The $22M Aussie Junior Backed by a $10 Billion Mining Giant

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mining giant South32 Limited (ASX: S32) doesn’t back projects it doesn’t believe in.

The $10.8 billion capped S32 only invests in exploration projects that it believes will create shareholder value. This is integral to its strategy, as the company consistently looks to reshape and improve its portfolio.

One way it does this is with alliances with ASX juniors, focusing on major discoveries within greenfield jurisdictions.

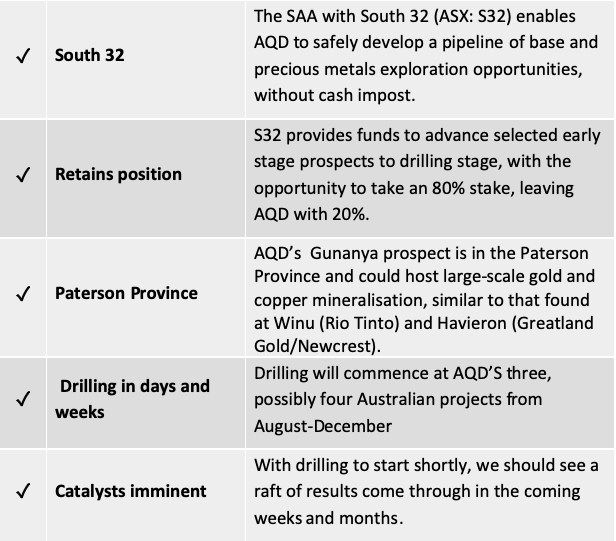

S32 has a Strategic Alliance Agreement (SAA) with today’s company to develop a pipeline of base and precious metals exploration opportunities with a focus on Australia, but with a Peruvian project as well. The relationship between the pair began in 2017, with S32 providing funds to advance selected early stage prospects to drilling stage.

The company is AusQuest Limited (ASX:AQD).

In 2018, AQD received approximately A$9.5 million from S32 for exploration programs and for ongoing project generation. It was approximately $7 million in 2019. Earlier this year, its SAA with S32 was extended for a further two years to at least the end of 2021.

All funding to advance projects to a drill-ready stage form part of the total earn-in expenditure of US$4.5 million for South32, entitling it to acquire a 70% interest in each project. South32 can then earn an 80% interest in each project by completing a pre-feasibility study.

Investors should note that AQD retains a 20-30% interest in what could be multiple Tier 1 opportunities.

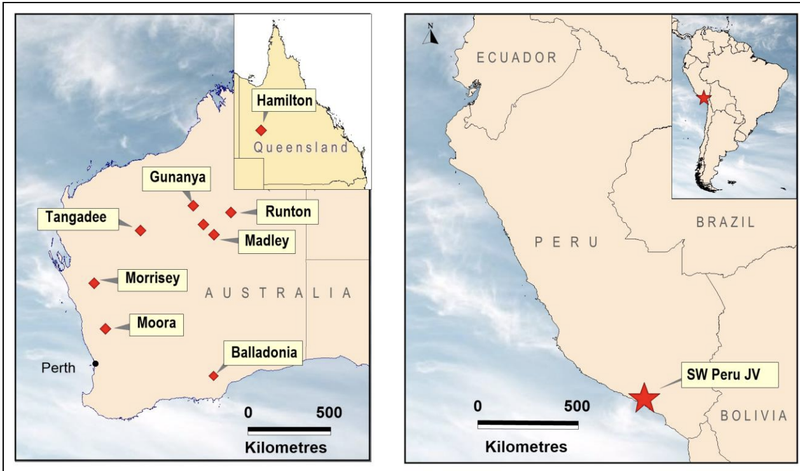

The $18 million capped junior holds in excess of 8,000km2 of exploration title in Australia and Peru (granted tenements and tenement applications) with seven projects (>3,000km2) under the SAA.

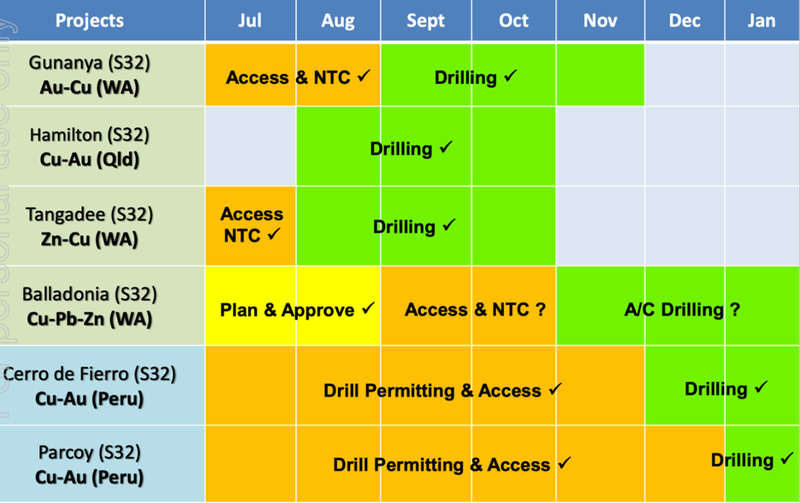

Due to COVID-19 restrictions, during the last quarter, AusQuest’s exploration focus turned to projects under the Alliance that are located specifically within Australia and which could be accessed in the second half of 2020.

This has resulted in preparations for drilling being initiated at two projects the Tangadee Zinc Project in WA and the Gunanya Gold-Copper Project, a new opportunity in the Paterson Province in WA.

Meanwhile, stage 2 drilling has now commenced at the Hamilton Copper Prospect in north-west Queensland under the SAA with South32. A total of six diamond drill-holes for approximately 1,800m is planned to test for copper mineralisation.

Drilling is expected to take approximately two weeks to complete with assays available within four weeks of the completion of drilling.

As for the other projects, Reverse circulation (RC) drilling programs will commence just days from now at a number of the Company’s projects, with drilling at Gunanya in the Paterson Province of WA to assist in determining its potential to host large-scale gold and copper mineralisation, similar to that found at Winu (Rio Tinto) and Havieron (Greatland Gold/Newcrest).

Overall, AQD will be accelerating its drilling campaign across several sites during the back half of this year, exploring for a range of commodities and mineralisation styles. These include large scale gold-copper deposits in the Paterson and iron oxide-copper-gold deposits in Queensland as well as stratabound zinc deposits in WA similar to those being mined in north-west Queensland.

There’s a lot to like about AusQuest.

It is a junior explorer with strong technical and targeting acumen and while exploration success is never a guarantee, the probability of discovery can be de-risked.

AQD is also in a solid capital position for future project generation. It ended the quarter with a cash position of ~$2.7M, with additional funding available from South32 for agreed work programs over Strategic Alliance Projects both in Australia and Peru.

With an extended SAA with S32 and renewed focus, AQD can confidently complete its operational objectives across its projects, whilst seeking out new target areas.

It should be a big back half of 2020 for AusQuest, as exploration at several targets reveals just what the company could be sitting on.

With that in mind, it’s time to introduce ...

Share Price: $0.031

Market Capitalisation: $22.35M

Cash Position: ~$2.7M

AusQuest: a quick overview

AusQuest Limited (ASX:AQD) offers investors something unique in the way of junior exploration companies.

Notably, it is applying its strategy of collaborative exploration: alleviating the financial burden of exploration, while allowing the company to progress a broad range of projects.

AusQuest is focused on large scale provincial opportunities, targeting major base and precious metals including copper, gold, zinc, silver and nickel.

AusQuest’s SAA with South32 funds its exploration, with the SAA providing cash flow into AusQuest’s projects and into the company.

The important thing for shareholders with regard to this unique situation is that any dilution occurs at the project level rather than impacting shareholder equity.

Whilst funded, AusQuest is managing all programs including drilling. To highlight its confidence in AusQuest’s projects, South32 CEO, Kerr, said when the agreement was put in place: “We are looking forward to working with AusQuest on potential opportunities to generate low-cost entry points for early stage exploration, outside our existing portfolio.”

South32 contributed approximately $7 million to AusQuest’s exploration activities in fiscal 2019. Following the extension of the SAA into 2020 and beyond, AusQuest remains in a strong position to continue its exploration pursuits across its broad range of projects.

Strategic alliance stronger than ever

The SAA with South32 extends out to at least the end of 2021.

Since 2017, the SAA has worked under an innovative framework in which AusQuest could use its extensive expertise to target new deposits and mineral provinces with major ore potential to generate and secure prospective early-stage exploration opportunities which are offered exclusively to South32.

Projects secured by AusQuest and offered exclusively to and accepted by South32, undergo a staged evaluation process which sees projects classified as either Exploration Opportunities or Drill-Ready Opportunities.

If a project is rejected twice by South32, at either the Exploration or Drill-Ready Opportunity stage, it becomes a rejected property and will no longer be subject of the SAA.

For Exploration Opportunities, work programs and budgets to advance each project to a drill-ready stage are agreed by the parties with South32 providing the necessary funds to complete the programs.

The companies will continue to work together to develop a pipeline of high-potential exploration opportunities in Australia, Peru and other agreed jurisdictions.

AusQuest’s managing director, Graeme Drew said of the extension, “This is a fantastic outcome for our shareholders with South32 backing the AusQuest team for a further two year period under a Strategic Alliance which has functioned extremely well since its inception in February 2017.

“The agreement is structured to provide AusQuest with the financial capability to identify and evaluate opportunities, as well as rewarding the company for success along the way.

“This extension of the SAA represents a strong endorsement of AusQuest’s credentials and technical skills, and is a vindication of the quality and scale of the projects we have been able to consistently bring to the table both in Australia and Peru over the past three years.”

The SAA also includes an arrangement to incentivise AusQuest’s project generation activities, with South32 agreeing to pay AusQuest a US$300,000 Bonus Generation Fee in the event that at least two Exploration Opportunities are accepted by South32 in a calendar year.

AusQuest will also receive an administration fee equal to 15% of funds expended on all projects under the SAA to help cover company overhead expenses and assist with the ongoing requirements for project generation studies.

US$4.5 million investment to acquire 70%

The Company now has seven projects that are currently Exploration Opportunities under the SAA: four in Australia and three in Peru.

Two were the subject of initial drill testing of targets (Balladonia in Western Australia, and Hamilton in Queensland), with follow-up drilling either underway or being proposed. Four are being advanced towards drilling, being Gunanya in the Paterson Province of Western Australia and Tangadee in Western Australia, Parcoy and Los Otros in Peru, and one (Cerro de Fierro) is the subject of a separate agreement with two stages of drilling already completed.

Once a project is accepted by South32 as a Drill-Ready Opportunity, it can then elect to earn a 70% interest in the project.

AusQuest must prepare a drill program and budget of at least US$500,000 in value and following agreement on the program, a joint venture agreement may be entered into on the key terms and conditions set out in the SAA.

Under these terms, South32 will contribute a total US$4.5 million to earn a 70% share in each joint venture and can then earn an 80% interest in each project by completing a pre-feasibility study.

The Peruvian projects are currently on hold while the country sorts through its COVID-19 response, which leaves AusQuest to put the majority of its current focus on its Australian assets.

Drilling in QLD

Hamilton Project (NW Queensland) – Copper-gold

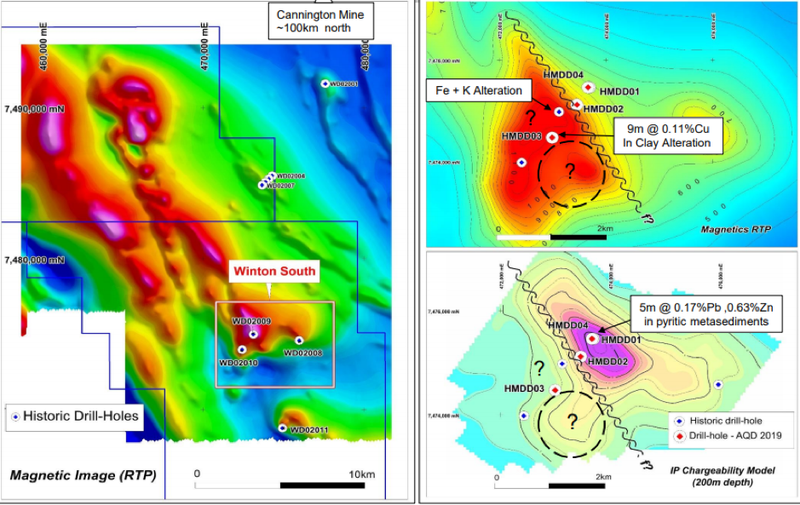

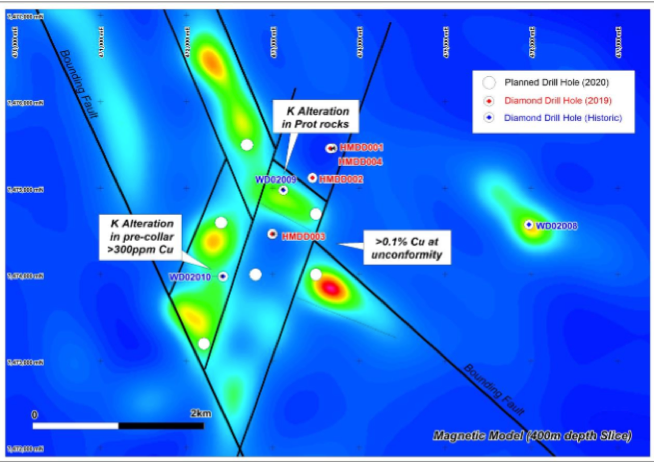

This week, AusQuest commenced drilling at the Hamilton Project in north west Queensland.

The Hamilton Project is located in north-west Queensland, approximately 120 kilometres south of the Cannington mine which is owned and operated by South32.

Limited historical drilling of magnetic and gravity targets in this area provided evidence for “near-miss” situations for Iron-Oxide Copper-Gold (IOCG) mineralisation beneath the cover sequence.

Under the SAA, a drilling program consisting of four holes for approximately 1400 metres was completed in September 2019 to test this target.

Anomalous copper values (9m at 0.11% copper) intersected within the overlying cover sequence are considered to be significant given they could represent leakage of copper from a nearby source within the magnetic complex being tested.

In June, AusQuest competed Heritage Surveys and received approvals to allow Stage 2 drilling to commence.

This is now underway as you can see by the image below:

A total of six diamond drill-holes for ~1,800m is being drilled to test for copper mineralisation proximal to previous drill-holes that provided strong indications of nearby copper mineralisation.

The Stage 2 drill-holes are widely spaced (~500m to 800m apart) and are designed to provide geochemical coverage of a variety of geological and geophysical targets beneath the Eromanga Basin cover sequence.

AusQuest’s Managing Director, Graeme Drew, said the Company was pleased to be drilling again following a period of consolidation of its Australian projects due to COVID-19 restrictions.

“The diamond drill program at Hamilton will be the first of several programs we are aiming to complete during the second half of 2020. Heritage surveys at our Tangadee Zinc Prospect have been completed and access into the Gunanya Gold-Copper Project in the Paterson Province of WA has also been confirmed, keeping our plans to complete drill programs in these areas before the end of the year on track.”

Assays are due four weeks after completion with Hamilton being very much a ‘watch this space’ story in 2020.

WA Projects – ready to drill

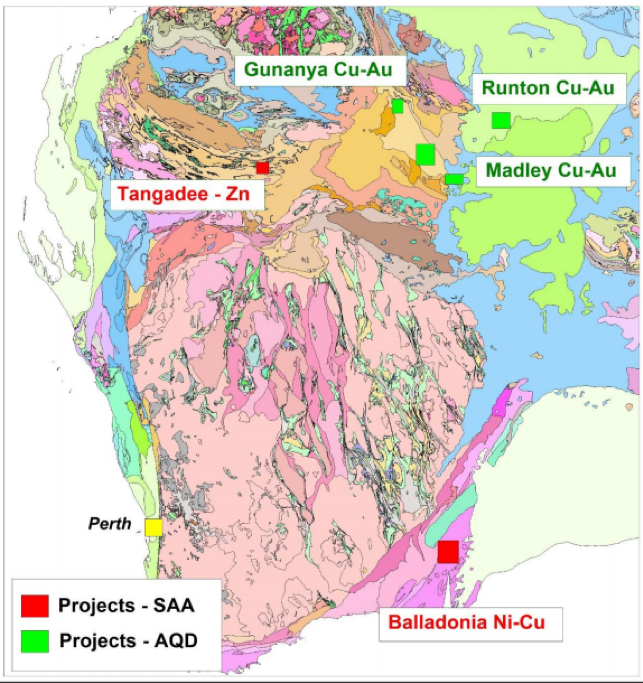

A key focus for AusQuest in Australia is large scale base metal deposits around the margins of the Yilgarn and Pilbara cratons in Western Australia.

The following map illustrates the breadth of AusQuest’s projects in Western Australia.

Now, let’s have a look at the projects.

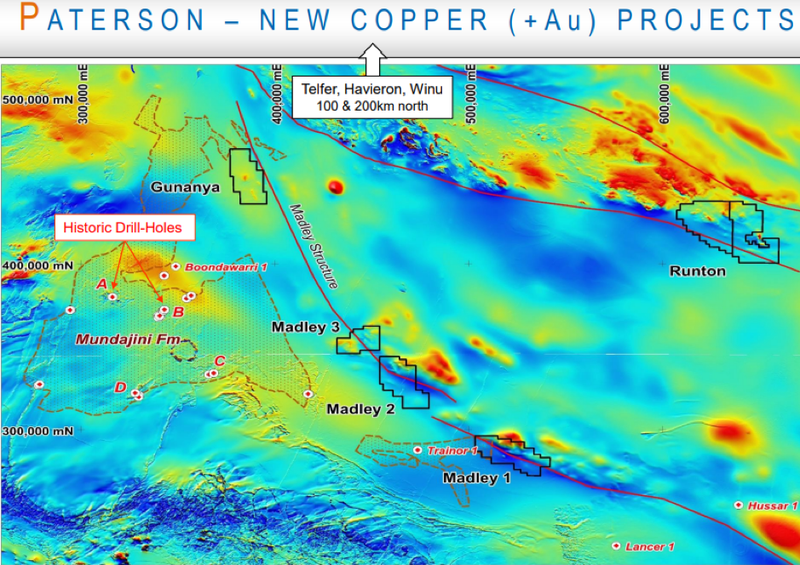

The Paterson Province – gold-copper

AusQuest expanded its portfolio of projects in Australia in 2019, acquiring a number of tenements in the Paterson province of Western Australia where Rio Tinto (ASX: RIO) and Greatland Gold (AIM: GGP) through their Winu and Havieron projects respectively have highlighted the substantial exploration potential of this region.

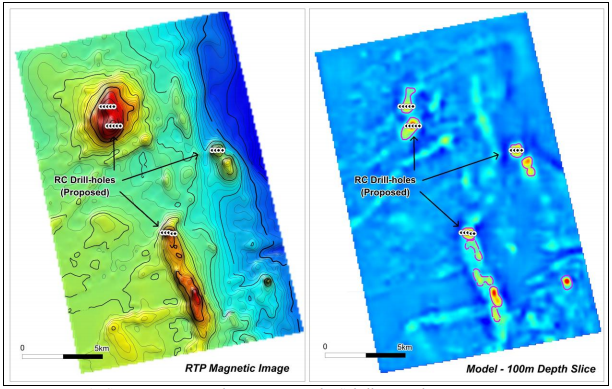

Now, AQD is poised to commence drilling potential gold-copper targets at the Gunanya Project, a move approved under its SAA with South32.

AQD will conduct a reverse circulation (RC) drilling program consisting of 6 to 9 drill-holes for a total of approximately 1,800 metres. Drilling is designed to provide an initial test of three targets defined by magnetics, which will assist in determining their potential to host large-scale gold and copper mineralisation, similar to that found at Winu (by Rio Tinto) and Havieron (by Greatland Gold).

At least two RC drill holes (200 metres apart) are planned over each of the three targets with the potential for further drilling to be undertaken subject to results. Drill holes are planned to test down to depths of approximately 200 metres.

Heritage Clearance surveys for a total of 19 drill sites are scheduled for late August and drilling is being planned for the September/October period, subject to receipt of all necessary clearances and the availability of drill rigs.

AusQuest managing director Graeme Drew underlined the significance of recent success in the Paterson Region saying, “The plan for early drilling of the Gunanya targets is a significant step forward in determining the potential of the project to host major gold and/or copper mineralisation similar to that found at other recent discoveries in the region.

“The Gunanya Project has several compelling targets based on analogies that we are able to draw with new discoveries in the Paterson Region from both a gold and a copper perspective. We are also evaluating several other opportunities in the Paterson for consideration under the SAA” he said.

“Drilling is the ultimate test of any target, and we are excited to be able to drill early in the exploration process at Gunanya.’’

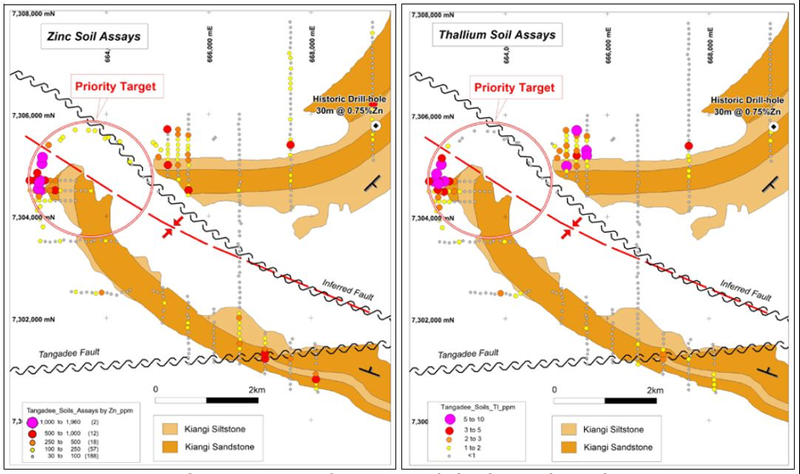

Tangadee – Zinc

Tangadee is a zinc project located approximately 150km south-west of Newman within the Edmund Basin of WA. It consists of one exploration licence covering an area of ~280km2.

AusQuest is targeting sediment-hosted zinc mineralisation similar to deposits found in north-west Queensland, with the area found to contain favourable host rocks, prospective large-scale structures and anomalous surface geochemistry, highlighting its potential.

Drilling will consist of a minimum of four (and up to eight) wide-spaced Reverse Circulation (RC) drill-holes (~1,400m to 2,400m) to test a large zinc (>1,000ppm Zn)/thallium (>5ppm Tl) soil anomaly that occurs within the core of a mapped synclinal structure adjacent to regional scale faulting, a priority setting for sediment-hosted zinc deposits in the Mt Isa region of north-west Queensland.

Drilling will commence around the end of August.

Balladonia – Base metals and rare earths

Back in WA, AusQuest intersected a carbonatite intrusion in the course of diamond drilling at its Telegraph Prospect, part of its Balladonia Project in the Fraser Range.

The company explained that this lies beneath the intense weathering/alteration that was reported from earlier air-core and reverse circulation (RC) drilling which also reported highly anomalous base metals (Cu, Pb, Zn, Ag).

Balladonia is another project subject to the company’s S32 SAA.

Carbonatite complexes are a major source of rare earth elements (REE) world-wide and are also known to contain base metal mineralisation (copper).

The discovery of a carbonatite intrusion/complex at the Telegraph prospect is considered to be the likely cause of the anomalous REE’s and base metals found within the weathered/altered profile.

Assay results from drilling at Telegraph confirmed the presence of a carbonatite intrusion and indicated the presence of a highly fractionated evolving system that is capable of producing both base metal and REE concentrations under the right conditions.

Work at Telegraph has been put on hold, whilst the Company reviews the implications of these results and their impact on the prospectivity of the region.

Peru remains a key medium-term target

Peru is a global leader in the mining industry and one of the world’s biggest producers of base and precious metals.

A study by the US Geological Survey (USGS), says Peru has the largest silver reserves and the second biggest copper and molybdenum reserves. It has a portfolio of 48 projects that represent investments of over US$57 billion by 2028.

Last year, mining investment amounted to US$6.15 billion, for this year the figure is set to increase to US$6.30 billion and next year to US$6.50 billion.

The mining sector is backed by an attractive legal and tax regime designed to support the industry, which has given weight to its political and macroeconomic stability.

High rates of production attract a large amount of inbound investment into the sector. An estimated US$59.5 billion is expected to flow into the country over the next few years.

That is no surprise, considering most of the world’s major mining companies, including BHP, Xstrata, Newmont, Glencore, Gold Fields, Freeport-McMoRan, Rio Tinto, Anglo American and Barrick have operations in Peru.

With that information in hand, it is little wonder that AusQuest entered this region.

The Peruvian projects

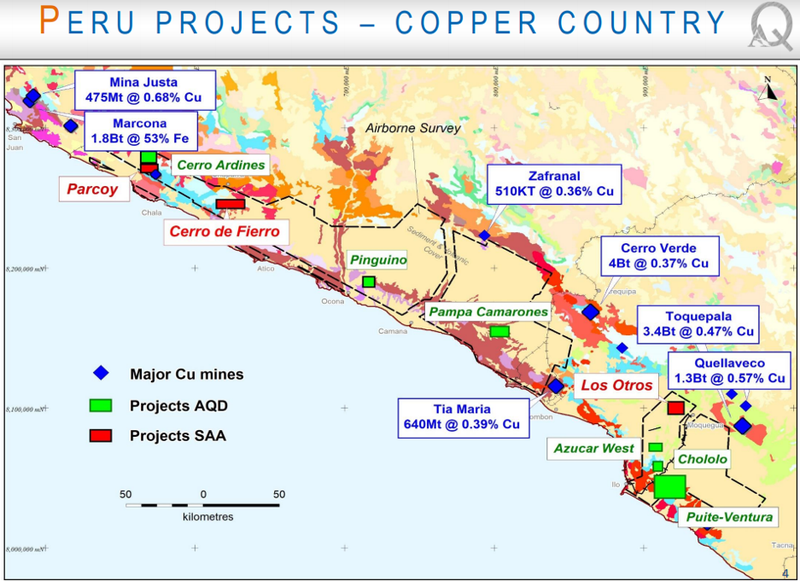

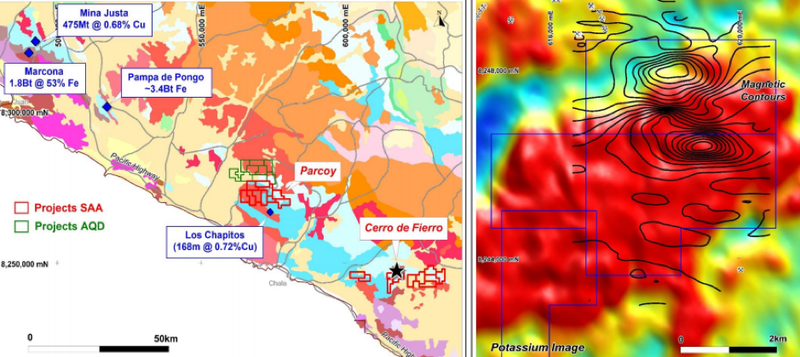

The following map illustrates AusQuest’s Peruvian projects, with projects under the SAA highlighted in red.

Notably, it’s AQD’s Cerro de Fierro project, which is under a separate agreement to its SAA with S32, which is the company’s most advanced project at present.

As stated, Cerro de Fierro in Peru is the subject of a separate agreement with South32.

This copper-gold project was a key focus early this year as the company looked to complete its stage II diamond drilling program.

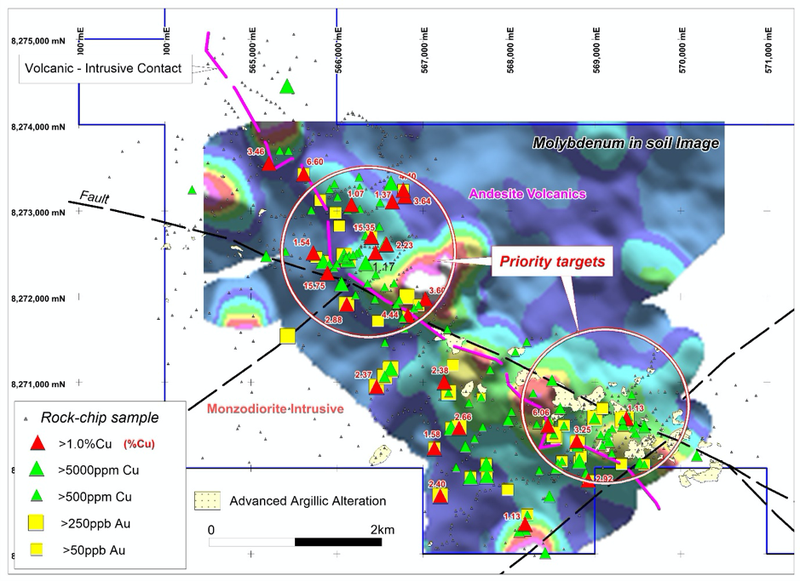

The company originally identified a magnetic target from its proprietary exploration data, suggesting the potential presence of a large iron oxide copper-gold system (IOCG) in the area. Initial drilling intersected economic grades and confirmed the existence of this system.

Earlier this year, AusQuest updated the market on its drilling program, highlighting encouraging results from a total of seven drill-holes for 3,200 metres drilled as part of the ongoing assessment of the IOCG (iron oxide copper-gold) prospect.

Copper mineralisation was intersected in every drill-hole but one.

Significant intersections from the current program include 51 metres at 0.3% copper, 0.2 g/t gold and 1.2g/t silver (including 6m at 1.2% copper, 0.4 g/t gold and 4.4g/t silver).

You can get the full picture in the following Finfeed article.

The copper mineralisation at Cerro is open in all directions and appears to be shallowing to the south where higher copper grades (>1% Cu) have already been identified by surface rock sampling. A new drill permit was expected to be approved around the middle of 2020 extending the current Permit Area to the south and allowing drilling to start shortly thereafter. This has been delayed due to COVID-19.

Parcoy Project

Also of importance is a high priority copper plus multi-element geochemical anomaly identified by AusQuest at the Parcoy Project, located ~50km north-west of Cerro de Fierro.

This project has highly anomalous copper and gold values at surface and is being progressed via the SAA with South32 towards drilling later in 2020 early 2021.

In terms of nearology, the Parcoy Project is located at the southern end of a recognised IOCG metallogenic belt, approximately 80 kilometres south-east of the Mina Justa mine development which boasts about 475 million tonnes at 0.68% copper.

In an upbeat discussion on this asset, Drew said, “There is obviously a lot of copper in the region and the possibility of manto-style mineralisation within the Parcoy Project area is tantalising and will be the focus of future exploration programs – including drilling.”

Commodities on the rise

With a significant emphasis on copper, it is worthwhile looking at current commodity movements.

Copper was the best performing base metal at the beginning of the year before dropping off. It is on the rise again as demand from the electric vehicle (EV) industry is set to increase with global efforts to reduce emissions.

As most of us know, copper plays an important role in the batteries used in battery electric vehicles (BEVs), but it is also used extensively in the electric motors that drive the wheels of BEVs.

Furthermore, copper also used intensively in the generation of electricity from renewables, such as solar and wind.

The following video explains the effect of copper on clean energy momentum:

It would thus seem that AusQuest has chosen to explore for a primary commodity with an enormous amount of upside.

In terms of its other commodities, zinc is also on the rise:

Zinc and lead have clawed their way back from four–year lows, with the price of zinc in the benchmark LME recuperating by more than 13% from March to June.

Better industrial data from China is also having an impact.

Meanwhile, gold is the metal of the moment.

The sustained and sizeable increase in the gold price that has occurred since August 2018, and quickly accelerated since mid-2019, slipped a little last week, but really shows no sign of abating reaching US$2000 per ounce this week.

There is a lot to look forward to in the final months of 2020 in terms of drilling, assays and potential catalysts to come.

It’s also worth noting that several of the commodities that AusQuest is exploring for in its multi-commodity portfolio, are performing exceptionally well.

All of this feeds into a big year for AusQuest in 2020, and we expect to see the share price reflect this as news continues to flow.

Given the recent performance of gold and copper in particular, the highly prospective regions AusQuest is exploring in, and the SAA with South32, there is a great deal of upside in this A$18 million capped junior.

Remember, South32 is a $10 billion company and it clearly sees something in AusQuest’s current projects and trusts the Aussie junior to continue to find highly prospective projects that it too can back.

With so much going on with existing projects and AusQuest tirelessly looking for new areas to explore, this is one junior that investors might consider adding to their portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.