America votes – you’re fired – ESG now front and centre

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The US election highlighted the importance of ESG (environmental, social and governance) issues with voters keenly focused on policies relating to climate change, including stances on the renewable energy sector.

Human rights issues were also at the forefront of voters' minds in areas such as equal access to medical resources, addressing escalating racial problems or instigating gender equality reforms.

But before the election was even decided, good governance and appropriate social protocols were sadly lacking in comments made by the incumbent president.

In part, Trump said, ‘’This is a fraud on the American public. This is an embarrassment to our country. We were getting ready to win this election, frankly we did win this election. We did win this election. So our goal now is to ensure the integrity for the good of this nation, this is a very big moment. This is a major fraud on our nation. We want the law to be used in the proper manner.

In stark contrast, Biden was much more measured as results came to hand and key takeaways from his victory address included commitments to bringing together a seemingly divided nation by addressing key issues such as health care and human rights, while also highlighting that ‘’science’’ would be central to his vision of transforming America into a smarter and more sustainable country.

Consequently, we should be in for a period of far greater stability with a strong focus on issues that come under the ESG banner, a factor that should significantly impact investment strategies.

What are the hallmarks of an ESG investment portfolio

Those who adopt ESG investing as a key criterion are interested in the impact of their investments on issues beyond clinical financial outcomes with one of the most prominent emerging themes in recent years being environmental responsibility.

From an environmental perspective, investors assess a company’s underlying business and its strategies on the score of their ability to provide sustainable solutions with energy being a key area of focus.

It took a while for investors to warm to this form of investing because there was an initial school of thought that enterprises embracing these issues would do so at the expense of profitability.

However, this has changed as investors have seen examples of an alignment between the quantum of stakeholder returns and commitments to ESG.

Indeed, workplaces that prioritise optimum efficiencies in areas such as equality are viewed to be more harmonious which in turn leads to improved productivity.

ESG now viewed as an earnings driver

Employing sustainable practices is now viewed as a positive measure of efficiency rather than a burden.

Australian Ethical Investment Ltd (ASX: AEF) is a prime example of a company that has attracted the attention of ESG focused investors in recent years.

Chairman Steve Gibbs recently addressed the sustainability/profitability debate as he discussed the group’s performance in fiscal 2020.

In part, he said, ‘’The world is now facing multiple crises with COVID-19 and climate change perpetuating existing social fractures and inequality.

‘’Thankfully, the relative outperformance of responsible funds such as ours have fundamentally dispelled the long-held stereotypical view that investing responsibly means sacrificing investment returns.

‘’The question now is whether the world will use this moment and the power of responsible investing to build a less carbon-intensive future.

‘’Sustainability has always been at the heart of our business and as pioneers of responsible investing we are in a strong position.’’

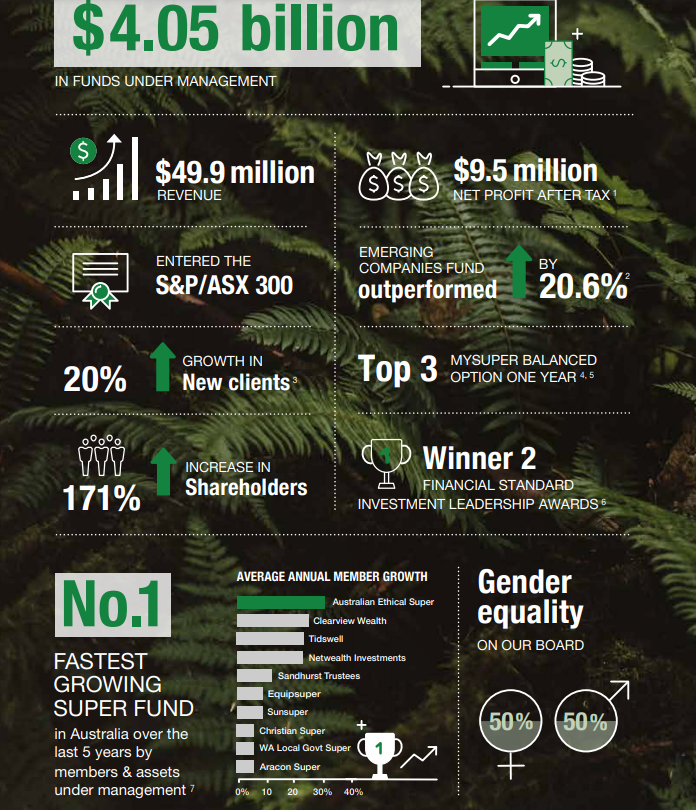

The following is a snapshot of AEF, a group that has been the fastest growing superannuation fund by members and assets under management over the last five years.

Notably, AEF’s portfolio of companies produced 75% less CO2 than the benchmark while increasing its investment in renewable power generation at a rate of five times the global sharemarket.

The company also achieved an important milestone during the year in terms of its rise as an ASX listed entity with its inclusion in the S&P/ASX 300 index, a development that should see it targeted more actively by institutional investors.

The performance of the group’s Emerging Companies Fund (+20.6%) is also worth noting, particularly in light of some companies we will feature that provide direct exposure to the ESG thematic.

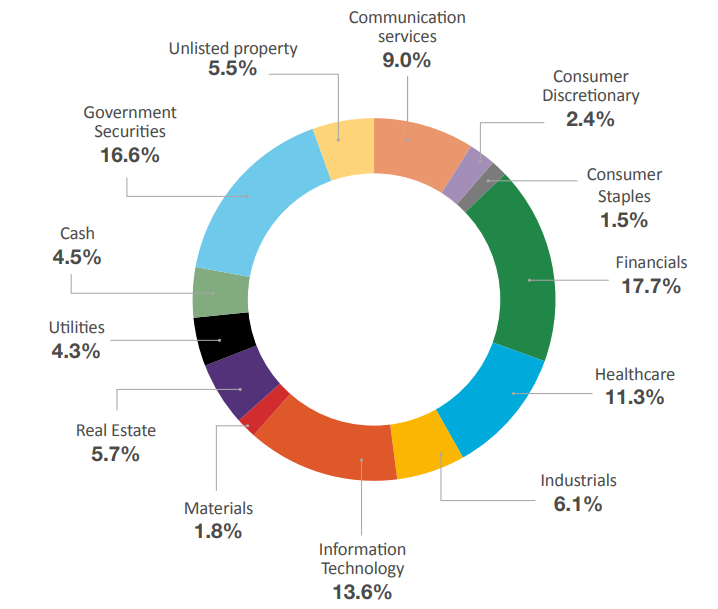

The following graphic indicates the industry breakup of AEF’s investments.

Aside from government securities and financials, there is a notable skew towards information technology (13.6%), healthcare (11.3%) and communication services (9%), sectors that often facilitate strong social and environmental outcomes by virtue of the services and technologies they offer (e.g. healthcare - hospitals/drug development; technology – clean/renewable energy initiatives).

Examples of technology’s contribution to ESG in the global environment

Across all markets, companies that have carved out a niche in the pursuit of delivering products and services that are going to improve sustainability have been well sought after by investors.

This has been particularly evident in the equities space with companies such as electric vehicle developer Tesla Inc (NASDAQ:TSLA) emerging as market darlings over recent years.

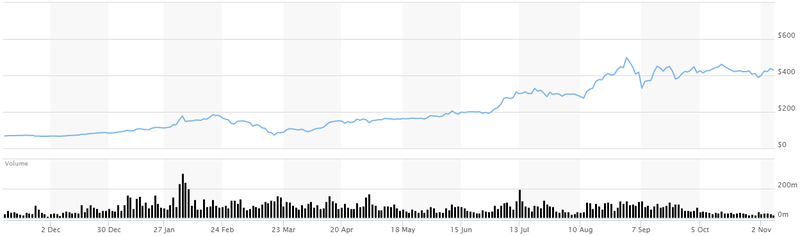

As the following chart shows, Tesla's shares have really surged in the last 12 months, increasing eight-fold from US$62.90 to a high of US$502.49 per share.

While they have retraced from that height, now trading in the vicinity of US$430 per share, this is still an outstanding gain and it could be argued that much of the recent share price weakness can be attributed to broader volatility in equities markets.

However, don’t be surprised to see plenty of support for Tesla following Biden’s election win as his strong commitment to ESG themes, particularly in relation to the environment embraces issues such as the promotion of renewable and sustainable energy technologies.

He also noted that science was very much a lever to be used to achieve such goals, and this is consistent with the likes of AEF heavily supporting sectors such as information technology, communications and healthcare.

Benefits of investing in emerging ESG companies

Aside from politics, it is important to gain an understanding of some of the key investment areas that come under the banner of environmental, social and governance.

Environmentally responsible enterprises actively avoid activities that could have a detrimental impact on air, land, water, ecosystems and human health.

Consequently, such organisations prioritise resource management and take initiatives that will assist in preventing pollution, reducing emissions and climate impact.

Avoiding or minimising environmental liabilities, lowering costs and increasing profitability through energy and other efficiencies, and reducing regulatory, litigation and reputational risk are without doubt beneficial for the bottom line and generally foster a sense of corporate support from like-minded organisations and consumers.

In fact, more than any time in the past, ESG factors, particularly those that relate to sustainability and environmental factors are influencing consumer spending.

Because of their elevated importance to the corporate world, substantial opportunities are presenting themselves for emerging companies which, harking back to AEF’s fiscal 2020 result, was a sector that outperformed to the tune of more than 20%.

Focusing on technology driven companies with bedrock science

Consistent with AEF’s asset allocation we are focusing on companies that are tech-centric, and in Biden’s words, ‘’bedrock science’’ is at the heart of their developments.

Further, most have already drawn interest from large corporates, and particularly in the electric vehicle industry they are ideally positioned to supply new age products to the likes of Tesla.

It is worth noting that the electric vehicle industry is only in its infancy, and almost on a daily basis we are seeing examples of new innovations that will broaden the applications of EV technologies.

In the early days, it appeared that the capacity of an electric vehicle in terms of power and range would see it limited to smaller cars travelling relatively moderate distances.

Now it is being embraced by the manufacturers of heavy duty trucks, and it was recently reported that luxury car maker Bentley would cease manufacturing fossil fuel cars by 2030, with a view to becoming completely carbon neutral.

This is a notable event as the company is renowned for its 12 cylinder petrol engines that have large carbon dioxide emissions.

Electric vehicle industry to drive COVID recovery

The electric vehicle industry is also seen by countries such as France and Germany as being central to a multi-billion Euro economic recovery.

It was recently reported in ‘Renew Economy - Clean Energy Use and Analysis’ that French president Emmanuel Macron will seek to jump-start the local auto industry decimated by the coronavirus pandemic with an €8 billion ($A13.2 billion) plan that includes a major boost for electric vehicles.

From a broader perspective, the increased focus on the renewable energy industry has been highlighted even further with the European Union unveiling a €750 billion ($A1.2 trillion) plan for a climate-led economic recovery from Covid-19 that puts investment in renewable energy, clean transport, smart energy and emissions reduction at front and centre.

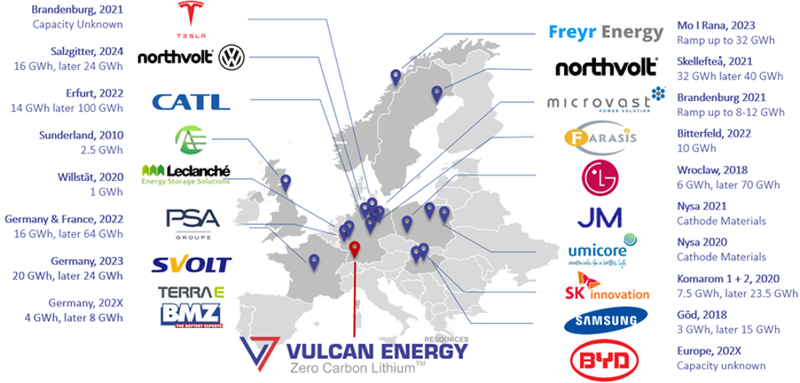

Given this backdrop, it makes sense for Australian investors looking to gain exposure to the trend to focus on companies positioned within Europe, particularly those with ready access to the large automotive manufacturing hubs.

Europe is expected to become the second most important centre (after China) of the global electric car and battery industries.

Euro Manganese - Chvaletice Manganese Project

Euro Manganese’s (ASX:EMN) principle business and current focus is the evaluation and potential development of the Chvaletice Manganese Project (CMP), which involves the re-processing of a manganese deposit hosted in historic mine tailings in the Czech Republic in order to produce high-purity manganese products in an economically, socially and environmentally-sound manner.

High grade, high purity manganese is used as a primary cathode material in lithium-ion manganese batteries or NCM batteries, and research has indicated that it increases performance and recharging capabilities.

Six large battery factories that will consume manganese inputs are located between 200 kilometres and 400 kilometres of the Chvaletice Manganese Project.

Several prospective customers have expressed interest in procuring high-purity manganese products from the Chvaletice Manganese Project, and in testing and qualifying the products of the proposed Chvaletice demonstration plant.

These parties have included manufacturers of electric vehicle batteries and related chemicals who aim to design precursor and cathode formulations, in combination with available nickel, cobalt and lithium products, as well as chemical, aluminum and steel companies.

The proposed environmental aspect of the CMP development is an important factor as EMN’s plans not only involve the production of a commodity but also environmental rehabilitation and recycling.

Management envisages a 25-year project operating life producing 1.19 million tonnes of HPEMM, two-thirds of which is expected to be converted into HPMSM.

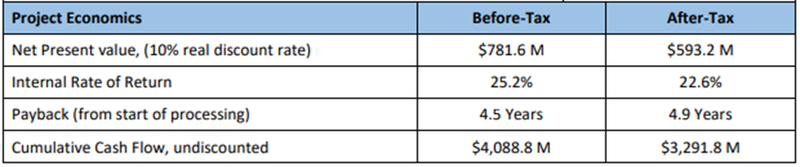

The above metrics further serve to demonstrate that ESG investing can provide leverage to highly profitable enterprises.

Vulcan Energy Resources - Zero Carbon LithiumTM

The same industry dynamics should serve to support Vulcan Energy Resources’ (ASX:VUL; FWB:6KO) quest to bring its Zero Carbon LithiumTM product to market.

Vulcan is advancing its projects in Germany’s Upper Rhine Valley with the aim of becoming the world’s first producer of a premium battery-quality, net Zero Carbon LithiumTM hydroxide product by co-producing lithium hydroxide and renewable, geothermal energy from the same geothermal brine.

Harking back to EMN’s Chvaletice Manganese Project, one of the most compelling aspects of the proposed project is that the production process will have positive environmental benefits.

Similarly, not only will Vulcan’s lithium product supply the green energy focused European lithium battery market, but the process facilitates the co-generation of geothermal energy from production wells, resulting in power lithium extraction at zero net carbon.

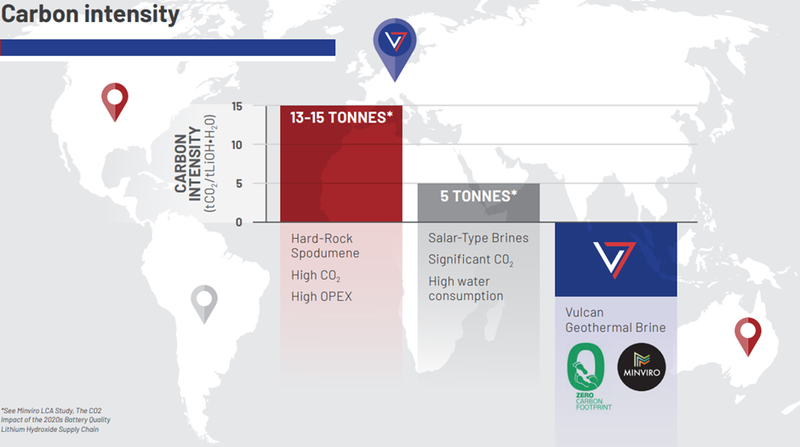

In fact, as indicated below, the CO2 intensity of VUL’s project is the lowest compared to any lithium project/production method worldwide.

Vulcan boasts Europe’s largest JORC lithium resource - a globally significant 13.95 million tonnes contained lithium carbonate equivalent (LCE) at two of its six licences.

Of this, 13.2 Mt LCE is in the JORC Inferred category on its 100%-owned Ortenau license.

The lithium product will supply the growing European lithium battery market, linked predominantly to the electric vehicle market.

Vulcan has successfully completed initial bench-scale test work on Upper Rhine Valley geothermal brine using adsorbent-type direct lithium extraction (DLE) technological approaches.

The company has a resource that can satisfy Europe’s needs for the electric vehicle transition from a zero-carbon source for many years to come, but just as importantly, it has proprietary technology that provides a competitive advantage and significant barriers to entry.

Importantly, Vulcan managed to complete its maiden resource and scoping study in just five months and it is fully funded to fast track feasibility studies with a PFS expected to be completed by the end of year as the company targets commercial production by 2023.

While Europe is the fastest growing centre for EV battery production in the world, ironically there is no local supply of battery quality lithium chemicals with 80% of the current supply of high carbon footprint lithium hydroxide coming from China.

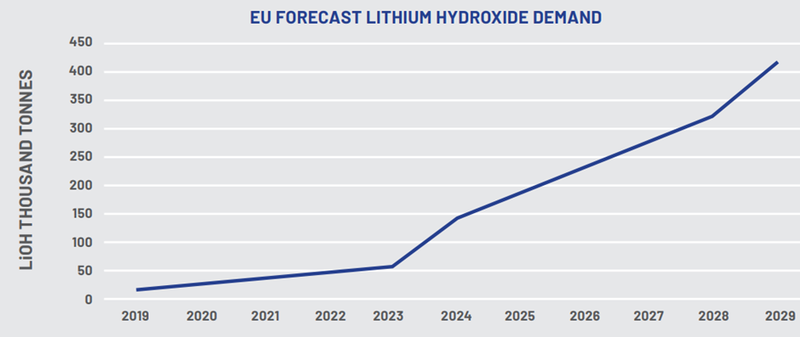

The following graph demonstrates the impact of emerging industry change with a sharp uptick in forecast demand for lithium hydroxide commencing in 2023.

MyFiziq - bedrock science in the palm of your hands

Bearing in mind that both tech and healthcare companies were a key focus for ESG investors, MyFiziq (ASX:MYQ)’s to be an ideal fit, being a combination of the two.

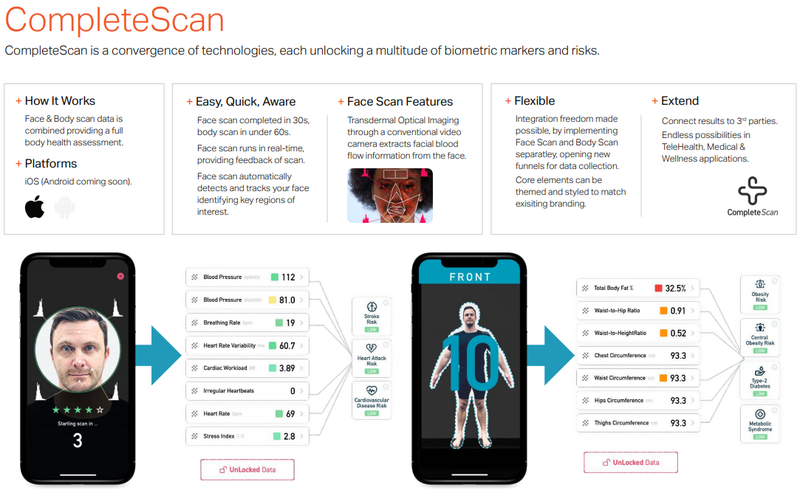

The company has developed and patented a proprietary dimensioning technology that enables its users to check, track, and assess their dimensions using only a smartphone privately and accurately.

The group’s goal is to assist its numerous partners across the tech and healthcare sectors by empowering their consumers with this capability.

This in return provides its partners with the ability to assess, assist, and communicate outcomes with their consumers when navigating day to day life.

MyFiziq’s technology is consistent with achieving the outcomes highlighted by the President-elect’s administration in that it provides consumers with a technology to assist in taking charge of their own destiny in an economical and personal way.

Furthermore, the group’s technologies employed in concert with their partners can potentially assist in reducing healthcare costs because of self-monitoring benefits and the associated preventative measures that can be adopted before chronic medical conditions take hold.

In October, the company signed a binding term sheet with Nexus-Vita Pte Ltd, a Singapore-based health monitoring and management technology company.

The goal of Nexus is to bring together leading global technologies into a single environment for an individual or organisation to then manage user care and understand their health on an individual basis.

Nexus-Vita has developed a medical health and wellness platform that is the bridge between an individual’s medical health and wellness management with the aim of reducing health costs for individuals, governments and the healthcare and insurance systems across the globe.

The platform is using state of the art record-keeping protocols in a singular digital platform where an individual can save their records and share them with their doctor, personal trainer or lifestyle advisor.

Nexus can drastically improve lifetime health, reduce the need for medical interventions, and save costs and resources for the user and health systems through its partnership with MyFiziq and the use of its CompleteScan technology.

Nexus stores and maintains these records for the individual or organisation, allowing easy access to enable health surveillance and monitoring with the goal being the identification of early health indicators and aggressive pre-emptive care enforcement.

The pre-emptive health platform is to monitor, improve and engage with a user for better quality of life, while also reducing user spending on medical treatment, and tempering interactions with the medical system.

With medical facilities and personnel stretched to their limits globally and further compounded by significant worldwide economic downturn and job losses as a result of the COVID-19 pandemic, Nexus’s solution is designed to improve health outcomes, saving individuals, insurers and government’s substantial costs while also helping to reduce the burden on the global medical facilities and supply chains.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.