Does MNB have the “most commercially attractive zero-carbon green ammonia project globally”?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,885,000 MNB shares at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our Investment in MNB over time.

In early 2021 there were hints in the quarterly.

In December 2022, a key agreement was signed.

Our Investment Minbos (ASX:MNB) had secured a deal for some of the lowest cost, clean electricity in the world.

A deal to acquire surplus electricity generated by Angola’s hydroelectric dam at an extremely attractive price.

(about 1/16th of what Australian and US industry users pay)

MNB’s plan for this low cost, clean electricity is to produce green ammonia...

Ammonia is used in fertilisers and mining explosives.

Electricity is the key (and most expensive) input into producing ammonia.

The electricity is generally sourced from fossil fuels.

It turns out having ready to go, low cost, clean electricity supply is an incredible advantage when building a new green ammonia plant.

It effectively REMOVES the upfront CAPEX cost of building a wind farm, solar farm or hydroelectric dam required to supply the clean electricity to produce the green ammonia.

This literally saves billions of dollars in CAPEX and a decade of feasibility studies.

The green ammonia project is a “blue sky” addition to MNB’s existing later-stage phosphate mine.

Today MNB provided an update on the ammonia project.

MNB is now calling it “the most commercially attractive zero-carbon green ammonia project globally”.

And that the project is now attracting significant Partner interest:

... specifically that “Three Development Finance Institutions have reached out to express interest in financing the CGAP”:

Here is what MD Lindsay Reed had to say about the interest:

We Invested in MNB for its phosphate project back in 2020.

When the green ammonia project was first hinted at in 2021 it looked interesting but it was conceptual and at a very early stage.

The hydro-electricity supply agreement in 2022 made it real and a lot more interesting.

And today’s update on technical progress and interest from multiple financiers was great news, adding to what promises to be a milestone year for both of MNB’s projects:

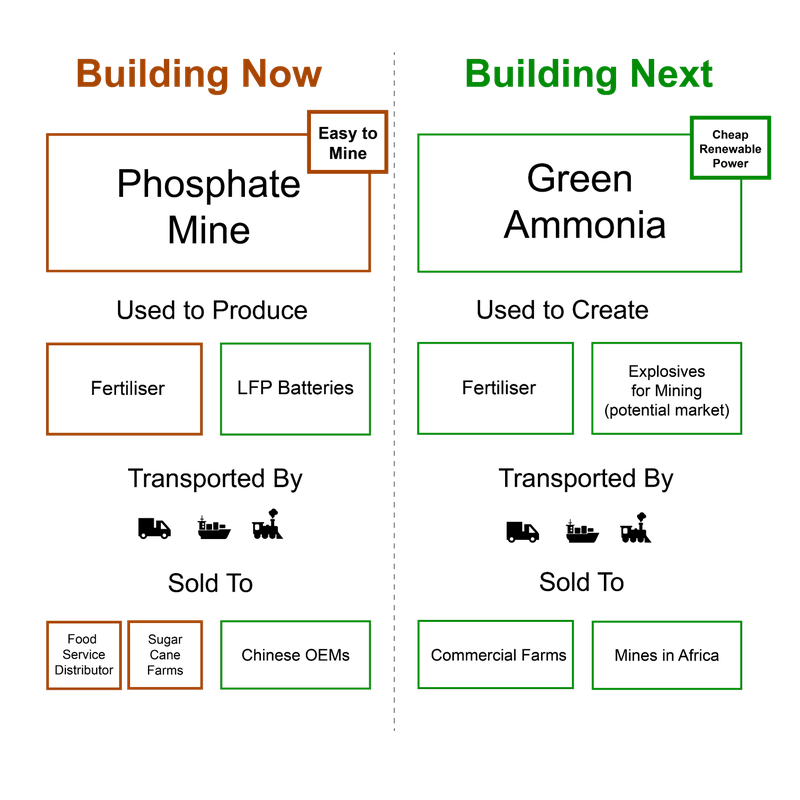

MNB has two key projects in Angola:

- Fertiliser project (in construction) - a phosphate (fertiliser) project that has an offtake agreement with the largest agri-distribution business in Angola - with first production expected by July this year.

- Green ammonia project (feasibility stage) - a feasibility stage green ammonia project powered by some of the cheapest green energy (hydroelectricity) in the world.

While construction is ongoing at its phosphate fertiliser project, today’s news came from MNB’s Green Ammonia project.

As well as mentioning the significant Partner interest the project was receiving, MNB also provided more project updates.

MNB completed baseline environmental surveys (the precursor for environmental permitting) AND kicked off the tender process for engineering/design work.

MNB is now at that stage in the documentation/feasibility phase where decisions are made on the type of tech its plant will be using and how the plant will end up looking - the part of the process where the project's cost is largely determined.

This will be when MNB nails down the design that will end up being pitched to construction contractors.

So it's no surprise that it's at this stage that strategic financiers have started sniffing around...

It’s the right stage for a strategic partner/financier to get involved - and hopefully bring expertise to the table and help shape the direction of the project.

What is MNB’s Green Ammonia Project?

MNB is aiming to produce green ammonia which is used to make fertilisers and explosives.

MNB wants to produce green ammonia for sale into farming and mining sectors locally in Angola, and across Africa.

To make ammonia, hydrogen and nitrogen are combined at high temperatures.

To make the ammonia “green”, the hydrogen must be made using a renewable energy source.

However the commonly used current process to make ammonia uses fossil fuels, and it relies on ‘steam reforming’ - which also emits large amounts of carbon dioxide.

Here are the three things MNB need to make “green ammonia”:

- Access to renewable energy

- Access to water to make hydrogen

- A facility to combine the hydrogen with nitrogen to make green ammonia

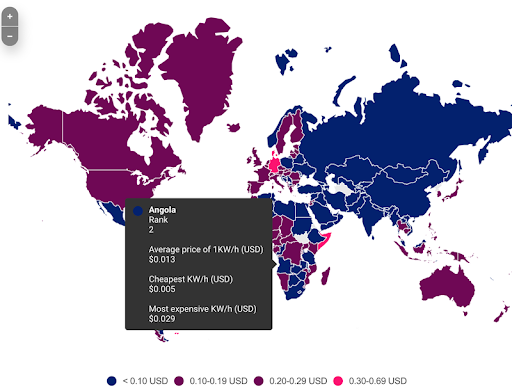

Project Benefit 1: Renewable Energy - readily available green source

MNB’s green ammonia project plans to utilise 200MW of local hydroelectric power to create ammonium nitrate for fertiliser and explosives used in the mining sector.

This local hydroelectric power is an existing renewable energy source that MNB does not need to build.

This means no upfront capital costs for the power source - saving billions of dollars in CAPEX and a decade of feasibility studies - a massive head start for the project.

As well as the CAPEX savings, MNB is ahead of operating power costs too - MNB has an agreement with the Angolan government’s energy operator for supply of hydroelectric power at some of the cheapest renewable energy prices on the planet.

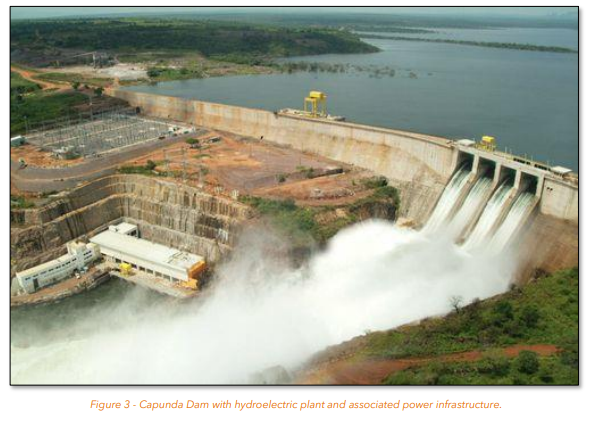

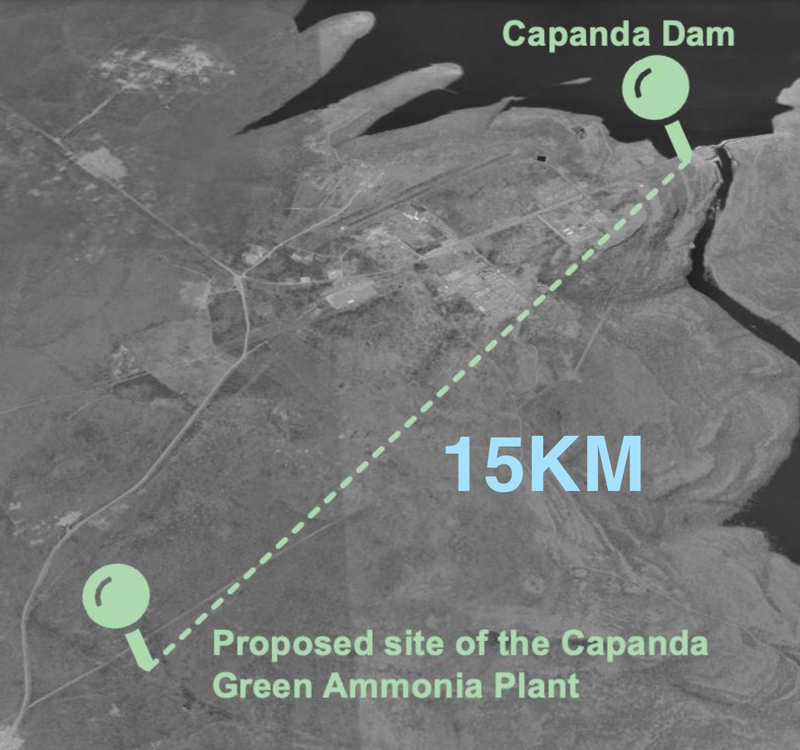

During our trip to Angola in 2022, we visited the hydro-dam from where MNB will procure its renewable energy:

As well as checking out the hydro-dam, we spent six days in Angola meeting the MNB in-country team and visiting the key sites for MNB’s two key projects.

Read about our site visit here: On the ground in Angola: Visiting MNB's Projects.

As we highlighted above, what makes this project different to other green ammonia projects is that MNB won’t need to build the renewable energy infrastructure.

It can instead utilise Angola’s existing infrastructure to generate the green power needed to create green ammonia.

This provides MNB with an important point of differentiation - as most of the world's current ammonia supply is produced using fossil fuels (~90%), which comes with a heavy carbon cost.

In order to meet carbon reduction targets, the world’s biggest ammonia producers want to move away from fossil fuels.

To do so, many producers are looking to build renewable energy projects near their existing ammonia plants, which require huge upfront capital investment.

They will also also need a reliable water source, which might not exist in close proximity.

How did MNB secure some of the world's cheapest renewable energy?

In 1987 the Russians built a hydroelectricity dam on the Kwanza River. It has a capacity of 520MW per day and generates more than half of all electricity in Angola.

Today, the dam is operated by an Angolan state owned company.

MNB was able to recognise and jump on this opportunity thanks to the many years that its management — in particular director Lindsay Reed — spent in Angola building relationships with stakeholders involved.

In December 2022, MNB signed an MoU to procure renewable energy from this dam.

Energy from that dam is expected to cost MNB US$0.004 to $0.015 per kilowatt hour, with an average cost of power of US$0.011/kwh (1.1c) for the entire 200MW over 25 years.

For context, that’s a fraction of the ~US$0.16/kwh (16c) price paid by industry users in Australia and the USA last year...let alone the >US$0.50/kwh paid in Europe in early 2022.

That’s right, MNB’s input power costs are about 1/16th of what Australian and US industry users pay.

Since the power supply MoU was signed the global economic outlook has materially changed.

Inflation and interest rates have gone up since 2022 and the cost crunch for large projects is real.

We think that this deal for both CHEAP and RENEWABLE energy is a key contributor to the “significant partner interest” in the project announced today.

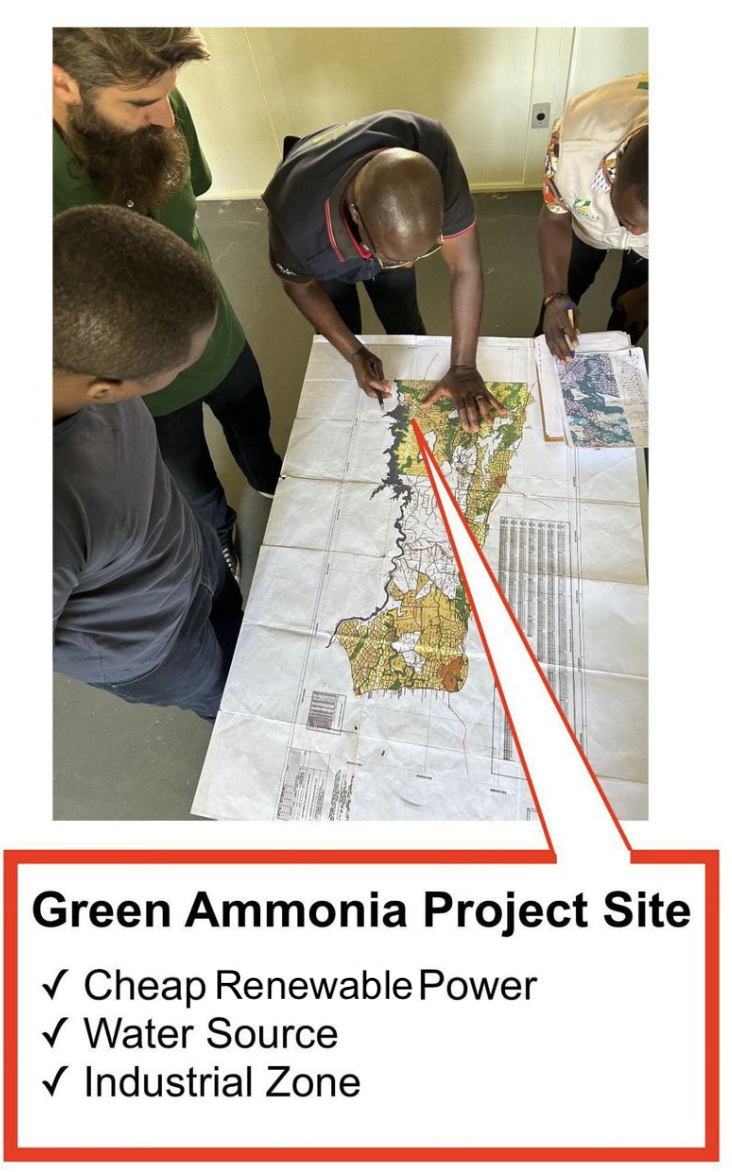

Ultimately, what makes MNB’s green ammonia project so unique is an ideal combination of:

- Access to very cheap renewable power

- A reliable fresh water supply

- Its location within an industrial zone, and

- Ready access to agriculture and mining customers

Benefit 2: Access to high quality fresh water

In order to make ammonia, MNB will need to make hydrogen.

This is done through a process called electrolysis which needs a water source.

MNB has access to a high-quality fresh water source, which is more suitable for electrolysis than saline groundwater or sea water.

Freshwater is more suitable because salt water can corrode the electrolyser and limit its lifespan.

It is also more suitable than desalination or treatment of the seawater/groundwater, as this can be an expensive extra step that increases the production cost.

We visited the proposed site for the freshwater supply on our site visit, which is close to MNB’s planned ammonia plant and sits along the Kwanza River:

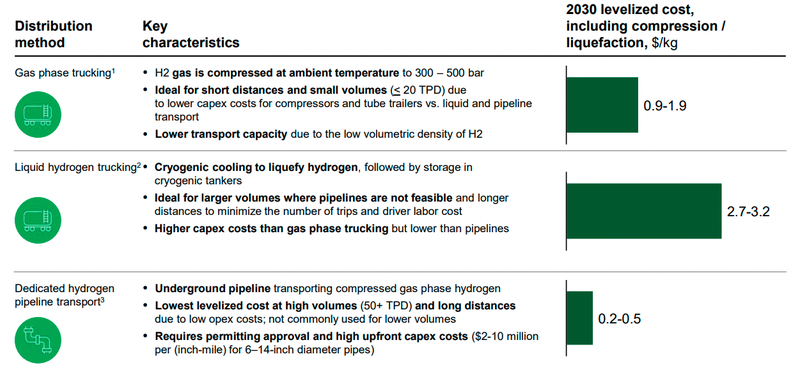

When producing hydrogen, proximity to the ammonia plant matters - because the cost of transporting hydrogen is expensive.

You can’t just make hydrogen anywhere.

According to the US Department of Energy - trucking hydrogen can cost up to US$3.20/kg.

Compare this to the current cost to produce hydrogen which is around $3-6/kg today.

Basically, the cost to truck hydrogen increases the production costs by 1.5-2x /kg.

(source)

Without the dedicated hydrogen pipeline infrastructure to transport hydrogen from the water source to the ammonia plant, green ammonia projects will need to build their plants next to the water source.

For existing ammonia plants, this can be difficult as a water source and/or renewable energy may not be available.

Until the hydrogen transport cost challenge is resolved, projects like MNB’s, that intend to build an ammonia plant in close proximity to BOTH water and renewable energy, will always have an advantage.

The best green ammonia projects will have the plant, clean water and renewable energy, all within a close distance.

Speaking of proximity, the most important part of MNB’s project is the end market - those who will be the ultimate buyers of MNB’s product.

Benefit 3: Close proximity to end market

There are two main end buyers for MNB’s green ammonia.

- Mining companies that use it for explosives

- Large commercial farms using ammonia fertilisers.

Ammonium Nitrate for Explosives

Explosives are important for the mining industry, used during the stripping of open pit mines.

Instead of diggers and jackhammers doing the work, explosives are used to blow up large surface areas (in a controlled manner) to speed up the excavation process.

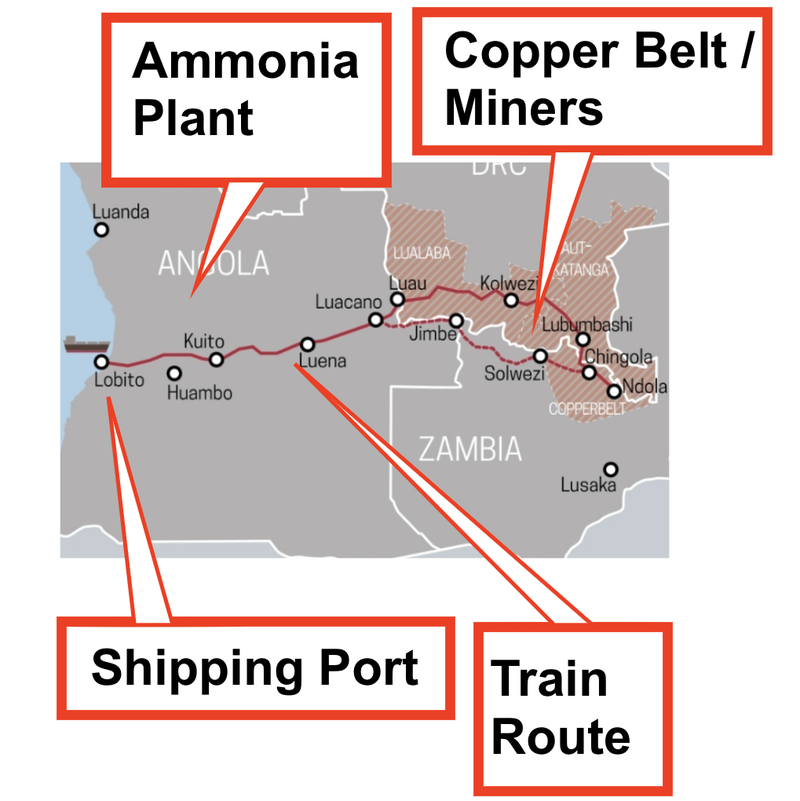

Many mines along the Zambia Copper Belt (which is right next to Angola) use explosives in their mining operations.

MNB will compete with alternative explosives providers from:

- South Africa, where MNB will have a land transport advantage of 1,000km, and

- Global explosives producers, where MNB will have additional marine freight and port cost advantages over seaborne competition.

For these mines, we think having security of supply from an inland African partner (like MNB) will be invaluable.

The Lobito Corridor is a crucial route that links Angola’s Tier-1 Lobito Port to the mines that sit along the copper belt in Zambia and the Democratic Republic of the Congo (DRC).

The planned Corridor will give these mines better access to global markets and a better price for their product.

Last week, the US government announced a US$360M funding package for the Lobito Corridor:

(Source)

Although the Lobito Corridor Railway is a long term project, it will provide better access for MNB to sell its ammonium nitrate for explosives to miners in the area.

Just this week the rail operator Trafigura announced that Ivanhoe's Kamoa-Kakula mine in the DRC would be assigned capacity on the route.

This marked the first mining/mineral transport deal for the rail project:

(Source)

We think that this rail project in particular gives MNB a significant advantage to get its ammonia product in the hands of its customers and highlights the importance of the project for the region.

Ammonium Nitrate for Fertiliser

In the technical study published last year, MNB said that it will produce Calcium Ammonium Nitrate (CAN) for fertiliser.

The market for CAN fertiliser is well established and the product can be exported to large scale commercial farms.

However, MNB has previously noted that the agricultural aspirations of Angola are growing, which means that the market for fertiliser will grow within the country as well.

We think that MNB will be able to use its well established relationships with farmers, government and distributors within the country to build a strong market demand for its product within Angloa.

However, the company still has optionality to sell to large scale commercial farms, either throughout Africa (most of them are in South Africa), or around the world.

MNB will likely deliver its product to market through a mixture of truck haulage and shipping, utilising the access to top tier ports in Lobito or Luanda.

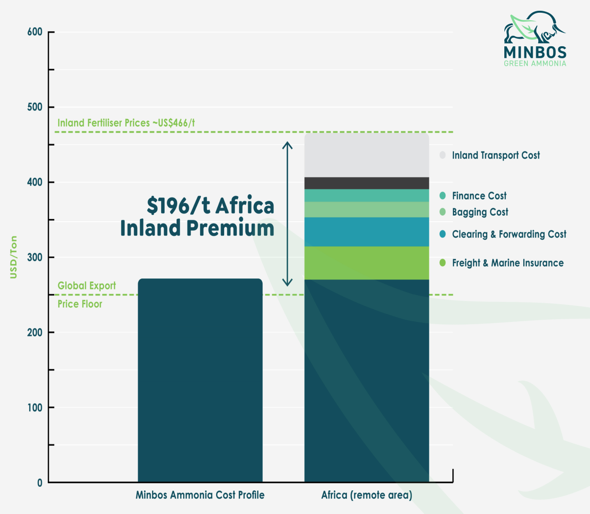

One of the biggest opportunities for the project is in capturing the “African Inland Premium” for nitrogen fertiliser.

Essentially, the African Inland Premium is a ~$200/t cost saving on MNB’s ammonia products sold to buyers located in inland Africa.

This savings in freight charges will make a material impact on the economics of MNB’s project.

To read more about the African Inland Premium read: MNB reveals first glimpse of green ammonia project - Financiers now circling

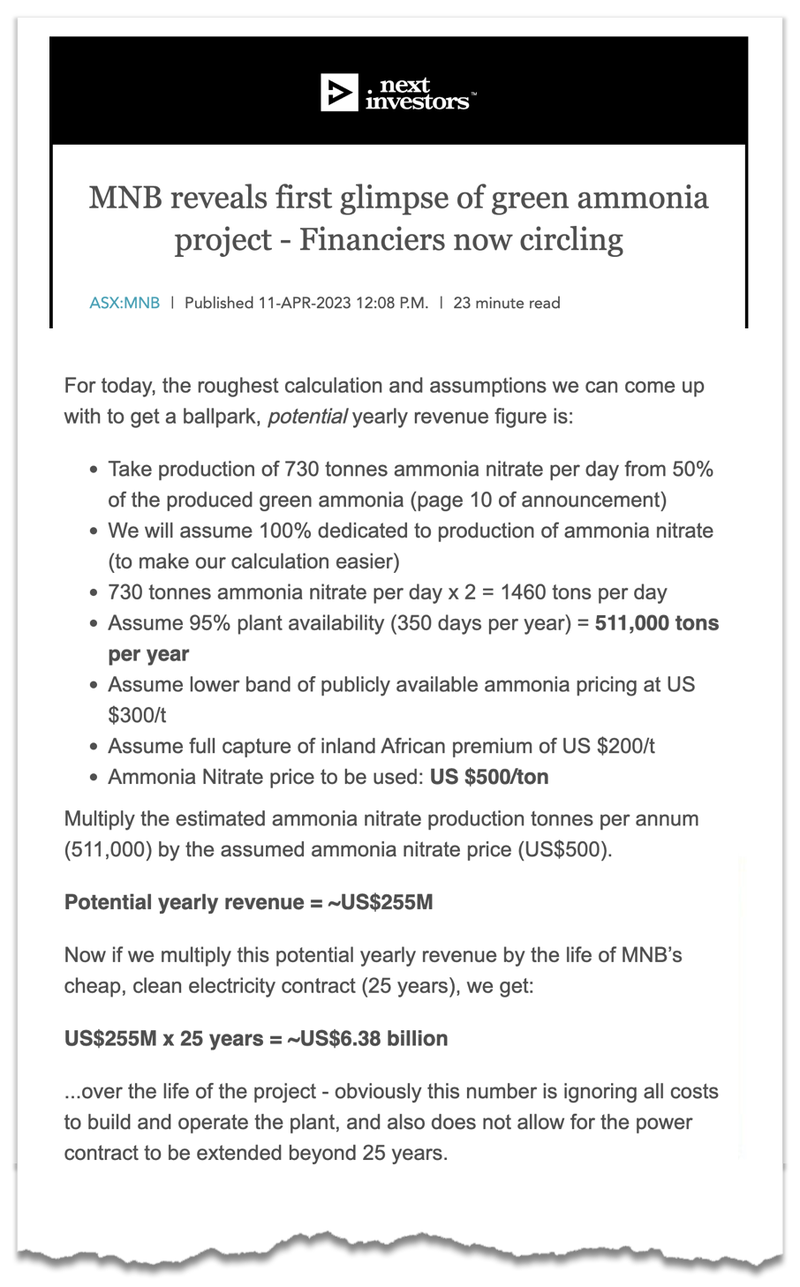

Green Ammonia Technical Study - early look at the economics

Last year MNB commissioned Stamicarbon to conduct a Technical Study on its Green Ammonia project.

This was a prelude to the PFS, and it didn't contain any numbers around revenue or net present value of the project.

CAPEX numbers were mentioned, and came in at between EUR 365M - 496M - a smaller fraction of some of the other green ammonia projects in development globally.

We wrote up a note on the Technical Study information, and did our own back of the napkin calcs on what kind of revenue MNB could possibly bring in on this project.

We stress we are not financial analysts here and the calcs are very rough.

You can read our note here: MNB reveals first glimpse of green ammonia project - Financiers now circling.

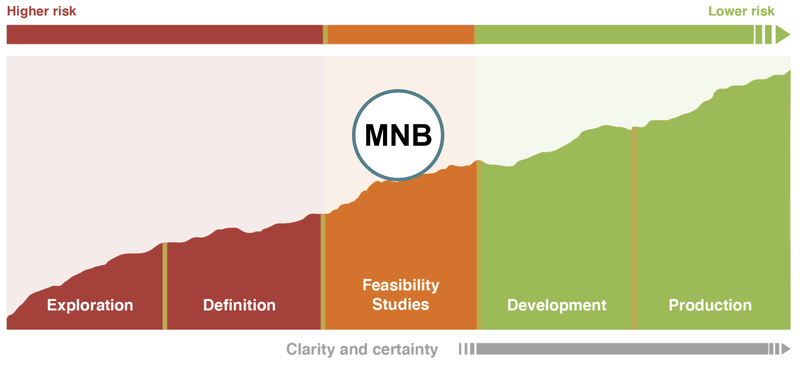

What stage is MNB’s Green Ammonia project at and what’s next?

MNB’s Green Ammonia project is at the PFS stage.

Here are the major milestones we are looking forward to from the project:

🔄 Pre Feasibility Study (PFS)

MNB is now working on a PFS for its green ammonia project, which will provide us with more information about capital costs, operating costs, revenues, and Net Present Value (NPV).

Ultimately the feasibility study will determine whether or not the project is commercially viable.

🔄 Environmental Impact Assessment

MNB has been working on its project's environmental impact study since ~September last year.

Today MNB finished the environmental baseline surveys which will form the basis for the impact study which MNB expects to be finished by the halfway mark of this year.

🔄 Market feasibility study

MNB intends to undertake a market feasibility study on opportunities to sell its green ammonia in Angola and to take advantage of the recently announced Lobito Corridor rail link (Angola, Democratic Republic of Congo and Zambia).

🔲 Binding power agreement Angolan power network operator

We want to see MNB convert its Memorandum Of Understanding (MoU) with Angola’s National Electricity Transmission Network (RNT-EP) into a binding power agreement. We expect this to come after feasibility studies are completed.

🔲 Sign technical, offtake, and investment development partnership

MNB mentioned in today’s announcement it had received ‘significant Partner interest’ from development financiers and potential project partners.

Recent MNB investor presentations have also alluded to strategic partnerships being something to watch for.

This is a big one for us.

We are hoping MNB can lock in a major financing partner for the project who also de-risks the project from a technical perspective as well as financial.

An update on MNB’s phosphate fertiliser project -

MNB’s Phosphate fertiliser project is currently in the latter stages of construction.

MNB expects first production from the project this year.

MNB’s phosphate will be used to make fertiliser for the agricultural industry AND the type of phosphate used in lithium iron-phosphate (LFP) batteries that are popular in electric vehicles, especially in China.

At its inception, the LFP part of the story wasn't as much of a consideration, but it's worth noting that LFP battery chemistry is now the most popular type of battery tech being used in EVs.

So demand for phosphate is just as strong from both markets - agriculture and for batteries.

So strong that MNB’s biggest shareholder (12% shareholder) is made up of a group that chairs one of the biggest battery anode companies in the world and CATL a global leader in lithium batteries space.

MNB’s phosphate project is being developed under a DFS which showed project economics of:

- NPV of US$203.4M (base case) - That figure was based on a long-term average phosphate rock pricing of US$422 per tonne — the 15-year average price.

- NPV of US$399.4M (upside case) using October 2022 figures.

- Post-tax internal rate of return (IRR) of 61%

- Payback period of 3.6 years

Most of the project’s CAPEX has already been covered with ~US$26M remaining that needs to be financed.

What’s next for MNB’s fertiliser project?

🔄 Funding for the remainder of CAPEX on the project

MNB requires a further US$26M to fund the CAPEX of the fertiliser project, according to the most recent presentation in December (source).

In October last year, MNB secured an indicative term sheet on a loan facility of US$14M from the Industrial Development Corporation (IDC).

The facility allows MNB to draw down on cash when they need it. The interest rate on the loan is the Secured Overnight Financing Rate + 6.77% payable quarterly in arrears.

The IDC is a South African development finance institution established in 1940 to promote economic growth and industrial development. MNB’s engagement with this corporation provides other commercial opportunities for offtake of Stage 2 production for South African customers.

This loan is subject to due diligence which has commenced.

With this loan facility in place, it would mean that MNB will still need to find the remaining US$12M to fund the rest of the project construction.

At the end of the December Quarter, MNB had ~$4.6M in the bank.

🔄 First production

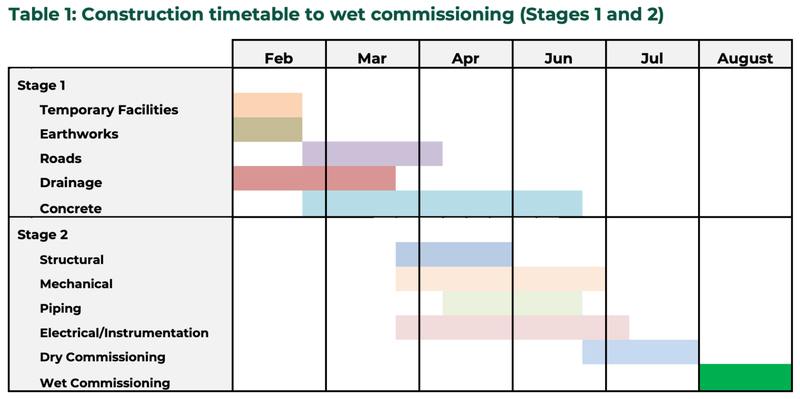

At the end of January, MNB published a timeline detailing all of the key construction milestones on the way to completing the project.

This puts construction complete at somewhere around Q3/Q4 in 2024.

We expect that once construction is complete, production will start shortly after.

🔄 Results of P4 Study

MNB has commenced a concept study into whether its phosphate waste product is suitable for P4 in LFP batteries (the types used in Chinese electric vehicles).

MNB has a Strategic Cooperation Agreement in place with a syndicate of Chinese new energy materials investors - controlled by the Chairman of CATL.

What are the short term risks to MNB?

Green Ammonia Project

In terms of MNB’s green ammonia project - the key short term risk is “Project Feasibility Risk” and “Funding Risk”.

With MNB entering the feasibility stage, the biggest risk comes around technical and commercial aspects of the project such as:

- Will the project be viable technically?

- Will the project economics be favourable?

- Are there environmental challenges to overcome?

- etc...

Big infrastructure projects, such as an Ammonia Plant, are complex to design and construct.

So, after completing a PFS, MNB may find itself in a position where it needs to find a large financing partner to commit large amounts of capital to get the project off the ground.

This funding risk is relevant for all large projects of this kind.

Therefore, MNB will need to demonstrate that the project economics stack up AND all of the technical, environmental, legal and feasibility risks are mitigated.

Phosphate / Fertiliser Project

For MNB’s phosphate/fertiliser project the short term risk is “Funding risk”.

MNB has a relatively small CAPEX funding gap that needs to be filled and so will need to try and secure additional funding to complete construction works and get its project into production.

There is a risk that the final funding package takes longer than expected to secure OR isn't secured at all which forces MNB to pivot in its development strategy.

Any delays from a funding perspective could impact the time it takes for MNB to get to first production (and revenues) from the project.

To see more risks we listed as part of our MNB Investment Memo check out the following:

Our MNB Investment Memo

Click here for our Investment Memo for MNB, where you can find a short, high level summary of our reasons for Investing.

In our MNB Investment Memo, you’ll find:

- Key objectives for MNB

- Why we are Invested in MNB

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.