ASX Catch of the Day

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australia is known for its clean green reputation, a factor that has provided significant benefits for our food producers for decades. Beef, fruit and vegetables, grain crops, nuts and seafood are particularly sought after.

Today, we examine three companies that produce fish and shellfish through farming methods for distribution in Australia and overseas.

Exporters stand to benefit from the depreciation in the Australian dollar against other currencies as it makes their product cheaper to buy, a factor to keep in mind.

Two of the companies we examine are salmon producers, and the other is the second largest producer of Yellowtail Kingfish, in particular the Hiramasa Kingfish, considered by Japanese sushi masters as the best fish in the world for sashimi because of its firm but delicate flesh.

As is the case with salmon, Kingfish is rich in protein and omega three, making it a natural source of vitamins that carry significant support from the medical profession.

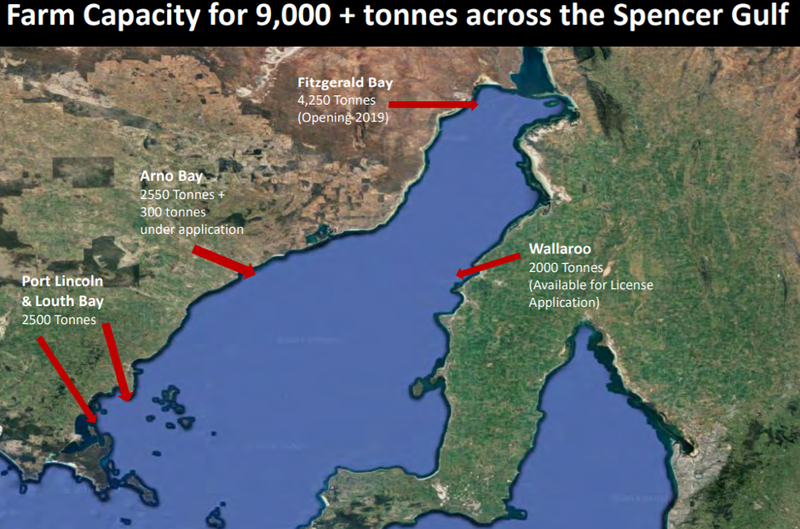

All three companies take advantage of the cool climate waters of southern Australia with the salmon producers located in Tasmania and the Kingfish producer operating out of the famous Spencer Gulf region where areas such as Port Lincoln have a virtually unrivalled reputation for delivering fresh premium quality fish and shellfish.

These are the pristine waters in which Clean Seas Seafood Ltd sourced approximately 700 tonnes of Yellowtail Kingfish that was sold in the December quarter.

Clean Seas Seafood

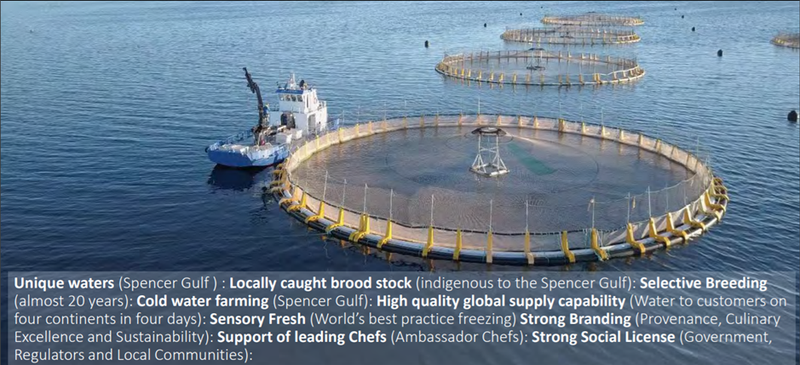

Clean Seas Seafood (ASX:CSS) is a global leader in the full cycle breeding, farming, marketing and distribution of Yellowtail Kingfish with the following picture illustrating its farming infrastructure with key takeaways regarding the environment, breeding process, supply chain management and brand power.

While the company is achieving strong levels of production, it is important to note that it is only in the relatively early stages of what is a highly scalable operation.

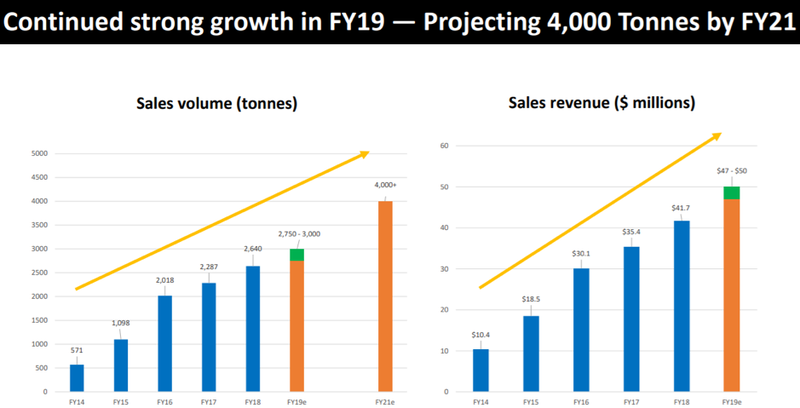

While production in fiscal 2019 is likely to be in the vicinity of 3000 tonnes, management is expecting this to increase more than 30% to 4000 tonnes by 2021.

Consequently, it is fair to say that the company should be priced for growth, and with a significant proportion of upfront capital expenditure absorbed in recent years, significant financial benefits should be recognised in the near to medium-term.

While further development and expansion will require funding, the business will be generating significant cash to assist in financing the company’s growth.

Strong sales growth in fiscal 2019

December quarter sales were up 23% on the previous corresponding period, and they were 25% ahead of the September quarter.

This is roughly the run rate that Clean Seas is targeting for the full year with management recently reaffirming sales guidance in a range between 2750 tonnes to 3000 tonnes for fiscal 2019, up substantially from 2300 tonnes in 2018.

This should generate sales revenue in the order of $50 million, representing growth of nearly 20%.

The company has been able to achieve price increases while still maintaining its competitive advantages and growing its client base.

Farm gate (local) prices have increased 21% over the last two years with price increases of more than 30% achieved in Europe.

Only a few weeks ago, managing director, David Head said that he expects double-digit sales growth to continue in fiscal 2020 and beyond.

Assisting in driving this growth is the company’s development of its sales and marketing capabilities in Europe, and an expansion of its presence in the US and Asian markets.

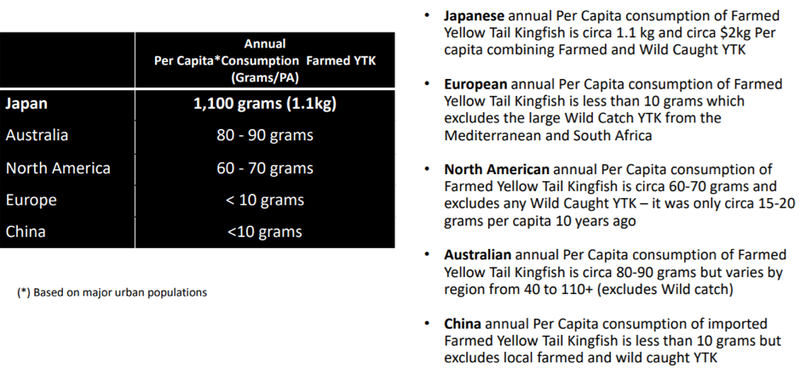

As evidenced below, there is particularly strong demand from Japan where per capita consumption of Yellowtail Kingfish is well above any other country.

The company’s ability to increase production is central to achieving sales targets, and management has invested heavily in increasing the live fish inventory in recent years.

In terms of catering for increased demand, it is encouraging to see a substantial increase in fish health and size.

Management is progressing plans to return to farming at the company’s Fitzgerald Bay leases, at the top of the Spencer Gulf near Whyalla in South Australia, later in 2019.

The Federal Government has supported this expansion through awarding a $2.5 million Regional Jobs and Investment Packages Grant, with the first quarterly payment of $0.4 million received during the December quarter.

Sensory Fresh to drive earnings and margins

Clean Seas’ competitive edge has been sharpened by the introduction of its Sensory Fresh product.

This involves liquid nitrogen freezing at an extremely fast pace in order to ensure the thawed product is the same ocean to plate taste and texture as the fish that are sold fresh.

In order to capture the colour, aroma and flavour, -35°C must be reached quickly. The company’s innovative Rapid Freezing technology achieves surface temperature of -95°C and core temperature -50°C to -70°C.

Patersons analyst, Jon Scholtz believes this product will be a key earnings driver in the future, saying, “We are highly positive on the Sensory Fresh frozen product line recently introduced which should open up the export market further and allow CSS significant potential for growth.

“The shift to Sensory Fresh should allow CSS to aggressively market and expand in the export market, thus increasing frozen sales growth.

“It should also allow the company the flexibility of timing its sales, maximising margins.”

When Scholz ran the ruler across the stock in the second half of calendar year 2018 he attributed a ‘speculative buy’ recommendation to the stock with a price target of $2.00, a significant premium to the group’s current share price of approximately $1.10.

The broker reaffirmed this recommendation following the December quarter update, noting the solid sales volumes achieved during the quarter and highlighting the marked improvement compared with the September quarter.

Many of the key growth catalysts will come into play in 2020, suggesting that the company could well push up towards the price target, provided it delivers on guidance in fiscal 2019 and demonstrates that the strong growth trajectory can be sustained.

Tassal runs after strong result

Shares in Tassal Group (ASX:TGR) hit a high of $5.10 after the company last week released a record first half result for the six months to December 31, 2018.

Though its share price has retraced slightly since then, it is still up more than 10% in February, and with management providing an upbeat outlook statement for the remainder of fiscal 2019, the positive momentum should be sustained.

Tassal is a vertically integrated salmon and prawn grower and salmon, prawn and seafood processor, seller and marketer.

The company produces and sells premium salmon from its ocean farms in Tasmania, while also managing the distribution of prawn and seafood products for both the Australian domestic and export markets.

Tassal has a long established position in growing Atlantic Salmon and the acquisition of the De Costi Seafood business provided it with the capacity to source and processes a wide range of seafood, as well as assisting in supply chain management in relation to salmon distribution.

Strong cash position

Operating cash flow increased 96.3% to $79.6 million in the first half of 2019, providing the group with the capacity to execute on its multi-pronged growth strategy.

This includes expansion into the prawn industry which has been facilitated by the $31.9 million acquisition of the Fortune Group.

The acquisition provided Tassal with three prawn farms which management expects will accelerate from producing 450 tonnes per annum to 3000 tonnes per annum within three years.

The net profit of $31.7 million represented year-on-year growth of 22.3%, and it was in line with the expectations of analysts at Morgans.

The salmon harvest was up 16.4% to a record 21,710 tonnes, and sales increased 21.7% to 20,578 tonnes.

Importantly, the value of live biomass (fish still maturing) was up 7% to $330.2 million, underlining the company’s ability to maintain strong sales momentum.

Management said that salmon market conditions were favourable with consumer demand continuing to outpace supply growth, leading to increased pricing.

Commenting on the group’s overall operations, long-serving chief executive Mark Ryan said, “Tassal continues to go from strength to strength with a thriving and sustainable seafood business supported by a strong team, environmentally sound farming practices and attractive market conditions.

Our focus on sustainable salmon growth, our De Costi Seafoods distribution operation, and now our diversification into high returns prawns, has us in the best position we have ever been in to deliver growing shareholder returns.”

Experienced management essential in aquaculture

The aquaculture business can deliver its share of curveballs, and having Ryan at the helm is a big plus for Tassal.

It is not unusual to experience out of the ordinary and ‘beyond management’s control’ cost overruns, while also having to contend with below expectation harvests as nature plays its part in the company’s fortunes.

The broader salmon growing industry, particularly in the northern hemisphere, has also had disease outbreaks which have killed a large percentage of fish during the growing cycle.

However, that hasn’t affected Tassal, and Ryan has demonstrated his ability to negotiate tough industry conditions, handle the growing pains of expanding production facilities, and more recently his business acumen has come to the fore in successfully integrating the de Costi business and acquiring Fortune Group.

He will need to bring all of this experience to the table as the company looks to ramp up its prawn farming operations, and on this note he said, “Material earnings from the prawn operations will commence in the short to medium term.

“With a nine-month working capital cycle [vs three years for salmon] and an EBITDA margin 2.5x salmon, Tassal’s new prawn business provides a very attractive new earnings growth runway.”

Analysts at Morgans noted that the prawn acquisition will drive a significant amount of growth from fiscal 2020 onwards.

Leading up to fiscal 2021 when earnings from the company’s prawn operation should be gaining substantial traction, the broker is still forecasting significant compound earnings per share growth of approximately 12%.

Morgans is forecasting a net profit of $65.7 million in fiscal 2019, representing earnings per share of 32 cents, implying a PE multiple of about 15 relative to the company’s current trading range.

Consequently, the company looks fairly priced around current levels without having run ahead of itself, and Morgans price target of $5.10 (upgraded from $4.60 following result) appears close to the money.

Huon Aquaculture Group Ltd

It seems that shares in Huon Aquaculture (ASX:HUO) may have received a boost from Tassal’s strong result, as its share price increased from $4.76 to a 12 month high of $5.04 on Friday.

However, Huon doesn’t offer Tassal’s product diversification, although it is at the very early stages of testing waters off Western Australia and New South Wales for their yellowtail kingfish breeding suitability.

This would be a slow burn though from a standing start, and the company really needs everything cranking with its salmon business to maintain good earnings momentum and solid cash flows in order to grow that business and invest in other ventures.

With regard to its salmon business, the fish are grown in three marine regions, two of which are situated in the south-east corner of Tasmania, and the other, Macquarie Harbour is on the mid-west coast.

Unfortunately, Huon started fiscal 2019 behind the eight ball with a lower biomass than had been projected due to the difficult growing conditions in the second half of fiscal 2018.

On this note though management said, “While we anticipate a harvest volume for FY2019 of around 20,000 tonnes, below the record level achieved in FY2018, stronger pricing is expected to deliver continued growth in operating EBITDA.”

By comparison, Tassal articulated its commentary regarding the stronger prices in a different fashion, saying that it assisted in offsetting increased overheads.

Consequently, if Huon experiences earnings pressure because of a lower harvest and higher overheads, the rising pricing may not be enough to offset lower revenues.

However, the company expects a return to long-term average production growth in the near term which could be enough to satisfy the market given that the company is trading on a conservative PE multiple of approximately 11 relative to consensus forecasts for fiscal 2019.

Similar to Tassal, the consensus target price of $5.06 suggest there is little share price upside from Monday’s closing price of $4.98.

One of the interesting factors to keep in mind ahead of the company delivering its interim result on February 22 is the impact that high temperatures may have had on fish weights.

When the company delivered its fiscal 2018 result for the 12 months to June 30, 2018 management said, “Average harvest weights improved marginally as the record average fish weight in the first half was offset by poor fish growth in the second half due to elevated water temperatures from a long, hot summer.”

The southern states including Tasmania experienced harsh summer conditions in 2018/19, suggesting this may feature in management’s commentary regarding average fish harvest weights.

While Huon doesn’t generate revenues from seafood other than salmon, the group has a wide range of products that it distributes in Australia and overseas as indicated below.

The company also has a strong retail business which is still growing.

In fiscal 2018 the group generated 24% of revenues from its Australian retail business with its domestic wholesale business accounting for 58% of income.

Exports accounted for 14% of revenue up from 6% in the previous corresponding period.

Key takeaways to look out for in this week’s interim result aside from harvest numbers, are biomass volumes and developments regarding the group’s diversification into yellowtail kingfish, particularly if a determination is made regarding the viability of the New South Wales site.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.