Hardey pens agreement to acquire established vanadium mine

Published 03-JUL-2018 14:18 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources Limited (ASX:HDY) has entered into an agreement aimed at facilitating the acquisition of a company that owns a vanadium mine that has produced high-grade ore in the past.

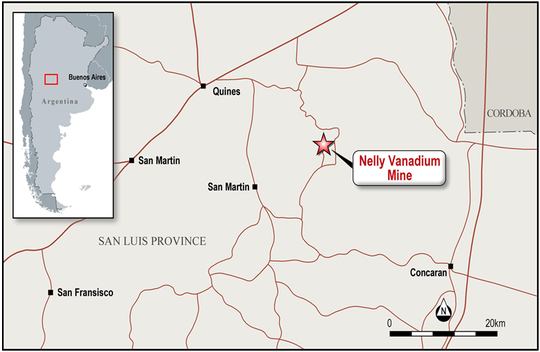

The company has entered into a share sale agreement with the shareholders of Nelly Vanadium Pty Ltd (NVPL), owners of the Nelly Vanadium Mine in San Luis Province in Argentina.

Under the terms of this agreement, Hardey has been granted a 40-day option to acquire 100% of the issued capital of NVPL.

Hardey Resources’ non-executive director, Terrence Clee highlighted the compelling near term outlook for the Nelly Vanadium Mine in saying, “Upon finalising the acquisition, the Board’s focus will be on undertaking exploration activities with the aim of proving up a JORC compliant resource and moving to re-open the Nelly Vanadium Mine.”

There is still a lot of work to do here, so investors should seek professional financial advice for further information before making an investment decision.

Nelly offers attractive metrics

The Nelly Vanadium Mine comprises several vanadium-rich polymetallic sheeted vein systems, aligned north-east to south-west, that are approximately one kilometre long and up to 5.5 metres wide.

Of significance in determining the potential scope for resource extension, when Nelly was operating between 1949-57 only one vein was partially exploited, leaving most of the deposit intact.

Past sampling and assay results throughout the historical workings produced grades from the partially mined vein that ranged up to 1.9% vanadium with a length weighted sample average of 0.82 per cent vanadium.

NVM has access to reliable power and water, while there is a transport infrastructure connecting the mine to key ports.

High grades will improve economic viability

The Nelly mine is on a 53-hectare tenement 170 kilometres from the capital of San Luis Province in Argentina.

The mine has ready access to mains power and water supplies, while nearby towns can provide supporting services and skilled labour.

Transportation infrastructure from the mine to key ports will allow the company to access major end markets.

In terms of output, a processing plant on-site produced nearly 4000 kilograms of vanadium and 400 kilograms of VO3NH4, an important intermediate in the purification of vanadium.

Modern technology should see an uptick in production

This level of production is fairly moderate by today’s standards, as at that time concentration processes were at an experimental stage, preventing the attainment of critical scale.

The primary customers during the 1950s in Argentina were national alloy and acid manufacturers.

During the 1950s, Nelly Vanadium was one of the few operating mines that had an on-site processing plant and accommodation for employees, arguably reflecting the significance of the deposit.

Exploration upside

The mine was initially developed as an open pit, and subsequently underground galleries were progressed, but there is extensive scope for exploration of existing veins at depth.

Studies undertaken and samples extracted most recently in 1974 have indicated that there is the presence of other base and precious metals.

In 2017, assay results on samples taken from the open pit and tailings confirmed high-grade mineralisation with up to 1.6 per cent vanadium oxide, confirming the high grades historically mined.

When Nelly Vanadium was operating during the 1950s, only part of the known resource was exploited, leaving most of the untapped mineralisation intact.

The extent of the resource will be a key focus in coming months, quite possibly offering considerable exploration upside.

The economic viability of developing vanadium projects has improved substantially as a result of a strong rally in the commodity price.

Vanadium’s supply demand metrics appear robust

Hardey is optimistic that demand for vanadium will remain robust over the next few years, as structural changes augur favourably for the continued expansion of the renewable battery sector.

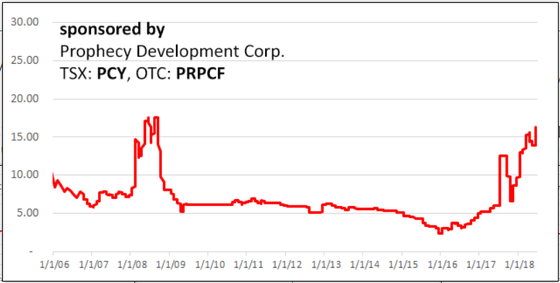

Indeed, the vanadium price is looking strong, as indicated above, trading in the vicinity of US$16.30 per pound.

This is pushing up towards levels not seen since 2008/09.

Is vanadium the next cobalt?

As a battery material, it has been supported by similar momentum that has driven the likes of cobalt to extraordinary highs.

With the price having more than doubled in the last 12 months and evidence of sustained momentum in recent trading there could well be further upside.

Analysts have been warming to vanadium since the start of the year as it has the potential to follow in the footsteps of other highflying battery materials stocks such as cobalt and lithium.

Supply shortages, due to China shutting polluting mines, coupled with accelerating demand from the renewable battery sector, have underpinned a substantial increase in the vanadium price over the past 2 to 3 years.

As management highlighted, this much improved supply/demand environment has led to an increase in investment in developing new vanadium supply chains globally, a factor that should make the economics of reopening the Nelly mine very attractive.

Is Hardey the next 1500 per cent+ King River

This has rubbed off on a number of stocks on the ASX with one notable smallcap in King River Copper (ASX:KRC), which has a vanadium project in Western Australia, delivering outstanding returns in fiscal 2018.

Running the numbers for the highest share price gains for stocks with a market capitalisation between $50 million and $500 million between July 1, 2017 and June 30, 2018, King River Copper comes in at number three with a year-on-year gain of 1516 per cent.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

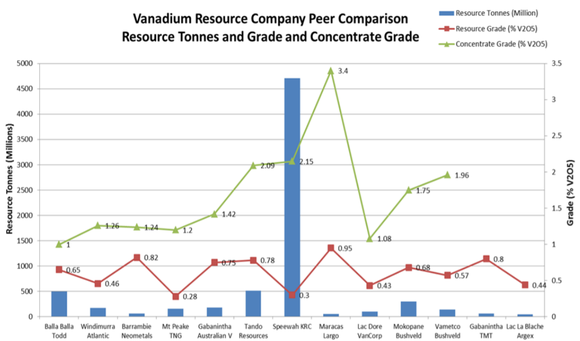

Only recently, King River released some comparative data referring to grades of deposits (indicated by the red line in the bar chart below).

This makes interesting reading in light of the fact that a length weighted sample average grade at the Nelly mine is 0.82 per cent, but in particular, partially mined veins and recent samples have delivered grades of up to 1.9 per cent and 1.6 per cent respectively.

Near-term projects should be well supported

Strong industry momentum should work in favour of Hardey as it strives to bring the Nelly project into production relatively quickly.

Of course it still has some work to do to make this happen, so investors should seek professional financial advice if considering this stock for their portfolio.

The other factor that could well come into play as investors embrace vanadium stocks is the issue of financing.

Often this is a stumbling block for smaller players, but as has been evidenced in the cobalt sector, investors are keen to get a piece of emerging growth stories with a positive macro theme.

As Argentina’s laws enable mining licences to be reactivated relatively quickly, an application is being prepared and will soon be lodged with the regulator.

While reactivation of the mining licence is considered somewhat of a formality, receiving the go-ahead could well be a share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.