Multiple share price catalysts at St George Mining

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

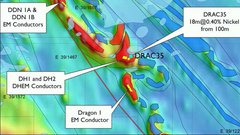

Emerging Western Australian nickel company St George Mining Ltd (ASX:SGQ) has delivered further strong results from drilling at the Mt Alexander Project, located near Leonora in the north Eastern Goldfields.

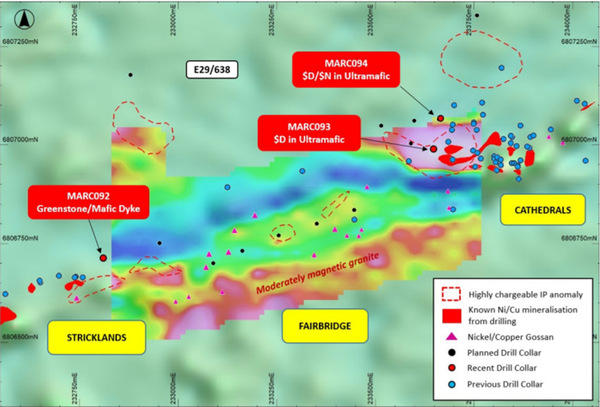

Two drill holes, MARC093 and MARC094, have been completed at the eastern margin of the Fairbridge Prospect to test an anomaly that is interpreted to be the western extension of the mineralised ultramafic at the Cathedrals Prospect.

Cathedrals is one of three discoveries that St George and its 25% joint venture partner, Western Areas (ASX:WSA) has made in recent years.

As well as Cathedrals, the Stricklands and Investigators discoveries feature nickel-copper-cobalt-PGE mineralisation.

The map below shows the sites where current drilling is taking place.

Potential catalysts in coming days

Both drill holes intersected thick intervals of ultramafic rocks and nickel sulphide mineralisation. MARC093 was completed to a downhole depth of 178 metres, while MARC094 which was drilled to the north of MARC093 was drilled to a depth of 226 metres.

The interim results demonstrate that the mineralised ultramafic dips to the north, with stronger nickel sulphide mineralisation at depth.

Significantly, a large chargeable anomaly has been modelled to the north of MARC094, at a vertical depth from surface of approximately 250 metres, and the first ever drilling of this large anomaly is scheduled for this week.

Commenting on these recent developments, St George Mining’s Executive Chairman, John Prineas said, “The drill programme at Mt Alexander continues to deliver exciting results and further hits of thick nickel sulphide mineralisation.

“Initial drill results at Fairbridge fit very well with our geological model for the Cathedrals Belt, which interprets the ultramafic unit dipping to the north with potential for further mineralisation down-plunge.

“This is encouraging for the remaining nickel sulphide drill targets at Fairbridge – particularly the large chargeable anomalies recently identified down plunge of the known mineralisation at the Cathedrals Belt.”

Argonaut supports step out drilling strategy

Argonaut’s resources analyst Matthew Keane has a speculative buy recommendation on the stock, and in response to recent developments said, “We are highly encouraged by the current strategy to step out of known mineralised zones to potentially extend the scale of the project.

“A maiden resource should be achievable by late 2019, and Argonaut estimates a potential inventory of 84,000 tonnes contained nickel equivalent at a grade of approximately 4% nickel equivalent.”

He noted that there have been virtually no false positive electromagnetic conductors at Cathedrals Belt, providing the company with significant confidence regarding the reliability of its data in shaping the group’s exploration program.

The establishment of a maiden resource would have to be considered as the most significant medium-term share price catalyst.

However, should the company continue to experience drilling success, this will be interpreted as beneficial in terms of establishing a quality maiden resource, potentially providing share price momentum leading up to this event.

While shares in St George were sold down in late 2018, this appeared to be a function of negative sentiment in broader equities markets.

Arguably, a better indicator of the company’s performance is the sharp increase in its share price in the last month, during which time it has surged more than 30% from 12.5 cents to yesterday’s close of 16.5 cents.

This rerating has occurred under larger than normal daily volumes, and significantly higher volumes than those that were apparent in the downtrend in late 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.