FYI’s HPA project now worth more than US$1 billion

Published 31-MAR-2021 12:40 P.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a development that will warrant a substantial uplift in FYI Resources Ltd’s (ASX: FYI) valuation metrics, the company has released an updated definitive feasibility study (DFS) in relation to its high purity alumina (HPA) project.

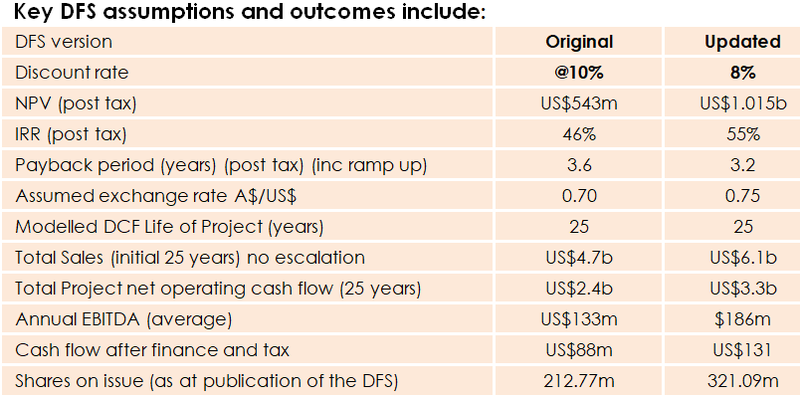

A combination of major technical improvements, substantial project de-risking and other key commercial developments accomplished since the initial DFS announcement on 11 March 2020 has resulted in the project’s post-tax net present value increasing 87% from US$543 million to US$1.01 billion.

The new metrics also take into account normally applied market valuation factors such as exchange rates (US$0.75) and discount rates (8%) to provide investors with the opportunity to make like-for-like comparisons with peers.

Operational developments such as multiple pilot plant trials have provided additional clarity from an operational and strategic perspective.

In terms of the revised production profile, the inclusion of 5N production is a significant development given the premium pricing it attracts relative to 4N.

The production of 5N also opens up new markets because of its high-end applications in areas such as lithium-ion battery manufacturing.

Average annual EBITDA of US$186 million over 25 years

There haven’t been any changes to the initial 25 year sale period, but the quantum of sales has increased from US$4.7 billion to US$6.1 billion with net operating cash flow during that period increasing from US$2.4 billion to US$3.3 billion.

From an earnings perspective, the revised DFS implies average annual earnings before interest, tax, depreciation and amortisation (EBITDA) of US$186 million, up from US$133 million

The DFS and revised NPV have confirmed the project is not only technically and financially robust, but the development work completed since the March 2020 DFS demonstrates continued project de-risking and positive value re-rating.

Moreover, the combined DFS study and updated NPV as outlined below demonstrates FYI’s HPA project’s outstanding investment case.

Modest development costs relative to earnings

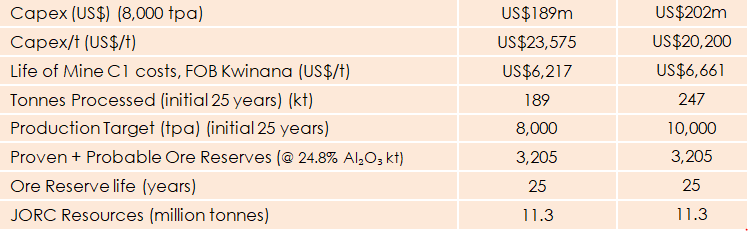

One of the impressive features of the revised DFS is the nominal upfront development cost of US$202 million.

As outlined above, the project is expected to pay for itself in just over three years with an implied internal rate of return of 55%.

This compares favourably with many other precious and base metal, as well as hard rock mining projects where upfront development costs can be all but insurmountable for smaller companies.

However, this is an extremely bankable project that should have the merits to attract considerable investment from institutions and offtake partners, as well as lending itself to traditional debt financing terms.

As outlined below, the ore reserve life of 25 years is unchanged, providing a tangible source of supply without having to consistently tap shareholders for exploration costs (updated DFS metrics in right-hand column).

Key factors driving vastly improved metrics

The updated DFS and NPV is based on the prior March 2020 DFS which considers FYI’s innovative, low temperature, low pressure leach and precipitation process flowsheet for the production of high quality HPA.

This updated DFS combines detailed technical and financial inputs that result in the study having a minus 10%/+15% degree of accuracy and confidence - suitable for this level of study.

The updated DFS has been prepared by the Company in conjunction with selected industry specialists.

FYI’s process design basis was the adoption and advanced refinement of a conventional leach and precipitation flowsheet that was adapted and optimised to commercialise the production of high quality, high purity alumina.

The process refinements are specific to FYI’s unique feedstock and its amenability through the highly modified flowsheet resulting in excellent production characteristics, including achieving lowest cost quartile for both operating expenditure and capital expenditure.

An updated financial model and NPV was completed based on all the prior PFS, DFS, pilot plant trials and other supporting studies used in calculating and estimating the project capital and operating costs as well as all other operating parameters.

FYI continues to progress the development of its HPA project strategy with the final engineering stage being a key upcoming milestones.

Management points to project’s persuasive economic attributes

The company’s updated DFS confirms the project’s ability to generate outstanding financial returns over the initial modelled life of 25 years.

Commenting on the underlying processes that have fed into the revised DFS, while also highlighting the project’s low capital and operating cost metrics relative to its peers, managing director Roland Hill said, “The update to the company’s DFS was an obvious progression in the development of our HPA project strategy.

"The quality and robustness of our HPA project was demonstrated in our March 2020 DFS.

"Since then, the company has continued the evolution of the project through further process design improvements, detailed test-work via numerous pilot plant trials and other supporting project de-risking activities.

"There has also been a number of external factors such as the AUD:USD exchange rate movement that has had an impact on the economics of the project.

"It was essential that a more up-to-date and de-risked financial case was presented to the market, and the updated DFS and NPV is the product of the revised study.

"The updated DFS outcome represents a persuasive economic case and demonstrates the merit of the project in being developed as potentially one of the sector’s highest quality, lowest capital and operating cost projects”.

Hill sees the revised DFS as demonstrating the quality of the project, the progressive project improvement and de-risking undertaken since the March 2020 base case DFS.

Specifically, he pointed to the company’s ability to deliver a nominal capital expenditure increase whilst maintaining minimal change to the operating expenditure (the opex and capex increase is largely due to the strengthening of the Australian dollar against the US dollar) of HPA produced.

Industry dynamics working in FYI’s favour

FYI employs a number of methods to determine pricing and demand models for the HPA market to establish a reliable estimated sales price.

This price establishing process includes the engagement of several independent commodity market research firms and direct contact with market participants.

One primary source relied upon by FYI and many of its peers is the CRU Group, a leading market intelligence and analysis firm specializing in HPA.

CRU has performed the HPA market determination function for FYI in its previous feasibility studies.

Detailed breakdowns of the HPA market have been taken into account, particularly focusing on supply, demand and pricing.

FYI mandated CRU especially for the updated DFS, with a research report released to the company in March 2021.

The most recent market survey and round of interviews conducted across producers, consumers, projects and other market participants across several geographies including Japan, South Korea, North America, Europe and China conclude there is evidence that the HPA market is entering a phase of mild tightness.

Consumers, particularly in the sapphire market for LEDs, state that supplies of reputable 4N HPA is becoming limited.

While it is evident that different trends are emerging in the HPA sector from the previous DFS report in March 2020, for the purposes of the updated DFS report the focus will be on the ‘performance-driven’ or 4N-5N market.

FYI understands that realising price premiums for high quality 4N material relies upon building strong relationships with customers, being able to adjust specifications to meet customers exacting requirements and consistently supplying material to the agreed specification.

Achieving and maintaining a reputation for delivery of reliable and consistent specification will become a very powerful marketing tool.

However, as a guide CRU noted that premium, high-quality HPA for specialists applications that is provided from a reliable source of supply is fetching around US$56 per kilogram.

This could see particularly strong pricing of circa US$50,000 per tonne realised for FYI’s 5N product.

The modelled HPA demand is forecast to grow rapidly at approximately 18.7% CAGR (compound annual growth) between 2021 and 2028.

As a result of the demand, CRU models the HPA market to tip into deficit in 2021, as reputable 4N and 5N current supply capacity fails to meet the market demand as production has not kept pace with demand growth.

Consequently, FYI sees tremendous potential opportunities to forge offtake agreements arising in the near to medium-term.

Where is the demand coming from

Lithium-ion batteries (LIBs) represent the largest potential growth sector for HPA demand over the coming decade.

These are currently used in portable electronics such as mobile phones and laptops, but their high energy density (energy contained vs weight) makes them ideal for use in the surging electric vehicle (EV) market.

CRU understands that separator manufacturers are seeking out high-quality HPA for their coatings, and this signifies a discerning customer class that will pay the higher price for quality HPA product.

Due to strong headline demand for LED units driven by broad application development, market acceptance and replacement of inferior and less efficient alternatives, LED modelled demand for 4N and 5N HPA is likely to grow from 20,000 tonnes per annum in 2020 to 85,000 tonnes in 2028, with a CAGR of 19.8%.

FYI’s early adherence to ESG issues pays dividends

The modern-day mining sector faces many material environmental, social and governance (ESG) issues.

Certain mining operations can have significant and long-lasting environmental and social impacts on the community with issues such as excessive energy use and greenhouse gas emissions, along with disproportionate effluent and waste production increasingly coming under the spotlight.

FYI is operating in a highly challenging environment. Declining resource accessibility, growing pressure to implement reporting standards and increasingly complex permitting processes from governments are major concerns in achieving and maintaining a licence to operate.

From the outset, FYI has made significant efforts in the development of its HPA project strategy to address ESG issues and the project’s overall sustainability awareness.

FYI is establishing stable frameworks and transitioning to increase its ESG standards along with programs and initiatives to reduce its legacy impact and potential risks.

Along with designing its HPA project and process flowsheet to minimize its environmental impact and greenhouse gas contribution, FYI also recognises its social and governance requirements.

FYI has combined these practices to identify and improve legacy issues to achieve best practices to be a leader in the sector.

To quantify FYI’s ESG footprint, the company is currently being assessed and rated by an independent industry rating service.

This should be viewed as a positive move by the group given the billions of dollars that are flowing into individual stocks that prioritise ESG, as well as particular funds that focus entirely on stocks that meet ESG criteria.

What’s in the pipeline

While the updated DFS confirmed the robustness and quality of FYI’s HPA project, there remain additional technical improvements and other commercial opportunities within FYI’s HPA strategy that have not been incorporated into the latest feasibility study.

These added opportunities may have the ability to positively impact future valuation metrics.

A key potential near-term event that has the capacity to provide share price momentum is a joint venture agreement with Alcoa, the group that FYI has been working in collaboration with through the testing phases.

This could be the precursor to an offtake agreement, and there is also the very real prospect of offtake agreements being forged with other global HPA users.

Management will be looking to progress financing arrangements throughout 2021, and any affirmative news in this regard will be seen as a significant development in terms of de-risking the project.

There is also the potential to develop other HPA product strains that would draw demand from new markets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.