4 Pines Brewery goes solar as record-breaking weather becomes the norm

Published 01-FEB-2019 12:38 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The past fortnight has seen record-breaking heatwaves in Australia, and on the other side of the globe, the US has gone into deep freeze lockdown mode that includes six states suspending postal services.

The enormous blast of frigid air sweeping through the country’s Midwest is on track to slam dozens of cold temperature records along the way. Already, the deaths of three people have been attributed to the nation-wide cold snap, and resulted in temperatures lower than those in Antarctica. Authorities have warned of ‘instant frostbite’ for skin exposed to outside air, in certain locations.

This Forbes article summarises how rising Co2 and climate change is responsible for the freezing temperatures being experienced by the US.

Extreme temperatures and extreme weather events related to human-made climate change are already here — and yet, governments of developed nations are still squabbling over not just the urgency of the issue but, in some cases, the very existence of the problem itself.

This week, NSW’s Darling River saw another mass fish kill. Unknown numbers, but surely in the hundreds of thousands of fish, have died yet again at Menindee, where the town is suffering through an ongoing ecological disaster brought on by extreme temperatures and drought.

The Darling River system is in dire straits, and many of the township’s residents are now being forced to buy water that’s safe to drink and wash in.

Is this the end times? You’d be forgiven for asking yourself, when each day, there’s a new weather record somewhere in the world, or a bizarre and extreme weather event filling the headlines.

The planet’s systems appear to be faltering one by one, in rapid succession, and it’s now difficult to embellish the size or urgency of the problem.

Still, we rely on the businesses (like the one below) to tackle what some governments, including Australia’s, are refusing to face.

4 Pines brewery crowdfunds a greener future

This week, Sydney craft beer brewery 4 Pines has crowdfunded $100,000 from retail investors to build solar panels at its Sydney craft brewery.

More and more, owners of property are deciding to invest in their own renewable energy source, in place of other options.

4 Pines raised the money in an incredible 17 minutes, and will now have the cash for a 100kW solar system.

Investors taking part in the crowdfunding will receive a projected return of ~8% based off 20-year historical data on sunshine radiation and usage patterns. Behind 4 Pines’ venture is Pingala, ClearSky Solar Investment and Smart Commercial Solar.

Warren Yates from ClearSky referred to it as a “new class of investment” which could offer investors predictability, and with only one true risk area — the unlikely event of the end users going bankrupt.

Green Keeper limelight — US green mid-cap REGI:NASDAQ

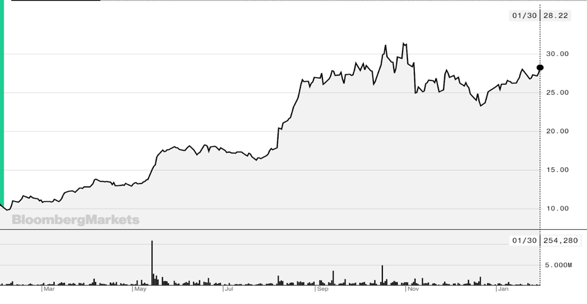

US mid-cap Renewable Energy Group Inc (REGI:NASDAQ), a company which produces biomass-based diesel and biofuel and develops renewable chemicals, has taken the US market by storm in the last 12 months.

The latest news is that ExxonMobil has just signed a joint research agreement with Clariant to evaluate the potential use of cellulosic sugars from sources such as agricultural waste and residues to produce biofuel.

If you aren’t familiar with biofuels, they are liquid fuels derived from materials like waste plant and animal matter. The two types produced in Australia are bioethanol and biodiesel (used to replace or supplement petrol and diesel in cars).

The partnership with ExxonMobil, REGI and Clariant builds on joint research between Exxon and REGI proving the ability for REG Life Sciences’ bio-conversion technology, which creates biodiesel through a single-step process using sugars from cellulosic biomass.

REGI has soared ~163% in the last year.

It’s an impressive performance, prompting a throng of new investors hungry for a similar green-tech bandwagon to jump on.

On the ASX, there are plenty to choose from, including bioplastics, solar, wind power, hydrogen and more — skim back over the Green Keeper columns of the last six months to get inspired.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.