Biotech stocks to watch in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Whether a day trader or a long-term investor, we often examine research released by industry experts, brokers and analysts with a view to uncovering the next big thing.

The more complex the sector, the more we are likely to rely on information outside that released by the company.

When it comes to complexity, the biotech sector is right up there, as generally companies in the sector are looking to develop drugs to treat conditions that are difficult to understand in themselves and the science behind the potential cures/treatments is equally baffling.

It doesn’t help that ASX announcements are often written by scientists who can’t get their head around the fact they are addressing an audience of investors with predominantly no academic experience in that field of science.

So if we are heavily reliant on external research, Finfeed thought it might be useful to look retrospectively at 2019 in determining the performance of one analyst who took on the challenge of selecting a clutch of biotech stocks that could be worth following in 2019.

I have the much easier task of running the ruler across the stocks that Jain mentioned.

It is important to note that the stocks featured were not to be considered as financial advice provided by her or her employers and is speculation on her part, but food for thought based on her knowledge of the sector.

Underlying themes

In determining what may be the broader sector drivers in 2019, Jain said, ‘’This year we believe partnering activity will remain high as there is no shortage of cash-rich companies looking to acquire or license promising assets.

‘’In the US, two major multi-billion-dollar deals have already been announced: Bristol Myers Squibb acquired Celgene for $90 billion and Eli Lilly acquired Loxo Oncology for $8 billion.

‘’This is promising after the relatively lacklustre second half of last year in terms of partnering in the US and sets a positive tone globally.

‘’We believe the FDA will remain friendly and open to supporting companies through accelerated pathways to get medicines with unmet needs to market faster.’’

Which companies fit the bill

With regards to companies that could be beneficiaries of some of these dynamics and other positive trends, Jain said, ‘’Starpharma and Medical Developments have the task ahead, but we expect Mesoblast (ASX:MSB) to get its GvHD product approved and Ellex to discuss an approval pathway with the FDA for its 2RT laser for age-related macular degeneration (AMD).’’

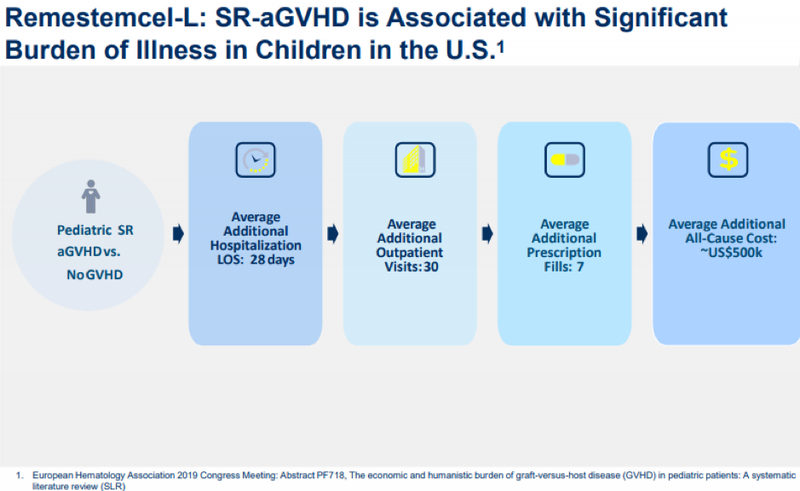

Jain’s confidence in Mesoblast was well-founded as the company entered into an agreement in October for the commercial manufacture of its lead allogeneic (off-the-shelf) cell therapy product candidate, remestemcel-L for pediatric steroid-refractory acute graft versus host disease (aGVHD).

This agreement will facilitate inventory build ahead of the planned US market launch of remestemcel-L and commercial supply to meet Mesoblast’s long-term market projections.

Since the deal was announced, shares in Mesoblast have increased 15%, and they are up 60% since Jain discussed the company’s merits in February.

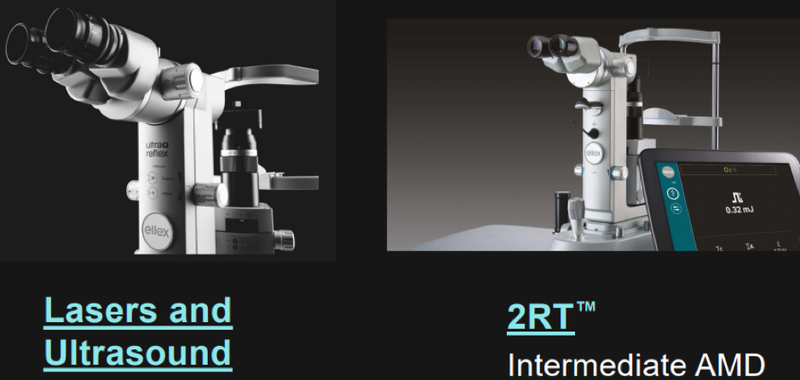

She was also correct in identifying the progress of 2RT as being central to Ellex Medical Lasers Limited’s (ASX:ELX) success in 2019.

By way of background, Ellex is a world leader in the design, manufacture and sale of a comprehensive range of ophthalmic lasers, evolving consumable devices and diagnostic equipment.

These products serve multi-billion dollar markets namely glaucoma, diabetic eye disease, secondary cataracts, age-related macular degeneration or AMD and vitreous opacities.

However, the FDA process is ongoing, and chief executive Maria Maieli said in an update in late November, ‘’Ellex remains on track to establish US regulatory pathway for 2RT in iAMD with the FDA prior to the end of calendar year 2019 with submission to the FDA of regulatory documents having been completed and the meeting which was to be held prior to the end of 2019 has now been rescheduled by the FDA to early first quarter 2020.’’

Consequently, it may be one to watch in 2020 as the company’s shares rallied strongly following management’s suggested timeline.

They are now trading slightly above where they were in February.

Jain was also expecting commercial momentum to pick up for marketed products by Medical Developments (ASX:MVP).

The company went on to become one of the best performing biotechs in 2019 with its shares roughly doubling since Jain flagged the stock.

MVP is a developer of emergency medical solutions dedicated to improving patient outcomes, and the group is a leader in emergency pain relief and respiratory products.

The company manufactures the well-known Penthrox® (green whistle), a fast-acting trauma and emergency pain relief product that is used in Australian Hospitals including Emergency Departments, Australian Ambulance Services, the Australian Defence Forces and Sports Medicine.

A prominent recent share price catalyst was the approval by the Chinese National Medical Product Administration (NMPA) for a new drug, with chief executive John Sharman saying, “The approval of the Penthrox IND by the Chinese authorities is a significant milestone for our company.

‘’The NMPA has accepted the safety and efficacy of the global clinical data.

‘’The clinical program we are undertaking in China comprises small studies designed to support the safety and efficacy of Penthrox in Chinese people.”

MVP’s share price pushed up towards its all-time high of $8.00 just last week, and with further share price catalysts in the wind it could go on to set a new high in 2020.

Jain has her eye on oncology stocks

Jain also believes oncology stocks will remain a hot focus globally, saying, ‘’ Progress with checkpoint inhibitors, CAR T-cell therapies and others in combination with immune oncology targets will be in focus in the US.’’

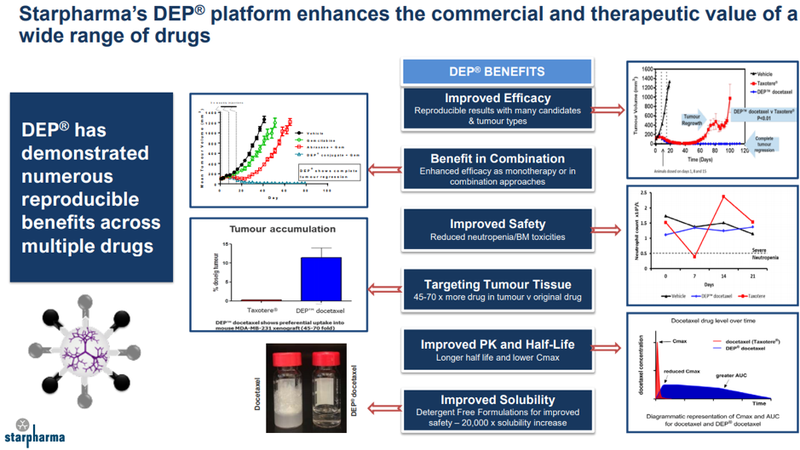

Her focus back in February was on Starpharma (ASX:SPL), a company whose blood cancer drug in partnership with AstraZeneca was slated to enter the clinical and internal chemotherapy DEP-docetaxel and DEP-cabazitaxel programs.

At that stage trial data was expected to be reported in the December half, and it was only last week that the company announced successful completion of the phase 1 component of its phase I/phase II trial for DEP® cabazitaxel, triggering a significant share price spike.

The trial met its objective of evaluating safety, tolerability and preliminary efficacy data, and identifying a recommended phase II dose of 20 mg/m2 .

The trial will now transition seamlessly into phase II, with two new sites initiated and recruitment activities already underway.

Starpharma’s shares were trading just above the $1.00 mark when Jain underlined the company’s prospects in February, and they are now not too far shy of the 2019 high of $1.39 set in June.

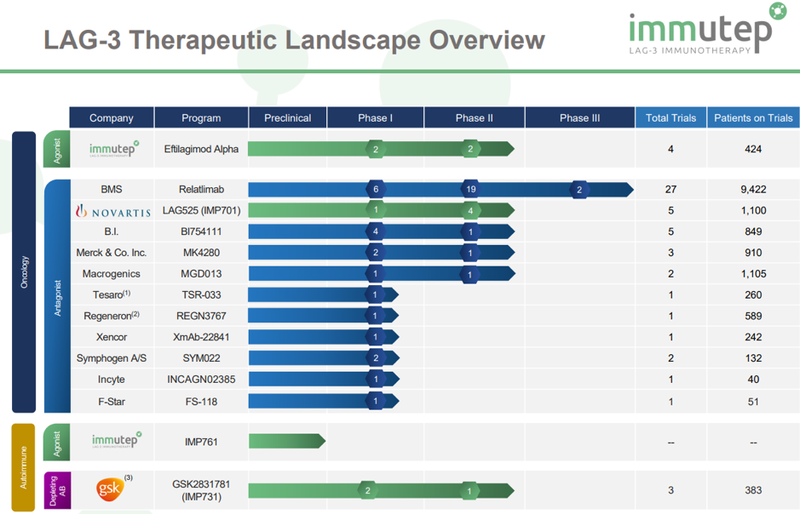

On the oncology front, Jain also pointed out another stock in Immutep (ASX:IMM), noting that it would have numerous data read outs from LAG-3 in immunotherapies trials throughout 2019.

While positive news emerged during the year, Immutep is likely to be more of a 2020 story as further developments regarding LAG-3 are still to unfold as the company remains the only pure play in that arena with the greatest number of product candidates under evaluation.

In addition, with the exception of Immutep’s partner GlaxoSmithKline after their acquisition of TESARO for an aggregate cash consideration of approximately US$5.1 billion, the company is the only group developing LAG-3 related product candidates for immuno-oncology and auto-immune diseases.

At this time several relatively small clinical data sets have been published regarding LAG-3.

As larger clinical trials, such as AIPAC, come to maturity, much more LAG-3 clinical data will accumulate, and this will occur hand-in-hand with a considerable expansion of the broader immuno-oncology landscape.

As one of Jain’s few companies mentioned that have come off since February, it may be one to target as newsflow ramps up in 2020.

Another company that Jain said she would be following was Prescient Ltd (ASX:PTX), and just last week it received encouraging data regarding its PTX-200 pH domain inhibitor in relation to phase 1B ovarian cancer trials.

PTX-200 is a novel PH domain inhibitor that inhibits an important tumour survival pathway known as Akt, which plays a key role in the development of many cancers, including breast and ovarian cancer, as well as leukaemia.

Unlike other drug candidates that target Akt inhibition which are non-specific kinase inhibitors that have toxicity problems, PTX-200 has a novel mechanism of action that specifically inhibits Akt whilst being comparatively safer.

This highly promising compound has encouraging Phase IIa data in HER2-negative breast cancer, Phase Ib/2 in relapsed and refractory AML and Phase Ib in recurrent or persistent platinum resistant ovarian cancer.

Last week’s data related to a safety study conducted on women with recurrent or persistent platinum resistant ovarian cancer, with acceptable safety and 80% of women exhibiting disease control (being partial response or stable disease).

Analysis of the interim data revealed that 12 of 15 patients (80%) exhibited disease control, with 11 women exhibiting stable disease and one patient having a partial response.

Escalation has not yet been completed and Prescient believes that it has not yet escalated to the optimal dose of PTX-200.

After trading in the vicinity of 6.5 cents in February, Prescient recently traded as high as 15 cents, but with more news around the corner it may be one to watch in 2020, particularly after some profit-taking resulted in a retracement last week.

Jain identifies NASH as the next mega-blockbuster opportunity

Commenting on particular types of diseases and/or conditions that could be central to intense activity in the near term, Jain said, ‘’The other big disease area on our radar is non-alcoholic steatohepatitis (NASH).

‘’There are several advanced players in the space and they will have key trial data readouts.

‘’Given there is no approved treatments yet for NASH and it is expected to be the next mega-blockbuster opportunity for the industry, positive data will attract great interest.’’

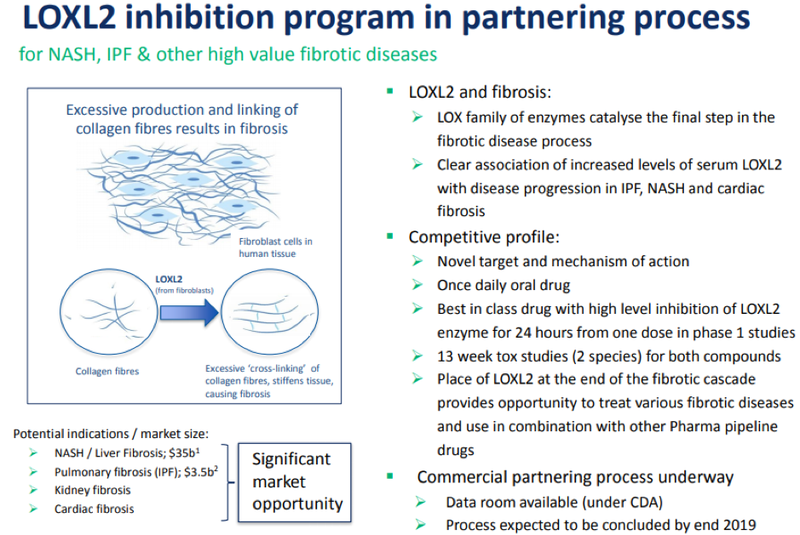

She noted that Pharmaxis Ltd (ASX:PXS) had two lead assets targeting the condition with one having partnered with Boehringer Ingelheim.

Phase IIa trial data results regarding this drug were due mid-year, and the results of commercial assessment to progress to phase II b are imminent - in fact, Pharmaxix entered a trading halt this morning having been advised of future development plans by Boehringer Ingelheim.

Management expects that the company will remain in a trading halt until the earlier of commencement of normal trading on December 18 or when an announcement is made regarding this news.

Jain was also upbeat about the LOXL-2 asset which was gearing up to be partnered in a potentially multi-million dollar deal.

LOXL-2 is an anti‐fibrotic Lysyl Oxidase (LOX) inhibitor focused on treating pancreatic cancer.

Pharmaxis has recently presented data at scientific conferences and in scientific publications detailing its unique proprietary assays that, for the first time, allow all of the LOX enzyme family to be measured in serum and tissue, even at very low levels.

These data demonstrate that LOXL-2 in particular has a relatively fast turnover in human serum and suggests that an effective drug will need to both penetrate fibrotic tissue and be present in concentrations high enough to inhibit LOXL-2 at all times.

Pharmaxis has used this unique assay technology in the development and assessment of all its current LOX and LOXL-2 inhibitors.

In what could mark the precursor to important news in 2020, data collected in 2019 has energised the partnering process by underlining the relevance of LOXL-2 and the superiority of its compounds.

On this note, chief executive Gary Phillips said, ‘’We are currently pursuing a number of different partnering options to enable this drug to commence phase 2 efficacy studies in patients with IPF or NASH.”

Shares in Pharmaxis have mainly been on a downward trajectory since Jain pointed to the company’s prospects, but they are up 40% since the start of November and should positive news emerge when the company comes out of a trading halt there could be further upside to come.

All in all, Jain’s report card reads fairly well, having successfully identified relevant themes and some promising stocks along the way.

How do these stocks stack up in 2020

Given Jain’s performance in 2019, Finfeed felt it was worthwhile checking on her latest take on those stocks.

She sees significant upside in Pharmaxis, having increased the company’s price target from 57 cents to 59 cents in late November, implying share price upside of nearly 130%.

Jain last ran the ruler across Starpharma in June when she maintained a buy recommendation with a valuation of $1.94, representing a 50% premium to where the company is currently trading.

Jain remains bullish on Medical Developments, and after reviewing the stock in late November she reaffirmed her buy recommendation while increasing the 12 month share price target from $7.05 to $7.15, only slightly above where the company is currently trading.

It was just last week that Jain reviewed Ellex, noting that competitive headwinds for the group’s iTrack business were emerging.

In part, she said, ‘’We believe iTrack faces several competitive headwinds in FY20 and beyond, which have likely impacted its revenue growth in YTD (year-to-date) trading and is likely to have greater impact starting in the December quarter of 2020.’’

This prompted her to reduce the 12 month price target from $1.39 to 98 cents.

However, with the company trading at 61 cents, potential downside appears to be more than factored in and she has maintained a buy recommendation.

Mesoblast remains a stock where Jain sees the most substantial capital gain with the price target of $5.10 implying upside of approximately 170% relative to the current price of $1.90.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.