Drilling and feasibility study to drive Aeon higher

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Aeon Metals Ltd’s (ASX:AML) resource upgrade at its Walford Creek Copper-Cobalt Project in North Queensland was a watershed event for the company, and one which arguably should have drawn a more significant share price response.

However, given Aeon has such a large resource in the high confidence measured and indicated category, the chances of further success in upcoming drilling and the completion of an impressive feasibility study in 2019 will see the company’s shares move towards broker consensus targets of approximately 60 cents.

One analyst went as far as to say that Walford Creek was emerging as one of Australia’s largest and highest grade undeveloped copper projects.

As a backdrop, in January 2018 the company released results of an updated Independent Resource Estimate.

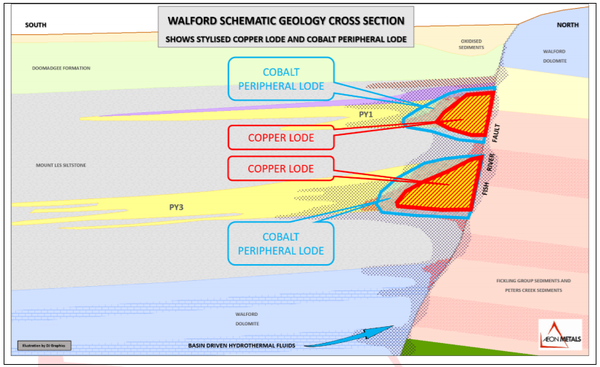

The updated estimates had two components, namely a Copper Lode Resource and a Cobalt Peripheral Resource.

The following shows the relationship between the high grade copper core and the surrounding peripheral cobalt mineralisation.

The recently completed resource upgrade shows that the total Vardy and Marley Resources now boast 37.4 million tonnes at 1.53% copper equivalent over 3.6 kilometres with a total Measured and Indicated increase of 103% to 26.9 million tonnes at 1.57% copper equivalent of which 76% lies within the Copper Lode Resources.

The resource upgrade also included a maiden resource and exploration target for the Amy Zone, the 5.7 kilometre strike extension of the previous resource.

Feasibility study the next catalyst

David Coates from Bell Potter estimates that the establishment of ore reserve tonnages required for a feasibility study mine plan would imply a potential mine life of 18 years at 1.5 million tonnes per annum.

He rates the potential for achieving this target as ‘high’ given a 1.8 million tonnes inferred resource has already been defined across four points in the Amy Zone, as well as taking into account the demonstrated predictability and consistency of the current Copper Lode Zone.

Taking these factors into account Coates said, “This points to Walford Creek emerging as one of Australia’s largest and highest grade undeveloped copper projects.”

Identifying upcoming catalysts, Aeon managing director Hamish Collins said, “Remarkable geological continuity has now been proven over 9.3 kilometres of strike with further geological continuity known to continue both west and east of the new Mineral Resources for approximately an additional 20 kilometres.

“Exploration of this area will be the focus of our 2019 drilling effort.

“The significant increases in the Measured and Indicated tonnages (which are the required basis for Ore Reserve estimates for development and mining) will enable Aeon to complete a feasibility study during 2019 for a project with a mine life of at least 10 to 15 years with the capability for modular expansion, if and when the Mineral Resource base is increased.”

Coates’ confidence that Aeon will be able to bring the project into production has been lifted significantly, resulting in him increasing his valuation (albeit speculative) from 53 cents per share to 58 cents per share, implying upside of more than 100% to Monday’s closing price of 27.5 cents.

Bear in mind that share price momentum could be driven by drilling leading up to the establishment of reserves and the completion of a feasibility study, particularly given the high level of confidence provided by the large tonnages in the measured and indicated resource estimates.

It is worth noting that drilling results returned between March and May last year resulted in the company’s shares nearly doubling from 24 cents to a high of 45 cents.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.