High profile investors support White Rock capital raising

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Ltd (ASX:WRM) intends to raise $7.35 million before costs, with the funds used to explore and drill test the company’s large and robust Last Chance gold anomaly at the Red Mountain project in the Tintina gold belt of central Alaska.

Management also intends to instigate a share consolidation with the conversion of every 100 existing shares into one share, an initiative which would tighten up its large but highly dilutive share register.

With regard to the proposed capital raising, it is worth noting that there has been significant international interest from institutional and sophisticated investors, including a strategic syndicate led by Palisades Goldcorp, Canada’s largest resource-focused merchant bank that capitalises on a deep value disconnect between the broader commodities market and junior resource equities.

Participation from this merchant bank is important for White Rock given that it effectively recognises the value of the company’s current resources in Alaska and Australia (Mount Carrington Gold-Silver Project), as well as taking into account exploration upside.

The capital raising will incorporate two tranches, with the first raising approximately $1.4 million and the second $4.4 million, and the latter subject to shareholder approval.

A fully underwritten share purchase plan (SPP) will allow existing White Rock shareholders to acquire new fully paid ordinary shares at the placement price of $0.003 per share, raising up to $1.5 million.

Capital raising to accelerate exploration at Last Chance

Commenting on the proposed capital raising and upcoming operational developments, managing director Matt Gill said, “The level of interest shown in this capital raising has been tremendous.

‘’It will allow White Rock to immediately recommence on-ground works in mid-June to explore and then drill the robust 15 square kilometre Last Chance gold anomaly located in the Tintina Gold belt of Central Alaska.

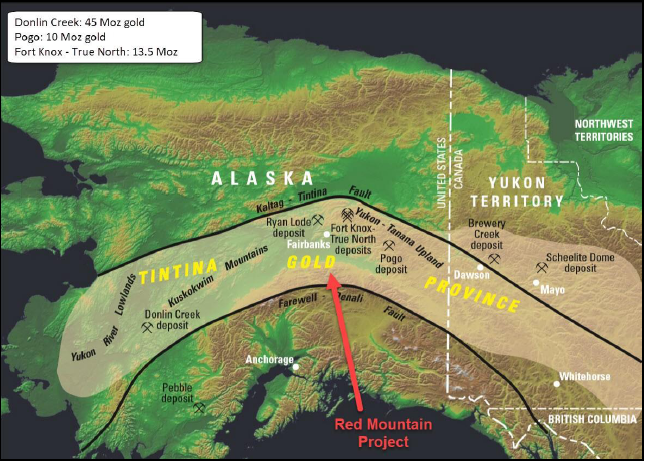

‘’Large, quality exploration targets in a gold belt that already hosts the likes of Donlin Creek (45 million ounces gold), Pogo (10 million ounces gold), and Fort Knox (13.5 million ounces gold), do not present themselves often and White Rock looks forward to drilling and potentially delineating a world-class deposit at Last Chance (see below).

“We have attracted some serious interest in the Last Chance exploration story and this funding will allow us to get on the ground in mid-June, conduct mapping, sampling and geochemistry, and be drilling by early August.

“Joining as new White Rock shareholders includes the likes of Palisades Goldcorp – a new Canadian resource merchant bank, Denver-based Crescat Capital, and industry leading geologist Dr. Quinton Hennigh.’’

Importantly, White Rock has the strength and calibre of Canaccord Genuity and Martin Place Securities supporting the raising which is a strong endorsement of the quality and exploration opportunity at the Last Chance prospect.

It is also worth noting that major shareholder Sandfire Resources Limited (ASX:SFR) has agreed to support the capital raising by participating in the Placement to maintain its holding above 10%, as well as a sub-underwriting commitment under the SPP.

Hennigh brings valuable experience to exploration program

Dr. Quinton Hennigh is an internationally renowned economic geologist, with more than 25 years of exploration experience and expertise with major gold mining companies including Homestake Mining Company, Newcrest Mining Limited (ASX:NCM) and Newmont Mining Corporation.

He has made several significant gold discoveries for Canadian exploration companies such as the 5 million ounce Springpole alkaline gold deposit near Red Lake, Ontario, for Gold Canyon Resources.

Hennigh is also chairman and president of Pilbara focused Novo Resources Corp. (TSXV: NVO) which he co-founded in 2009.

It is worth noting Hennigh’s comments regarding the Last Chance target as he believes it is potentially one of the largest and highest magnitude gold anomalies he has ever seen.

Hennigh said, “Based on the particular sampling technique employed, I am confident that the large and robust gold anomaly is highly significant and likely indicates the presence of a very large, never before recognised nor drill-tested gold system that is chemically akin to the large Pogo deposit (Northern Star: 10 million ounces at 11 g/t gold) situated approximately 200 kilometres east-north-east.

“Events leading to the discovery of the Last Chance anomaly are remarkably similar to the history of discovery at Pogo.

‘’Follow up soil sampling quickly identified drill targets and the first exploratory drill hole intercepted the large Liese zones, that became the high-grade core of the Pogo deposit.

“White Rock Minerals plans to undertake aggressive soil sampling at Last Chance with a view to quickly identifying drill targets in an effort to replicate this pattern of discovery.

‘’Barring delays due to extreme weather conditions or COVID-19, management anticipates developing drill targets by late July and undertaking up to 2500 metres in its first phase drill test this season.’’

Importantly, the Alaskan Department of Natural Resources indicates that the Last Chance gold anomaly has never had any historic mining claims staked, suggesting that the area is unexplored.

Together with the size and strength of the gold anomaly, White Rock is encouraged by the exploration potential for the Last Chance Gold Prospect to yield a significant new gold discovery.

The detailed definition of stream sediment sampling provides a clear area for focused on ground follow-up activities.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.