GLV Commence Pre-Drill Work on Potentially Giant Oil Resource

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 40,500,000 GLV shares and 6,750,000 GLV options at the time of publishing this article. The Company has been engaged by GLV to share our commentary on the progress of our Investment in GLV over time. 20M shares and 5M options are escrowed for 2 years and subject to final approval.

The asset is in, the team is on board...

Now it's time to get down to work.

Pre-drilling work.

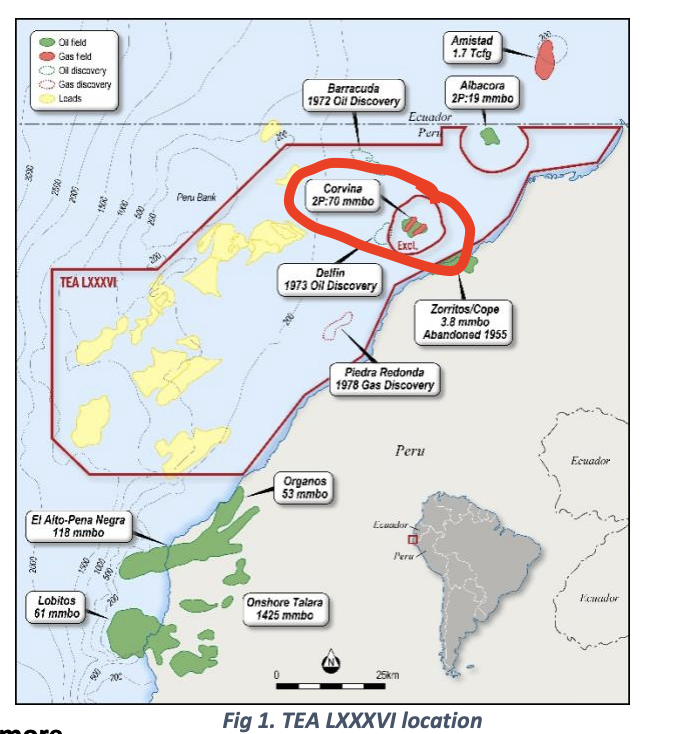

Our 2023 Energy Pick of the Year Global Oil & Gas (ASX: GLV) has an 80% interest in a giant exploration block offshore Peru.

And to figure out exactly how “giant” an oil resource might be, today GLV started 3D seismic reprocessing at the first of its three major prospect areas within the block.

GLV’s goal is to make a large offshore oil and gas discovery.

It's going to spend the next couple of years working up its targets and preparing for a drilling event.

GLV is currently capped at less than $7M.

Prior to GLV’s first drilling, there are a number of standard oil & gas exploration project de-risking events that GLV needs to execute, each of which should progressively re-rate the share price upwards pre-drill.

(like what happened with IVZ from 2020 up to its first drill in 2022.)

We would expect GLV to be capped at many multiples of its current market cap if it can advance closer to drilling a large target.

This means not a lot of downside at this early stage, if prepared to wait...

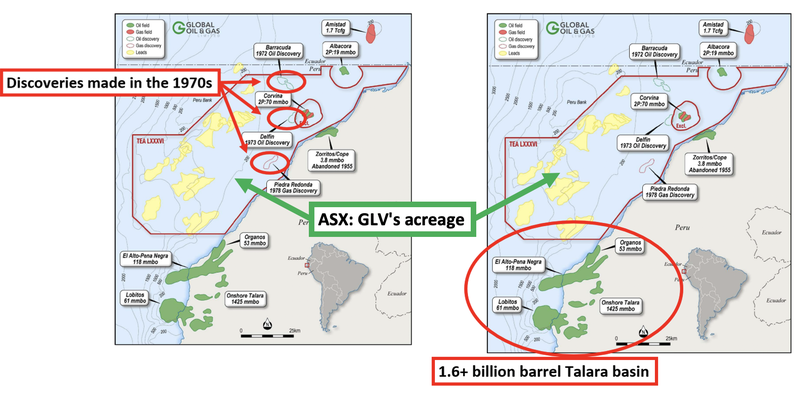

GLV’s project is surrounded by existing discoveries and sits inside a basin that has produced ~1.6 billion barrels of oil in the past.

Despite having tens of thousands of kilometres of seismic shot over the project area, a new discovery hasn't happened since the 1970’s...

.. and this is the opportunity for GLV.

GLV picked up this asset last year, and to ensure it positions itself to make a discovery, in recent months it has been steadily assembling a team of crack oil sleuths.

GLV brought in Havoc Services as technical advisors, and Dr Alain Stein (Havoc leader) is coming onto GLV as a Senior Advisor to the GLV board.

The Havoc team were founders of Ophir Energy plus a bunch of other oil and gas names, and in late 2022 its wholly owned subsidiary ‘Harmattan Energy’ was sold to supermajor Chevron.

Havoc’s team has made discoveries in excess of 2 billion barrels of oil equivalent and raised billions of dollars along the way.

In short - these guys are proven oil finders, and have the network of financiers to develop and sell assets.

And now they are working with GLV.

GLV has also brought in Scott Macmillan from Invictus Energy (ASX: IVZ) as a Director. Regular readers would recognise Scott and IVZ as we have been Invested in that stock since 2020 when it was trading at 3.9c.

(IVZ hit 40.5c before its 2022 drill result, 26.5c before its second drill result in 2023, and now trades at ~10c.)

We are backing the GLV team given their past success.

We have Invested in GLV for the long term - like we noted earlier - it will be a couple of years before we get to any drilling action.

In the meantime, GLV is working on determining the best possible drill target.

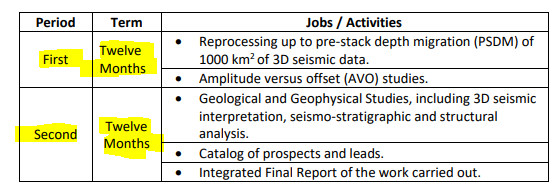

To do this, GLV will be selecting three “prospective areas” inside its acreage which it will reprocess the existing seismic data on.

We are hoping these three areas can eventually combine into a billion barrel plus prospective resource - something of scale that could attract a bigger funding partner to eventually drill,

For oil and gas hunters - reprocessing seismic data is like putting on prescription glasses and finally being able to see properly.

Reprocessing seismic data enhances structure mapping, improves lithology and fluid discrimination, and allows for the estimation of prospective resources - allowing the best possible drill target selection.

This morning GLV announced they have picked the first of those three areas AND it's the biggest one from GLV’s ~20+ portfolio of leads.

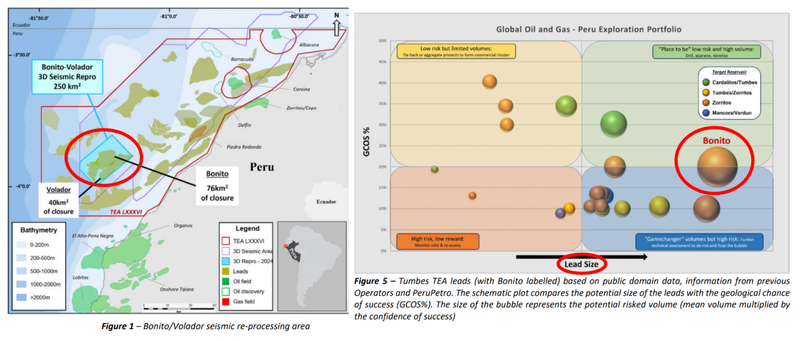

Today GLV confirmed the Bonito prospect would be the first to have its 3D seismic data reprocessed.

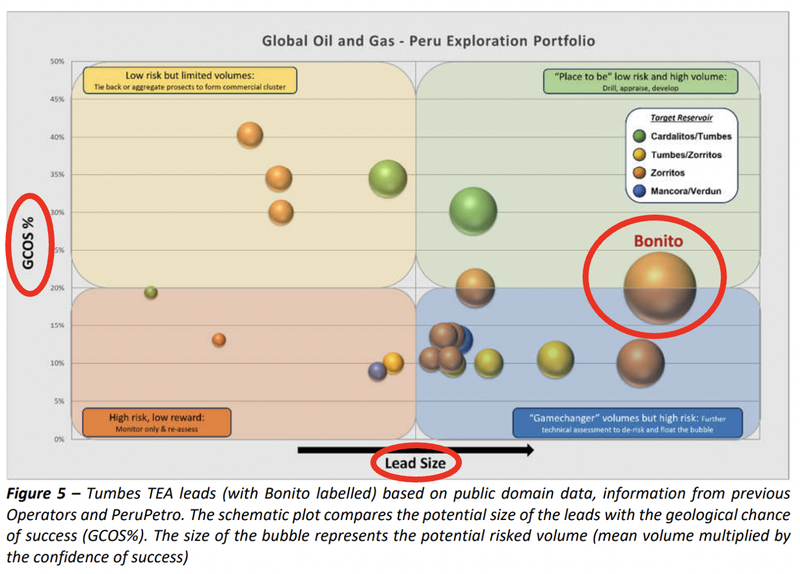

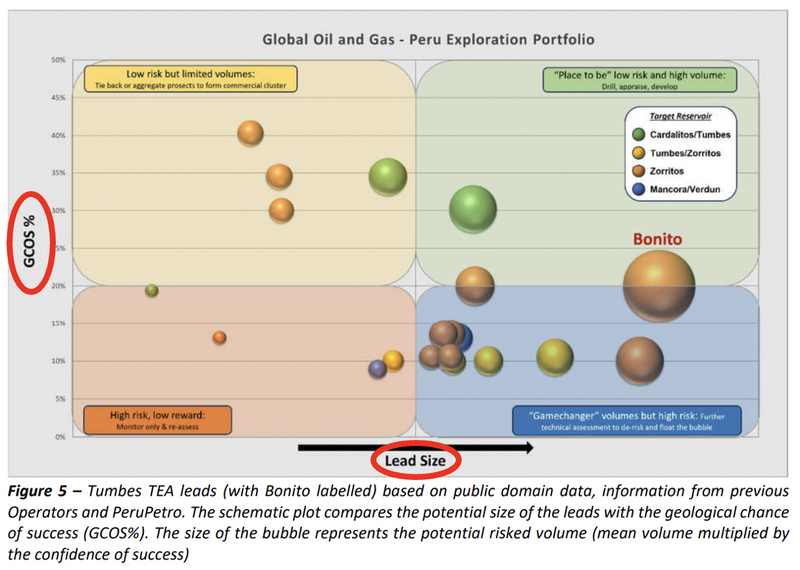

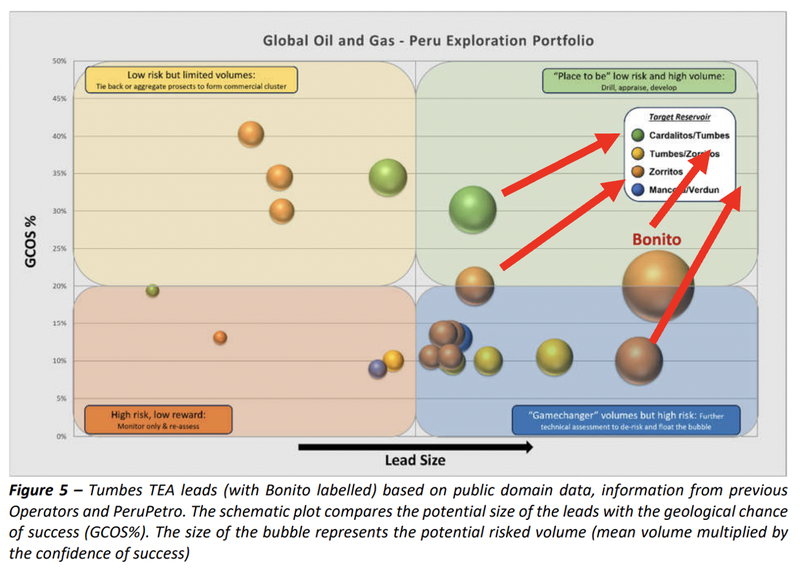

Bonito is GLV’s biggest existing lead as per the below chart in today’s announcement.

GLV has been using this chart to show where its portfolio of leads sit in terms of size and chances of exploration success.

The X axis of the chart is “ranking by size (volume)” and the Y axis is the “Geological Chance Of Success (GCOS)”.

Volumes tell us how big of a discovery could be made and GCOS gives us an indication of how likely a discovery is.

The end goal is to try and make the giant blob bigger AND get it as high up in the right quadrant of the chart below - to make it a Low-risk/High-volume drill target.

GLV holds an 80% interest in an oil & gas project that covers ~4,858km2 of ground offshore Peru.

The project is surrounded by existing discoveries and sits inside a basin that has produced ~1.6 billion barrels of oil in the past.

On top of that, GLV’s block also has a data library of ~17,935 km in 2D and 3,878 Km2 of 3D seismic data - work that would cost tens of millions of dollars to complete if it were to be done today.

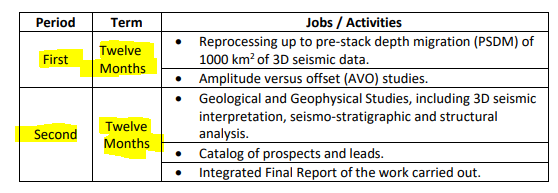

In line with Peruvian laws, GLV is operating under a Technical Evaluation Agreement (TEA).

Under this agreement, GLV has ~2 years to work its project up and rank high priority drill targets.

Over that time, GLV can also put out prospective resource numbers for its best targets.

Then, after the two-year period is up, GLV can apply to convert its TEA into exploration licences, which would allow it to drill.

This all means GLV has a relatively low cost work program for the first 24 months... which in a market like the one we are in is good news for a small cap explorer.

GLV picked its first reprocessing target area today

For now, GLV’s focus is on reprocessing ~1,000km^2 of existing 3D seismic data.

This morning GLV showed us where the first ~250km^2 would be reprocessed.

GLV picked the Bonito prospect, which is already the biggest lead inside GLV’s 20+ portfolio of drill targets.

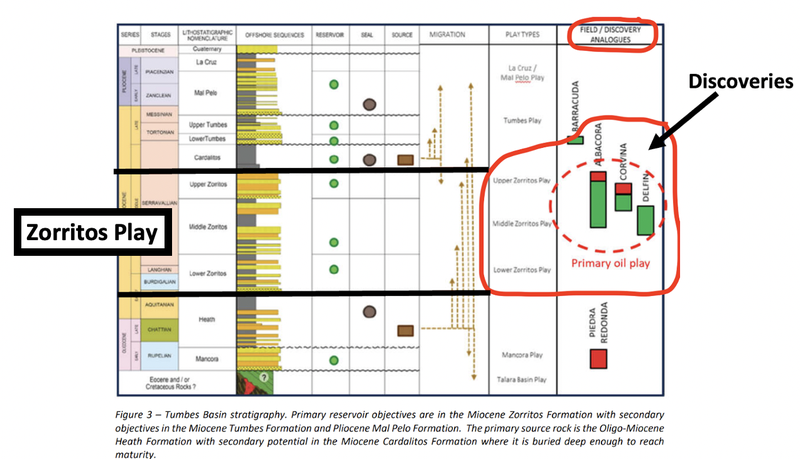

At Bonito, GLV will be targeting the “Zorritos Play” which is the primary reservoir across multiple discoveries in this part of Peru.

The most notable discovery within the Zorritos Play is the 27.8m barrel Corvina Oil field which has in the past produced light oils at ~4,000 barrels of oil per day.

Here is where that Corvina field sits relative to GLV’s ground:

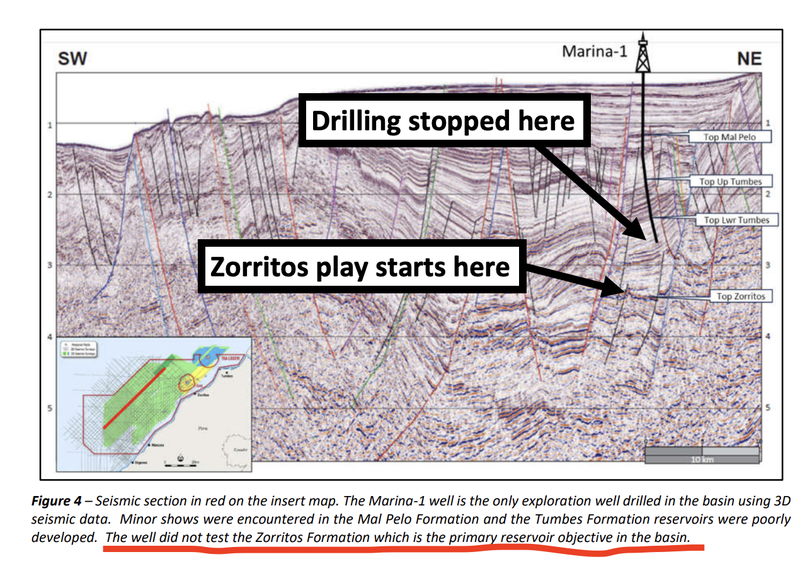

One of the biggest takeaways for us from today’s announcement is that GLV is targeting a formation that hasn't been drilled for decades.

In our first GLV note, we mentioned that GLV’s project had only seen one well drilled in the last 50 years.

(Source)

That was the Marina-1 well drilled by Karoon Energy and its JV partner’s Tullow Oil & Pitkin Petroleum back in 2020.

The tie-back to today’s news is that Marina-1 was drilled at a time when oil prices went negative, and drilling stopped before reaching the Zorritos Play at all...

So a key differentiator for GLV’s approach is to do what the previous owners of GLV’s block didn't do, to target the Zorritos.

The next step for GLV is to reprocess ~250km^2 of 3D seismic data which will form the basis for a prospective resource announcement for its Bonito target.

GLV has over 20 prospects/leads to follow up

In today’s announcement, GLV again published its prospect/lead chart.

GLV has been using this chart to show where its portfolio of leads sit in terms of size and chances of exploration success.

The X axis of the chart is ranking by size (volume) and the Y axis by the Geological Chance Of Success (GCOS).

The bigger the bubble size, the larger the target, and the closer the target is to the top right quadrant, the lower its risk.

What we want to see is a giant bubble in the top right quadrant before GLV is ready to start drilling.

That is where GLV’s seismic reprocessing comes into play.

Over the next two years, GLV will be looking to try and take the biggest bubbles, make them bigger and move them into the top right quadrant.

At the end of the two years, the biggest bubbles with the lowest risk will likely become targets that get drilled first.

Next catalyst - GLV to lock in two more targets

GLV also mentioned today that it would be finalising the location of its next two targets before starting seismic reprocessing in those areas.

Chances are GLV picks the biggest bubbles with the highest likelihood of making it into the top right quadrant.

Will wait and see and expect to see newsflow regarding these in the coming weeks/months.

We are Invested in GLV for the long haul as we like the tiny current valuation - as a drilling event draws closer over the coming years we expect to see broader investor interest increase, and with that, growth in the company’s valuation.

Right now, GLV is capped at ~$7M, and had $1.8M cash at 31 December 2023, giving it an enterprise value of ~$5.2M.

Our view is that as GLV works up its project and sets three clear drill targets with what we hope combine to form billion barrel plus prospective resources, GLV’s market cap re-rates to a valuation appropriate to the size/scale of targets that will eventually get drilled.

Investing early, as an oil & gas explorer works its project up, is core to our tried and tested oil & gas Investment Strategy which is as follows:

- Invest early, as the company is in the early exploration work stage.

- Increase our Investment, as the company de-risks the project through permitting, geophysics and target generation.

- Top Slice, if the share price runs in anticipation of exploration results

- Free Carry, into results while still maintaining a large position to be leveraged for a discovery

- Evaluate our position post-drilling.

It's an approach that worked out well for us with another one of our portfolio companies, Invictus Energy, which actually shares a common director with GLV - Scott Macmillan...

For context - our Initial Entry price for IVZ was 3.5c back in September 2020 after which the company ran multiple rounds of seismic, defined prospective resources and then drilled and made a discovery.

Over that time share price at one point hit ~40c - a max return from our Initial Entry price of >1,000%.

We still continue to hold a large position in IVZ following their discovery last year as we continue to see upside in the company.

GLV is now at similar stage to where IVZ was a few years back - reprocessing seismic, with aim of putting together prospective resource numbers and ranking high priority drill targets.

The long term term approach to our GLV Investment forms the basis for our Big Bet which is as follows:

Our long term GLV Big Bet:

“GLV defines a multi-billion barrel prospective resource and sees its market cap re-rate by 20x prior to drilling”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GLV Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for GLV?

Reprocessing 3D seismic data across Target #1 (Bonito prospect) 🔄

Today GLV confirmed the first target to have seismic data reprocessed on would be the Bonito prospect.

GLV will be reprocessing ~250km^2 of 3D seismic data as part of its work on its first target.

We will be watching for any news on the reprocessing/analysis works.

Target areas #2 & #3 to be picked 🔄

GLV is looking to pick three targets which will be the focus of its 1,000km^2 seismic reprocessing program.

Today, GLV picked target #1 and is also working toward deciding where the next two target areas will be.

We will be watching to see which two targets go into GLV’s final three for reprocessing.

What could go wrong?

Given GLV is operating under a two year “Technical Evaluation Agreement”, there is no short term exploration risk for the company.

The two major risks in the short term are “Funding risk” & “Market risk”.

GLV is a junior explorer and so doesn't make any revenue.

Even with a low cost forward work programme, with $1.8M in cash on 31 December 2023, it's always possible that GLV looks to top up its cash balance at some stage in the future, which may put some temporary pressure on the company’s share price.

There is also a risk that high interest rates impact market sentiment and lead to a lower oil price which may deter investors from high risk small cap oil & gas explorers.

Both scenarios, in the short term, could impact GLV’s share price negatively.

Over the long term - there is plenty of work to do, and there's a chance GLV may never get a target up to ‘drillable’ status for a myriad of reasons - it may not find a target worthy of drilling, it may not be able to attract the larger capital to drill, the market may turn against it.

At the end of the day - GLV is a micro cap exploration stock - these stocks can be volatile and move quickly up or down.

Our GLV Investment Memo

In our GLV Investment Memo, you can find:

- GLV’s macro thematic

- Why we Invested in GLV

- Our GLV “Big Bet” - what we think the upside Investment case for GLV is

- The key objectives we want to see GLV achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.