How we invest in early stage biotech companies

Published 17-SEP-2021 08:42 A.M.

|

7 minute read

Biotech companies can be highly profitable for investors that get in at an early stage.

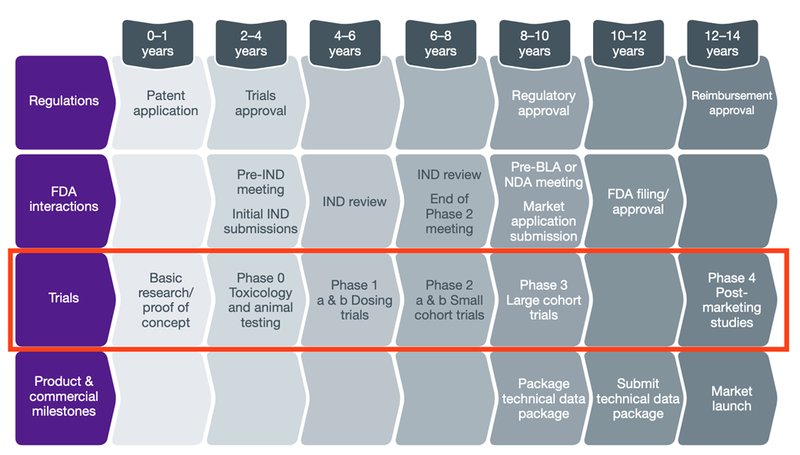

The typical timeline for an FDA approval of a drug from the initial discovery phase all the way to commercialisation is around 10-12 years, and along this journey there are many entry and exit points for investors to make money.

In today’s newsletter, we are going to run through the stages of drug development from inception to commercialisation, highlighting the risks along the way.

A successful drug can be life-changing (and sometimes life-saving), which is part of why the biotechnology industry is rife with optimism, from both management and investors. So it is important for biotech investors to have a realistic timeframe for share price appreciation and an understanding of the risks of their investment.

Value is not created overnight and the road to biotech success is paved with regulatory hurdles and binary trial results, where positive outcomes should result in sustained share price appreciation.

We will take you through the early stage biotech company lifecycle, so that you can better understand your biotech investments and know the key questions to ask at each stage.

The typical lifecycle of an early stage biotech company is:

Discovery → Preclinical Trials (Phase 0) → Clinical Trials (I, II, III) → Commercialisation ($$$).

Discovery

The goal of the discovery phase is to identify drugs that could provide therapeutic relief for certain diseases.

A lot of the early work and hypothesis testing in the discovery phase is done in combination with academic institutions (think universities), funded through government and philanthropic grants.

Intellectual property rights such as patents provide important protection for drug developers, and it provides much of the early underlying value of the drug.

At this stage, the drug is considered highly speculative.

Companies will identify these early opportunities and accelerate development for the most promising drugs by raising money in the capital markets and undertaking clinical trials (more on this later).

Key questions to ask:

- Is there commercial value in the drug solution?

- What is the competitive landscape for similar types of drugs?

- Does the company own or sufficiently control the IP rights to the drug?

- Is the science validated by any peer-reviewed publications?

- Who is behind the science of the drug’s development?

Preclinical Trials

The goal of pre-clinical trials is to test the efficacy, dosage and safety conditions of the drug on animals (typically rodents), which will hopefully translate to humans.

This is done by evaluating a few potential drug candidates (variants of a similar drug), and narrowing the pool down to those drugs that are most safe and efficient.

Pre-clinical trials that are announced as successful are an indication of the potential success of the drug in humans, but no more than that. It’s a step in the right direction and de-risks the project for investors, but there is still a long pathway to commercialisation.

The costs up to this stage are manageable with private investment, but once development reaches clinical trials, companies will be looking to raise money either through the market or government grants.

Key questions for investors:

- Is there a high probability that the drug is safe and effective?

- What is the estimated cost of development through to commercialisation?

- What is the timeframe until commercialisation?

- What is the regulatory pathway for drug development?

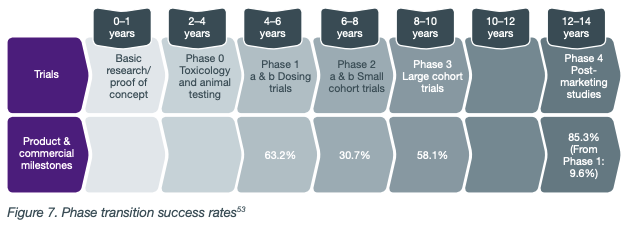

Clinical Trials

The clinical phase is defined by human trials, as opposed to testing the drug in animals or in vitro.

It has three phases: I, II, and III, and concludes with the filing of a New Drug Application (NDA) with the appropriate regulatory authorities (like the FDA in the United States or the TGA in Australia).

As each clinical trial phase is successful, a company’s value typically increases, and speculative investment risk reduces, as the company edges closer to commercialisation.

Phase I

Phase I is primarily focused on the safety of the drug, but also provides early signs of the drug’s efficacy in small studies conducted in either healthy subjects or patients with the disease.

Even though a high percentage of drugs will succeed in this stage, it is still an encouraging milestone for early stage biotechs to achieve.

Phase II

If a drug is shown to be safe it will progress to Phase II trials which test the drug for efficacy in patients with the specific disease (does the drug work as intended?).

But how do you know if it is successful?

Efficacy is measured through biological metrics that are called endpoints, which are determined by the company BEFORE the trial begins.

Examples of endpoints are improvement in quality of life, relief of symptoms, survival and reduction in the infection or disease.

When interim and final trial results are released, investors should pay attention to whether these endpoints are reached and if there is statistical significance between the patients that take the drug and the ‘control group’ that take a comparator (either a placebo or another drug).

If the endpoint is achieved with statistical significance, it indicates that the results were not just a fluke and the drug is efficient in treating the disease.

This is a critical value adding point for the company and investors.

Patient recruitment is also an important part of the Phase II (and III) trials, where people with the specific condition are recruited into the trial.

Where the parameters for the people with disease are very narrow (like with very rare diseases) this can be an important part of the process, and may take longer than expected.

If the drug is successful at this stage it could lead to a significant re-rating of the share price, and it provides the company leverage to negotiate and engage in strategic partnerships with larger pharmaceutical companies.

Phase III

Phase III is a much larger study to validate the earlier clinical studies.

This is the final stage before the drug is approved for commercialisation.

At this point, the company has a choice to de-risk the project by partnering with a larger pharmaceutical company, or fund the trial themselves by raising capital.

Like with Phase II trials, efficacy is measured through endpoints, but here it is done in consultation with the key regulator bodies like the FDA.

Again, these endpoints need to reach statistical significance in the clinical studies in order to be eligible for FDA approval.

Once approved, the drug can then be commercialised.

This is a significant milestone for biotech companies, and will generally see a significant share price increase for investors.

Investors should be aware that there is a real possibility that if the initial trial data is not satisfactory to the regulatory body, more trials might be required to gain approval. This can be a costly exercise and a step backward for the company.

Key questions for investors:

- Did the drug meet the endpoint and receive approval from the relevant regulatory bodies?

- Is the commercial case still valid for the drug?

- What competitors are there on the horizon?

- Is there a partnership that can provide the distribution networks to support commercialisation?

Commercialisation

The holy grail for small biotech companies is a take over by a Big Pharma company with deep pockets and commercialisation expertise. This is where early stage investors realise the gains of their patience and hard work.

Rarely will a small biotech grow to directly sell its product to consumers, whereas larger biotechs will take the technology to market - selling it to doctors, negotiating with insurance companies so that patients can get access to the drug.

This is a space in which many traditional private equity firms invest. There are also a number of large public companies competing in this segment.

Larger pharmaceutical companies are typically valued on generated cash flows from the drugs. Patient uptake, drug pricing, and the evolving competitive landscape need to be carefully considered.

Key questions for investors:

- What is the distribution strategy for the company?

- Is there a Big Pharma company interested in the drug?

- What are the recurring revenues & cash flow for the company? Are they enough to justify the current valuation?

- What is the competitive landscape for the drug?

As we can see, the process of biotech drug development isn’t easy - there are many important stages, each with their own risks and rewards.

Knowing your risk profile is incredibly important in this industry. A smart investor often diversifies through exposure to companies in a number of different stages of development.

Our new business model at Finfeed is to research, analyse, and invest in up and coming small cap ASX-listed biotech stocks that we believe have a high chance of success. We then share our research and commentary along our investment journey with our readers.

We are taking our lead from early stage biotech experts and one of the most successful small cap biotech fund managers in Australia, Merchant Group.

Last month the Group’s new Merchant Biotech Fund made its first investment: in DXB... so we did too.

We are looking to add some new stocks to our portfolio over the coming months so keep an eye out on your inbox for news.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.