Go for gold, but go for value

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

For decades, everyone from global mining giants to market minnows have been striking it rich in African goldfields.

The broader continent remains extremely unexplored, particularly in terms of using modern means and more sophisticated technology.

Africa is known for delivering high grade large gold deposits which are developed into long life mines generating millions of ounces, and a wealth of riches for shareholders.

However, the extent of the gains that can be made by investing in gold companies often comes back to timing.

Getting in before those high-grade drill results first hit the deck or even crunching the numbers to get back of the envelope numbers as to the likely size of the maiden resource estimate can provide a useful early entry point.

Where do you want to be on the exploration curve

Finfeed examines a couple of companies that have plenty in common, but are at different points on the exploration and discovery curve.

Both companies make for interesting investment propositions, but making a choice may come down to the investor’s appetite for risk, their ability to determine potential upside and perhaps having a willingness to forego some share price upside with a view to focusing on the present rather than what could be.

For investors who have a penchant for the latter, Tietto Minerals Ltd (ASX:TIE) may be worth consideration.

Tietto and the other company we review, Mako Gold (ASX:MKG) have plenty in common including impressive exploration success and strategic exploration territory in the prolific gold bearing region of Côte d’Ivoire.

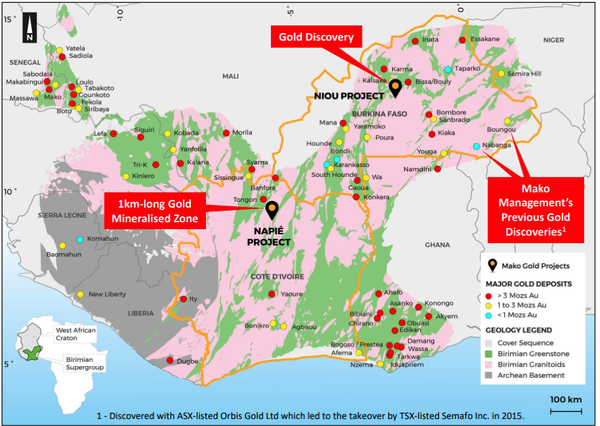

Mako has gold projects in Côte d’Ivoire and Burkina Faso in the gold-bearing West African Birimian Greenstone Belts which hosts more than 60 gold deposits in excess of 1 million ounces.

As indicated below, management has a proven track record of high-grade gold discoveries in West Africa and it is focused on exploring highly prospective projects with the aim of putting Mako on the map.

The main variance between the two companies is that they are on different stages of the exploration and discovery curve.

Tietto shareholders ride the rollercoaster

Firstly, it has been a transformational year for Tietto, and it is a good example of how significant timing is in terms of capturing optimum value.

The company’s share price performance since listing on the ASX in January 2018 has been a tale of two years with its first year extremely underwhelming and 2019, nothing short of outstanding.

The issue price of the company’s shares on listing was 20 cents per share, and the following share price chart tells the story.

In the first two weeks after listing, the company’s shares traded at a slight premium to their issue price.

While they bounced around a bit in February/March 2018, it wasn’t until August 2019 that they consistently traded above the issue price.

A number of factors contributed to a 100% increase in the company’s shares over a three month period between June and August.

The intersection of bonanza grades such as 10 metres at about 25 g/t gold at the group’s AG (Abujar‐Gludehi) deposit in May was followed up by encouraging rock samples in early July and a much thicker intersection albeit at lower grades of 2.8 g/t gold in August.

These together with further strong results in September and October have seen the company hit a 12 month high of 27 cents.

While you could say that early-stage investors are only just in the money where the company is currently trading, as we said it is all about timing, and on that note it could be argued that some high-grade hits in January and February were good enough to get investors interested around the 8 cents per share mark.

Investors who saw the potential in Tietto at that stage are now sitting on a paper gain of 200%.

Will Mako do a Tietto

Given this backdrop, forward-looking investors may benefit from considering Mako Gold at current levels.

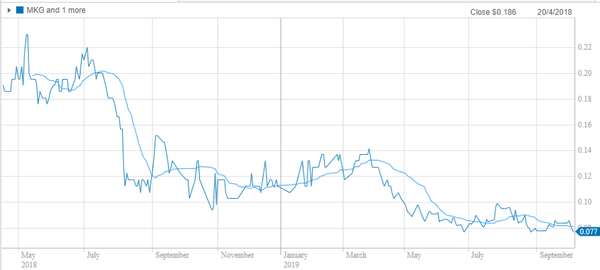

The company listed on the ASX about three months after Tietto, also with an issue price of 20 cents per share.

Mako had the same early-stage honeymoon period where its shares traded broadly in line with the issue price, but as the following chart shows, the next 12 months featured a sharp decline.

While the chart doesn’t look pretty, bear in mind that like Tietto the company’s shares plunged over the first 12 months, but then pulled up at a support level.

Twelve months from the date of listing, Tietto’s shares had plummeted from 23 cents to 6 cents where they finally found a bottom.

Similarly, Mako appeared to find a bottom around the 8 cents mark in June, continuing to trade in a tight range between 8 cents and 10 cents.

Share price drivers in 2019/2020

Since listing on the ASX, Mako has made outstanding progress with its Burkina Faso and Côte d’Ivoire assets, having already announced a gold discovery after its maiden drilling program at the Niou Project in Burkina Faso.

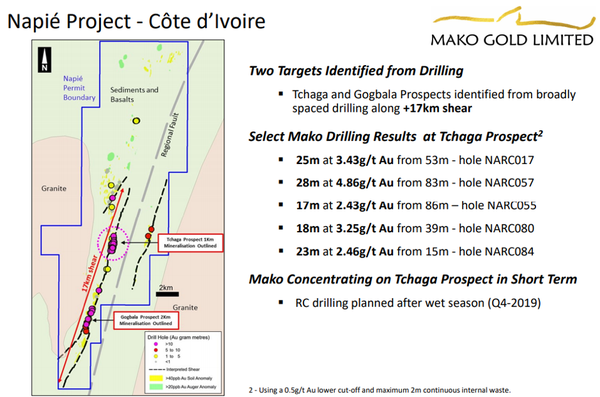

In addition, very encouraging results have been received from three drilling campaigns carried out at the company’s farm-in JV Napié Project in Côte d’Ivoire.

Regards the Côte d’Ivoire project, multiple RC drilling programs delivered wide and high-grade intersections, including 28 metres at 4.9 g/t gold, and in a short time frame the group has doubled the strike length of the deposit.

Looking at comparisons with Tietto, while the group delivered some bonanza grades in single digit intersections, the wider intersections have been more along the lines of what Mako has delineated to date.

For example, at AG wider intersections such as 36 metres and 14 metres had grades of 4.4 g/t gold and 5.6 g/t gold respectively.

New permits less than 30 kilometres from Tongon

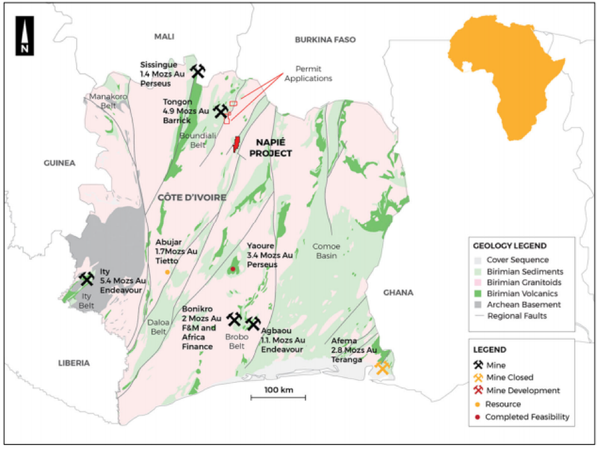

Mako is tapping into the same geological trends as Tietto and other major gold producers in Côte d’Ivoire.

As the following map shows, the Napié Project lies just to the south-east of Barrick Gold’s Tongon project which has a gold resource of approximately 5 million ounces.

With drilling planned to recommence in the December quarter of 2019 after the wet season there is the likelihood of strong news flow in early 2020, suggesting that below featured on Mako’s share price chart may be close to an inflection point.

Consequently, forward-looking investors who believe that Mako can come up with the same impressive drilling results that have driven Tietto in the last few months could view this as an ideal entry point.

Certainly, one of the smartest operators in Africa in Resolute Mining Group (ASX:RSG) has demonstrated its belief in Mako’s potential, having recently participated in a placement and non-renounceable issue allotment, increasing its shareholding from about 12.3 million shares to 15.2 million shares.

In terms of nearology, Tietto’s AG (Abujar) deposit is much further south and roughly equidistant between mines operated by Perseus Mining (ASX:PRU) and Endeavour Mining.

Not only is Napié in closer proximity to a major project in Tongon, but as you can see in the map above it has applied for permits that are less than 30 kilometres from the Tongon mine and processing plant.

Should the Ministry of Mines award these permits to Mako, it is likely to be a market moving development, making the company one of the best small cap ‘nearology’ plays in Côte d’Ivoire.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.