Metro Mining undervalued: EBITDA $44 million; Mine Life 17 years

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metro Mining Ltd (ASX:MMI) has started 2020 on a high - in fact, a 14 month high in share price terms.

Following a strong rally in the six months to December, the company’s shares hit 17 cents last week, representing an increase of more than 70% since July 2019.

Importantly, this rerating has been performance driven with the bauxite producer delivering at the top end of production guidance for the 12 months to 31 December, 2019, which is the group’s reporting period.

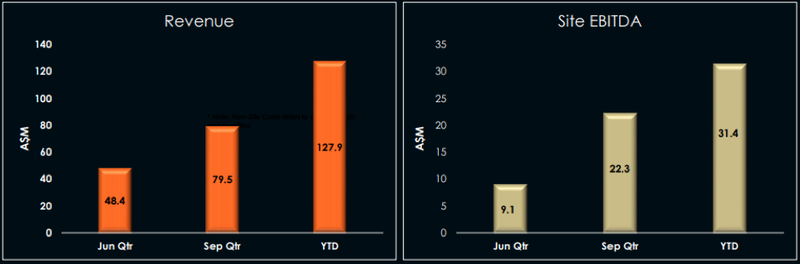

While the audited financial result won’t be released until late February, this translates into a robust profit with earnings before interest, tax, depreciation and amortisation (EBITDA) of $12.6 million in the December quarter lifting full-year earnings to $44 million.

Metro Mining has consistently underpromised and outperformed at all levels, and the company has done it again.

Morgans analyst Chris Brown was the most bullish of the three brokers covering the stock and he was forecasting EBITDA of $39 million.

Consequently, this represents an outstanding financial performance.

But in Metro’s game, delivering a premium financial result is a function of management’s ability to maximise efficiencies across all the moving parts from extracting the materials out of the ground through to loading them on a ship.

Managing Director, Simon Finnis and his team have not only managed the operational logistics extremely well, but they have demonstrated strong financial acumen positioning the company to fund an extensive expansion program that will see production increase to 6 million tonnes per annum by 2021.

Punching above its weight

Very few ASX listed mining group’s with a market capitalisation of around $250 million can boast this level of profitability and a track record of consistently delivering across-the-board.

Of those that can, it would be difficult to find a company that can match Metro’s near term earnings growth outlook, its income predictability and substantial mine life.

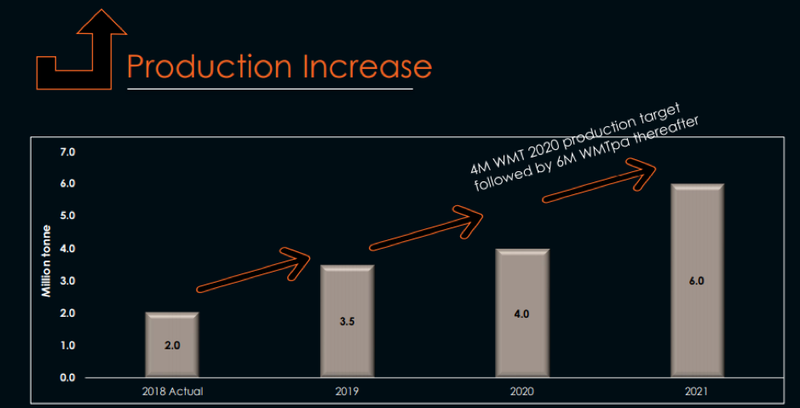

Earnings growth will to a large extent be driven by the increase in production from 3.5 million tonnes per annum in 2019 to 4 million tonnes per annum in 2020 and 6 million tonnes per annum thereafter.

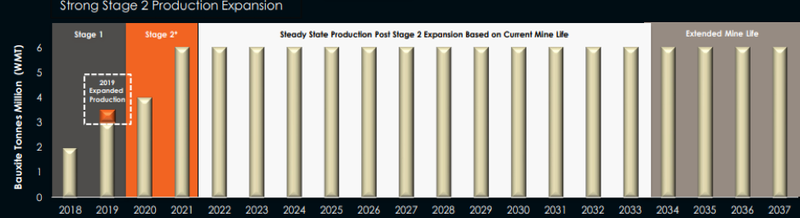

With the current reserve of 110 million tonnes and all approvals and finance in place, there are no question marks surrounding the ramp up in production.

Furthermore, Metro isn’t like many other miners in terms of wondering where the next ounce of gold or the next tonne of copper is going to come from - its established reserve will support a mine life of 17 years from 2021 based on production of 6 million tonnes per annum.

In tandem with the increase in production, management will be constructing a floating terminal to speed up ship loading, allowing the loading of new vessels, including Cape Size ships.

This will not only carry logistical advantages and further strengthen earnings predictability, it will also translate into freight savings of around $4.00 per tonne, which when you are looking at a $6 million tonne per annum operation represents a sizeable saving.

The last 12 months has been a stellar period for Metro.

The company began production in calendar year 2018, meeting management’s guidance and providing a platform for the first year of full production in 2019.

Metro stuck by its 2019 production guidance of between 3.3 million tpa and 3.5 million tpa throughout the year and duly delivered at the top end of guidance with full-year production of just over 3.5 million tpa.

In discussing the outlook for 2020 with managing director Simon Finnis, he remains confident that the company can produce and ship 4 million tpa.

Analysts forecasting earnings and share price to double

Of the three analysts that cover the stock, all estimate that Metro can ship at least 4 million tonnes in 2020.

Chris Brown has covered the stock for some time, and he believes 4 million tonnes is on the money.

His 2020 revenue and earnings forecasts which we will discuss later are based on this level of production.

Brown released a note in late December which mainly commented on the benefits of a loan refinancing initiative that represented the potential benefits compared with the previous lending arrangements.

Finfeed recently discussed the implications of the refinancing with Finnis who highlighted a range of advantages, including the flexibility of repayments.

Under the new arrangement, three payments of $5 million are to be made in July 2021, September 2021 and January 2022, freeing up capital over the next 18 months which will cover the construction phase of stage II.

This is part of the funding package for the Stage II expansion at Bauxite Hills, and is in conjunction with the offer of a loan facility of $47.5 million from the North Australian Infrastructure Facility (NAIF).

Commenting on the revised funding package, its alignment with construction costs and the benefits of the stage II expansion, Brown said, ‘’The NAIF facility of up to $47.5 million, with a very attractive 9 year term, is to support the $51.4 million Stage 2 expansion of Bauxite Hills.

‘’This funding is to be used for construction and mobilisation of the Floating Terminal (FT), budgeted to cost approximately 85% (approximately $43.5 million) of the total expansion cost.

‘’The FT will enable MMI to control, achieve and maintain a high level of loading efficiency, and load up to Cape Size vessels, with an expected reduction in unit shipping costs of approximately US$4.50 per tonne.

‘’MMI is now very well placed to fund the Stage II expansion.’’

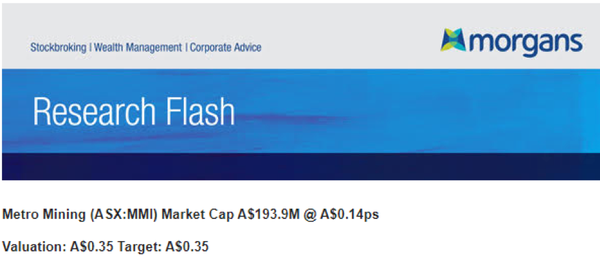

This prompted Brown to reaffirm Metro’s valuation of 35 cents per share, and his share price target is in line with the valuation, but as with any buy recommendation and valuation, this is speculative on the broker's behalf.

This implies share price upside of more than 100% relative to Metro’s recent trading range, indicating that the rerating that has occurred over the last month or so was off an oversold base and still doesn’t capture the inherent value that lies in the stock.

Brown expects earnings to increase to $64 million in 2020, and at full tilt in 2021, he is forecasting (speculative, of course,) Metro to generate EBITDA of $82.6 million.

This implies compound annual earnings growth of 37% over the next two years, metrics that most miners with a market capitalisation of around $250 million would find difficult to match.

Modest PE multiple and prospect of dividend yield

Crunching the numbers, Brown’s 2021 earnings forecasts equate to 4 cents per share, implying a forward PE multiple of about 4.3 relative to the recent high of 17 cents.

This represents a heavily discounted PE multiple relative to Metro’s growth profile - companies that can deliver even 20% compound growth would normally trade on a double-digit PE multiple.

Currently, it isn’t hard to see the company trading more in line with Brown’s price target of 35 cents sooner rather than later.

Digging deeper into Metro’s valuation metrics, Shaw and Partners senior analyst Andrew Hines recently initiated coverage of the company, and he is forecasting a maiden dividend of 2 cents in 2021.

This represents a yield of 12% relative to a share price of 17 cents.

Examining the cash flow metrics, it certainly appears that Metro would have the capacity to pay such a dividend.

Hines is forecasting free cash flow of $42 million in 2021 while Brown estimates that cash flow after interest and capital will be $65.7 million.

Strong demand for Australian bauxite

Industry dynamics are also working in Metro’s favour, and while making assumptions regarding commodity prices and exchange rates is fraught with danger there is a general view that there will be little deviation in the near-term from those that prevailed in 2019.

Argonaut analyst, Matthew Keane sees Metro as well-positioned to take advantage of relatively predictable conditions in 2020, and he has a buy recommendation on the stock with a valuation of 32 cents per share, not too far shy of Brown’s valuation.

Keane said, ‘’Following supply disruptions from Guinea, exports of bauxite from Australia have thrived.

‘’China imports of bauxite from Australia have been steadily increasing throughout 2019.

‘’October imports increased 5% month on month and 31% year-on-year to 3.5 million tonnes, a historic record.

‘’The new International Maritime Organisation (IMO) regime, which bans the use of the high sulphur bunker oils, is set to increase shipping rates.

‘’This will further favour Australian bauxite over Guinea, due to the shorter shipping distance.

‘’Chinese domestic bauxite production has been in decline in recent years due to reserve depletion, declining grades and environmentally driven mine closures.’’

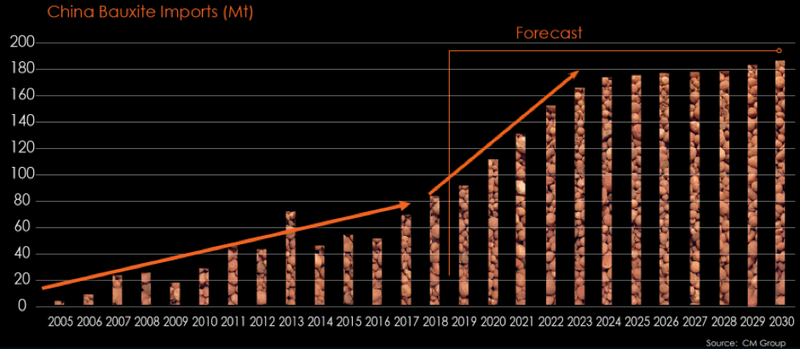

As indicated in the following graph, China’s demand for bauxite is expected to accelerate sharply between 2020 and 2023, while remaining at historically high levels at least out to 2030.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.