Mid Week Oil & Gas Update: EXR, IVZ, NHE

Published 04-OCT-2023 12:23 P.M.

|

8 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own at the time of publishing this article:

- EXR: 4,937,858 shares and 1,071,429 options

- IVZ 6,261,999 shares and 2,833,212 options

- NHE 3,980,926 shares and 2,437,037 options

The Company has been engaged by EXR, IVZ and NHE to share our commentary on the progress of our Investment over time.

Small cap oil & gas drilling events make for interesting viewing...

Interesting from the sidelines, but a white knuckle ride for investors.

Over the next two months there are three small cap companies with drilling events we expect should deliver a significant share price reaction when results come out, and even in the lead up to results.

The “reaction” (up or down) will depend on whether the results exceed or fall below market expectations...

The three companies are:

- Invictus Energy (ASX:IVZ) - is drilling its second well into a 20 trillion cubic feet + 120 million barrel oil unrisked prospective resource in Zimbabwe.

- Noble Helium (ASX:NHE) - is drilling the first well at its helium project in Tanzania targeting a 15.3 billion cubic feet unrisked prospective helium resource.

- Elixir Energy (ASX:EXR) - is drilling an appraisal well into its QLD gas project targeting a ~395 billion cubic feet contingent gas resource.

Today, we will do a quick check-in on all three companies to see where they are at and what we want to see next.

We will also touch on what we think could contribute to strong re-rates in share prices off the back of what we hope are successful drill programs for all three companies.

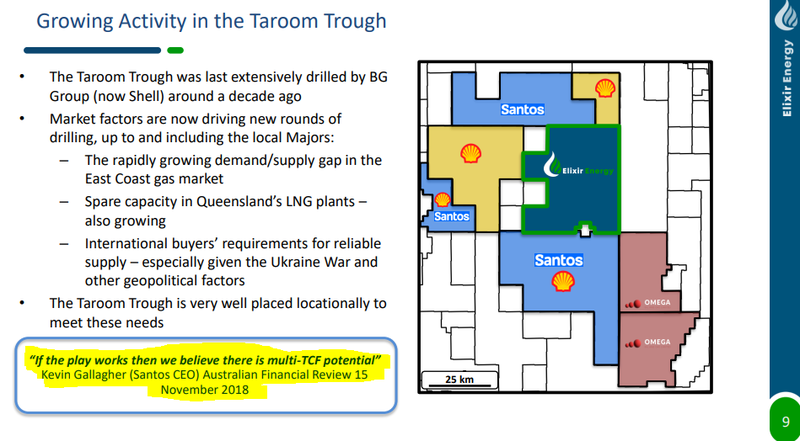

Elixir Energy (ASX:EXR) - Drilling starting in a few weeks.

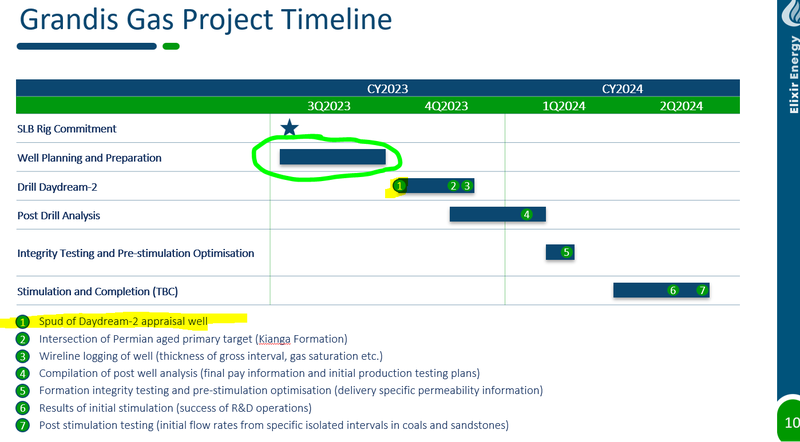

EXR’s drill program is expected to start in the last week of October.

EXR’s project already has a “contingent resource estimate” showing 395Bcf of potentially recoverable gas — within its initial 3.3 Tcf unrisked mean prospective resource.

This is an appraisal well meaning it isn’t chasing a new discovery but instead looking to see if its contingent resource can be converted into a commercially viable reserve.

The project is right next to existing processing and export infrastructure, and acreage held by energy majors like Shell and Santos.

EXR’s drilling will have the following aims:

- Prove commercially viable flow rates.

- Increase EXR’s already large 395 bcf contingent resource.

- Book the project’s first gas reserves (converting contingent resources into reserves).

EXR is also well advanced in terms of funding for the raising with the following:

- $9.5M cash in the bank at 30 June 2023 ✅

- $7M raised via a placement at 7c per share ✅

- ~48.5% R&D grant funding for the well and a debt funding agreement which will mean EXR gets immediate access to the funds ✅

Now EXR is running a Share Purchase Plan (SPP) to raise a further $3.5M at 7c per share.

We participated in the recent EXR placement and have just sent our cash to apply for the Share Purchase Plan, which is at the same terms as the placement (7c per share with 1 for 2 attaching 12c option, expiring Oct 2026).

EXR is trading at ~6.7c, so while we are technically paying a small premium to what could be purchased on market, if EXR delivers a successful drill program and the market turns back positive over the next few years, we think the attaching 12c option is quite attractive.

We also have fond memories of participating in the EXR cap raise at 2c back during the COVID market crash around May 2020 - in the following couple of years EXR delivered a bull market share price run to hit highs of about ~50c.

Now, this previous post market crash price run is certainly NOT an indicator that a price run like this will happen again, this is only a single anecdotal data point that we experienced during unique market conditions back in 2020.

We are Investing in the EXR SPP because it suits our risk profile and investment strategy (and the free oppie) but it may not be right for everyone’s risk profile.

We are also hoping for big results on EXR’s upcoming drill campaign and follow up flow testing programs scheduled for next year.

What’s next for EXR?

🎓 To learn more about Share Purchase Plans see our educational article here: What is a Share Purchase Plan?

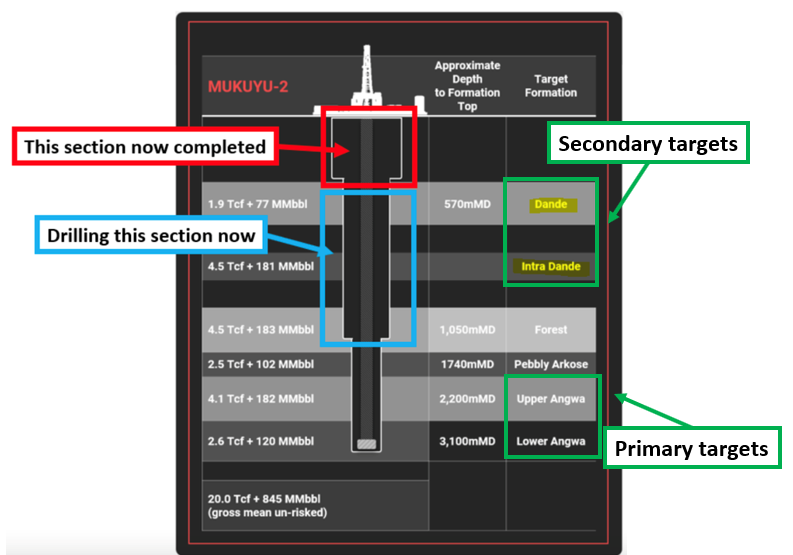

Invictus Energy (ASX:IVZ) - Drilling right now, about to hit first target zones.

IVZ kicked its drill program off on the 21st of September.

Drilling is expected to take 50-60 days, after which we should start seeing results relatively quickly (assuming there are no technical delays).

IVZ’s plan is to drill to a Total Depth (TD) of ~3,750m and then test the well.

IVZ’s well has already been drilled down to a depth of ~496m (as announced this week).

Now, IVZ is currently drilling through the first two of its six stacked targets - the secondary reservoir targets (Dande and Intra Dande).

This next stage of drilling will run down to ~2,040m of depth before IVZ runs more casing, wireline logging and then starts drilling to TD.

What’s next for IVZ?

- Drilling section 1 ✅ - completed down to a depth of ~496m with a blowout preventer installed.

- Drilling section 2 🔃 - IVZ is currently drilling to a depth of ~2,040m before running its first wireline logging program (precursor for drill results).

- Drilling section 3 🔲 - Drilling to TD (~3,750m) to commence after the second phase of drilling is completed. IVZ’s main targets sit in this section.

Given that drilling started on the 21st of September and is expected to take 50-60 days to complete. We are expecting to see results on or before the 20th of November, 2023.

We might even get some preliminary results after IVZ runs initial wireline logging on the first 2040m of the drillhole prior to switching drill hole size and finishing drilling of the final ~1,750m.

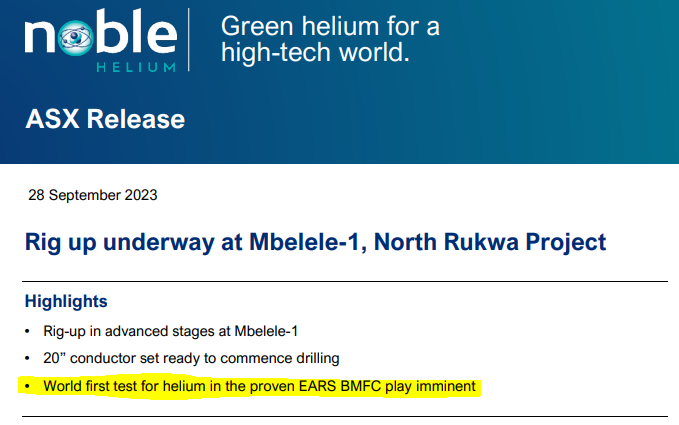

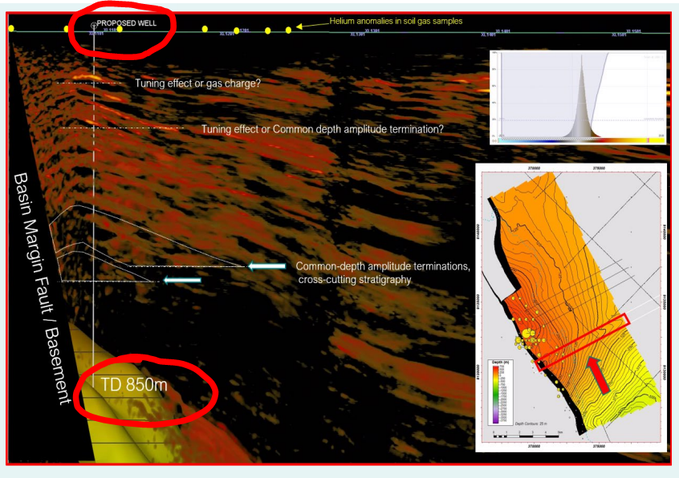

Noble Helium - Drilling to start in the coming days/weeks.

Just last week NHE confirmed that its drill rig was close to being drill ready.

NHE already has ~38 semi-trailers full of rig parts and all of its services contractor (SLB’s) equipment on site.

The company is now in the final stages of putting it all together so that drilling can start.

Once everything is put together, tested and ready to go, NHE expects to start drilling its Mbelele-1 well.

We expect drilling to start in the coming days/weeks.

NHE’s well is drilling down to a true vertical depth of ~500m (Total Depth of ~850m), which is a lot shallower when compared to EXR and IVZ’s wells.

That should mean NHE gets results a lot quicker AFTER the drill program starts.

What’s next for NHE?

⚠️The Big One: Drilling ⚠️

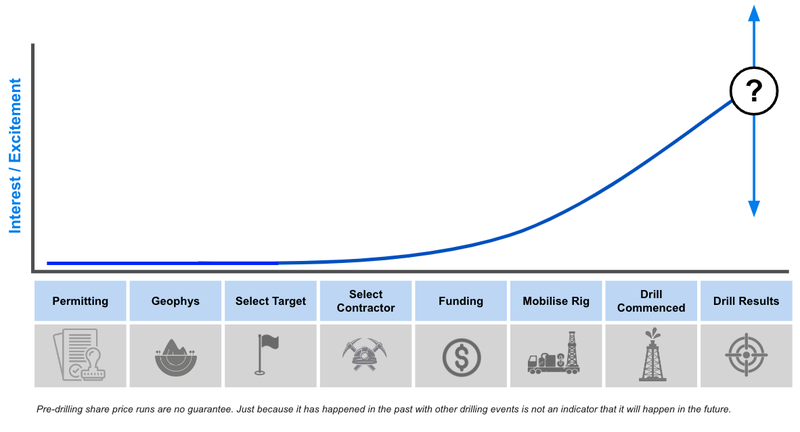

Drill programs and share price performance

Typically share prices of oil and gas explorers tend to rise as the companies get closer to drilling and especially closer to drilling results.

Typically we see investor interest/excitement in big oil and gas drilling events peak when the companies are drilling and days/weeks away from results.

So far, in this year’s current market conditions it's been a little bit different...

Across all three of our companies, share prices have been trading sideways and hovering around the share price where the company raised cash to fund drilling.

For IVZ, that is around 15c (where IVZ raised $15M a few weeks ago).

For NHE, that is around 20c (where NHE raised $12M back in August).

For EXR, that is around 7c (where EXR raised $7M in August and is now running an SPP).

As drilling and drill results edge closer by the day, we are waiting for each stock to digest the cap raising shares and hopefully start a pre-results run.

Some investors who participate in funding rounds are most likely looking to take more off the table than they would otherwise, given how the rest of the market is doing.

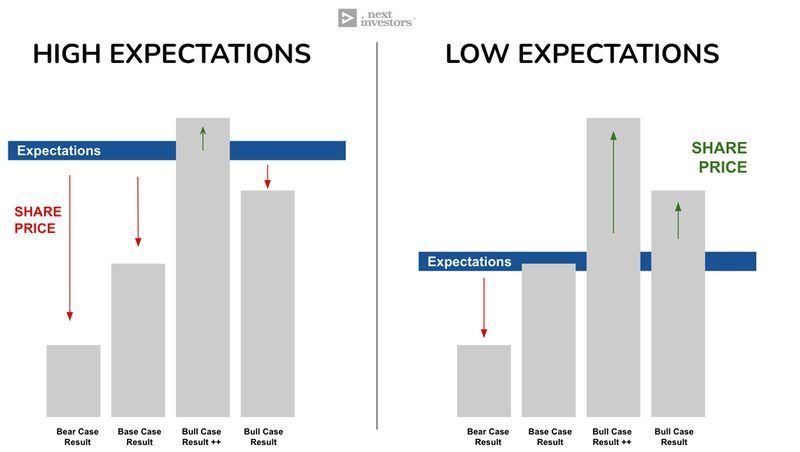

What does all of this mean for share prices?

At the end of the day, share price performance comes down to supply and demand for shares.

The heavier selling vs. buying pre-drilling means that more of the investors looking to partially de-risk pre-result by selling some shares would have likely done so by the time drill results come out.

Put simply - expectations for the drill program would be tempered with investors holding positions that they are a lot more comfortable rolling the dice with.

When expectations are low and investors have already de-risked pre-drilling, dampening the pre-results price run, it sets up a scenario where IF a company delivers exploration success, it is primed for a re-rate to the upside.

IF, in IVZ and NHE’s case, discoveries are made then the market will be caught off guard with an UNEXPECTED positive announcement.

Typically that is the perfect combination of factors that lead to a stronger move higher in a company’s share price.

This is of course assuming a rare positive drilling result - oil and gas exploration is high risk and the results may not be positive.

Macro thematic heating up in the background

Another factor that can contribute to a re-rate in a company's share price higher is strong macro tailwinds.

Typically, capital flows chasing macro thematics can be the strongest reason for company’s share prices going higher.

Think of the recent run in uranium stocks as investors look to allocate money in any company with a uranium project.

Uranium stocks all across the board went up 30-40-50%+ without putting out any news - the companies that put out news are up even more than that.

We think the oil & gas space is slowly heating up without investors really catching on to it YET, or waiting to see if the rise will be sustained over a longer period of time.

Oil prices are up almost 50% over the last two months and recently hit ~US$94 per barrel.

In early September Saudi Arabia and Russia also extended their voluntary production cuts through to the end of the year putting more pressure on prices.

(Source)

IF IVZ or EXR can deliver a good drill result and the oil & gas macro thematic continues getting stronger then we could see strong share price moves higher.

Oil & gas drilling events are high risk with often binary outcomes and with a material chance of failure. We make investments in oil & gas exploration companies as part of an overall diversified portfolio. No one oil & gas investment makes up more than 5% of our total portfolio.

This strategy works for us and it may not work for everyone.

Relevant education articles to today's note:

🎓 A Beginners Guide to Investing

🎓 Expectation setting leading up to drilling programs

🎓 What is a share price catalyst?

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.