Microcap HVY developing garnet mine - first non-binding MoU offtake is in

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,750,000 HVY shares and we invested $50,000 in the HVY royalty agreement deal at time of publishing this article. The Company has been engaged by HVY to share our commentary on the progress of our Investment in HVY over time.

We are increasing our Investment in micro cap stock Heavy Minerals (ASX:HVY).

This morning the ~$4.7M market capped HVY announced its first non-binding offtake MoU.

The offtake is for 15,000 tonnes per year of HVY’s future garnet production for 3 years at its WA project.

According to the announcement, that’s ~ 10% per year of forecast yearly production.

A rough, back of the napkin estimate is that could equate to ~$10M per year revenue for 3 years to HVY.

(our rough estimate is based on 10% of the average yearly forecast revenue, which we worked out from the 2022 HVY scoping study to be ~$100M per year, by dividing the life of mine revenue of $1.59BN by the 16 year estimated mine life - so it’s a pretty rough calc. Also this is a non-binding MoU too, which needs further negotiation - and commodity prices are inherently volatile.)

AND we may see additional deals signed in the coming months which gives us more of an idea on pricing and potential revenues for HVY...

HVY mentioned in today’s announcement that it was engaging with “Garnet Distributors in North America and Internationally”.

(Source)

We are Invested in HVY because of its tiny market cap relative to its advanced feasibility study garnet project economics.

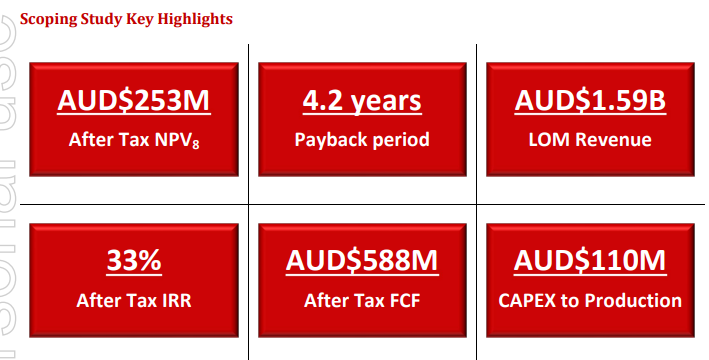

The scoping study based on HVY’s resource had a $253M NPV, on a CAPEX of $110M.

(a pre feasibility study is now underway which will firm up these numbers)

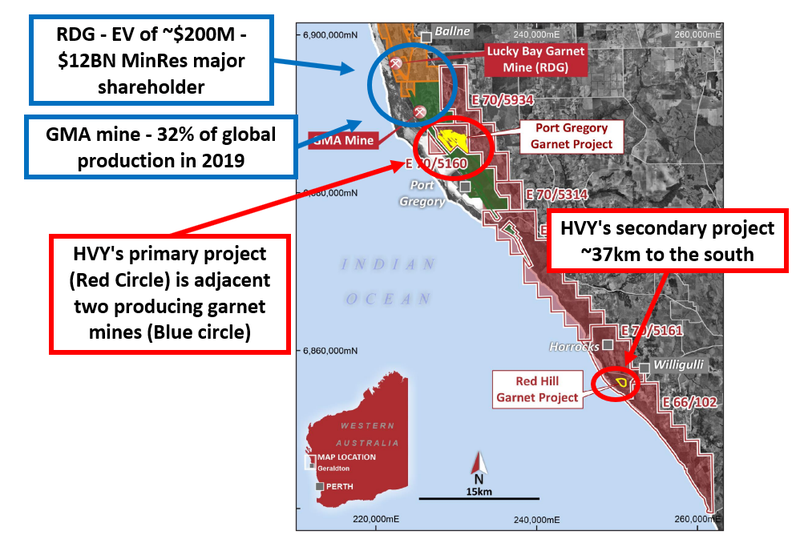

A later stage garnet producer next door to HVY is capped at ~$100M and trades with an enterprise value of >$200M.

We are increasing our Investment in HVY because we think it could successfully develop a profitable garnet mine over the next few years.

We first Invested in HVY back in July 2023 at 10c.

We then bought into the HVY royalty agreement in December.

And now we will be further adding to our HVY position by taking up our maximum allocation in the HVY SPP at 8.2c.

HVY is looking to raise a very modest $750k at 8.2c per share from existing shareholders and the offer is open until 5:00pm (AWST) on Friday, 15 March 2024.

HVY shareholders can see the updated SPP timeline here. The instructions on how to participate are here.

In our view, HVY’s share price has been tracking sideways for 6 months because the market has been waiting for HVY to announce further funds have been received from the sale of a royalty on its future production.

The first $500k from this royalty deal was signed on, received and announced in December 2023 (we put cash into this).

This money was put towards starting off the PFS, which has now commenced.

We think if the market sees more royalty funds come through, then the funding question over HVY will be removed and the HVY share price should re-rate from its current ~$4.7M market cap.

This is why we are now increasing our position in HVY.

We will be taking up our full SPP allocation of $30k.

What does HVY do? What is “garnet”?

HVY is a “mineral sands” developer with three projects.

Mineral sands projects might not be as interesting as commodities tied to EV batteries, but they can become highly profitable, if under the radar, success stories.

That’s why billionaire investors like MinRes Chris Ellison typically have some exposure to mineral sands assets.

Our exposure to mineral sands is via our Investment in HVY.

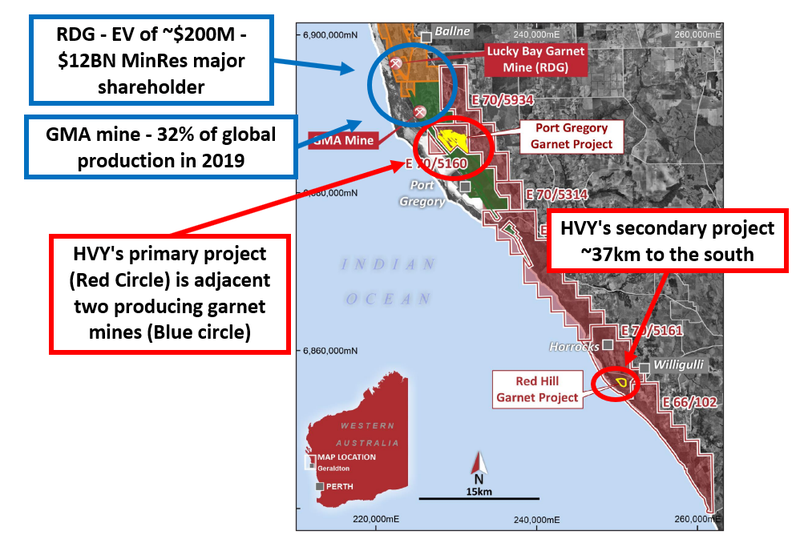

HVY’s most advanced project is a garnet-rich deposit located in WA, in very close proximity to two other garnet producers. This project is the main reason for our Investment.

Never heard of garnet before?

We hadn't either until we started doing due diligence on this company over 18 months ago. We then did enough research to decide to make a long term Investment.

Garnet is an important industrial material, specifically used in abrasive sand-blasting to treat and prevent rust on ship hulls, bridges and other large metal structures.

It is also used in “abrasive water-jet cutting” of metals, glass and other materials in the automotive, aerospace and electronics industries.

Garnet is one of only a few materials that can be used in industrial sandblasting AND cutting.

Importantly, garnet is eco-friendly compared to alternative industrial abrasives like dirty coal slag or carcinogenic copper slag.

As the world focuses on becoming environmentally friendly we expect the shift towards industrial garnet to further accelerate.

Why HVY, why garnet and why now?

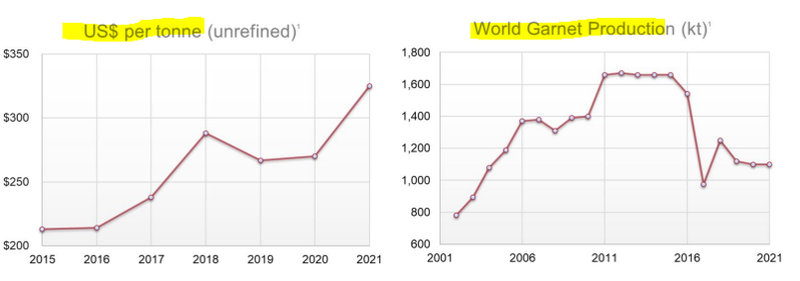

The garnet price is rising and global supply is dropping.

And HVY has a large garnet resource with a fast track plan to get it developed.

The below charts are 3 years old, but give you some indication of the trend over the last decade:

We think the garnet demand increase will continue for several reasons:

- Unlicensed garnet mines in India were damaging the environment, so the government completely banned any garnet mining in India, removing a key global supply source.

- Western buyers under pressure to “go clean and green” are seeking alternative ESG friendly garnet from environmentally friendly operations (like HVY).

- At a summit run by the global shipping industry, 175 nations agreed to a net-zero commitment to reduce greenhouse gas emissions by or around the year 2050. This included removing pollutants used in shipping - where coal slag and copper slag could be replaced by eco-friendly garnet for ship hull cleaning.

- The US administration has introduced an Infrastructure & Jobs Act. The bill includes a total of US$40BN of new funding for bridge repair (source), replacement, and rehabilitation, which is the single largest dedicated bridge investment since the construction of the interstate highway system. This includes US$2BN to fix some 30,000 steel bridges, including removal of rust - the key use of garnet (source).

We think the garnet demand is going to be strong over the next decade, which is why we are increasing our Investment in HVY.

What stage is HVY’s project at?

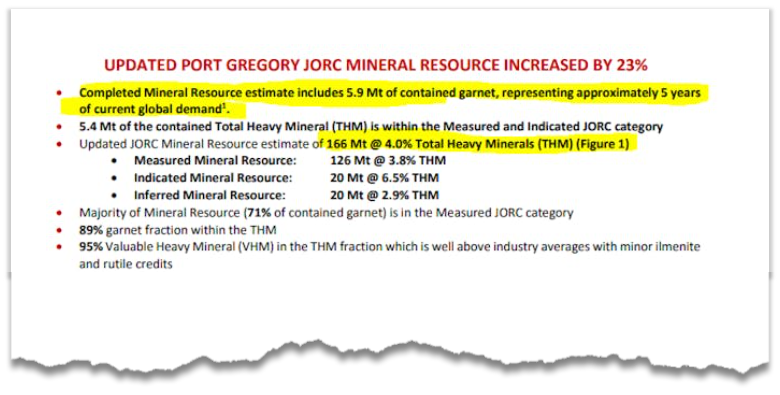

HVY already has a JORC resource and has published a scoping study which demonstrated a NPV of $253M off $110M CAPEX.

HVY also has two further permits that could materially increase the company’s garnet resource with some further drilling.

HVY’s has also managed to secure Dutch government backed finance support for the potential development of the project (subject to due diligence) through a “funding letter of support” that was announced to the ASX in mid 2023.

Right now HVY is capped at ~$4.7M.

Later stage garnet producer RDG next door is capped at ~$100M and trades with an enterprise value of >$200M.

RDG is toward the end of its project build and is currently ramping up production.

(updated current enterprise values: HVY: ~$4.5M, RDG: ~$200M)

We have Invested in HVY to see it hopefully catch up to RDG in valuation terms over the coming years as it advances toward production.

Here is where HVY’s project sits relative to RDG’s:

There are only a handful of companies in this industry. We think HVY can enter quickly and gain market share, helped by the support of a potential debt financier which is closely tied to a major ship company (see above).

Obviously there are risks associated with every small cap resource investment, and a successful Investment is no guarantee. We will cover some of the risks we have identified later in this note.

Here is a summary of the 13 reasons we originally invested in HVY from our initial launch note,

(note the HVY market cap at the time was $6M, today it is $4.7M)

Summary: Why we are Invested in HVY:

As published on 14th July 2023.

- Tiny market cap after lots of progress - When we initially Invested in HVY it was capped at just $6M with a scoping study already completed for its project.

- Tight structure low shares on issue (SOI) - When we initially Invested HVY had ~55 million shares and ~18 million options on issue. Prior to our Investment, the top 5 shareholders held ~75% of these shares.

- Management skin in game - Before our Investment, HVY directors held ~11.6% of the company, with chairman Adam Schofield holding 7.7% himself.

- Garnet is an important niche material - Garnet is leveraged to big industries like the maritime and aerospace industries to allow for rust removal, industrial cutting and anti-corrosive paint to be applied to surfaces. It cannot be easily replaced.

- Favourable long-term pricing environment for garnet - Supply side is decreasing with Indian garnet production being banned. On the demand side bans are being considered for garnet alternatives (copper slag/silica) due to ESG concerns. We expect to see demand outstrip supply in the coming years leading to higher prices.

- US is spending ~US$40BN on upgrading old rusty bridges - The US has budgeted US$40BN of new funding for bridge repair, replacement, and rehabilitation. We expect this to increase demand for garnet as a sandblasting product.

- Quick, viable pathway to becoming key garnet supplier - HVY’s project has an established JORC resource, a completed scoping study and is just about to start a pre-feasibility study. HVY is targeting first production in 2026.

- Close proximity to two producing garnet projects - HVY’s projects sits next door to the GMA mine which supplies ~35% of the world’s almandine Garnet and Resource and Development Group’s newly constructed mine.

- Neighbour RDG trading at a ~$220M enterprise value - Resource and Development Group next door is capped at ~$150M and has an enterprise value close to ~$220M. RDG is also ~65% owned by $13BN Mineral Resources.

- Project economics stack up, plenty of room for upside - HVY’s scoping study shows an after-tax project Net Present Value (NPV) of $253M, a payback period of 4.2 years, and an after tax Internal Rate of Return (IRR) of 33%. The project CAPEX is also relatively modest at $110M.

- Upside to increase garnet resource - HVY could double its existing JORC resource with more drilling to the north/south of its existing JORC resource and at its Red Hill project where it has a 90-150Mt (4.1 to 5.4% THM) exploration target.

- Project financing support from Dutch Export Credit Agency - HVY recently received a “Letter of Support” for project funding from Atradius - the Dutch Export Credit Agency.

- ESG focus and Australian project attractive to European/US garnet buyers - Western companies are seeking sustainably produced materials, which will increase interest in sustainable produced garnet, especially given the cloud surrounding garnet that was previously produced in India

We think all of these 13 reasons we Invested in HVY see it capable of securing a material share price re-rate and take it to many multiples of its current market cap of $4.7M.

You can read the deep dive into each of these reasons in our initial HVY launch note here.

Ultimately, we are hoping these reasons lead to HVY achieving our Big Bet which is as follows:

Our “Big Bet” for HVY

“We want to see 20x return as HVY moves into production by 2026 and become a profitable garnet mine”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our HVY Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

HVY signed an offtake MOU today

Today HVY signed a non binding MOU for an offtake agreement.

The deal was signed with ABSS which sells Garnet into the sand blasting and water jet cutting markets in New Zealand and Australia.

Here are the key terms for the agreement:

- Deal duration: The deal is signed for an initial 3 years from the start of production at HVY’s project.

- Purchase amount: ABSS agree to buy 15,000 tonnes of garnet per annum for the three year period which would account for 10% of HVY’s production.

At the moment, the signed deal is a non-binding MOU.

HVY expects to convert the deal into a binding offtake deal “within the coming months”.

We also noticed HVY tease additional offtake deals in today’s announcement which means we could see more deals like today’s one as the company works through its PFS.

(Source)

Offtake deals this early into the company’s feasibility studies are a strong sign there is demand for HVY’s garnet. Usually, these type deals are signed after the company has published its later stage feasibility studies and is looking for financing for its project.

We are looking forward to seeing more on the offtake front from HVY.

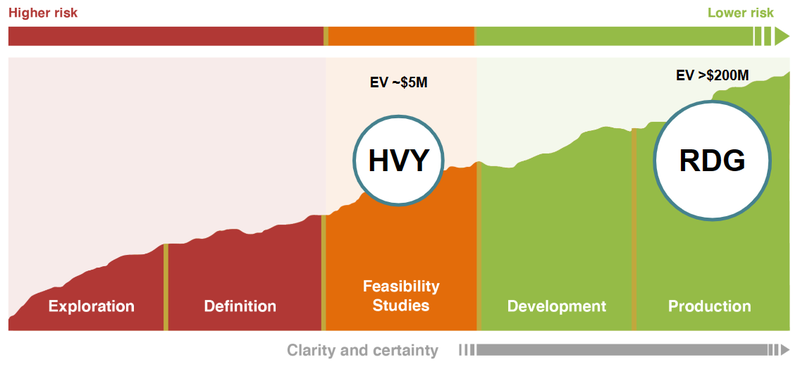

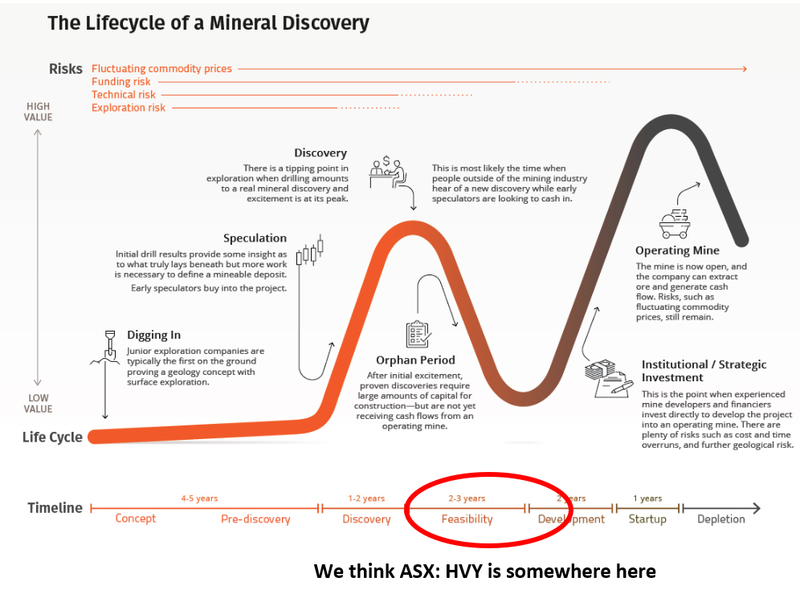

Where HVY sits on the Lassonde Curve

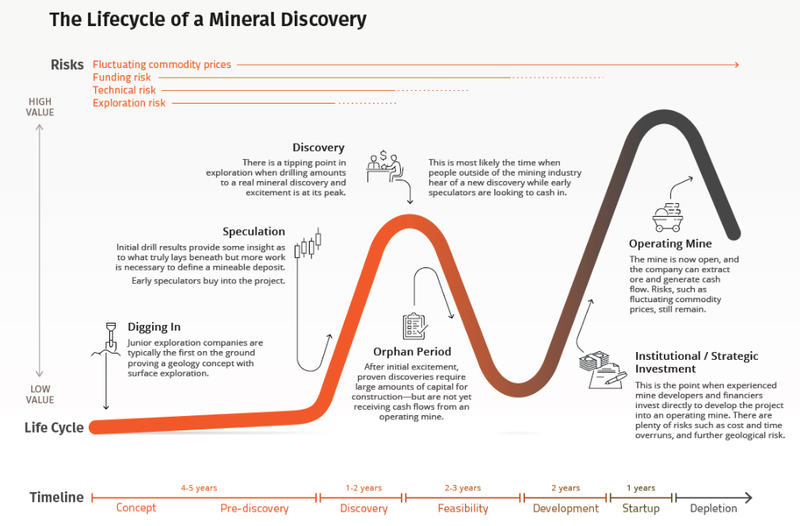

One of the charts we refer to the most when Investing in junior explorers/developers is the Lassonde Curve.

The Lassonde Curve shows how the share price of a junior reacts as the company takes a project from exploration into production.

The chart shows how share prices rise immediately after a new discovery is made and how it can fall as the company progresses through the “resource definition” and “feasibility stages”.

We use the chart as an objective way of looking at our companies relative to the curve.

By plotting where the company sits, we generally get a good idea of how we think the share price might perform in the coming months.

Here is where we think HVY sits right now relative to the Lassonde Curve:

HVY is definitely post-discovery and has already gone through the resource definition phase.

HVY has a JORC resource estimate of 166mt at 4% Total Heavy Minerals (THM) for a total of ~5.9mt of contained garnet (equal to ~5 years of global demand).

(Source)

HVY has already done a scoping study and has just recently kicked off its Pre-Feasibility Study (PFS) which is why we think the company sits somewhere in the middle of the Lassonde Curve.

(Source)

What’s next for HVY?

Royalty agreement 🔄

We want to see HVY remove the funding question mark that is weighing on its share price by announcing a significant cash injection from the sale of more royalties on its future production.

In our view, HVY’s share price has been tracking sideways for 6 months because the market has been waiting for HVY to announce further funds have been received from the sale of a royalty on its future production.

Royalty agreements can be a beneficial funding method, as it can secure funding for the company without the dilution of equity - a win for long term shareholders.

To date the company says it has raised ~$750k from the royalty raising.

(Source)

Pre-feasibility study 🔄

We are looking for progress on a proposed pre-feasibility study (PFS) as the funding picture clears up, ideally through the royalty agreement.

The PFS would allow HVY to market its project to financiers, and potentially advance offtake discussions.

According to HVY’s latest quarterly report the PFS is expected to be complete next quarter.

Progress relationship with Dutch Credit Export Agency (ECA) 🔄

We would also like to see an update on a further strengthening of the relationship with Atradius Dutch State Business (Atradius) which manages the government credit guarantee scheme on behalf of the Government of Netherlands official Export Credit Agency (ECA).

ECAs are an important cog in the global trade machine, as they provide loans, loan guarantees and insurance to help reduce the risk of exporting to other countries.

The Dutch have a large shipbuilding industry, and we think they might be interested in HVY’s garnet products.

What are the risks?

In the short term key risk is financing and timeline delays.

As a small cap exploration and development company HVY doesn’t earn any revenue, and therefore relies on the market to raise capital and advance its projects.

As of 30 June 2023 the company had $0.32M in the bank, which means that the company will need to secure funding in the near term in order to progress the development of its projects.

The company has now extended the date for its SPP which it is looking to raise $750,000.

If the company is not able to secure funding, it may cause delays to the timeline for completion of the feasibility study.

If timelines continue to blow out then investors may lose interest in the story and cause the share price to move down in the short term.

In the long term, project financing risk is relevant for HVY.

The CAPEX for the project is $110M according to HVY’s scoping study.

In order to move into production, the company will need to find a way to finance this cost - this is typically a mixture of debt and equity. Sometimes offtake partners stump up cash early.

There is no guarantee that the company will be successful in this pursuit, or it may take a lot longer than planned.

To see all of the other risks to our HVY Investment Thesis check out our HVY Investment Memo here.

Our HVY Investment Memo

In our HVY Investment Memo you’ll find:

- HVY’s macro thematic

- Why we Invested in HVY

- Our HVY “Big Bet” - what we think the upside Investment case for HVY is

- The key objectives we want to see HVY achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.