20 gold nuggets, the ingots of tomorrow Part 3: Gold and silver drive down costs of production

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After covering 10 gold stocks across Tuesday and Wednesday, the precious metal is still looking strong and today we will examine five more companies that stand to benefit.

However, there are a few different slants to the clutch of stocks that we will run the ruler across today.

Firstly, they are explorers and/or developers of multi-commodity operations where income generated from the production of precious metals has the impact of reducing operating costs of what is in essence a base metal project.

From a geological perspective, the ore bodies that hold such minerals often come under the categories of volcanogenic massive sulphide (VMS) or copper-gold porphyry deposits.

They are generally operated by the big miners that target large, long life, low-cost projects.

Consequently, it is no surprise that some of our blue-chip mining groups have been throwing both financial support and technical expertise behind smaller companies that are looking to further explore and develop what are already considered as promising projects.

Some of these have established resources of significant size and grade.

All of the companies we examine feature precious metals such as gold and/or silver as a mineral that would potentially be produced in tandem with the primary commodity.

Addition of gold and silver drives Adriatic higher

Shares in Adriatic Metals PLC (ASX:ADT; FSE:3FN) have traded strongly since May 2018 when the company forged a relationship with Sandfire Resources NL (ASX:SFR), a development that has provided financial support and technical expertise to assist the company in progressing its zinc-lead-barite-silver mines at Veovača and Rupice in Bosnia and Herzegovina.

The company’s shares recently hit a 12 month high of $1.23, representing a six-fold increase since Sandfire announced its support.

While some profit-taking appeared to occur in July/August, investors were quick to pounce on the stock this week, and based on Wednesday is closing price the company’s shares were up 30% since Monday.

Looking specifically at silver, the commodity has broken through the US$17.00 per ounce mark, up from about US$14.30 per ounce less than three months ago.

From an operational perspective, the project comprises an advanced historic open cut mine at Veovača and Rupice, an advanced proximal deposit which exhibits exceptionally high grades of base and precious metals.

Adriatic’s short-term aim is to expand the current JORC resource at Veovača and to complete in-fill and expansion drilling programme at the high-grade Rupice deposit.

In July, the company released a maiden Mineral Resource Estimate for the group’s Rupice deposit, as well as an updated Mineral Resource Estimate for the Veovača deposit.

This has culminated in the group establishing Rupice as Bosnia’s highest-grade polymetallic deposit containing significant silver and gold credits, with 80% of the Mineral Resource in the Indicated Resource category.

The following map shows that the deposits are located in the prolific Balkan Metallogenic Belt, well known for hosting quality lead-zinc deposits.

The Rupice Mineral Resource begins at surface and currently extends to depths of 300 metres.

The mineralisation remains open with significant potential to increase the size of the Mineral Resource.

Drilling at Veovača has added gold and silver into the entirety of the Mineral Resource Estimate and increased the Indicated Resource category to 71%.

Adriatic now has a substantial resource inventory that can be used in initial scoping studies.

Hartleys resources analyst Paul Howard was impressed by recent developments, noting that the total combined resource for the Vareš Project is 16.8 million tonnes at 3.5% zinc, 2.2% lead, 23% barite, 0.3% copper, 120g/t silver and 1.1g/t gold.

With metallurgical test work underway and results expected in September quarter, Howard’s assumptions suggest the grade equates to approximately 9.4% zinc equivalent for 1.6 million tonnes of contained zinc equivalent metal.

He has a speculative buy recommendation on the stock with a price target of $1.46.

Hot Chili on fire as Cortadera continues to grow

In June, Hot Chili Ltd (ASX:HCH) released highly promising drilling results in relation to its Cortadera copper-gold porphyry discovery in Chile, triggering a share price surge of more than 10%.

Diamond drilling (DD) has expanded the growth potential of the Cortadera copper-gold deposit, confirming larger potential than management had anticipated.

The continuation of outstanding drilling results which have revealed large intersections of copper-gold mineralisation has resulted in the company’s shares continuing their strong run, hitting a 12 month high of 4.3 cents in July, representing a month on month gain of approximately 50%.

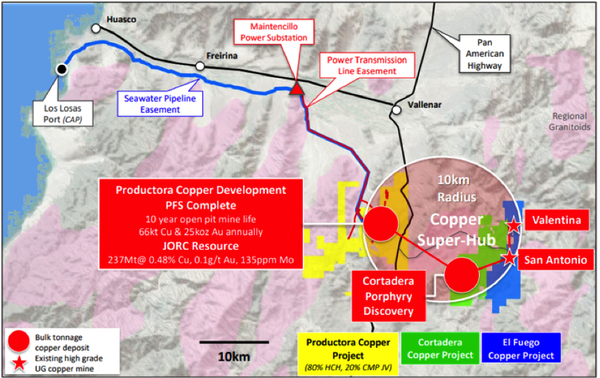

Importantly, Cortadera lies 14 kilometres from Hot Chili’s large-scale Productora copper development and adjacent to the high grade El Fuego satellite copper projects, as indicated below.

The background to Cortadera, and indeed management’s strategy in incorporating the asset into the broader Productora Copper Development is interesting.

In February, Hot Chili negotiated a formal option agreement to acquire a 100% interest in Cortadera, and in early April the company commenced a drilling program aimed at confirming and extending areas of surface enrichment and wide, higher grade copper-gold sulphide mineralisation which had not previously been closed off by 23,000 metres of historical drilling.

The company has created what it terms a Copper Super-Hub which has the potential to add scale to the Productora project while also increasing its returns on investment.

Ongoing exploration success has boosted management’s confidence that Cortadera is part of a much larger system.

While only at an early stage, the Cortadera discovery has demonstrated many characteristics commonly associated with major gold-rich, copper-gold porphyry systems.

Phase 2 drilling is currently underway, focusing on the largest of the four porphyries discovered to date where recent results confirmed a new, high grade, bulk tonnage zone.

Management recently confirmed that it had engaged independent consultants to prepare an initial mineral resource estimate (MRE) for Cortadera, a potential share price catalyst.

A transformational year for Inca Minerals

It was only on Tuesday that Inca Minerals Ltd (ASX:ICG) announced the acquisition of a second new IOCG-focused project called Frewena Fable.

Like Lorna May which was acquired in June, Frewena Fable is located in the Northern Territory.

These initiatives are part of a transformational approach for Inca which from a strategic perspective appears to position the company as a more focused operation with just as many if not more highly prospective assets than it had as a predominantly South American focused business.

However, Inca Minerals maintains an important foothold in South America through itsRiqueza project in Peru.

In what has been another strategically beneficial development for the group in 2019, management has secured South32 (ASX:S32) as an earn-in partner at Riqueza which is considered prospective for Tier-1 porphyry and skarn deposits.

Management is now replicating the strategy of attracting major mining houses as partners to early-stage projects in Australia.

The MaCauley Creek, Lorna May and now Frewena Fable acquisitions illustrate this strategy is well progressed.

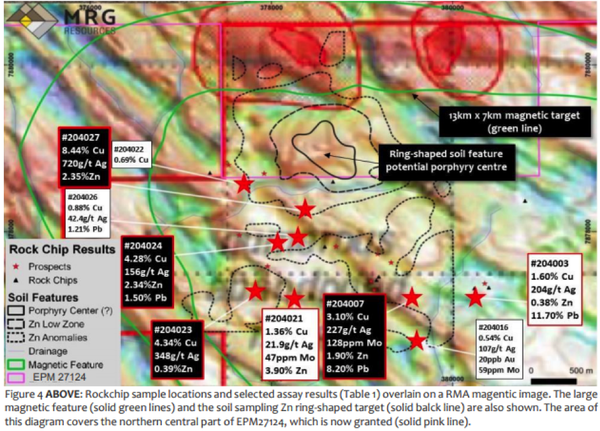

With the silver price in full flight, the MaCauley Creek project located in North Queensland shapes up as very interesting given geochemical sampling has returned samples such as 8.4% copper and 720 g/t silver and 4.3% copper and 348 g/t silver.

The deposit occurs within the Townsville-Mornington Island mineral belt, which hosts more than twenty porphyry deposits and/or prospects.

Is the Polar Express bound for Lundin?

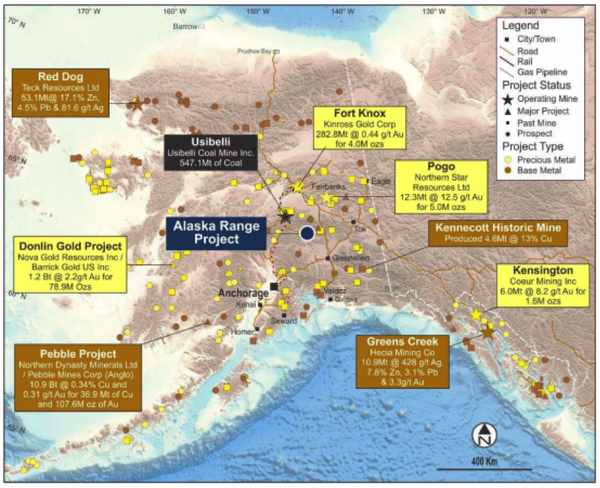

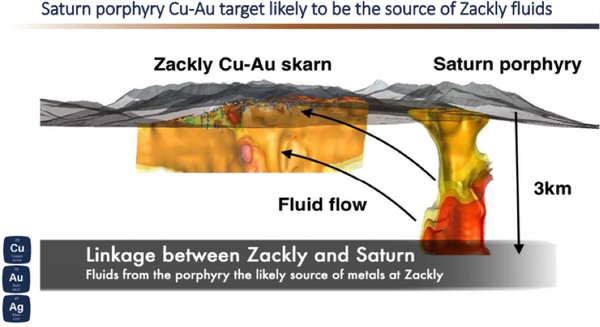

It was only last week that PolarX Ltd (ASX:PXX) released initial data from an Induced Polarisation (IP) survey over the Saturn target within its Alaska Range Project, an initiative that identified large anomalies which are consistent with the targeted copper‐gold porphyry mineralisation.

PolarX is exploring and developing the Alaska Range Project which covers approximately 260 square kilometres of State Mining Claims.

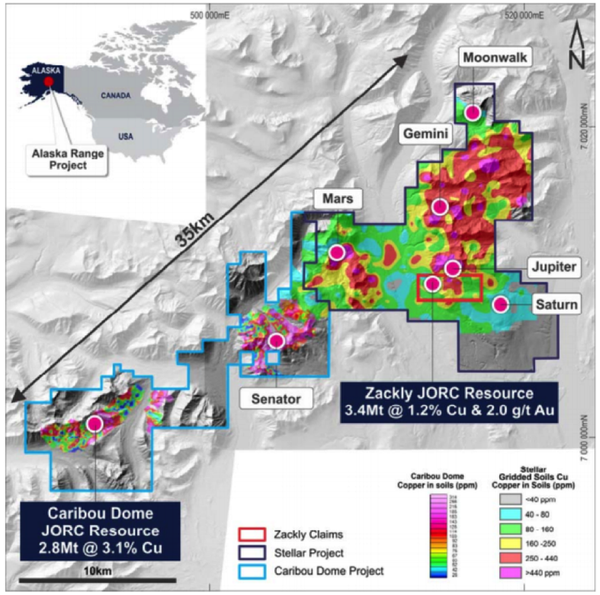

As indicated below, high-grade existing resources and numerous large unexplored advanced targets are within this impressive 35 kilometre mineralised belt now under PolarX’s control.

While more than 40 million ounces of gold have been mined to date in the broader region, the area remains considerably underexplored compared with other tier 1 provinces.

However, that appears to be quickly changing with a number of Australian companies either acquiring assets or taking interests in projects in that area, including Northern Star (ASX:NST), South32 and Sandfire Resources.

This video footage from the recent Noosa Mining Conference which features managing director Frazer Tabeart provides a comprehensive overview of the project, including management’s development strategy and near to mid-term exploration goals.

Both the Caribou Dome and Zackly deposits lie within the Alaska Range Project, and they have resource grades of 3.1% copper and 1.2% copper respectively.

Importantly, Zackly also has a gold grade of 2 g/t.

However, it is early days and there is the potential for resource expansion.

Management expects that the Zackly skarn will rapidly increase in size as the company drills to the east of the orebody.

Importantly, PolarX has chosen to maintain full ownership of Zackly as it expects that this asset alone will support a premium valuation for the company.

This appears to be an astute approach by management given that it has been able to attract one of the world’s most prominent mining groups to provide substantial funding for the Stellar Project.

In June, the company entered into a strategic partnership with Lundin Mining Corporation over the Stellar Project which includes the Saturn target under which Lundin Mining invested $4.3 million in PolarX to secure the right to subsequently enter a staged earn‐in joint venture.

An initial diamond drilling program comprising 8 to 10 deep holes at Saturn for a total of approximately 5000 metres has been agreed with Lundin Mining and the first two holes are now underway.

The following graphic shows the Saturn target as well as outlining the 35 kilometre belt which will be the focus of further exploration activity.

If exercised, Lundin Mining can acquire a 51% interest in Stellar by staged exploration spending of US$24 million and staged cash payments to PolarX of US$20 million within three years.

Lundin Mining is now PolarX’s largest shareholder with a 12.85% stake.

Shares in PolarX have more than doubled since May, and this can partly be attributed to the market’s recognition of Lundin Mining’s investment as an endorsement of the project’s prospects.

From a geological perspective, management believes that the Saturn anomaly could potentially be the fluid source for the east-west trend skarn mineralisation and alteration discoveredat Zackly.

White Rock up 80% since June

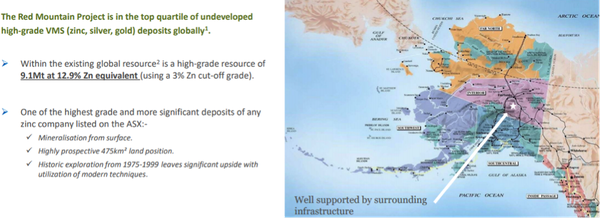

White Rock Minerals (ASX:WRM) is a diversified explorer and near-stage producer, with its flagship exploration asset being the Red Mountain Project in central Alaska, where it has an earn-in joint venture arrangement with Sandfire Resources.

There are already two high grade deposits at Red Mountain with an Inferred Mineral Resource of 9.1 million tonnes at 12.9% zinc equivalent for 1.1 million tonnes of contained zinc equivalent.

White Rock’s other asset is the Mt Carrington gold-silver project in northern New South Wales.

This could be brought into production in relatively quick time given the existing infrastructure and the already established resource of 341,000 ounces of gold and 23.2 million ounces of silver.

No doubt, the inherent value in the Mt Carrington project is being better recognised now that both gold and silver are on a roll.

In terms of Mt Carrington’s potential development, a PFS conducted in 2017 was based on a ‘gold first’ staged operation.

During the June quarter, strong Australian gold prices encouraged management to continue to explore avenues to advance the Mt Carrington Project with interested parties and several corporate advisory groups.

Based on a gold price upwards of $2000 per ounce there is the potential for Mt Carrington to generate a significant return on investment with an NPV8 at 2 times capital expenditure, generating free cash flow of $80 million and an internal rate of return (IRR) of 70% with a capital payback of just 13 months.

It is also important to note though that the company’s existing resource at Red Mountain boasts strong silver grades and there is evidence from more recent exploration that gold grades could also continue to increase.

This could potentially drive down the costs of a project where the primary metal is zinc.

During the quarter, White Rock in conjunction with Sandfire, commenced a comprehensive program exploring for high-grade zinc and precious metals volcanogenic massive sulphide (VMS) deposits.

Sandfire's Joint Venture funding arrangements under the agreement are structured across four stages and include an option to spend a minimum of $20 million over four years to earn 51%, with a minimum contribution of $6 million in 2019.

Sandfire can then elect to increase its interest in the Red Mountain Project to 70% by sole-funding a further $10 million and by delivering a pre-feasibility study within a further 2 years.

In terms of valuation, Baillieu Holst analyst Warren Edney made some interesting observations when he ran the ruler across the stock in 2018.

At that stage, he was assuming an Australian dollar gold price of $1730 per ounce, some $500 per ounce shy of where the precious metal has traded recently.

Using these metrics he said, ‘’Our analysis generates a pre-tax ungeared NPV of $22.8 million ($14.6 million on an after-tax basis).

‘’This could represent a base case given that it does not include Stage 2 but would be a more robust proposition if the mine life was increased.

‘’Our view is that Mt Carrington’s value should be reflected in WRM’s market capitalisation as it does represent a potential development option given the potential funding from Cartesian.’’

Cartesian is still one of White Rock’s largest shareholders with a stake of 4.7%, and its involvement in financing project development is a possible scenario.

However, setting aside what may happen on the development front, it could be argued that investors are starting to realise the value that lies in White Rock as the recent share price increase has seen its market capitalisation increase from around $8 million in June to approximately $13 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.