9 Spokes surges on contract with Bank of America

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Leading provider of marketplace and insights data to small businesses, 9 Spokes (ASX:9SP), has entered into a formal contract with Bank of America to provide its small business (SB) customers with access to a white-labelled platform powered by 9 Spokes for an initial period of three years.

This news triggered strong investor interest with the company’s shares up 12% to 2.8 cents at one stage under some of the highest volumes recorded this year.

The platform will provide the bank’s SB customers with a holistic view of their finances, including integrated key third party solutions that owners need to manage their businesses.

While management didn’t quantify the financial terms of the contract, it did confirm that it would have a material impact on 9 Spokes revenue.

However, this represents more than simply a one-off contract win as it is a vindication of management’s confidence in pushing ahead with its strategy of bringing big financial institutions on-board.

On this note, Adrian Grant, co-founder and chief executive of 9 Spokes said, “Working with a large American Bank and bringing our SB Platform to the largest and most entrepreneurial economy in the world has been a key part of our vision at 9 Spokes.

‘’So, today marks a major milestone in delivering on that vision and we could not be more delighted that Bank of America is working with us on this journey.”

Builds on BNZ and OCBC

Of course, this comes on the back of the company forging a banking partner contract with the Bank of New Zealand (BNZ), the group’s first Microsoft One commercial partner co-sell success.

The relationship with Microsoft also represents a strong endorsement of the group’s management team and the functionality of its resources.

Also, Asian financial institution, OCBC Bank went live in January 2019

In being patient, the company is now in a position to continue to approach larger organisations, but arguably much better placed to attract mid-size businesses that see the relationship with Bank of America as an endorsement of 9 Spokes’ product and services offering.

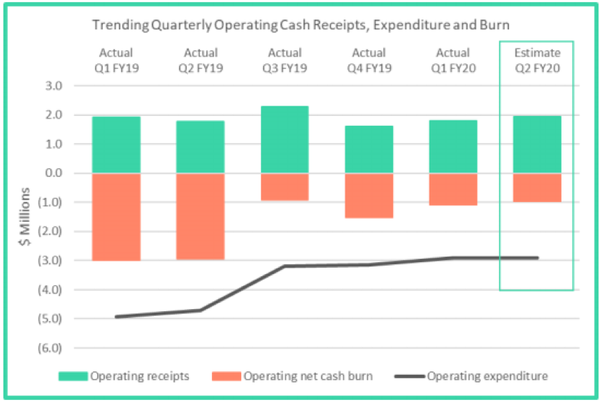

You can see that this is starting to be reflected in the group’s financial performance with operating cash burn falling dramatically, while cash receipts are building at a steady pace.

Efficiency enhancing products are generally resilient

As a backdrop, 9 Spokes is a tracking tool designed to help Small and Medium Businesses (SMEs) enhance their performance and be their best business self.

It collates and sorts the SME's data, so they can more easily see their progress against the things that matter most to their business.

SMEs can connect their cloud software to 9 Spokes to get a comprehensive picture of their business performance through a single smart dashboard-so it's easier to make the big and small decisions required to manage and grow their business effectively.

As well as connecting their existing supported software to the dashboard, businesses can choose from a selection of other recommended and accredited apps to suit their industry.

9 Spokes is provided under a direct model to small businesses and as a white-labelled platform allowing banks to offer 9 Spokes to their SME customers under their own brand, as is the case with the Bank of America contract.

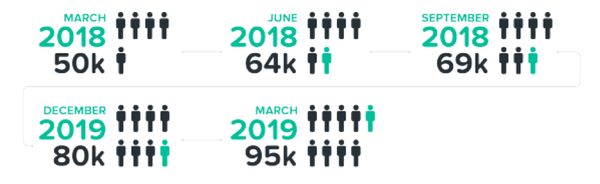

As at March 31, 2019 the total number of users had reached 95,000, an increase of 90% compared with previous corresponding period.

Traditionally it has been the case that providers of performance enhancing products and services tend to negotiate difficult market conditions relatively well as this is an area that small businesses will continue to invest in as it is seen as even more relevant during challenging periods.

Important fit with Business Advantage 360

Bank of America’s digital strategy includes integration of the 9 Spokes platform into Business Advantage 360, the bank’s innovative cash flow dashboard for SB customers.

The bank introduced Business Advantage 360 to make it easier for entrepreneurs to manage the various financial aspects of their business.

Available for the first time to any Bank of America client with a business deposit account, Business Advantage 360 provides a complete view of business cash flow and access to real-time expertise and guidance – all in one simple tool with new functionality.

With more than 9 million clients who own small businesses, Bank of America is committed to delivering a seamless experience across all channels, making it easier than ever for clients to manage their finances and gain a competitive business advantage.

In addition to Business Advantage 360, Bank of America offers a streamlined small business mobile lending experience and launched business advantage relationship rewards, the most comprehensive multi-product rewards program available in the small business banking space.

Consequently, 9 Spokes has teamed up with the ideal partner in terms of its commitment to the small business sector.

9 Spokes by its own admission set out with the ambitious goal of establishing a global presence from which to scale.

The company is achieving this by partnering with dominant brand banks in each of its target markets (US/Europe, UK, Asia and Australasia).

With Bank of America now on board, the strategic foundation for this strategy has been well and truly cemented and positions 9 Spokes exceptionally well to broaden its sales efforts to other SB banks by capitalising on a strong pipeline of interest and to scale the business as the leading data insights platform globally.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.