Hot Chili to strike ore processing deal with government

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

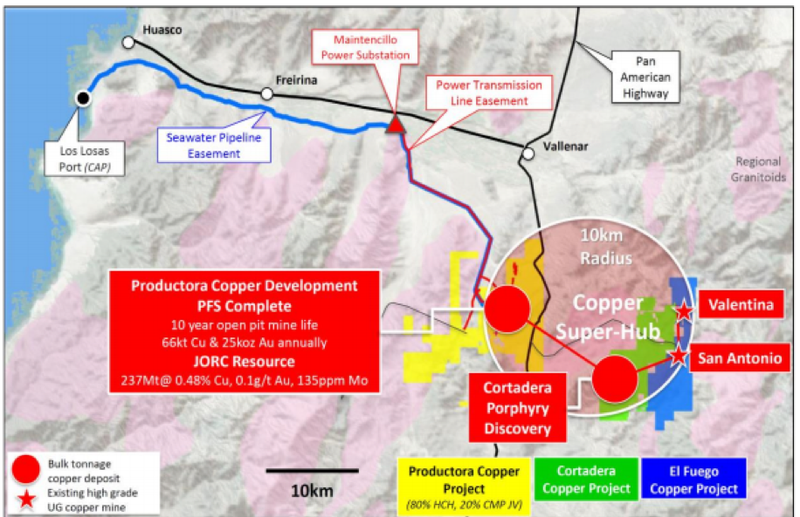

Hot Chili Limited (ASX:HCH) has accepted (on a non-binding basis) an offer from the Chilean government agency Empresa Nacional de Mineria (ENAMI) for lease mining and processing of high grade ore from the company's Productora copper-gold project in Chile.

Formal agreement will be a win-win for Hot Chili and its key local and government stakeholders, and is expected to see the company announce first production and revenue from its assets in Chile this year while safeguarding 400 jobs at ENAMI's Vallenar plant.

ENAMI's offer is supported by Hot Chili's joint venture partner at Productora - Compania Minera del Pacifico (CMP) and the formal agreement is expected to be ready for review and execution within the coming weeks subject to acceptance of appropriate terms and conditions.

Royalties and bonuses applicable

The execution of a formal agreement with Sociedad Minera El Aguila Limitada (SMEAL - 80% HCH, 20% CMP) will be subject to a number of terms outlined by ENAMI.

These include an intention to lease, for a period of two years the mining concession "La Productora 1-16" (referred to as the "Concession") under terms and conditions to be agreed by both parties.

Under the terms of the agreement, ENAMI may sublet sectors of the Concession to third parties, who will exploit the site and deliver their production to the ENAMI plant in Vallenar.

A royalty of 10% will be applicable for the sale value of the minerals extracted from the Concession in addition to the payment of an additional bonus of US$2 per tonne of copper ore purchased at the Vallenar Plant.

Estimated production of 10,000 tonnes per month

Considering existing underground mine developments and the average grade of historical production by ENAMI from Productora, ENAMI estimates production of 10,000 tonnes per month could be achieved quickly with grades of 1% copper.

Agreement to the ENAMI offer will reinforce Hot Chili's commitment to social responsibility for the government and local community of Vallenar, while also providing cash flow and additional bulk mining reconciliation data for high grade resources at Productora.

Applying the current copper price of US$2.15/lb, the potential mining and processing agreement is estimated to represent approximate annual payments to Hot Chili ranging between US$400,000 and US$500,000 relative to its 80% interest in SMEAL.

The royalty component of the ENAMI offer provides further payment upside in the event of higher copper prices or higher copper ore grades.

Potential share price catalysts in the coming weeks relate to outstanding drill results from Cortadera that have been flagged by management, as well as discussions with other key stakeholders.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.