under all-time record volumes.

While there appeared to be some profit-taking following this news, it may well have been associated with end of financial year tax loss selling as there has been a sharp rebound in recent weeks with the company’s shares increasing by 50%.

However, news released at the start of this week wasn’t well-received the company’s shares coming off roughly 20%, indicating the need to closely monitor news flow.

Go for gold

While stocks in the battery metals space have generally struggled, it has been quite the opposite with gold as the precious metal recently hit a six-year high of US$1442.90.

However, there has been an extra bonus for Australian producers with the Australian dollar hovering in the vicinity of US$0.69 implying an Australian dollar gold price of about $2050 per ounce.

With the gold price only briefly slipping below the US$1400 per ounce mark since the June rally and foreign exchange rates remaining relatively stable, the implied margins for Australian producers are exceptionally high.

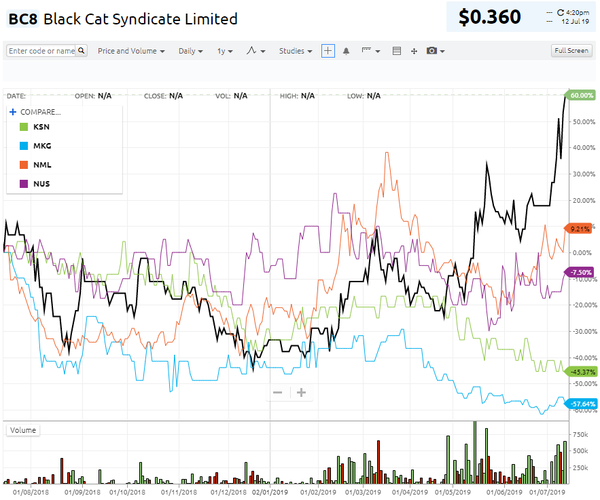

The 12 month share price performances of most of the microcap gold stocks presenting on Wednesday are shown below with Black Cat Syndicate Ltd (ASX:BC8) represented by the black line clearly the outperformer.

Black Cat Syndicate Ltd (ASX:BC8)

However, as we will go on to explain there are some emerging players that are likely to experience share price traction from upcoming developments, and these are worth examining as potential dark horses in a hot field.

Since listing on the ASX in January 2018, Black Cat Syndicate Ltd has shown plenty of promise, and the company has a portfolio of assets that are delivering excellent exploration results.

Black Cat controls 100% of approximately 87 square kilometres of the Bulong Gold Project, of which about 87% of tenements are granted.

Bulong is situated just 25 kilometres east of Kalgoorlie by sealed road and has a pre-WW1 history of small scale, high-grade gold production, recorded as approximately 150,000 ounces at more than 1 ounces per tonne gold, predominantly from the Queen Margaret mine.

Mains power runs through Bulong with five regional mills, support services and a residential workforce nearby.

Management has made rapid progress on the exploration front having delineated the Queen Margaret, Myhree-Boundary and Trump Corridors which total 17 kilometres in length, including the Myhree discovery.

Just 10 months from the commencement of drilling, Black Cat has also announced a qualitative Maiden Resource totalling 1.4 million tonnes at 2.5 g/t gold for 109,000 ounces of contained gold within these three corridors just 10 months from commencement of drilling.

Results released last week in relation to the Myhree deposit were extremely impressive with grades up to 36 g/t gold and some broad intersections such as 12 metres at 1.7 g/t gold from 190 metres.

The continuation of thick, high-grade results, deep into the Myhree system is extremely positive.

With mineralisation down to 300 metres, the scale potential at Myhree is encouraging in terms of both open-pit and underground potential.

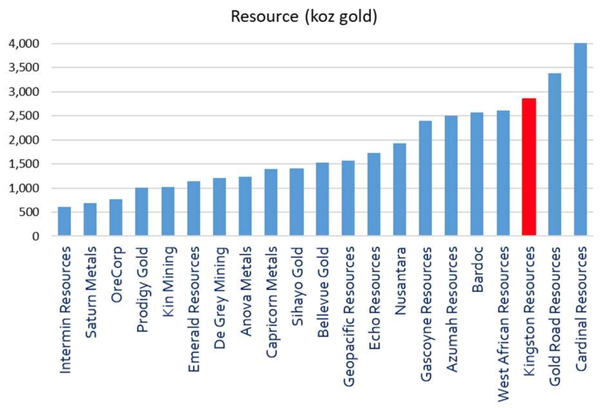

Kingston Resources (ASX:KSN)

KSN is a gold exploration company, and potentially a relatively near-term producer given that its assets include a large producing mines.

Management’s priority is the world-class Misima Gold Project in Papua and New Guinea (PNG), which contains a JORC gold resource of 2.8 million ounces, a production history of over 3.7 million ounces and outstanding potential for additional resource growth through exploration success.

Kingston currently owns 70% of the Misima Gold Project.

The group also owns 75% of the Livingstone Gold Project in Western Australia.

Such were the robust economics of the project that the Misima mine only closed when the gold price fell below US$300 per ounce, about US$1100 per ounce below where the precious metal is currently trading.

After funding further exploration in the March quarter, Kingston’s stake in the project is expected to increase to 75% with the group’s joint venture partner Pan Pacific Copper owning the remaining 25%.

The next table not only demonstrates the size of the company’s resource (right-hand side) against one of the largest emerging projects referred to by S&P Global (Gold Road’s Gruyere Project in Western Australia), but it also highlights the undervalued status of Kingston Resources on an enterprise value to resource ounces scale (left-hand side).

Misima field work commenced in December 2017, delivering immediate success with the discovery of a new prospect, Ginamwamwa, located adjacent to former mill site.

This new prospect continues to deliver some amazing gold grades near surface.

Bonanza gold grades have been identified immediately west of some artisanal workings where gold in veins were delineated in September, and 100 metres further east of that, on the other side of the creek the company has detected more high grades in an intersection of 8 metres at 14.2g/t with individual samples up to 39 g/t gold.

With multiple and untested targets over eight kilometres of prospective strike there is enormous upside potential from exploration, and there is a school of thought that this could provide feed for a high-grade, near surface, starter pit.

Kingston definitely looks to be the sleeper among this clutch of stocks.

Mako Gold Ltd (ASX:MKG)

has recently completed reverse circulation drilling at the company’s 224 square kilometre Napié Project in Côte d’Ivoire, with the program having unveiled some promising exploration results.

Twenty-seven holes were completed for a total of approximately 4100 metres, which exceeded the 3600 metres originally planned in this phase of drilling.

Highly anticipated assay results are expected in coming weeks as this program followed up on previous promising results in key target areas, primarily focused on the Tchaga Prospect.

Promising drilling results from the Tchaga prospect included 8 metres at 8.5 g/t gold from 31 metres and thicker intersections such as 28 metres at 4.9 g/t from 83 metres.

Drilling on the Tchaga Prospect tested 1.4 kilometres of strike length to infill and extend the 500 metre long broad zones of gold mineralisation identified to date.

The Napié Project is located in a gold rich region with some of the world’s largest miners operating multi-million ounce mines.

Given the highly prospective nature of the region and the drill results already released by Mako, there is a strong possibility that upcoming assay results could provide share price momentum.

Another near-term catalyst would be the release of the JORC resource which will include results from this drilling campaign.

Another company that has been boasting high-grade gold exploration results in recent weeks is...

Navarre Minerals Ltd (ASX:NML)

At the start of July the company reported encouraging high-grade gold assay results from the Tomorrow and Macnaughtan prospects as part of an ongoing 10,000 metre drilling program at the company’s 49%-owned Tandarra Gold Project (RL006660), 40 kilometres north of the 22 million ounce Bendigo Goldfield and 50 kilometres north-west of the world-class Fosterville Gold Mine.

Significant new high-grade gold assays have been received from step-out drilling on the southern end of the Tomorrow prospect which have resulted in a 300 metre extension in the strike length of the mineralised quartz structure to approximately 1.1 kilometres, which remains open to the south.

Impressive drill results have included 3 metres at 44 g/t gold including 1 metre at 131 g/t gold from 111 metres down hole.

Another wider intersection of 6 metres grading 14 g/t gold within 24 metres grading 4.2 g/t gold.

Navarre is certainly one for the watchlist.

Nusantara Resources Ltd (ASX:NUS)

NUS is also shaping up as a strong prospect in 2019 based on its advanced position with the Awak Mas Project in South Sulawesi, Indonesia.

The company’s shares have experienced strong momentum since late May, increasing by approximately 40%.

The company’s flagship asset is its Awak Mas project, and at the start of the year the company was well funded with over $10 million in cash and shareholder commitments.

With a promising DFS completed and key permits in place the project is ready for funding.

The numbers stack up well with the project having a mineral resource of 2 million ounces, an ore reserve of 1.1 million ounces and an 11 year mine life based on production of 100,000 ounces per year.

This doesn’t account for exploration upside which given that drilling has confirmed the potential for resource expansion, increased average annual production or a longer life profile is possible.

Particularly strong results included 37 metres at 2.3 g/t gold including 8 metres at 4.1 g/t gold.

Multi-commodity stocks to watch

PolarX Ltd (ASX:PXX)

PXX could have some exciting news on the horizon as it is about to commence drilling at the Saturn copper-gold porphyry target within its Alaska Range Project.

An initial program of up to 10 holes covering a distance of approximately five kilometres has been agreed with Lundin Mining Corporation, a leading global mining group and PolarX’s largest shareholder with a stake of 12.8%.

A $4.3 million share placement to Lundin Mining will provide the funding for the upcoming drilling campaign.

The Saturn porphyry copper‐gold target was identified in early 2018 through evaluation of regional aeromagnetic data, and it was subsequently confirmed through a higher‐resolution survey in October 2018.

The anomaly is approximately three kilometres to the east of the high‐grade Zackly skarn deposit, a style of mineralisation often associated with large mineralised porphyry systems, making PolarX very much a ‘watch this space’ stock.

In terms of having a strong resource base and a successful and advanced exploration program under its belt...

White Rock Minerals (ASX:WRM)

...is hard to beat.

It is another company targeting the highly prospective Alaskan region.

Along with its joint venture partner, Sandfire Resources (ASX:SFR), the group is poised to identify extensions of high-grade Volcanogenic Massive Sulphide (VMS) mineralisation as it drills new targets in the vicinity of the existing deposits.

White Rock entered into an Earn-In and Joint Venture Option Agreement with Sandfire in March for the exploration and development of the Red Mountain Project in Alaska with a four stage funding package, including an option to spend a minimum of $20 million over that period to earn 51%, with a minimum contribution of $6 million in 2019.

A high-grade zinc and precious metals VMS project, Red Mountain already has two high grade deposits, with an Inferred Mineral Resource of 9.1 million tonnes at 12.9% equivalent, for 1.1 million tonnes of contained zinc equivalent.

Drilling is focused on testing new targets defined from the ongoing field activities that include geological reconnaissance, surface geochemistry and modelling of the recent 2019 airborne electromagnetic (EM) survey.

Plenty of energy at Noosa

The conference has coincided with a strengthening in the oil price as it pushed above US$60 per barrel at the start of the week.

Analysts at Taylor Collison noted on Monday that Tropical Storm Barry is capping production in the Gulf region with American crude inventories upwards of 1 million barrels of oil per day of output, or 53% of the region’s production.

The broker also reported that in Asia, oil refining margins are now sitting at their highest levels since September 2017, as refiners cut output and tightened supplies.

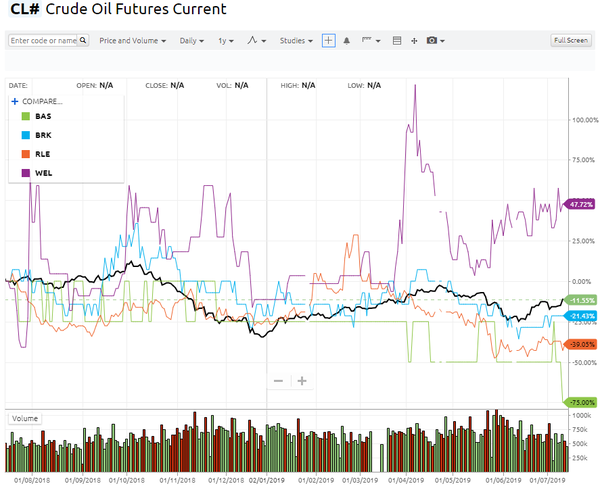

In the following chart we mapped four of the microcap oil and gas companies presenting on Wednesday against the crude oil futures benchmark over a 12 month period.

Similar to gold, there was a clear outperformer in Winchester Energy (ASX:WEL), but you will notice there are some interesting emerging stories, a point in case being the first company we look at which is an oil producer with a market capitalisation of only $3 million.

Looking across the companies presenting at Wednesday afternoon’s microcap session, Bass Oil (ASX:BAS) is first cab off the rank.

Bass Oil (ASX:BAS)

As we said, Bass has a sub-$5 million market capitalisation, but it could be argued that the company is punching above its weight.

There are numerous larger companies that are nowhere near production, but total June production of 18,968 barrels of oil achieved from Bass’s 55% owned Tangai-Sukananti field netted the group 10,450 barrels.

The average monthly realised oil price was US$61.01 per barrel, resulting in robust positive cash contributions given that the field situated in the prolific oil and gas region of South Sumatra, Indonesia has low operating costs of less than US$25 per barrel.

Bass has received drilling tenders for the Bunian 5 well, part of the broader Tangai-Sukananti field.

A tender should be awarded in the near term, and Bass’s aim is to drill the Bunian 5 as soon as the rig is available which is now likely to be October.

Bunian 5 is expected to double production from the field taking up the remaining available production capacity of the Tangai-Sukananti field facilities, as well as increasing developed reserves.

Since hitting a 12 month low in mid-June, shares in Brookside Energy (ASX:BRK) have rallied approximately 30% in recent weeks on the back of a scaling up of its land and leasing business model in the world class Anadarko basin region of Oklahoma.

Brookside Energy (ASX:BRK)

Brookside is focused on the mid-continent region of the US with the company aiming to build value through the acquisition and development of producing oil and gas assets, as well as the leasing and development of acreage opportunities.

The company’s non-operated working interest wells in the Anadarko Basin plays continue to deliver excellent production rates, providing further support for the quality of the acreage that Brookside has been able to secure within that region.

During the March quarter, management announced significant progress with its leasing, trading and high-grading operations within the SWISH AOI. To date, the SWISH AOI leasing campaign has delivered Brookside a potential circa 6,000-acre position in the promising SCOOP (South-Central Oklahoma Oil Province) Woodford-Sycamore trend where several of the New York Stock Exchange (NYSE) listed tier-one independents are reporting very significant per unit resource potential.

Returning to Australia.

Real Energy Corporation Ltd (ASX:RLE)

RLE is a gas development company with a focus on the Cooper Basin, the country’s most prolific onshore producing petroleum basin.

Gas from this region is anticipated to address the critical undersupply situation which is emerging on the east coast of Australia, in particular Queensland.

Real Energy has 100% ownership in two large permits in Queensland - ATP 927P and ATP1194PA.

Real Energy is focusing initially on the Toolachee and Patchawarra formations.

These formations are well-known throughout the basin for holding and producing gas.

Seismic interpretation in conjunction with existing petroleum well data has determined that the Toolachee and Patchawarra formations are significant across much of the group’s acreage.

In June, the Queensland Government granted a pipeline licence between the Tamarama producing wells located on the company’s ATP927 permit and the Mount Howitt facility operated by Santos Ltd (ASX:STO).

The gas pipeline will allow raw gas to be produced and transported firstly to the Mount Howitt facility and then into the gas processing and transport infrastructure owned by Santos and Beach Energy Ltd (ASX:BPT).

This is a significant development given that Real Energy executed a gas processing and transporting agreement with Santos and Beach Energy last year, and not surprisingly the company’s shares rallied strongly on the back of this news.

In particular, it provides a tangible pathway for the company to negotiate gas offtake agreements, as well as gaining funding to construct the pipeline.

Shares in

Winchester Energy Ltd (ASX:WEL)

have soared 50% in the last two months, spurred on by activity across its oil exploration, development and production assets in the Permian Basin of Texas.

The company has established initial oil production on its large 17,000 net acres leasehold position on the eastern shelf of the Permian Basin, the largest oil producing basin in the US.

Winchester’s lease position is situated between proven significant oil fields.

Management is of the view that with the several known oil productive horizons in its lease holding, that it can build through the application of modern geology, 3D geophysical analysis, drilling and completion methods, a potentially significant proven reserves and oil production asset.

At the start of the week, Winchester reported promising oil and gas shows with strong fluorescence and cut at the Upper Cisco Sand target over a 61 foot gross interval from 4750 feet to 4811 feet.

The full significance of this oil and gas show will be evaluated by wireline logs when the well has reached its planned total depth of 5500 feet.

The prospective resource estimate (Best Estimate P50) for the Lightning Prospect (Lower Cisco Sand) is nearly 2 million barrels of oil.

From a production perspective, the company noted in late June that the recently completed White Hat 20#3 well had recorded initial gross production of 259 barrels of oil per day over 30 days.

It is also flowing gas at a mid-range rate of 120,000 cubic feet per day, equivalent to approximately 20 barrels of oil per day.

The company noted towards the end of June that growth average oil production over a recent seven-day period was 386 barrels of oil per day with Winchester’s working interest share of production standing at 255 barrels of oil per day.

It should be a big few days in Noosa with Australia's mining companies coming together in the sun to impress outside investors and soak up the atmosphere while they are at it. Next week, we'll wrap the conference up and take a look at several of the other stocks that presented.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.