Institutional investors see buying opportunities in graphite sector

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is no getting around the fact that the graphite sector is under pressure with even big players such as Syrah Resources (ASX:SYR) badly knocked around as its shares plummeted from approximately $2.00 in January to recently trade as low as 35 cents.

However, there were high expectations of Syrah, and perhaps investors looking to take a contrarian approach could be better served by identifying an emerging player that hasn’t already got a lot of fat built into its share price.

Finfeed has identified Comet Resources (ASX:CRL) as a little dynamo poised to power ahead in 2020 on the back of resource growth and the delineation of higher grade mineralisation evidenced as recently as November.

Comet’s Springdale Graphite Project consists of two tenements (E74/562 and E74/612) located approximately 30 kilometres east of Hopetoun in south Western Australia.

Comet boasts established resource

The company released a Maiden Resource Estimate in late 2018, and the project has good access to infrastructure being within 150 kilometres of the port at Esperance via sealed roads.

From a geological perspective, the tenements lie within the deformed southern margin of the Yilgarn Craton and constitute part of the Albany-Fraser Orogen.

With regards to the broader graphite sector, having been pummelled in the second half of 2019 after being hit by the perfect storm, a recovery may not be far away with investors likely to move ahead of an anticipated graphite supply shortage in 2021.

So is this the perfect time to wade into Comet Resources?

Recent exploration results and a strong outlook for 2020 suggest it is.

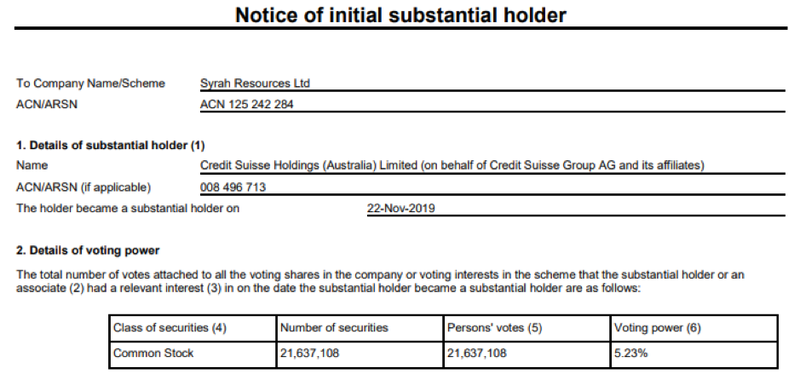

Credit Suisse has recently made a move, having taken a 5.2% stake in Syrah Resources as advised on November 22, 2019.

Identifying value in a depressed market

When negative sentiment exists in a sector it is often the emerging players that offer the best value, and potentially superior capital gains.

The up and comers are not left with a hangover of disenchanted shareholders just waiting for an exit point as the share price recovers.

Once a commodity comes back into vogue, the smaller players that flew under the radar when the sector was out of favour suddenly become the flavour of the month.

Comet Resources fits neatly into this category, and it came out with some outstanding exploration results at the end of November.

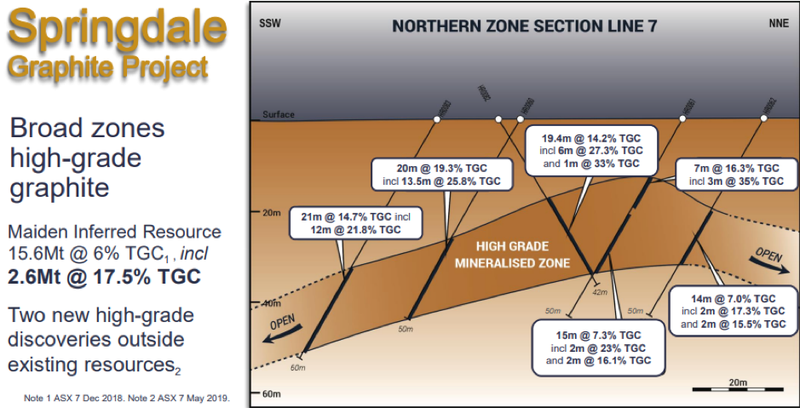

This built on what was already a good story, as unlike many other smaller players in the sector, the Springdale Graphite Project has an established resource as outlined below with two new high grade discoveries that could contribute to a resource upgrade in 2020.

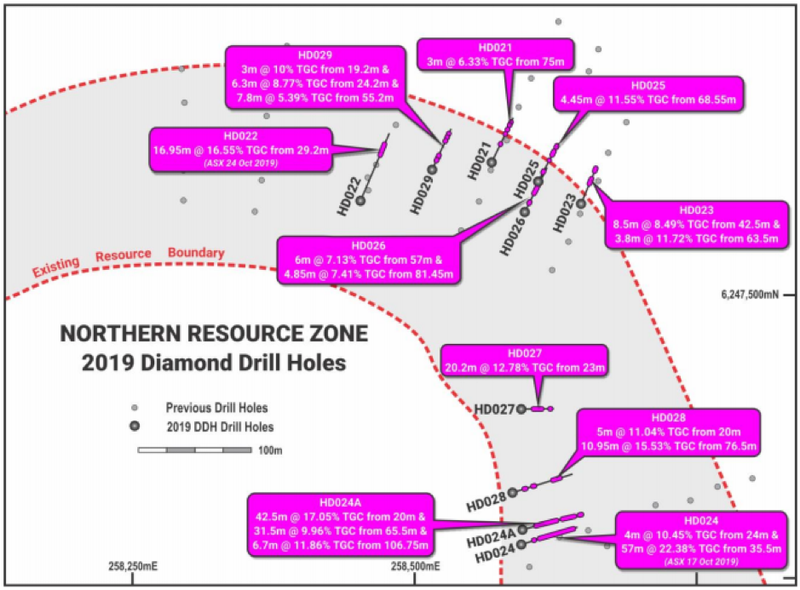

The drilling results were outstanding with high grade graphite mineralisation intersected in all infill and twin holes conducted for the program.

These included a highest grade graphite result to date of 3.23 metres at 51.02% TGC (total graphitic carbon) from 35.3 metres from a wider interval of 42.5 metres at 17% TGC from 20 metres in hole HD024A.

This hole was drilled as a twin of HD024 (Oct 2019) and showed stronger oxidation and veining but again confirmed the continuity of the high grade graphite mineralisation on the eastern side of the north zone as indicated in the following map (right-hand corner).

Progressing towards prefeasibility study

Managing director Matthew O’Kane highlighted the significance of this recent round of results and their relevance in terms of the company’s strategy in 2020 in saying, “Once again we saw spectacular grades in the infill program.

‘’While we have already achieved many high grade intercepts in the Northern Zone at Springdale, we are particularly impressed by the width and grade of the intercepts in hole HD024A, including the highest grade intercept to date of 3.23m @ 51%.

‘’Now we’re very focused on the active metallurgical test work program and look forward to releasing those results as they become available.”

Comet looking undervalued

In 2020, Comet will be conducting further drilling and surveying while also advancing its metallurgical test work.

This will allow the company to progress discussions with parties regarding the potential applications of the style of graphite it can provide.

Potential share price catalysts include exploration upside and a possible conversion of a portion of the resource from the inferred category to indicated.

One factor that works in favour of graphite explorers is the consistent accuracy of electromagnetic survey in terms of identifying where the mineral is located.

Graphite lights up like a Christmas tree when surveyed using electromagnetic technology, and given that the Springdale resource is located near surface, management has a distinct advantage in terms of expanding the existing resource and possibly identifying new zones of mineralisation within the tenements that are known to have similar geological characteristics.

Bearing in mind the likelihood of resource expansion, and particularly taking into account Comet’s established resource, its enterprise value of approximately $5 million seems extremely conservative.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.