New market conditions means new companies to invest in

Published 05-FEB-2021 11:08 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Some new names entered the vocabulary and portfolios of retail investors in January, according to the latest monthly data from global investment platform eToro.

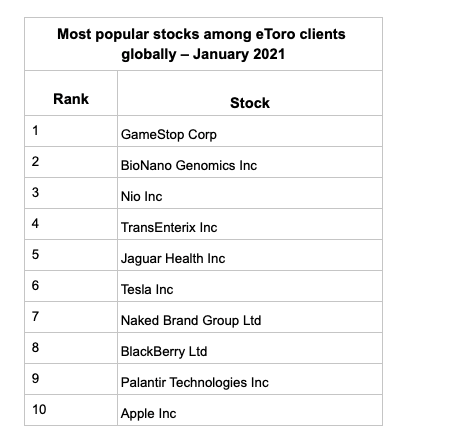

Five new companies broke into the list of 10 most popular global stocks last month. The list represents the most bought stocks for that month rather than the most held stocks for users on the eToro platform.

Healthcare firm BioNano Genomics was the second most popular stock in January, improving on the seventh-place the month before.

Medical device maker TransEnterix leapt into fourth place after winning approval to sell its robotic surgery AI units in the European Economic Area.

But the name on everyone’s lips is GameStop, which sits squarely at the top of the table for January. A flurry of retail activity pushed the electronics retailer, alongside underwear company Naked and software company Blackberry, into the top 10 for the first time – leapfrogging enduring favourite Apple.

However, these new entrants failed to push familiar names too far down the list. Amazon still remained a popular stock with retail investors, down from eighth in December to eighteenth in January. Chinese tech giant Alibaba also took a tumble from fifth but remained the seventeenth most popular stock with eToro investors globally in January.

Gil Shapira, Chief Investment Officer at eToro, commented, “We are navigating unprecedented market conditions and we have seen some users on eToro add some ‘new’ names to their portfolios. We continue to emphasise to all retail investors that it is vital to remember the basic tenets of investing: diversify and only invest in markets and instruments you are familiar with.

“Pharmaceutical and tech stocks have remained popular with eToro investors month-on-month. The companies many of us use regularly continuously appear in this list, highlighting the value of investing in the firms you know and understand. Apple has delivered a return of nearly 75 per cent over the last year, Amazon is up nearly 69 per cent for the same period.

“This point is very important as long-term investors nearly always have more resilient portfolios and are therefore much better placed to ride out volatile conditions.”

Here's a list of the top 10 stocks to trade on the eToro platform.

Commenting on the top ten for January, Gil Shapira, adds: “Markets were incredibly volatile towards the end of January, and that is reflected in the top ten most popular stocks for the month, which includes some names related to the latest events in the market.

“However, we continue to see eToro investors adding big names such as Amazon, Facebook, and Microsoft to their current holdings in sufficient volumes to place these stocks among the most popular on the platform month-on-month.

“While it is always important to invest responsibly, investors should pay particular attention to their actions now, when share prices are so frothy. This is the time to stick to the basics and ensure your portfolio is properly diversified.”

eToro was founded in 2007 with the vision of opening up the global markets so that everyone can trade and invest in a simple and transparent way.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.