Gold boom brings outstanding support for Los Cerros' capital raising

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) announced on Monday morning that it had completed a capital raising via private placement to professional and sophisticated investors.

Funds will be used to advance the Quinchia Project in the heart of the prolific Mid-Cauca gold-copper porphyry belt of Colombia, which hosts several multi-million ounce gold and gold-copper deposits.

Diamond drilling is scheduled to commence in the last week of July via a service provider initially, prior to Los Cerros' taking receipt of its own diamond rig to accelerate further drilling.

This will provide the company with capacity to target deep-seated high-grade mineralisation which in the course of historical drilling has featured promising broad intersections of promising grades at depths of around 150 metres.

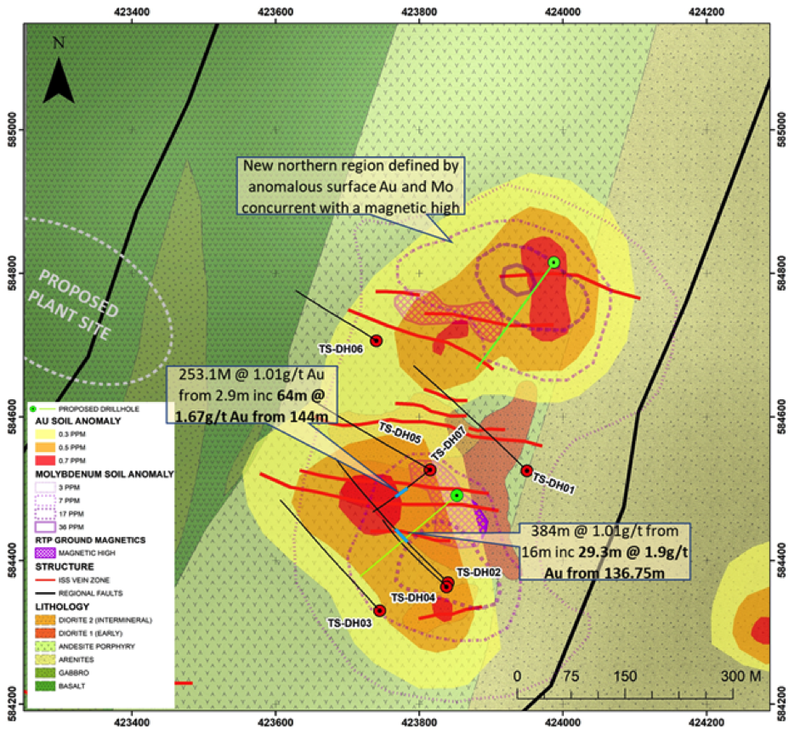

The initial 2,500 metre diamond drilling program will commence at the Tesorito porphyry before moving to targets at Chuscal and Miraflores.

After taking delivery of the company’s own rig, management intends to further step-up the scale of the drill program.

Importantly, Los Cerros has an established platform to build on with a JORC Resource of 877,000 ounces gold and reserves of 457,000 ounces gold at the Miraflores deposit, and it is targeting porphyry mineralisation at the nearby Tesorito and Chuscal prospects.

All seven previous holes drilled at Tesorito have successfully intersected porphyry-style gold mineralisation, including impressive intercepts of 384 metres and 253 metres as indicated below.

Gold and copper best performing commodities

While equities markets are uncertain, from a commodity price perspective the upcoming drilling campaign is timed to perfection, and this no doubt underpinned robust support for the capital raising.

The gold price is approaching all-time highs, while the copper price is closing in on highs not seen since early 2019.

In a strong endorsement, the company received firm bids for approximately $10 million and has proceeded to accept binding commitments for a placement of $3,530,000 before costs.

In a nervous market, this is an outstanding achievement by a microcap company and it could only be viewed as a stamp of approval for the group’s projects and management’s ability to generate strong shareholder returns from their development.

Commenting on the outstanding support for the capital raising, Los Cerros’ managing director Jason Stirbinskis said, “The response to our capital raising and enthusiasm to sustain an expanded drilling program to test multiple gold-copper targets at Quinchia has been spectacular.

‘’With these funds we can pursue an extended drilling program well into 2021.

‘’We thank our shareholders who have supported this placement and welcome new investors to our register.

‘’With this placement and strong endorsement of our plans, we eagerly look forward to further developing the Quinchia Gold Project which includes Tesorito, Chuscal and Miraflores, starting with drilling at Tesorito targeted to start at the end of the month”.

Capital raising follows strong corporate interest from multinational

In a sense, the significant support for the capital raising shouldn’t have come as a surprise with blue-chip multinational mining groups eyeing off Los Cerros’ assets.

In April, global mining group AngloGold Ashanti (JSE:ANG; ASX:AGG) entered into a binding terms sheet, exchanging its Chuscal joint-venture interest for Los Cerros securities, effectively making it a 4.3% shareholder in the company.

Under the terms of the agreement, AngloGold Ashanti will have the right to increase its interest to 10%.

Los Cerros stands to benefit from agreed access to the group’s regional geophysics data, as well as unlimited use of its IP equipment for the next 18 months.

The agreement took Los Cerros’ ownership of Chuscal to 100% and resulted in the company holding 100% of the entire Quinchia Project of which Chuscal is a part.

All of Los Cerros’ projects are located within the highly prospective mid-Cauca porphyry belt that hosts many multi-million ounce discoveries, some owned and discovered by AngloGold such as the Nuevo Chaquiro and La Colosa projects which have a combined gold equivalent resource of 55 million ounces.

From a broader perspective, AngloGold Ashanti has notched up more than 100 million ounces of gold resource discoveries, making it a very attractive shareholder to have on the register.

AngloGold has deep understanding of Miraflores

AngloGold’s interest is particularly interesting in relation to targets identified by Los Cerros beyond the boundaries of the existing Miraflores gold deposit, part of the Quinchia project.

The newly identified targets have potential for high grade vein shoots and will be tested in the upcoming drill program.

Given recent improved understanding of regional geology, a recent review of the foundations of the geological model was undertaken to better understand the distribution of gold bearing structures within the resource envelope and beyond.

Modern exploration at Miraflores commenced with 10 diamond holes drilled by AngloGold Ashanti and B2 Gold in 2006-2007, followed in 2010 by TSX-V listed explorer Seafield Resources.

Over the next four years, Seafield completed 63 diamond drill holes for approximately 22,000 metres, defining low sulphidation epithermal mineralisation.

Seafield drill results included the following, outstanding intercepts:

- 23.95m @ 4.67g/t Au from 282.55m in QM-DH-03

- 6.0m @ 11.04 g/t Au from 343.1m within 194.9m @ 1.57g/t from 159.4m in QM-DH-32A

- 10.6m @ 11.97g/t Au from 233m within 1,145.7m @ 1.89g/t from 185.9m in QM-DH-33

- 60.0m @ 5.48 g/t Au from 225m within 161.15m @ 3.23g/t Au from 183m in QM-DH-34

- 59.2m @ 5.72 g/t Au from 182.8m within 238.15m @ 2.06g/t Au from 146m in QM-DH-50

Los Cerros believes that the considerable data set generated by Seafield Resources has not been fully interpreted and assimilated, and there is the opportunity to develop a deeper understanding of the Miraflores structure and economic potential.

Close examination of this data has also prompted management to focus on the investigation of Tesorito and Chuscal, both of which are less than two kilometres from Miraflores.

However, this has elevated management’s interest in Miraflores itself, especially given strong gold forecasts and the advanced nature of Miraflores’ engineering and approvals.

To test the modelling, Miraflores targets will be added to the planned drilling program at Tesorito and Chuscal.

Miraflores has a Reserve of 457,000 gold ounces at 3.29 g/t gold based on a 2017 feasibility study.

The study generated the following parameters based on capital expenditure of US$72 million for a retreat long hole stope with backfill mining operation feeding a 1,300 tonnes per day conventional cyanide leaching facility, producing average annual production of 48,000 ounces of gold per year over a 10 year operating life.

Crunching the numbers, you can see that such an operation would deliver substantially higher returns and reflect a much shorter payback period based on the current gold price.

The same sort of metrics can be applied across Los Cerros’ other assets, leaving the company strongly leveraged to movements in the gold price, and potentially the copper price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.