Last night VW announced it wants to secure battery metals directly from miners...

Last night VW announced it wants to secure battery metals directly from miners...

Over the last 24 hours we have seen a lot of mainstream media about European automakers and their big moves into electric vehicles - the big automakers are probably timing their key media releases to coincide with the current attention on the climate goals of the G7 summit.

And it all bodes well for the two investments in our portfolio we are probably most excited about over the next few months and years....

We have links and key summaries of all the relevant media at the end of this note...

BUT

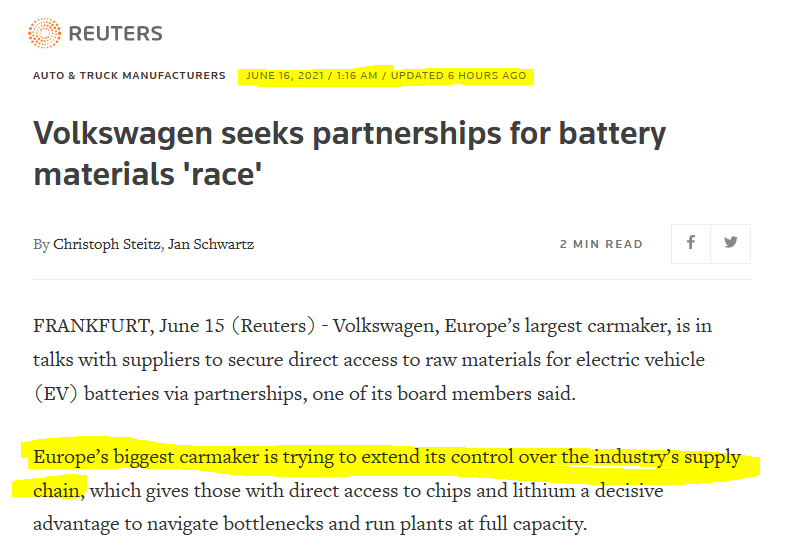

The news that most caught our eye overnight was a Director of VolksWagen (the biggest car maker in the world) said that “the company is in talks with suppliers to secure direct access to raw materials for electric vehicle batteries.”

Back in March this year Volkswagen announced at its event called “Power Day” its strategic switch to producing electric vehicles, and that a key ingredient to VolksWagen’s main electric vehicle battery is going to be Manganese.

Our long term investment Euro Manganese (ASX:EMN) is developing a source of ultra high purity manganese from the recycling of a tailings deposit located in the Czech Republic - a couple of hours away from a proposed new battery factory.

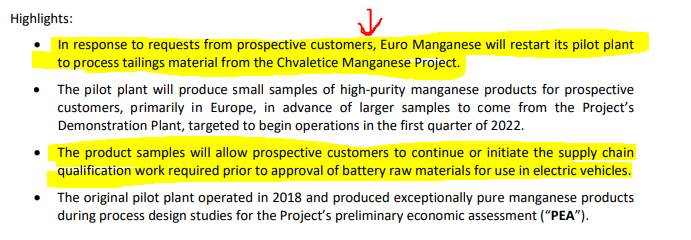

Coincidentally, yesterday EMN announced that “at the request of prospective customers” they have restarted their 2018 pilot plant to fast track production of some high purity manganese samples for testing by new potential offtakers.

ASX:EMN

We note the plural “prospective customers” used by EMN in their announcement.

We also note these prospective customers appeared to be so keen to get manganese samples from EMN that they couldn’t wait until EMN’s new demonstration plant is started early next year...

So EMN had to restart their 2018 pilot plant to fast track some samples.

Prospective customers generally take small samples first so they can test if the product is fit for purpose before committing to a larger offtake agreement - “try before you buy”.

We think this news is a positive step to a future offtake agreement (which we believe will be a significant share price catalyst when it occurs).

EMN also announced investors in the USA can now buy EMN shares through its new listing on the OTC market under ticker code EUMNF - watch the performance here

See our EMN investment milestones, EMN investment strategy and past commentary about EMN here.

Hot off the press: Vulcan Energy Resources (ASX:VUL) joins Global Battery Alliance

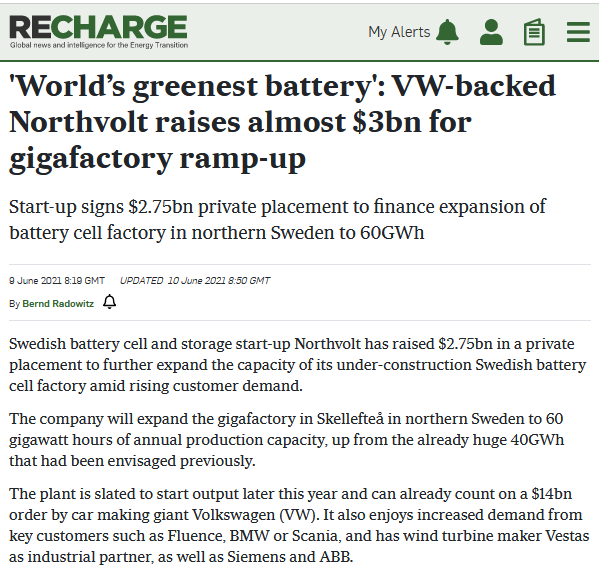

Regular readers will know that we have been banging on about the European battery metals thematic for almost 2 years now (from before COVID), and we couldn’t be happier by how quickly electric vehicles have taken off globally - far exceeding our expectations.

Regular readers will also know that we never stop talking about our other big investment and long term hold in the European battery metals space - German based Zero Carbon Lithium player Vulcan Energy Resources (ASX:VUL).

Lithium is a key ingredient in batteries, and the European Union is mandating that batteries produced in Europe must use locally, ethically and sustainably sourced materials - VUL perfectly ticks all these boxes.

Today Vulcan has announced that it has been admitted to the Global Battery Alliance - joining 70 members who share the goal of “creating a sustainable battery value chain globally”.

ASX:VUL

Industry members include BMW Group, BASF, BP, Google, Renault Group, LG Chem, Umicore, Volkswagen Group and Volvo Group. Vulcan joins SQM and Wesfarmers as members from the lithium sector.

Not a bad bunch for VUL to be sitting at the table with.... It’s like being invited to sit with the cool kids at the school cafeteria...

Except instead of kids, they are multinational mega corporations with billions of dollars to deploy on securing vital EU lithium supply chains.

See our VUL investment milestones, VUL investment strategy and past commentary about VUL here.

Recent Mainstream Media: EMN and VUL

Crucial reading for any EMN and VUL investors:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.