MMJ net tangible asset value implies share price upside of 150%

Published 09-APR-2020 11:04 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

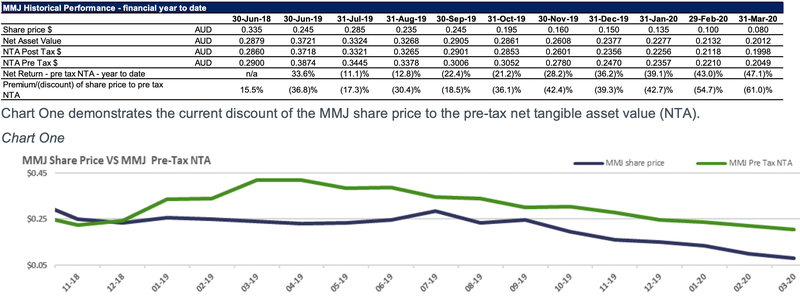

Global cannabis investment group MMJ (ASX:MMJ) has released its March quarter business and investment update, a feature of which was the net tangible asset value per share as at March 31, 2020.

This highlighted that the company is trading at a sharp discount to its intrinsic value.

Similar to most players in the cannabis sector, MMJ’s share price has been sold down substantially in the last 12 months, but it needs to be remembered that it is a diversified operation that provides investment opportunities across the full range of emerging cannabis-related sectors, including healthcare, technology, infrastructure, logistics, processing, cultivation, equipment and retail.

Indeed, it is the only ASX listed investment company which offers Australian investors the opportunity to invest in unlisted and listed cannabis-related businesses in Australia and offshore.

Further, MMJ has a proven track record in acquiring and realising considerable value from its cannabis related investments.

Since 2015, MMJ has created a significant number of investment opportunities from its connections in Canada and Australia in the private investment sector and realised exits that have benefited its shareholders.

Consequently, it could be argued that MMJ doesn’t deserve the broadbrush treatment that has characterised the cannabis sector in the last 12 months or so.

Underlining the strength of MMJ’s investments is its net tangible asset value per share of approximately 20.5 cents, implying 150% share price upside relative to Wednesday’s closing price of 8.2 cents.

Learning from the wine and spirit industry

Management provided an interesting snapshot of dynamics within the cannabis industry and where it is heading.

Understanding these aspects is central to establishing a strategy that underpins investment in businesses that can provide optimal shareholder returns.

From a broader perspective MMJ is bullish on the economy as a whole going forward, but more importantly it is confident that it has cherry picked the winning sub-sectors in the cannabis space.

Consequently, management believes that it is now time to look for investment opportunities in a recovering market.

MMJ made an interesting analogy with other industries that have similar supply chains that span planting, harvesting, production, distribution and marketing.

On this note, management provided an overview of how the wine and spirits industry operates.

"The cannabis space is unique, but its product evolution is not likely to be that much more different from other social entertainment products such as wine and spirits. A farmer has to grow the various plants (grapes, potatoes, etc.) needed to produce different types of alcohol. The farmer then sells the biomass to a factory that in turn produces various consumer end products. These products are differentiated and marketed which in turn create long-term brand loyalty. In the case of wine, the farmer also creates the biomass and end product while simultaneously marketing and finding customers.

"However, the majority of revenue in the wine and spirits industry comes from the first type of arrangement and not the second. This is because farming isn’t a terribly attractive industry from a long-term growth perspective and therefore receives very little capital markets attention. In addition to being very capital intensive, growth in that industry is dependent on growing farm size and utilisation. Companies that purchase the biomass and turn it into consumer products however are far more attractive from a growth perspective and therefore capital markets perspective as well.

Putting the Bud into cannabis

Management is of the view that cannabis is superior to wine and spirits in terms of positive effect on the individual and on society as a whole, and its potential for secondary consumer branded products.

However, the plant to shelf cycle isn’t likely to evolve in a tremendously different way.

The cannabis industry in North America will likely have several large players and a lot of smaller specialty niche players.

Put simply, the majority of customers will consume the cannabis equivalent of Bud Light’s and Heineken’s while some of the enthusiasts will focus on smaller volume growers and niche brands.

Given these dynamics, it’s imperative not to own the farmers, but rather the processors and the consumer brands.

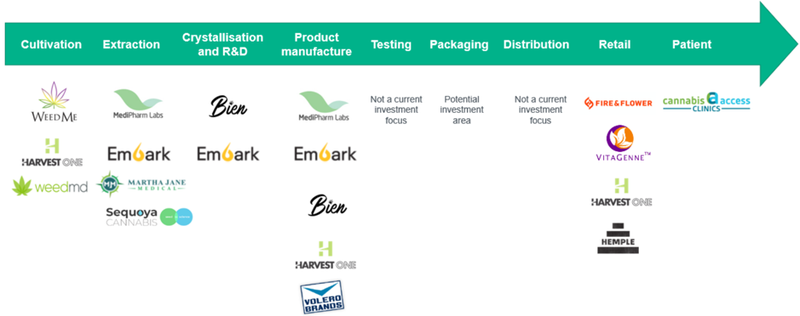

As indicated below, MMJ’s investment portfolio is skewed towards this industry sub-sector.

In fact, excess capital investment at bubble valuations into the farming sub-segment of the cannabis industry is what led to the overcapacity and collapse of the cannabis stocks in 2019.

MMJ, however, continues to be well-positioned in a recovery scenario through its focus on extraction and consumer branded products.

Impact on MMJ’s investment portfolio

Management explained that extraction is the engine that will drive higher margins in the cannabis space as it converts biomass into a variety of products that consumers perceive as being more value-add.

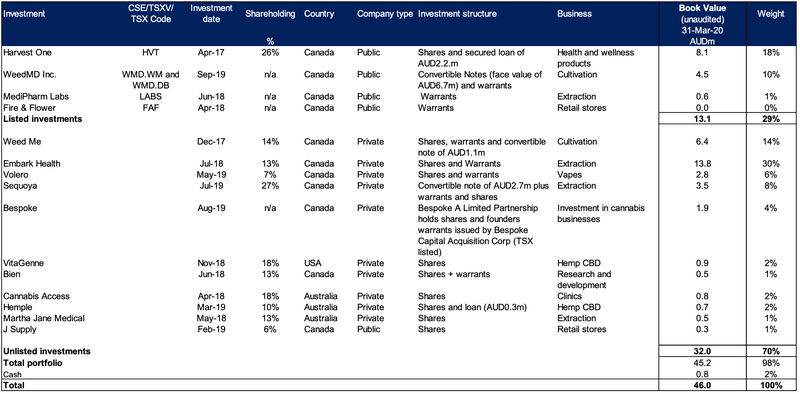

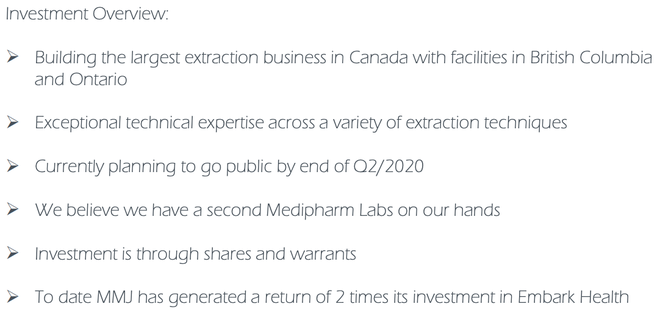

MMJ’s holdings in that space include Embark Health, Sequoya Cannabis, and Medipharm Labs.

On a combined basis, this sub-segment accounts for 39% of the group’s total portfolio.

After extraction the next engine of high margin growth will be Consumer Branded Products as they offer specific items on shelf that customers can rely on for consistent pricing and desired effect.

MMJ’s holdings in this sub-segment include Volero Brands, WeedMD, and Harvest One.

All told, CPG represents approximately 38% of the group’s total portfolio, and combined these two core cannabis 2.0 sub-segments represents almost 80% of its total portfolio.

While COVID-19 will cause an intermittent disruption, management is very bullish regarding the prospects of MMJ’s business investments.

In summing up, management said that the cannabis sector names that focus on extraction and consumer branded products will recover and lead the sector higher as the coronavirus disruption dissipates.

A key takeaway is that some companies have a disproportionate amount of capital tied up in cannabis farming, and these will seek to divest those capital-intensive assets and focus on higher margin extraction and consumer branded products.

Such cannabis 2.0 businesses will have higher valuations in the public markets as well.

This should provide MMJ’s private company holdings such as Embark Health and Sequoya Cannabis with the opportunity to become publicly listed entities, a development that would capture the intrinsic value of the businesses.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.