MyFiziq's global recognition and strong cash flow performance

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

MyFiziq Limited (ASX:MYQ) has released its Quarterly Activities Report for the three months to 30 September, 2020 which featured an impressive uptick in cash receipts from customers.

Just today, the company also announced that JV partner Body Composition Technologies Pte Ltd, of which MYQ owns 51.45%, has had its visceral fat validation study conducted by the University of Western Australia published in world-renowned Nature Research journal Scientific Report.

Read the report here: https://www.nature.com/articles/s41598-020-73631-x

Scientific Reports is an open access Nature Research journal and is the 7th most-cited journal in the world.

The findings identified that there is a high correlation between certain anthropometric measurements and VAT mass.

In particular, the study confirmed that, in men, waist circumference (WC), waist-hip ratio, and waist-height ratio (WHtR) had ‘high’ correlations with VAT mass. In women, only WHtR was ‘highly’ correlated with VAT mass.

“This is a significant milestone for the company and validation of our scientific rigour when developing our technology and unique data sets. It also acknowledges our approach to using anthropometry measures, including waist circumference, as a scientifically agreed method to identifying chronic disease risk within a population," said MYQ CEO Vlado Bosanac.

"Our ability to screen people at home on their personal device in complete privacy, is significant and the publication has given this deep consideration and as such has accepted the science as publishable due to its high standard.”

Quarterly Results

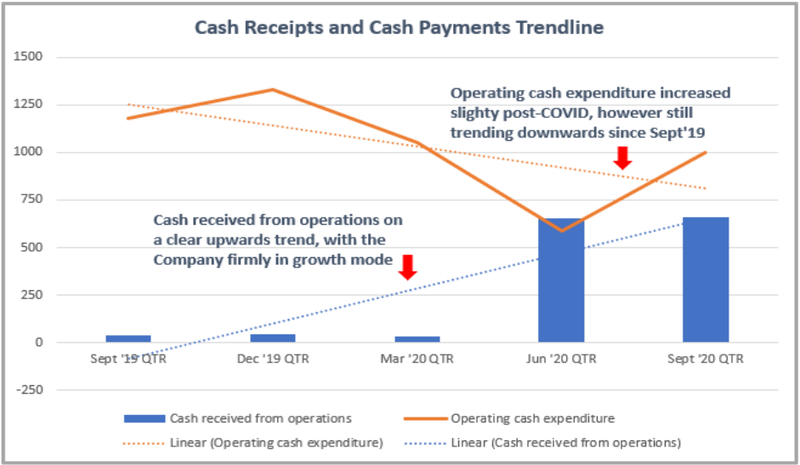

Coming off a nominal base in the previous corresponding period, MYQ's income of $659,000 represented an increase of more than 1600% compared with the same quarter in 2019.

Another development that boosted the company’s coffers was the receipt of a $784,000 R&D tax incentive from the Australian Tax Office, the largest claim to date.

There was also plenty to like in terms of cash preservation, the other important part of the equation.

Cash expenditure reduced from about $1.2 million last year to $1 million in the current quarter, a 15% improvement.

There was a vast improvement in net cash used in operating activities, a modest $310,000 compared with more than $1.1 million in the previous corresponding period.

From an operational performance, the quarter also featured the important launches of Evolt Active and Bearn.

In terms of cash flow metrics, the following graphic tells the story.

September quarter followed up by strong start to December quarter

So strong has MyFiziq’s start to the December quarter been that its significant achievements in September have arguably been overshadowed.

It was a stellar start to October when the company announced that it had signed a binding term sheet with Nexus-Vita Pte Ltd, a Singapore-based health monitoring and management technology group.

Nexus-Vita has developed a medical health and wellness platform that is the bridge between an individual’s medical health and wellness management with the aim of reducing health costs for individuals, governments and the healthcare and insurance systems across the globe.

Nexus and MyFiziq will collaborate to integrate MyFiziq’s body tracking application into all of Nexus’s verticals, commencing with an initial integration into Nexus’s pre-emptive health platform by January 2021.

Under the terms of the agreement, Nexus has undertaken to deliver a minimum of 100,000 active users within the first 12 months of launch.

Shortly after the Nexus deal was announced the company signed a binding term sheet with Jayex Healthcare Limited (ASX:JHL), a UK based health communication monitoring and management technology company.

The Jayex brand is synonymous with patient management systems for general practitioners (GPs) in the UK where the company has been operating for 40 years.

Under the agreement, Jayex intends to integrate the MyFiziq CompleteScan capabilities into its Jayex Connect platform, as well as adding new capabilities that allow for remote patient assessment using the CompleteScan platform to assess patient and consumer needs.

MyFiziq cashed up to continue strong growth with potential NASDAQ listing

Come mid-month, it was time to raise capital and management completed a substantially oversubscribed $5 million capital raising, placing the company in the most robust financial position it has been in for a number of years.

Discussing this development and other financial developments that have placed the company in a strong position, chief executive Vlado Bosanac said, “The week has closed out on a very positive note with the oversubscribed capital raising placing $5,000,000 into the MYQ account.

‘’This was further enhanced with inflows from our US NASDAQ initiative funding, Government R&D reimbursements, a license payment from BCT and partner revenues.

‘’This totalled a further $1,504,977 of inflows to the company.

‘’I am pleased to say the company is in the best financial position it has been in for the past few years, with ample capital to accelerate growth and execute on our NASDAQ initiatives.”

Shares in MYQ have increased five-fold since June, but broader market volatility has seen them retrace to about $1.00, perhaps providing an entry opportunity for investors who missed the strong uptick that occurred in recent months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.