Funding clears the way for Metro’s Bauxite Hills expansion

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a pivotal development for Metro Mining (ASX:MMI), one of Australia’s leading bauxite producers, the National Australia Infrastructure Facility (NAIF) Board has made an Investment Decision to support the stage II expansion of the Bauxite Hills Mine in North Queensland by providing a long-term loan facility of up to $47.5 million.

Where smaller companies are developing large-scale projects, the issue of financing is always critical.

Consequently, when the question mark regarding financing is removed as a potential barrier to development, it is quite common for companies to experience strong share price momentum.

This was evidenced on Tuesday morning when Metro’s shares traded as high as 14 cents, up approximately 17% on the previous day’s close.

The metrics surrounding the lending facility are such that they will provide Metro with ample funding to construct and mobilise a floating terminal at Skardon River, the main component of stage II as it accounts for about 85% of the total estimated capital cost.

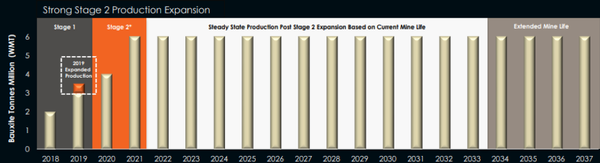

The stage II definitive feasibility study (DFS) based on expanding to an annualised rate of 6 million wet metric tonnes per annum indicated a total capital cost of $51.4 million.

There is also a significant degree of flexibility in terms of the repayment period as the loan is for up to 9 years.

Given that the DFS points to a project payback period of 18 months, Metro should be able to repay the debt well within the timeframe provided.

The timing of the financing is also important in that it will allow Metro to quickly transition from annualised production of approximately 4 million wet metric tonnes in 2020 (based on analyst’s expectations) to 6 million wet metric tonnes thereafter.

Underlying earnings to double to more than $80 million

Completion of stage II by 2021 will have a substantial financial impact on Metro, making it one of Australia’s most compelling mining companies by valuation.

Morgans analyst Chris Brown is forecasting that fiscal 2020 production of 4 million wet metric tonnes will generate operating underlying earnings of $64 million.

Brown attribute a valuation of 35 cents per share to Metro and his 12 month price target is in line with this valuation, implying share price upside of about 150%.

In his most recent research released less than a fortnight ago, he used 5 million wet metric tonnes as his production assumptions in 2021, estimating that Metro would generate underlying earnings of $82.6 million in that year.

This would equate to a net profit of $55.6 million, representing earnings per share of 4 cents.

It is worth noting that there is potential for Metro to exceed the earnings forecasts for fiscal 2021 if it functions at full capacity, producing and shipping 6 million wet metric tonnes for the 12 months to December 31, 2021.

Despite this impressive outlook based on Brown’s base case assumptions, Metro is trading on a PE multiple of 3.5 relative to Tuesday morning’s high of 14 cents.

Given group production to date has Metro well on the way to meeting Brown’s fiscal 2019 net profit forecast of $22.1 million in fiscal 2019, the company provides strong earnings visibility and predictability.

Furthermore, Metro is forecast to generate compound annual earnings per share growth of nearly 60% between 2019 and 2021, indicating that the company is substantially undervalued on a PE multiple to growth metric.

NAIF financing recognises broader benefits of Bauxite Hills

The Northern Australia Infrastructure Facility (NAIF) is a Commonwealth Government $5 billion lending facility to finance projects via the governments of the Northern Territory, Queensland and Western Australia to achieve growth in the economies and populations of northern Australia, while also encouraging and complementing private sector investment.

Consequently, provision of the loan facility is recognition of the public benefits that will continue to be generated for Cape York as a result of the Bauxite Hills Mine and an Indigenous engagement strategy creating significant employment for local communities.

Approximately 40% of the Bauxite Hills Mine workforce is currently Indigenous.

Metro will continue to provide opportunities as part of the stage II expansion.

This positive Investment Decision is further confirmation of the strong long-term financial returns to be generated from the Stage 2 expansion.

The mine life is out to 2037 and following commissioning of stage II, Bauxite Hills will be positioned in the lowest quartile of the global cash cost curve for bauxite producers.

Commenting on the significance of the NAIF support and long-term financing in the context of growing Metro and benefiting the broader community, chief executive Simon Finis said, “We are very pleased to have secured the support of NAIF in providing a long-term loan to provide financing for the stage II expansion.

‘’Bauxite Hills will be a significant contributor to the economy of Northern Australia and a large employer from the surrounding communities for many years to come.

‘’I would like to personally thank the NAIF team for their time and commitment during the due diligence process in order to understand the project, the global bauxite market and its importance to Northern Australia.

‘’With the stage II DFS complete and financing secured, we are now awaiting completion of the final design of the Floating Terminal in order to be in a position to present to the Board for final approval.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.