engage:BDR matches 2019 performance despite COVID-19

Published 11-MAY-2020 09:55 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

engage:BDR (ASX:EN1;EN1O) has provided a trading update and commentary regarding the group’s performance in April and May as well as making comparisons with previous corresponding periods.

Consistent with EN1’s results, the advertising industry traditionally generates 65% to70% of its revenues in the second half of the year (July – December), as experienced by EN1 in 2019 (34% / 66%).

Management expects 2020 to produce similar revenue seasonality, as experienced in 2019 and all prior years.

Discussing the impact of COVID-19 on working arrangements, management said that EN1 employees are still operating remotely as stay in place orders remain.

Today’s analysis highlights that remote productivity has been significantly stronger than working from EN1 offices.

Management will conduct cost benefit analysis for the future, when considering costs associated with office leases.

Approximately 95% of the US population is in lockdown (stay in place orders), and many brands (not specific to EN1) have temporarily reduced their marketing budgets, as consumers cannot transact with them currently.

Momentum building in May

As expected, April was the start to a new quarter and typically, demand is lighter in the first three weeks of the first month.

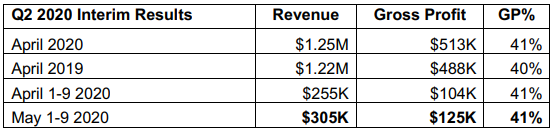

April revenue of $1.25 million was 3% higher than April 2019.

Management sees improvement across all granular metrics – advertiser bid rates, bid prices, number of active and new campaigns, auction win rates, clearing prices and daily revenue growth, which are all key indicators of what to expect in the coming weeks.

May performance has been significantly stronger than April’s, which is indicative of where the month should finish, and management also said that May is currently expected to yield better results compared with April.

The preliminary analysis of April revenue impact (COVID-19) when compared to March, was approximately 38%.

Management expects this figure to be narrower for May, considering many businesses in the US are to re-open this month.

Importantly, EN1 generated revenues of $305,000 between 1 May 1 and 9 May, were up substantially on the same period in April when revenues were $255,000

As of yesterday, daily revenue had peaked to 75% of March’s daily averages.

Management looking to take advantage of low interest rates

While management was working with an Australian bank in the application process it did not progress to submission as the pre-application process recently determined that EN1’s assets and principle business activities are mostly in the US which places it outside of their lending guidelines.

However, EN1 qualifies and has applied for US EIDL funding under the CARES Act and should have updates in this area shortly.

Management has received conventional debt term sheets from the company’s advisory firm Virathus for $8 million and is in the evaluation process.

EN1 is also in talks with US banks about applications for term loans, as interest rates are the lowest in recent years.

Management is focused on refinancing current note balances and securing equity-free alternatives.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.