Comet prepares to drill at Barraba as copper price gains momentum

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

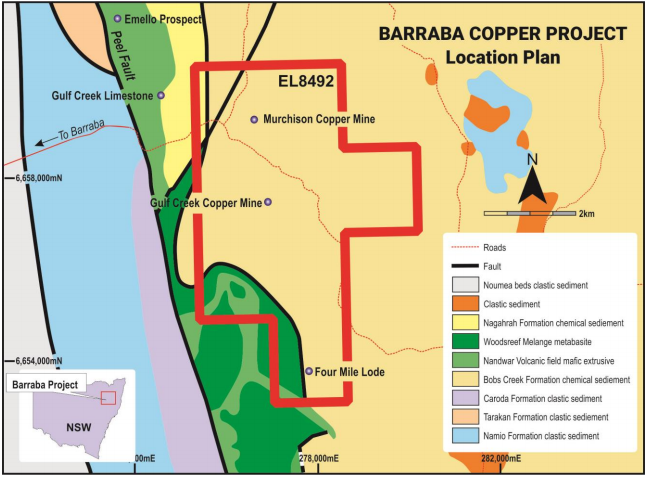

Comet Resources Limited (ASX:CRL) has provided an update on the Barraba Copper Project in NSW, including the appointment of Mart Rampe, a highly experienced geologist as the manager for all aspects of the project.

Rampe has 46 years’ experience in minerals exploration and development which includes grassroots exploration through to pre-mine development, an ideal background given Barraba’s early-stage status.

He has held senior exploration management positions in publicly listed and private exploration companies, and he has also worked with a number of commodities including gold, base metals, uranium, coal and industrial minerals.

Managing director Matthew O’Kane is confident that copper is set to see an increase in demand due to the global efforts to reduce emissions from the transport network and also from the generation of renewable electricity.

Indeed, looking at the last five years this was a key commodity price driver as the price of copper increased some 60% to approximately US$3.20 per pound.

However, the copper price slumped from more than US$2.80 per pound to a low of approximately US$2.10 per pound in the first quarter of 2020, due largely to the anticipated demand impact of coronavirus.

Ideal time to target emerging copper plays

For investors looking to take a medium to long-term approach, the demand dynamics are still in place, suggesting now may be the time for forward-looking investors to identify undervalued copper plays.

Copper is not only an important part of the batteries used in Battery Electric Vehicles (BEVs), but is also used extensively in the electric motors that drive the wheels of BEVs, and is also used intensively in the generation of electricity from renewables such as solar and wind.

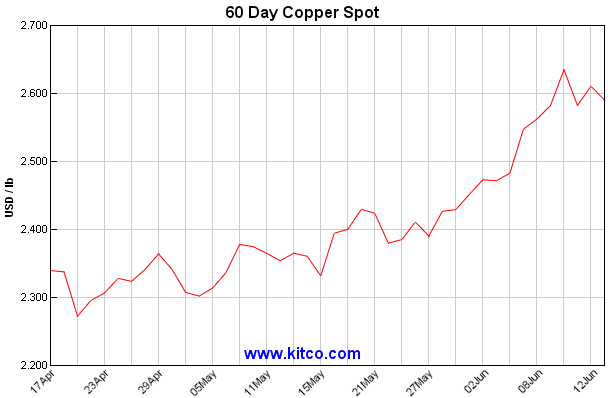

There is also significant potential for post-Covid-19 fiscal stimulus initiatives by governments to provide further demand for copper, with the strong performance of the copper price over recent months providing further support for this argument.

The sharp uptick in the commodity price can be seen in the following chart.

Drilling in vicinity of historical deposits

It is important to note that the Barraba Copper Project has not been systematically tested by modern exploration techniques.

The initial exploration program will include drill testing of areas below the historically identified deposits, plus high-level exploration targets delineated by an induced polarisation (IP) survey of parts of the licence area that were not previously followed up.

To complement the drill testing, Comet will also complete downhole geophysics with the aim of providing additional information about potential parallel and blind lodes, in addition to the known historical lodes.

As volcanogenic massive sulphide (VMS) deposits often occur in clusters, this is a much-anticipated exploration program.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.