Multiple catalysts support GTI’s decision to progress Utah uranium projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A combination of an improved uranium pricing environment, US government initiatives to increase supplies of uranium and positive exploration results are likely to see strong support for GTI Resources Ltd (ASX:GTR) in 2020.

The company has already performed well from a share price perspective, increasing nearly three-fold since March despite the impact of a sharp downturn in equities markets.

The company’s shares surged last week after it released promising assay results from a sample collected from historic mine workings within the Jeffrey claim group in Utah.

GTI could receive further support on Wednesday with management flagging the commencement of its spring exploration program at the Jeffrey project in the week commencing 4 May, 2020.

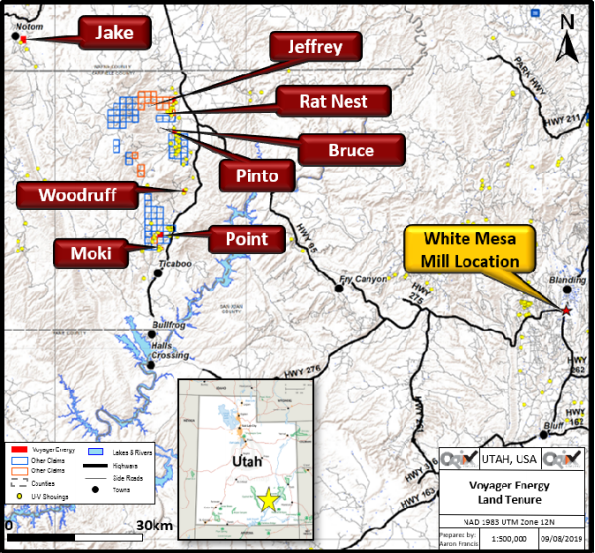

GTI’s properties in that area cover approximately 1,500 hectares of the Henry Mountains region, within Garfield and Wayne Counties near Hanksville, Utah.

Economic benefits of combined uranium and vanadium production

The region forms part of the prolific Colorado Plateau uranium province which historically provided the most important uranium resources in the US.

Ores have been mined in the region since 1904 and the mining region has historically produced in excess of 17.5 million tonnes at 2,400ppm U3O8 (92 mlbs U3O8) and 12,500 ppm V2O5 (482 mlbs V2O5).

The ability to extract both uranium and vanadium from the mines is beneficial in terms of project economics.

The region benefits from well‐established infrastructure, including the White Mesa mill, the only conventional fully licensed and operational uranium/vanadium mill in the US, situated within trucking distance of the properties.

High grade uranium/vanadium at Jeffrey

A field program conducted in November 2018 identified high-grade in-situ uranium/vanadium mineralisation from within the workings on the Jeffrey Claim, including a sample that returned 13,932 ppm (1.39%) U3O8 and 2.46% V2O5 from geochemical analysis.

The highlights of the most recent assay samples include a U3O8 grade of 1,167 ppm (0.12%) and 38,917 ppm (3.89%) V2O5 from an assay sample collected from historic mine workings within the Jeffrey claim group.

Management is commencing exploration at the Jeffrey Project due to the historical exploration activity and small mining operations within the claim group that have indicated the potential for a high-grade mineralised trend across a distance of more than one kilometre.

Within this area, the company has now identified over 20 open historical drill holes, with the number split between each end of the prospective trend.

Starting next week, GTI is conducting a down-hole geophysical logging program in these holes in a high-value effort to refine drill targets prior to commencing with the permitted exploration drill program.

The logging program will generate down-hole U3O8 assay values which will aid in determining the geometry of the mineralisation as the trend moves away from outcrop and underground exposure.

Trump to provide financial support over 10 year period

In a move specifically targeted to provide significant strategic support for US domestic uranium producers, President Trump’s 2021 budget now includes annual expenditure of US$150 million for 10 years to create a US$1.5 billion strategic uranium reserve.

The administration is seeking to provide material support for US uranium miners and the nuclear fuel supply chain.

This program indicates a purchasing requirement for approximately 3.75 million pounds of annual domestic production based on a weighted average price of US$40 per pound.

In addition, the US Department of Energy recently revealed that further congressional approval will be sought to expand this initiative to acquire a total of between 17 and 19 million pounds of U3O8 over 10 years.

A report released last week said that “the U.S. Government will take bold action to revive and strengthen the uranium mining industry.”

White Mesa owner responds positively to affirmative political action

In February 2020, Energy Fuels Inc. (NYSE: UUUU; TSX: EFR), owner of the White Mesa uranium and vanadium processing plant in Utah, completed a US$16.6 million capital raising to underpin activities to increase uranium and/or vanadium production at the company's properties in response to news regarding government support for the industry.

Uranium Energy Corp (NYSE: UEC) also welcomed the Trump administration’s first move to support the industry.

Former US Secretary of Energy and current UEC chairman, Spencer Abraham said, “The establishment of a Uranium Reserve will allow domestic uranium companies to restart some operations and begin to rebuild domestic uranium mining capability.”

UEC president and chief executive, Amir Adnani, added: “We are pleased President Trump has taken the first step to act on the recommendations of the US Nuclear Fuels Working Group by initiating a program to purchase US-mined uranium for America’s strategic Uranium Reserve.

US is world’s largest consumer of uranium

The US is the world’s largest consumer of uranium and requires over 40 million pounds of U3O8 supply annually.

In 1996 US miners produced over 6 million pounds of U3O8, however, US domestic production fell to a meagre 1.6 million pounds in 2018, a year-on-year fall of 33%, and production figures for 2019 are believed to be as low as 174,000 pounds.

During 2018 the US-sourced over 90% of its U3O8 requirements from foreign sources.

Management is very encouraged the significant US government support for US domestic uranium producers and sees it as potentially game-changing for GTI and the US industry, supportive of the company’s US strategy to develop its uranium and vanadium properties in Utah.

GTI is moving to rapidly advance its projects in Utah given the obvious potential to supply high-grade uranium ore to help fill existing mill processing capacity.

Management is also looking for value-accretive opportunities to expand its US project portfolio in this space.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.