$150 million in cash, yet so FAR from intrinsic value

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FAR Limited (ASX:FAR) announced on Monday that the COVID-19 pandemic combined with the steep fall in Brent oil price by over 60% since January 2020 had adversely impacted global financial markets including the global availability of credit.

Consequently, FAR’s ability to close the Sangomar Project debt arrangements that were ongoing during this time have been compromised such that the lead banks to the senior facility have now confirmed that they cannot complete the syndication in the current environment.

Normally a development such as this would result in a sharp decline in a company’s share price, but in the case of FAR it prompted a 20% surge in the company’s share price, indicating that investors are starting to assess the big picture.

While a question mark hangs over financing, there is no question that FAR is in a strong financial position with arguably the best global energy project of any ASX listed company of a similar size.

In fact, with a market capitalisation of about $110 million, FAR is punching well above its weight – or from another perspective, it is trading well below where it should be.

As a backdrop, FAR has zero debt and cash of $150 million.

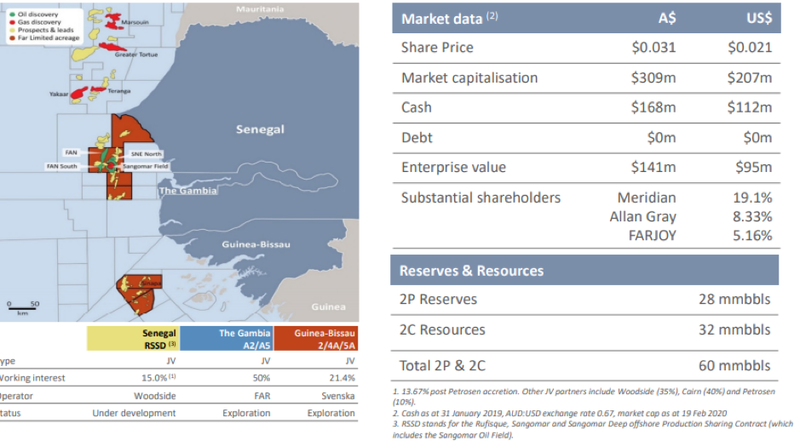

The company is a joint venture partner in developing one of the largest offshore oil discoveries of the last ten years (Sangomar), which post project delivery in early-2023 is expected to make FAR one of the largest ASX-listed oil producers – note the reserves and resources below.

Largest hydrocarbon discovery in 2014

A Final Investment Decision was taken in January 2020 for the world class Sangomar Oil Field in Senegal, the largest global hydrocarbon discovery in 2014.

Sangomar is a phased development targeting up to a gross amount of 100,000 barrels of oil per day (bpd), with the potential to transform FAR from explorer to material producer in early 2023.

It is worth noting that FAR has a 15% stake in the project, as well as other interests in Gambia and Guinea-Bissau, boosting the group’s underlying asset valuation well beyond its enterprise value of $150 million.

Importantly, the Sangomar Oilfield is a low cost operation at US$22/bbl breakeven cost from first oil underpinned by attractive fiscal terms and experienced offshore operators including Woodside Petroleum.

It should be remembered that oil was trading in the vicinity of US$50 per barrel only a month ago.

Pushing above US$20 per barrel in 1999 the commodity has only ever traded below that level for a matter of weeks.

US$20 per barrel is a blip

With oil now trading at sub GFC lows, it is difficult to see the commodity falling considerably lower.

Should a recovery occur, the Sangomar project will be one of the first to move to commercial viability based on its low-cost profile.

With financial and equities markets in a state of disarray at the moment, it isn’t surprising that the FAR decision has been put on hold.

However with attractive economics of an NPV10 of $650 million immediately following first oil in early 2023, it would be surprising to see FAR having to wait long in order to negotiate a suitable funding arrangement.

Plenty of shareholder value to preserve

Managing director Cath Norman is focused on maximising shareholder value, and in response to these recent developments she said, ‘’At the end of February 2020 the company had approximately $150 million cash at bank and no debt.

‘’As announced on 25 March 2020, the Sangomar Operator, Woodside, and our joint venture partners continue to explore and evaluate all options to preserve and enhance the value of this world class development.

‘’In view of the current global economic climate, the Board has commenced a process to review all strategic alternatives available to the company which are focused on preserving shareholder value for the longer term.’’

Analysts at Bell Potter ran the ruler across FAR just 10 days ago, reaffirming their buy recommendation and revising their valuation to 5 cents per share.

This isn’t far shy of the consensus valuation of 6 cents per share, but more importantly it implies share price upside of more than 300% to today’s closing price of 1.2 cents.

Consequently, yesterday’s 20% rerating could be the start of further upside.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.