All stakeholders to drive demand for AssetOwl technology

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Despite positive news flow over the last 12 months that has resulted in some sharp share price spikes it has been somewhat of a rollercoaster ride for enterprise property management platform provider AssetOwl Ltd’s (ASX:AO1) shareholders.

However, news released last week appears to have not only provided a significant share price uptick of about 30%, but the company has managed to hold on to most of the gains since its shares doubled in July/August.

Last week’s news was extremely important from an operational perspective with the company announcing the commercial release of Inspector360, the revolutionary next generation of its photo-centric property management platform.

The Inspector360 app is now available for download from the Google Play store and Apple’s App Store to mobile and tablet devices.

Highlighting the significance of this development, earlier in the year the company’s shares increased three-fold when management announced that it had negotiated a partnership agreement with a leading property inspection service provider to bring Inspector360 to market.

Inspector360 builds on AssetOwl’s existing residential inspection software, InspectorAsset, which uses virtual reality technology to create an internal view of a property to assist all stakeholders before, during and at the conclusion of a tenancy.

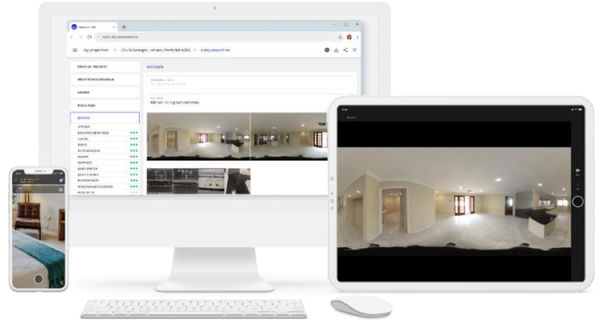

As indicated below, the Inspector360 platform can be used on desktop, tablet and mobile devices.

Other property majors working with Asset Owl

Commercial rollout has commenced with acceptance trials through RE/MAX WA, part of a 120,000-strong network of agents active in over 100 countries and territories.

Having completed development of Inspector360 v1.0, AssetOwl is now focused on refining the user experience and stability at scale of the platform’s key functions.

These include providing tenants, property managers and landlords with an exact record of the condition of residential properties during a tenancy and when tenants move in and out, using AssetOwl’s proprietary virtual tour technology to create an internal view of a property.

The platform also provides speech-to-text conversion of verbal descriptions of the apartment or house, which is then integrated with the property report, optimising the paperless condition report workflow between property managers and tenants during the entry inspection process.

AssetOwl is in the process of finalising full contracts with RE/MAX and with other parties that have been working with AssetOwl to aid development of Inspector360, including Colliers International (WA), PCR & Inspection Services, The Agency and Attree Real Estate.

All parties benefit from the technology

Highlighting the revolutionary impact this has on the industry and the significant value add for all parties to the rental agreement, chairman, Simon Trevisan said, “The release of Inspector360 into the Australian property management market is a milestone event for the company.

‘’My fellow director Geoff Baldwin and I collectively have over half a century’s experience in the residential real estate sector.

‘’Drawing on this experience supports our view that Inspector360 has the ability to revolutionise the way house inspections are done, creating substantial value for tenants, managing agents and owners by both bringing significant economic efficiencies and greatly improving the qualitative outcomes.

‘’We will continue to enhance Inspector360 to ensure the platform stays at the cutting edge of the property software market.

‘’This will underpin our value proposition to AssetOwl’s customers, their end-users and to our investors.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.