Introducing Our Top Energy Pick of 2020: Eying Elephant Scale Potential

Here at the Next Oil Rush we seek outsized returns from investing from ASX small cap energy explorers aiming for giant discoveries.

We are long term investors and take positions in the stocks we cover.

Our first ever Top Energy Pick was up 1,200%.

Our energy “Pick of the Year” in 2019 was up 361% and is still going strong.

Today, we announce our 2020 energy Pick of the Year.

Here is what we look for in our top energy exploration picks:

- First mover - Exploring in a frontier region with potential to make the “first ever” discovery.

- Small market cap - Potential of at least 10x gains (be aware however these are high risk investments).

- Near term price catalysts – Significant drilling event planned that will drive investor interest in the story.

Our team have been searching for the next energy explorer to take a position in for our long term portfolio. We’ve conducted extensive due diligence and met the management of numerous ASX listed small cap companies in our search.

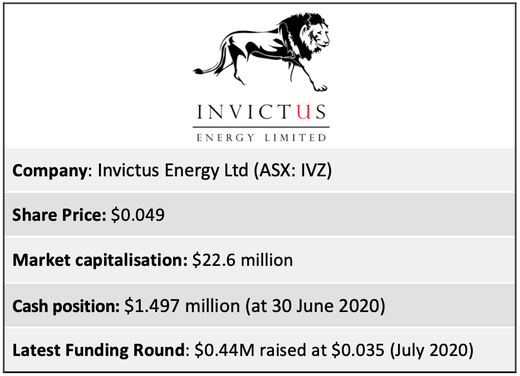

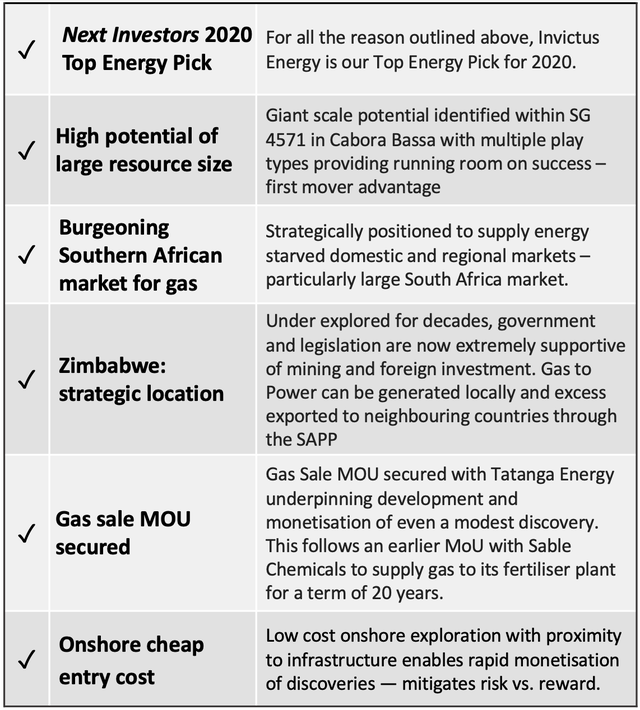

That process has resulted in us taking a long term position in our Top Energy Pick of 2020 — Invictus Energy Ltd (ASX:IVZ).

We don’t invest in many oil & gas stocks, currently only holding three — EXR, 88E, and now IVZ, with each of these meeting our three criteria as top energy exploration picks.

Here we explain why we have taken a large position in IVZ and selected it as our Top Energy Pick of 2020...

Huge upside potential on discovery

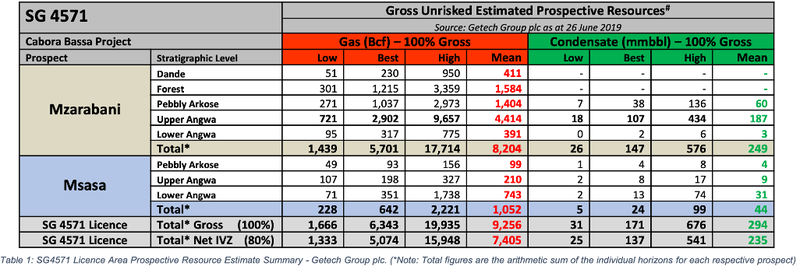

IVZ’s Cabora Bassa Project in northern Zimbabwe comprises a massive 9.25 trillion cubic feet (Tcf) of gas plus 294 million barrels of conventional gas/condensate (gross mean unrisked).

This makes it potentially the largest, seismically defined, undrilled structure onshore Africa.

The project is in one of the last undrilled rift basins in Africa. It is potentially a play opening project, and for that reason success would attract a significant premium.

This type of frontier exploration has brought transformational success to numerous junior explorers. First movers are able to secure the best acreage, the best terms and the most lucrative markets.

The company has a market capitalisation of just over $20 million — a fraction of what it could be worth if discovers a large resource and opens up Zimbabwe’s Cabora Bassa basin to eventual production.

Further, IVZ fits our high level criteria to be crowned a rare energy “Pick of the Year”:

- First mover – One of the last undrilled rift basins in Africa

- Small market cap – Around $20M

- Near term price catalysts – Farm out imminent followed by drilling

We have seen this play out before with one of our other portfolio stocks.

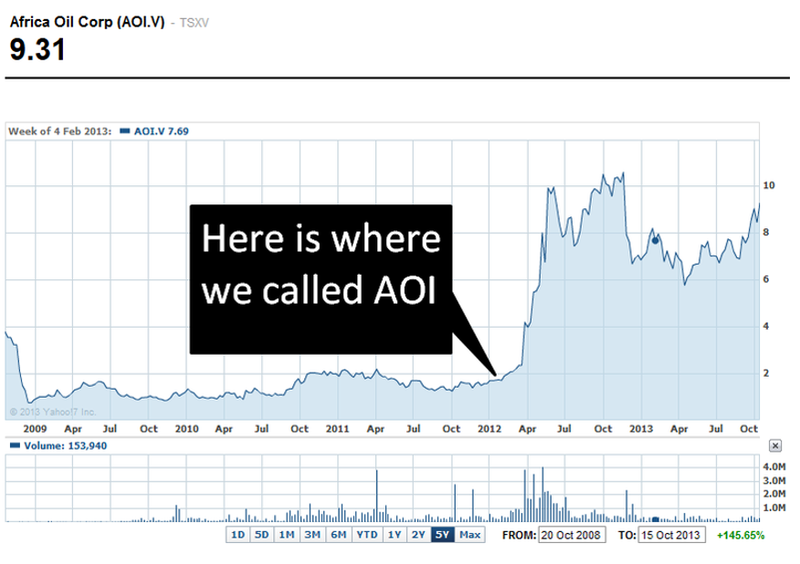

Back in 2012, in a company making event, Africa Oil Corp. (TSX: AOI) made an enormous oil discovery in Kenya, unlocking a new oil basin in East Africa.

In response, the company’s share price soared 800% in a matter of months, as well after well continued to be successful.

Like IVZ is right now, AOI was an early stage explorer that we introduced to our readers ahead of its mammoth discovery. It was our “Top Pick” and perfectly fit our energy explorer criteria:

- First mover – First to drill in the Rift Valley, Kenya

- Small market cap – around $40M

- Near term price catalysts – Strategic investor followed by basin opening drill program

We first wrote about AOI in February 2012 and called it our “Tip of the Decade” when it was trading at around C$1.80 per share, before reporting the discovery and reaching C$11.25 in the following months.

Africa Oil, however, is not alone in its company making African oil discovery. Here are some of the other juniors that have had play opening discoveries that delivered some outsized returns:

Africa Oil’s Kenyan discovery was made with the assistance of experienced joint venture partner, £9 billion Africa focused Tullow Oil (LSE: TLW).

Tullow Oil has a history of partnering with smaller explorers and discovering giant oil fields in Africa and then bringing them to production. As you can see in the table, it boasts no less than three play opening discoveries.

Cove Energy made headlines in 2012 with its Windjammer gas discovery in Mozambique.

In one of the most prominent public takeovers worldwide that year, the previously London-listed Cove was acquired in a £1.2 billion deal by Thailand’s national oil company following a bidding war with Shell.

Huge oil discoveries have been made along the East African Rift over last decade.

The location of IVZ’s project in the Cabora Bassa is one of the last undrilled rift basins in Africa on the doorstep of a massive market, and it has elephant scale potential.

In evaluating IVZ, we applied our understanding of other successful rift basin plays in a comparison to the Cabora Bassa Basin.

Our Top Energy Pick of 2019 did it too

The potential for IVZ to open up the Cabora Bassa Basin is not unlike what Elixir Energy (ASX:EXR) is doing in Mongolia’s South Gobi region. EXR ticked all our boxes for an energy pick of the year back in 2019:

- First mover – First to drill for Coal Seam Gas in Mongolia

- Small market cap –$16M

- Near term price catalysts – near term basin opening drilling program

EXR was issued the first ever coal seam gas PSC by the Mongolian government and went on to make the country’s first ever gas discovery in February 2020. It is situation in proximity to infrastructure and in right on the door step of gas hungry China.

The coal seam gas explorer was our Top Energy Pick of 2019 and has been up 361% since we took a large position in the company, adding it to our investment portfolio. We continue to hold EXR for the long term, as we continue to see additional upside as exploration continue across its vast landholding.

The third oil & gas junior in our portfolio, in addition to EXR and now IVZ, is 88 Energy (ASX: 88E).

This is a stock that we have been following for a number of years, originally writing about it when it was priced at just 0.6¢, before sharply rising by 1,200% to 8¢ per share on successful exploration drilling in onshore Alaska.

It has since pulled back significantly, and while broad market sentiment for the company is low, we continue to back 88E’s management team, and ahead of an active coming months we’ve used the current low valuation as an opportunity to top up our investment and double our holding in 88E.

IVZ’s Elephant Scale Target

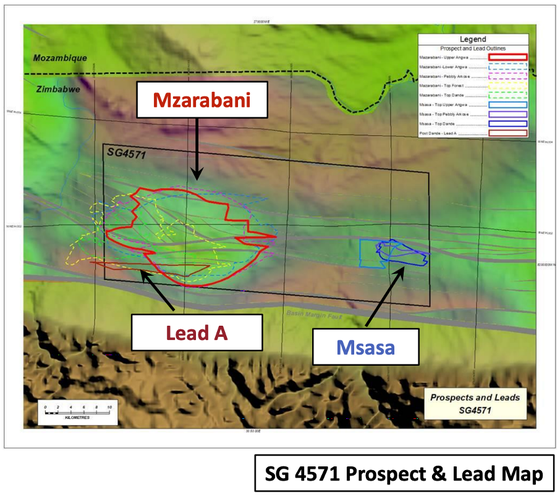

Located in northern Zimbabwe, IVZ’s project sits within the Cabora Bassa Basin which has all the ingredients of a working petroleum system and comes with a robust dataset.

Here, IVZ is progressing what looks to be the largest undrilled seismically defined structure onshore Africa.

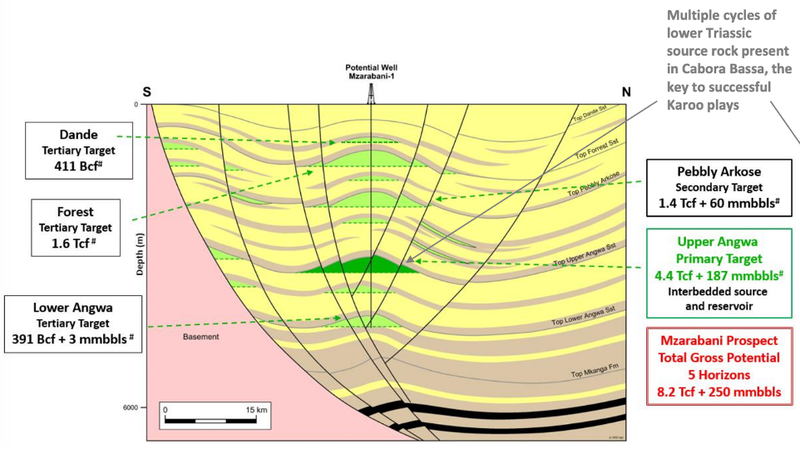

Representing one of the largest conventional exploration targets globally, the project’s Mzarabani Prospect is estimated to contain 8.2 Tcf + 250 million barrels of conventional gas / condensate (gross mean unrisked) across five horizons.

This is certainly elephant scale. (Elephant fields are conventional oil or gas fields with a recoverable reserve of 1 billion boe or more).

To get an idea of how big the Cabora Bassa project is, its 9 Tcf gas is approximately double the size of the Pluto and Xena gas field offshore Western Australia.

It is also potentially nine times the size of the Waitsia gas field in WA, the largest onshore discovery in Australia in 40 years, containing just under 1 trillion cubic feet gas.

IVZ is chasing enormous target and it can do that with one single well.

This target is so big that if it had been located anywhere else in the world it would have been drilled already.

Given its size, if any one of the stacked prospects are hit with the drill bit, it would be a transformational result for IVZ and its shareholders.

Could a farmout be imminent for IVZ?

IVZ’s has advised the market that it is now at an “advanced stage of farm out process” in active discussions with multiple parties to participate in ‘high impact’ basin opening well — in a farmout of the Cabora Bassa Project.

Looking at the company’s currently humble $23M market cap, its appears investors are waiting on the sidelines to see the nature of a farmout deal before investing.

Here at Next Investors, we’ve taken a different view — we have been quietly accumulating a large position in IVZ ahead of a potential farmout, as this would almost certainly be a significant share price catalyst.

IVZ already has access to a $30M Mobil dataset relating to this project

Back in the early 90s, Mobil was exploring for oil in Zimbabwe when it identified large resource potential in the Cabora Bassa Basin.

The petroleum giant identified and mapped the massive Mzarabani anticline in the heart of the basin, which has an area of more than 200km2, under closure, at favourable depths to host a conventional gas target.

Eventually, Mobil concluded that the petroleum system was more likely to be gas prone rather than oil prone — not the result Mobil was after as there was no structured market for gas in the region at the time.

Highlighting this fact was the Pande and Temane gas fields onshore Mozambique of four to five trillion cubic feet.

Discovered decades earlier, in the 1960s by Gulf Oil, these gas projects had changed hands multiple times by the time Mobil came to Zimbabwe, yet they were not developed as they couldn’t be monetised.

Mobil saw little point in trying to discover more gas so relinquished the Cabora Bassa project.

The early 1990s saw a pullback in exploration in Africa, particularly in frontier jurisdictions onshore. Majors that had been exploring across the continent left as petroleum prices crashed. BP left Tanzania, while Shell left Kenya.

Nearby countries, including Kenya and Uganda, have since promoted their petroleum potential, along with previous exploration programs which attracted the likes of Energy Africa, Hardman Resources and Heritage Oil to pick up where the majors left off in the Albertine Graben in Uganda.

These junior explorers re-evaluated the data left behind by the majors and saw some overlooked potential in these rift basin plays.

Their initial work encouraged the likes of Tullow Oil to farm-in to their acreage, acquire some additional seismic data and drill some exploration wells.

It didn’t take long for the discoveries to materialise and shortly after the second oil discovery was drilled by Hardman Resources, Tullow launched a $1.5 billion takeover bid for the company (having already acquired Energy Africa for $500 million).

The discoveries kept coming in the Albertine Graben and later Tullow ended up buying out Heritage’s interests in Uganda for $1.35 billion and then divested a 1/3 stake each to CNOOC and Total S.A for $2.9 billion.

The success by these junior explorers in the Albertine Graben inspired our 2012 portfolio pick, Africa Oil Corp to repeat that success in the Lokichar Basin in Kenya.

Zimbabwe, meanwhile, never bothered to promote its petroleum potential, instead promoting its mineral riches including gold, platinum, diamonds (and asbestos) at the time.

For years IVZ’s Cabora Bassa Project remained untouched and overlooked. Mobil’s extensive project data and reports were never made available in the public domain.

The country’s political and economic situation and changes to investment laws under former President Mugabe also worked against the petroleum sector. Zimbabwe was essentially uninvestable from a foreign investment point of view.

However, with a crisis comes opportunity. This is where IVZ comes in.

Invictus enter Zimbabwe

In 2010, 25 years after oil giant Mobil left Zimbabwe, Scott Macmillan — now IVZ managing director — entered the geological survey office in Harare where Mobil’s original field data — the gravity, the magnetics, etc. — were locked in a climate controlled storage room at the library.

Macmillan sat in the geological survey office and poured through Mobil’s reports, and from our discussion with him he was astounded with what he found there.

Mobil had spent a significant amount of money, resulting in a great data set and the identification of some pretty big targets already.

The highly prospective 250,000 acres are in the most prospective part of the Cabora Bassa Basin and come with a substantial $30 million dataset acquired by Mobil in the 1990s.

Given that the project has been locked away out of reach from industry, IVZ has been extremely fortunate to have the technical know how, plus the contacts and connections to be able to secure it first and bring it to industry.

The founder and managing director of Invictus Energy, Scott Macmillan is Zimbabwean — his family have been in the country for five generations and he has extensive business experience there with intimate knowledge of the jurisdiction.

Macmillan previously worked for Woodside Energy as a Senior Reservoir Engineer on large offshore oil and gas field developments and on a team focused on Africa exploration. He was also the Senior Reservoir Engineer for AWE Ltd working on the Waitsia Gas Field — the largest onshore gas discovery in Australia in the last 40 years.

He was drawn to the significant size and technical merits of the Cabora Bassa project, evident from the extensive exploration previously undertaken by Mobil.

A major part of our investment criteria is backing management, especially when they have significant skin in the game.

IVZ’s Managing Director Scott Macmillan has the right experience and deep relationships in country, plus being born and raised in Zimbabwe, knows how to get projects off the ground there.

Not only that, but the country is actively encouraging investment.

Zimbabwe is finalising a new Production Sharing Agreement (PSA) that will provide a transparent legal and fiscal framework, and ensure a predictable, stable and transparent legal and fiscal regime.

As a priority project, Cabora Bassa will be fast tracked through various approvals processes, including the finalisation of the PSA.

$IVZ Good progress being made by @energy_invictus

— Scott Macmillan (@scott_mac_zw) September 1, 2020

in country with Production Sharing Agreement being finalised and community consultations comleted. Interview with Minister of Energy Hon. Soda Zhemu last night courtesy of ZBC. pic.twitter.com/TSrwLLt2DB

Targeting elephant scale potential – means large upside from current valuation

IVZ’s has a total prospective resource of 9.25 Tcf plus 294 million barrels of conventional gas / condensate (gross mean unrisked) across the Cabora Bassa Project (Special Grant 4571).

The project contains the world class multi-Tcf Mzarabani and Msasa conventional gas-condensate prospects.

The Mzarabani Prospect, a multi-Tcf and liquids rich conventional gas condensate target, is potentially the largest, undrilled seismically defined structure onshore Africa (200km2 under closure) at 8.2 Tcf.

Not only is there a lot of gas but potentially also a lot of liquid associated with it as well, with 249 million barrels of conventional gas-condensate.

With this liquid condensate resource, the Mzarabani Prospect could be even bigger than the famous Dorado oil discovery — the largest oil discovery in Australia this century, which led to Santos acquiring Quadrant Energy last year.

In addition, IVZ’s Msasa Prospect also has elephant scale potential — estimated to contain 1.05 Tcf + 44 million barrels of conventional gas / condensate (gross mean unrisked) across three horizons.

Both the Mzarabani and Msasa prospects are a stacked targets with several prospective horizons that can each be tested by a single well.

A stacked target greatly enhances chance of success with multiple potential combinations of reservoir traps and seals.

In addition to the Mobil dataset, new geological and geophysical work has de-risked the acreage.

Going into a farm out and drilling event, based on the decades of work completed to date, it is clear that all the ingredients for a working petroleum system are present in the basin.

Source, reservoir and seal are all present and sampled at outcrop to the west of SG 4571 and mapped into the subsurface. The Lower Triassic source rock, which is key in large scale successful Karoo plays, is present in the Cabora Bassa Basin.

The project has passed technical review/assessment and is undergoing commercial evaluation, above ground due diligence and detailed forward program costing (including drilling cost).

IVZ’s rough estimate of the cost of the first one to two wells at Mzarabani is in the US$8-$16 million range, or a medium cost of US$12.5 million. Smaller targets would be in the US$6-8 million range.

This appears to us to be extremely cheap given the size of the prize on success.

By way of comparison, the Brulpadda discovery in South Africa has cost $200 + $150 million (original well + side track) to test 4-5 Tcf + condensate.

While the first well of a potential play opener, like any exploration endeavour, is not guaranteed to be successful, all the evidence of a working petroleum system is there, from the geo chem work and basin modelling work done and the evidence seen on the seismic.

Strategically located in Zimbabwe, IVZ will be able to command premium energy prices with access to the large regional market. In South Africa gas is at premium prices — the indicative LNG benchmark price of US$7.53-$7.95/mmbtu.

Simply put, this has potential to be a company changing and nation changing project.

Just the kind of opportunity we like to invest in.

Looking at the size of the target begs the question why hasn’t it already been drilled?

It’s not due to geological reasons, but due to political and above ground reasons with industry locked out of Zimbabwe for decades.

If IVZ find gas, what happens then?

Let’s look at the local gas market...

Rolling power outages and daily blackouts caused by electricity shortages are hampering both industry and investment in southern Africa.

By 2030, some 530 million Africans will still lack adequate power supply.

Against that backdrop, gas is becoming an increasingly important supply of reliable and clean energy, both in Africa and worldwide.

While the industry is still in its early stages, small scale LNG is being trucked to mining operations in Southern Africa, displacing diesel at ~40% of the cost. Also convenient is that a number of large smelters and refiners in Zimbabwe, Zambia and South Africa are equipped to switch from coal to natural gas.

All in all, Gas to Power is a very elegant solution and is increasingly important to the regional power needs in this part of the world.

Yet, current gas supplies are nowhere near enough to even meet current regional power demand.

In South Africa alone, independent studies estimate that by 2030 the country will face a daily gas shortfall of around 1 billion cubic feet — the size of Australia’s entire East Coast gas market.

But despite the current supply limitations, extensive infrastructure is in place to support the regional gas industry.

In Zimbabwe, Gas to Power can be generated locally and excess exported to neighbouring countries through the Southern African Power Pool (SAPP).

The network provides a virtual pipeline route to monetise gas within and across borders through gas to power projects.

Importantly for IVZ investors, it will provide IVZ access to markets, where there is a huge electricity shortfall with >15,000 MW of new generation capacity required.

IVZ signs off-take MoUs

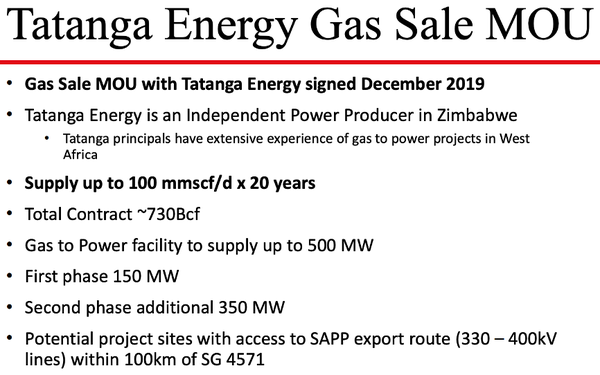

In December 2019, IVZ entered a MoU with Tatanga Energy. Under the agreement, and in the event of a commercial gas discovery from Special Grant 4571, the Cabora Bassa Project will provide gas supply for a 500-megawatt gas-to-power plant.

The parties will work together to investigate the economic and commercial viability of supplying gas from the project to the plant.

The gas will then be sold to the national grid and to other captive clients including mines, industrial and other large consumers of energy in Zimbabwe, Mozambique and Zambia.

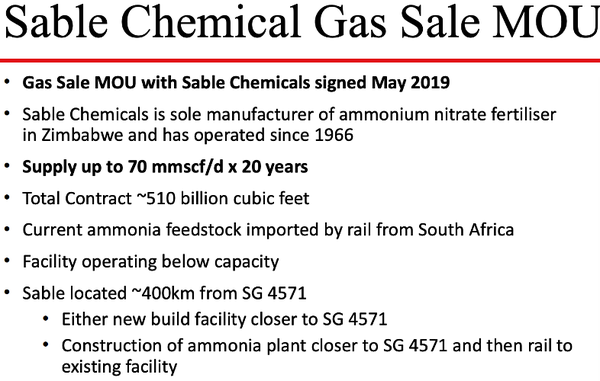

The MoU with Tatanga follows an earlier MoU with Sable Chemical Industries Limited to investigate the economic and commercial viability of supplying natural gas from the Cabora Bassa Project to the Sable fertiliser plant located in Kwekwe, Zimbabwe.

Under the terms of the MOU, Sable would be contracted to take 13 billion cubic feet of gas per year with an option to increase to 26 billion cubic feet.

The 20 year supply term provides strong revenue visibility in the event that Cabora Bassa is transformed into a source of commercial gas supply.

Next steps for IVZ

Based on what has been released to the market to date, it appears Invictus hope to conclude the farmout process and bring in a partner very shortly, with an eye for drill testing this play opening project.

Also anticipated to be approved imminently, is an environmental impact assessment.

Once that’s out of the way, the company can then start the detailed drill design and the field work that’s required.

Some infill seismic will likely be acquired to refine the required subsurface drilling.

And that’s when things will really start to heat up.

The company — and shareholders — will then look ahead to drilling of a high impact basin opening well or two and hopefully unlocking a vast new African energy resource.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.