APPROVED: EMD Receives Authorisation to Prescribe MDMA for Therapy

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 5,866,667 EMD shares and 2,933,334 EMD options at the time of publishing this article. The Company has been engaged by EMD to share our commentary on the progress of our Investment in EMD over time.

ASX biotechs are some of our strongest performers at the moment.

However one company is yet to have a proper run.

Today, this company announced a breakthrough that enables it to scale its potentially revolutionary treatment.

The treatment is for a condition that as many as 1 in 10 Australians suffer from and has an economic cost stretching into the billions of dollars.

And significantly more globally.

We're talking about Emyria (ASX:EMD) - Australia's leading (and only listed) psychedelic assisted therapy company.

In the US, suddenly there is big money being invested in psychedelic therapies.

Just last week, Lykos Therapeutics (formally known as MAPS) secured US$100M in a Series A funding for its MDMA treatment for PTSD.

And this treatment is not even legal yet in the US outside of clinical trials.

In Australia, the law was recently changed to allow approved psychiatrists to administer these treatments under an Authorised Prescriber Status.

Today, EMD’s specialist was granted “Authorised Prescriber Status” for its MDMA assisted therapy for PTSD

One of the first in Australia.

This is a major milestone for the company and for the industry as a whole.

Authorised Prescriber Status allows EMD’s specialist to provide MDMA-assisted therapies in its clinic in Perth as a treatment and not just in a clinical trial.

Think of this like EMD just got the “commercialisation” tick of approval from the TGA for its therapy.

Authorised Prescriber (AP) Status is hard to get.

It requires multiple submissions to the TGA, ethics approval, a tried and tested protocol for therapy delivery and strict guidelines on how the treatment can be administered.

Each specialist needs to apply individually for AP status, and only those with AP status can conduct MDMA assisted therapy outside of a clinical trial.

Now that EMD has undergone the process once, we expect that the company now has the “blueprint” for other specialists in its clinical practice to get AP status, which will allow the company to scale up its therapy offering.

This is the first step towards getting large institutions (payers) to fund therapies for its members - think Department of Veteran Affairs, Health Insurance Companies, Pension Funds etc...

Today, EMD provided an updated company presentation to outline the strategy going forward.

In there, EMD highlights just how expensive mental health services are for patients.

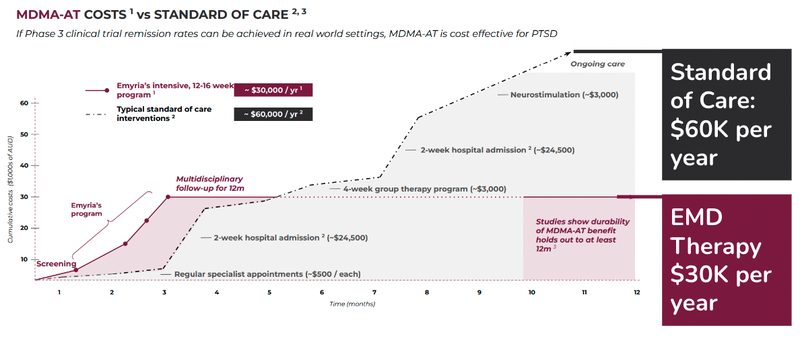

Here is how the cost of EMD’s treatment compares against the current standard of care model:

(Source)

As you can see EMD’s psychedelic assisted therapy program is expected to cost around half of what the current standard of care is.

It’s important to note the majority of the benefit can be captured in the first three months for assisted therapies, compared to the standard of care.

When negotiating payer deals, EMD will likely show this data to support the economics of funding clinical services.

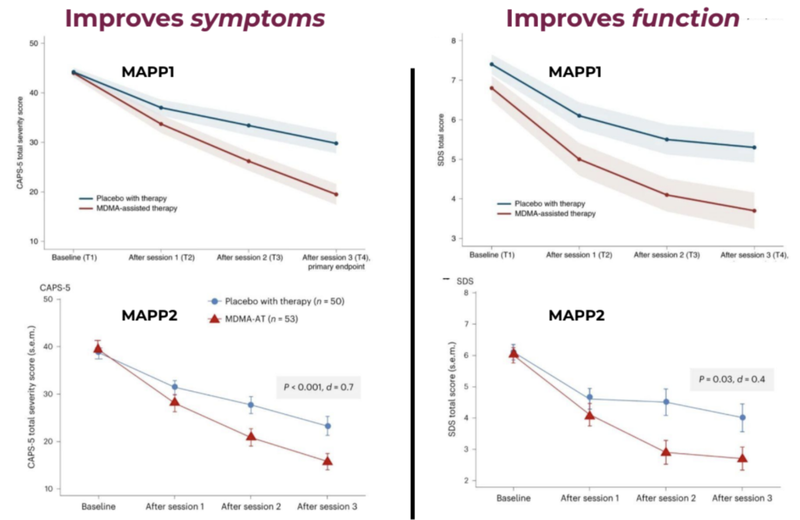

MDMA-assisted therapies are also shown to have worked through two phase three studies by MAPS (now known as Lykos Therapeutics).

The blue line shows the placebo group and the red line shows the Assisted Therapy group with improvements in function and symptoms.

A key stat from these trials is that 71% of MDMA assisted therapy participants no longer met the criteria for PTSD compared to just 47% from the placebo group.

This is a significant improvement and adds to a body of evidence that companies like EMD will be able to use to secure payer agreements for its services.

This is the ultimate goal for EMD, and, hopefully, a landmark catalyst that will support our investment in the company.

There is big interest in this space.

Just last week, the company that conducted these clinical trials, now known as Lykos Therapeutics, locked away $100M in funding to support its late-stage trials for PTSD.

(Source)

Lykos (MAPS) has done two late stage trials for PTSD, has an FDA application pending and managed to lock away a US$100M raise in an otherwise tough fundraising environment.

EMD is the first mover in Australia, has a phase 2B trial ongoing, has distribution networks in place AND is currently capped at ~A$21M.

Our view is that as the macro drivers behind MDMA assisted therapies get stronger, capital will start pouring into the space, and EMD will be best positioned to benefit from capital inflows.

Big Bet for EMD

“EMD re-rates to a +$300M market cap by making a breakthrough with one or more of its clinical trial programs (MDMA, psilocybin, ketamine, CBD) while rapidly growing the footprint of its mental health treatment clinics”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EMD Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What does EMD actually do?

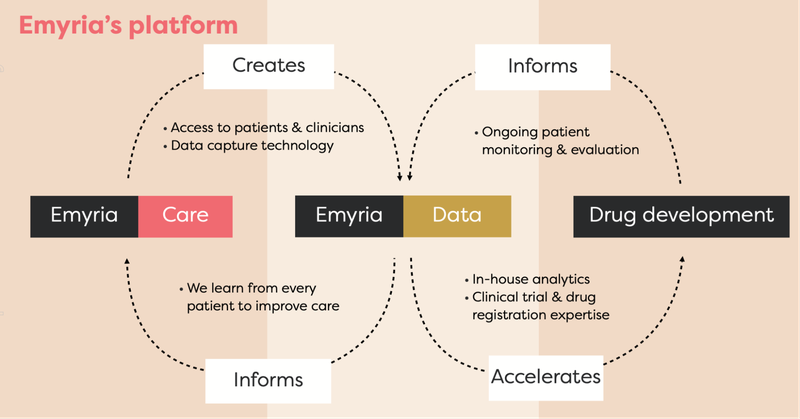

EMD is an “integrated clinical drug development and care delivery” company.

EMD’s primary area of focus is on psychedelics such MDMA, psilocybin and, more recently, ketamine.

The company is looking to use these drugs to support treatments for mental health problems- first targeting PTSD, and then expanding into other areas.

EMD has an integrated business strategy because it has:

- Treatment centres - places where treatments can be administered with wrap-around care, i.e. providing a full suite of practitioners such as psychiatrists, mental health nurses, psychologists, counsellors, OTs, social workers, physical therapists.

- Treatments - EMD can legally source the drugs, which include psilocybin, ketamine, MDMA and an ongoing drug development program into analogues, aiming to make the treatment work better for a range of conditions.

- Data - EMD collects and owns valuable patient data to help improve its drug treatments and therapy programs.

EMD was in psychedelic therapy, the sector BEFORE the Therapeutic Goods Administration (TGA) down-scheduled psychedelics for mental health in early 2023.

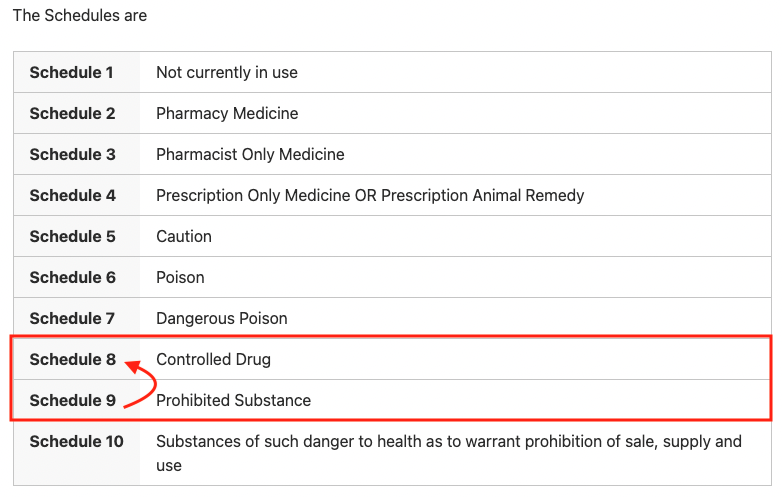

The TGA is the regulatory body that governs drug development and medicines in Australia.

Each particular medication has a “schedule”, the lower the schedule (generally) the safer and more accessible the medicine.

Early last year psychedelics moved from a “Schedule 9” prohibited substance to a “Schedule 8” controlled drug.

This meant that it could be administered by people with a special status - Authorised Prescriber status.

Australia is the first country in the world to do this, providing a commercial “global head start” for any local biotech developing psychedelic and MDMA based treatments.

We think enabling the use of psychedelics to treat mental health conditions could be one of the biggest evolutions in psychiatry in the last 70 years.

Especially when the psychedelic treatments are coupled with powerful data driven insights and definitive clinical trial data.

That’s what EMD is aiming to deliver.

And Australia made it possible.

With a breakthrough treatment on the cards, Australia’s new regulatory regime generated headlines around the world:

EMD is effectively a first mover in an entirely new industry...

AND today, it became the first community-based clinic in Australia to have a specialist successfully achieve “Authorised Prescriber Status” under the TGA’s regime.

This means that EMD will be able to administer MDMA-assisted therapies outside of a clinical trial - thus allowing the public to access its treatments.

As an out-of-pocket expense, the treatment is expensive for the everyday person, at around $30,000 per year.

However, the goal is to get this cost covered by a payer like a health insurance company, given that it is cheaper than the estimated standard of care at $60,000 per person per year.

In order to do this EMD needs to show that its therapies are safe and effective and treat mental health conditions like PTSD.

To do this, EMD has recently started a Phase 2b trial.

MDMA - the new frontier of mental health treatment

Mental health issues in Australia are prevalent.

Over 40% of Australians experience some mental health issues over time.

Drug development in this space has been fleeting, with antidepressants the last major therapeutic treatment for mental health issues.

However, 1 in 5 patients who are administered antidepressants are resistant to the treatment (source), and this medication doesn’t support other mental health issues like PTSD.

MDMA has been shown to be an effective treatment, when used in combination with psychotherapy, to treat mental health disorders like PTSD.

In September last year, Lykos (formerly known as MAPS) published a study that showed 71.2% of those in the MDMA-AT group no longer had a PTSD diagnosis, versus 47.6% in the placebo group.

See our detailed take on Lykos data here: More on why the MAPS study matters for EMD

Just last week, the company that conducted these clinical trials, now known as Lykos Therapeutics, locked away $100M in funding to support its late-stage MDMA trials for PTSD.

Key takeaways:

- Lykos officially launched a for profit biotech company - MAPS rebranded as Lykos Therapeutics as a for profit biotechnology company to advance MDMA assisted therapies

- Lykos lodged a new drug application with the FDA - Lykos now has a new drug application to the FDA to use MDMA in concert with talk therapy last month, becoming the first to ask regulators to approve a psychedelic as a therapeutic product. IF approved it would be the first psychedelic-assisted therapy accepted by a US federal regulator.

And the big one...

- Lykos raised US$100M - Lykos raised US$100M in Series A funding. The capital raise was led by Helena and had some heavy hitters involved including billionaire Steve Cohen’s family foundation, True Ventures and Satori Neuro.

Lykos (MAPS) has done two late stage trials for PTSD, has an FDA application pending and managed to lock away a US$100M raise in an otherwise tough fund raising environment.

EMD is the first mover in Australia, has a phase 2b trial ongoing, has distribution networks in place AND is currently capped at ~A$21M.

With Authorised Prescriber Status for one of its specialists, EMD has put itself in a strong position to be a market leader in the space.

Getting to Authorised Prescriber Status is no easy task either...

It requires multiple submissions to the TGA, ethics approval, a tried and tested protocol for therapy delivery and strict guidelines on how the treatment can be administered.

Because EMD has done this before, we expect the company will be able to do it more efficiently with other physicians on its books and scaling up its MDMA-assisted therapy offering.

Also, any clinicians that want to work in the space or want to get themselves listed as “Authorised Prescribers”, may be able to come to EMD to licence its blueprint/protocol for MDMA assisted therapy.

Why is AP status important?

A psychiatrist who wants to administer MDMA-assisted therapy needs AP status before it can do so.

Anyone interested in accessing MDMA-assisted therapy will need to go to a psychiatrist with AP status (or participate in a clinical trial).

As EMD currently has a specialist with AP Status, a facility to run the therapy and the MDMA supply needed, it is the only place (right now) for the public to access this therapy.

This is the first step in EMD’s commercialisation strategy.

Scaling EMD’s clinical offering

Late last year EMD appointed a new Chairman Greg Hutchinson.

Greg is a gun at scaling clinical services offering novel new treatments - which is exactly what EMD wants to do.

Mr. Hutchinson was instrumental to the growth of Sonic HealthPlus which is a subsidiary of ~$13.8B capped, Sonic Healthcare Ltd. (ASX: SHL).

During Greg’s tenure as the CEO of Sonic HealthPlus, the company became one of the largest providers of occupational and community medical services in Australia, with over 7,000 active clients across 40 different locations.

We think this hire highlights the direction of the company - and that is to scale up its clinical offering, and become a juggernaut in the mental health space.

The pieces are now falling into place for EMD.

To read our full take on the new chairman hire read: EMD first mover in psychedelic care market

What’s next for EMD?

MDMA-AT Phase 2b patient recruitment updates 🔄

We want to see EMD recruit all 72 patients into the trial so that we will have a timeframe for results.

These results will show how effective EMD’s protocol is at treating PTSD and will support commercial negotiations with payers to cover the cost of MDMA-Assisted Therapies for its members.

Animal study results for fast-acting MDMA analogue 🔄

EMD is developing its own analogues (modified versions of the drug that work better). These tests are currently being run on animals and we want to see if EMD publishes positive results here.

Approval for ketamine assisted therapy protocol 🔄

EMD has a pending application for a ketamine assisted therapy trial.

Secure key approvals for psilocybin use 🔄

EMD has a pending application for psilocybin use in an assisted therapy trial.

Secure a major payer partnership (we see this as a major catalyst) 🔲

If EMD is able to secure a payer for its treatments, we think this would be a major catalyst for the company.

What are the risks?

Clinical Trial Risk

There is no guarantee that EMD will be able to show that its Assisted Therapy programs will be more successful than a placebo in a clinical setting.

Regulatory Risk

EMD is working in a heavily regulated space.

The company will have strict guardrails on what it can and can’t do thus limiting the speed at which it can move and potential innovation.

Funding Risk

Small caps often need to raise cash to fund their growth.

Whilst EMD is generating revenue now, it is still making a loss - i.e. it spends more cash than it brings in. If EMD is unable to develop a self-sustaining business model with positive operating cash flow, this could require EMD to raise capital in the future, likely at a discount to market prices to secure funds.

Our EMD Investment Memo

In our EMD Investment Memo, you can find:

- EMD’s macro thematic

- Why we Invested in EMD

- Our EMD “Big Bet” - what we think the upside Investment case for EMD is

- The key objectives we want to see EMD achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.