GTR to fast track drilling at Jeffrey uranium project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Backed by positive survey results, GTi Resources Ltd (ASX:GTR) is fast-tracking its planned maiden exploration drilling program at the Jeffrey uranium and vanadium project in Utah.

Management now expects drilling to occur in the middle of June 2020.

The positive results from the recent geophysical down hole survey of 26 open historical drill holes have been integrated into the planning of the proposed 10-hole drill program at the Jeffrey project.

Calibrated gamma geophysical logs in the historical drill holes have provided equivalent U3O8 grades, and further information on the mineralised geometries.

The results of these downhole surveys were consistent with the company’s expectations and demonstrated a continuation of known mineralization under cover at two locations within the project.

Numerous zones of mineralisation were intercepted in the historical drill holes, including an intercept of 0.3 metres at 0.234% eU3O8.

This favourable outcome has encouraged management to rapidly advance the planned drill program.

Over the preceding period GTR has confirmed the presence of high-grade uranium and vanadium potential at the Jeffrey project in Utah, and completed the gamma logging program to leverage existing open drill holes dating from the late 1970s to generate low-cost, high-value assay data.

The in-situ equivalent assay data will be utilised to refine knowledge of the local mineralisation as the trend moves away from outcrop and shallow underground exposure, and guide refinement of drill targets for the planned follow-up drilling campaign which will involve advancement of up to 10 shallow core holes commencing mid-June.

It is worth noting that GTR is well-positioned to fund follow-up drilling programs after the recent exercise of options raised nearly $1.2 million.

Rats Nest samples too hot to handle

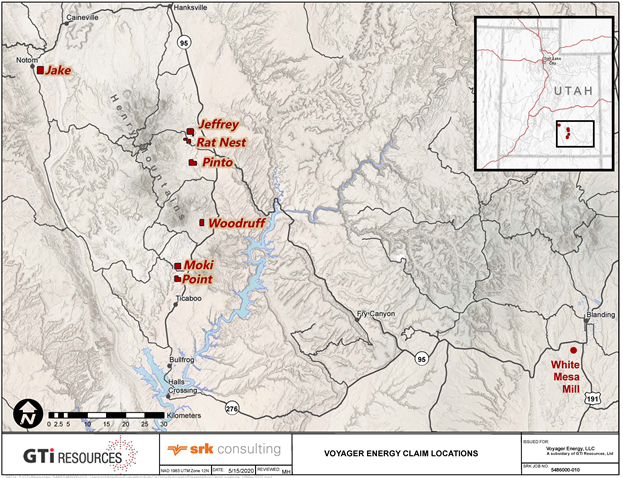

GTR also conducted sampling and mapping work on outcrop and underground workings at the nearby prospective Rat Nest Project which as can be seen on the map above is in close proximity to the Jeffrey Project.

Sampling included both face-cut channel samples on historical underground working faces, as well as grab samples.

These samples were sent to a laboratory in Reno, Nevada for assay.

However, some of the samples emitted radiation at levels that exceeded the laboratory’s safe handling limits and were subsequently sent to their facility in Vancouver, Canada for assay.

The assay results for the Rats Nest samples are expected to be available in the coming weeks.

From a broader perspective, the Jeffrey Project is one of several held by GTR in Utah, covering approximately 1,500 hectares of the Henry Mountains region, within Garfield and Wayne Counties near Hanksville.

The region forms part of the prolific Colorado Plateau uranium province which historically provided the most important uranium resources in the US.

The region benefits from well-established infrastructure and a mature mining industry.

The White Mesa mill, the only conventional fully licensed and operational uranium/vanadium combination mill in the United States, is located within trucking distance of the properties.

The industry backdrop is also looking positive with the Trump administration’s 2021 budget proposing the creation of a US$1.5 billion U3O8 reserve through purchasing the commodity at an annualised rate of US$150 million.

GTR has been one of the market's best performers in May-April, delivering shareholders a 700% gain since April 1.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.