Biomorphik App with MyFiziq technology released on Google and Apple

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Just a fortnight after MyFiziq Limited (ASX:MYQ) announced that the Biomorphik App integrated with MyFiziq’s technology had been registered with Google Play and Apple Store for release approval, management has today confirmed that the app has been released on both platforms.

In line with the initial product release, Biomorphik will commence a comprehensive B2C marketing strategy to draw users to the new platform with the first stage allowing people to monitor their bodies closely and pre-empt potential issues before they become prohibitive to the user’s health.

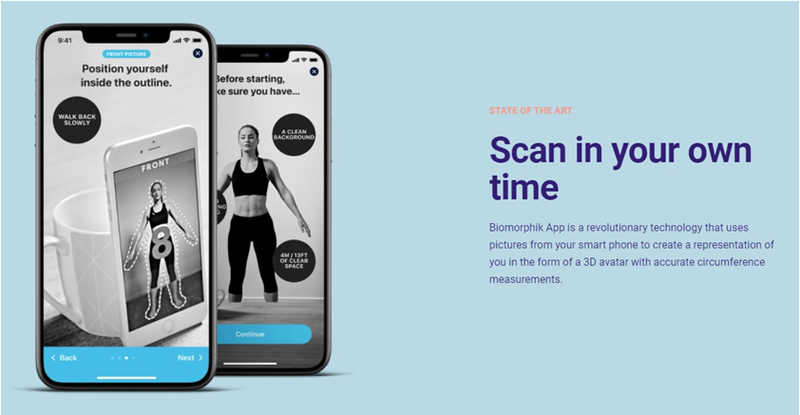

At its core, Biomorphik is a behavioural change company with a key goal being to improve the health and wellness of people at a whole-of-society level through better creation, measurement, storage, analysis, and access to data.

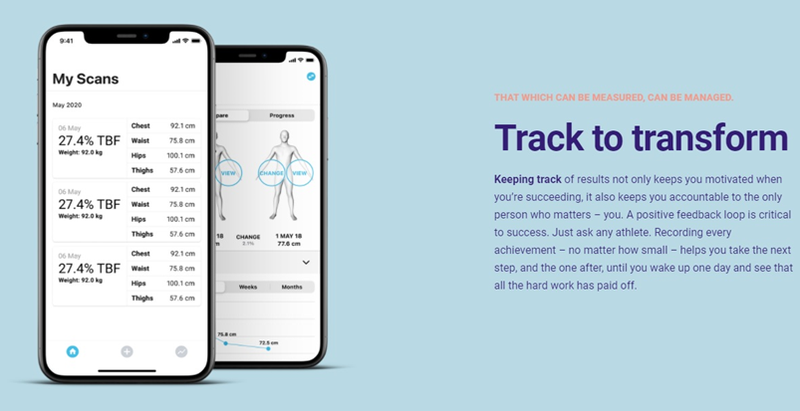

The technology is highly complementary with MyFiziq’s patented proprietary image capture and dimensioning technology that enables its users to check, track, and accurately assess their dimensions and vital signs using only a smartphone privately on-device.

Pricing provides highly competitive option for consumers

Under the terms of the commercial contracts, Biomorphik has given an undertaking to deliver 100,000 active monthly users to MyFiziq.

In the event this target is not achieved, MyFiziq has a right to terminate the agreements between the parties.

Biomorphik will offer both a monthly subscription at AUD$22.99 per month for unlimited scans, as well as a yearly subscription payment option with a significant discount at AUD$142.99 per year for unlimited scans to consumers.

This pricing represents a highly attractive offering relative to other players in the sector.

On the score of affordability, MyFiziq chief executive Vlado Bosanac said, ‘’When you consider a single Dexa body composition scan can cost up to AUD$80.00, the monthly fee of AUD$22.99 is an extremely cost-effective option.

‘’The user can scan as many times as they wish to track body composition changes, empowering the user to make better decisions regarding their health and wellness.’’

Bosanac went on to say, ‘’With the applications now live and available for download, Nathaniel (CEO of Biomorphik) is programming a well-formulated marketing approach to the release over the first quarter of 2021.

‘’Once this commences, we will assist Nathaniel and Biomorphik with their campaign as needed, and I believe this will be the first of the releases to take a more aggressive approach to customer on-boarding as it forms such an integral part of their customer journey and retention, through real data and supervision.

‘’I encourage our shareholders and stock followers to try the Biomorphik app now that it has been released on the Australian iOS and Google Play app stores.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.