Core Exploration announces maiden Mineral Resource estimate at Lithium Project in NT

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Emerging Australian lithium developer, Core Exploration Limited (ASX:CXO), has announced a maiden Mineral Resource estimate for the BP33 Lithium Deposit at its Finniss Lithium Project in the Northern Territory.

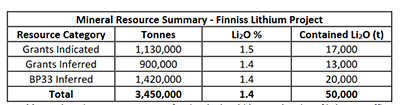

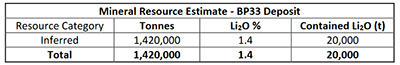

The Maiden Mineral Resource estimate defined by drilling to date within the BP33 Prospect, comprises an Inferred Resource of 1.4Mt at 1.4% Li2O and this grows the total Mineral Resources at Finniss to 3.45Mt @ 1.4% Li2O.

The potential to expand the maiden BP33 Mineral Resource is considered high as the resource is currently extended only 20 metres south of the most recent drill intersection of 75m @ 1.68% Li2O at the southern end of BP33.

Resource extension and exploration drilling will recommence next month at BP33, to test directly south of the high-grade lithium drill intersection. The aim of the drilling is to increase the size of the maiden resource.

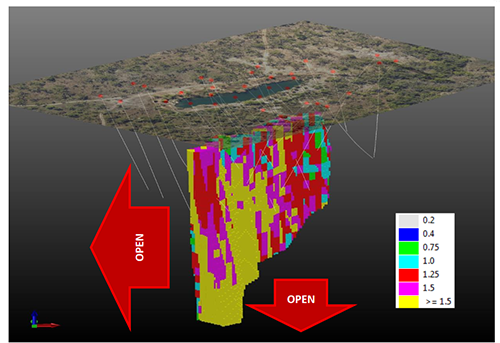

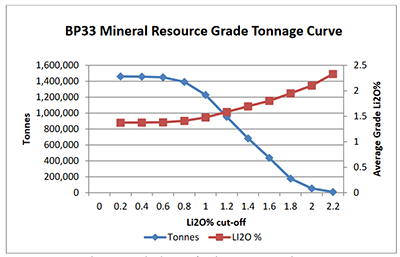

This diagram shows the Lithium Grade (%Li2O) of BP33 Resource at the Finniss Lithium Project:

The BP33 Mineral Resource is open to the south and south-west in a 300 metre long target area between pegmatites identified at surface at BP32 Prospect and BP32W Prospect.

CXO’s next drilling at BP33 is planned to immediately define the south and south-west extensions to the BP33 Resource and undertake exploration drilling in the target area between the BP33 Resource and BP32 and BP32W prospects.

Of course it is an early play, and investors should seek professional financial advice if considering this stock for their portfolio.

The company will also recommence aggressive exploration and resource expansion drilling campaigns in coming weeks over the larger Finniss Lithium Project area:

The aim is to substantially grow the Mineral Resource base for the Finniss Lithium Project which underpins a potential long-life lithium mining and production business.

Core’s Managing Director, Stephen Biggins, stated: “We see the addition of resources at BP33 as highly valuable addition to the Finniss Project, and a first step in demonstrating strong potential for incremental growth to potential mine life that can be delivered by the highly prospective ground position over the Bynoe Pegmatite Field near Darwin in the Northern Territory.

“We strongly believe that the BP33 deposit remains open to the south based on previous drilling delivered wide and high grade intersections of lithium mineralisation, and we look forward to expanding the resources at BP33 and the Finniss Project through our ongoing exploration and resource drilling.”

Core’s Pre-Feasibility Study

CXO is in the final stages of completing a Pre-Feasibility Study (PFS) for the development of a spodumene concrete and/or direct shipping ore operation from the Grants Lithium Deposit, and expects to deliver the PFS next month.

The company expects to complete a full Feasibility Study for the development of mining and processing lithium from the Finniss Lithium Project. This is subject to positive results from the PFS. It aims to complete regulatory approvals, financing and internal approvals, and commence production at Grants, at the end of 2019.

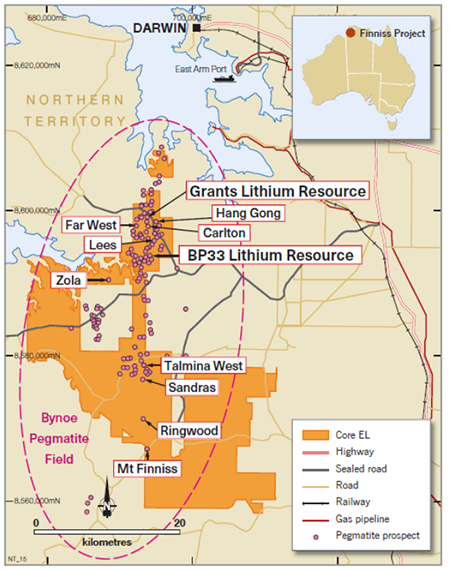

The Finniss Lithium Project has substantial infrastructure advantages supporting the Project’s development, such as being close to grid power, gas and rail. It is also within easy trucking distance by sealed road to Darwin Port, which is Australia’s closest port to Asia.

BP33 Lithium Resource

The BP33 Lithium Deposit is hosted within a rare element pegmatite that is a member of the Bynoe Pegmatite Field. It is situated 15km south of Darwin and extends for up to 70km in length and 15km in width. Over 100 pegmatites are known within clustered groups or as single bodies. Individual pegmatites vary in size from a few metres wide and tens of metres long up to larger bodies tens of metres and hundreds of metres long.

The results of the Mineral Resource Estimate, including BP33 and Grants, are included in the table below:

The Mineral Resources are reported at a high cut-off at 0.75% Li2O.

CXO contracted Dr Graeme McDonald (BSc PhD MAusIMM) to undertake the Mineral Resource estimate for the BP33 Lithium Deposit. As part of the preparation, Dr McDonald developed:

- a geological interpretation based on cross sections

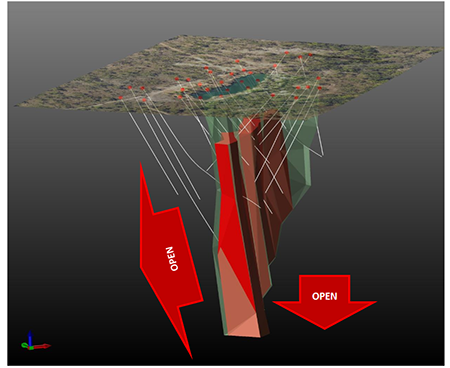

- a 3D geological interpretation from interpreted cross sections

- domain interpretations for lithium

- a black model of the deposit

- a geostatistical analysis of the data, and

- estimated lithium grades.

His report notes that fresh pegmatite at Bp33 is composed of coarse spodumene, quartz, albite, microcline and muscovite (in decreasing order of abundance). Spodumene is a lithium bearing pyroxene (LiAl(SiO3)2). It is the predominant lithium bearing phase and displays a diagnostic red-pink UV fluorescence. The pegmatite is not strongly zoned, apart from a thin (1-2 metre) quartz-mica-albite wall facies and some barren internal quartz veins.

The diagram above shows the BP33 Main Pegmatite (green) and Resource (red/brown) open along strike to the south and at depth.

BP33 has a flat Grade-Tonnage curve at the 1.3% Li2O “sweetspot” for spodumene production.

A high 0.75% Li2O cut-off grade results in no significant reduction in the contained tonnes, demonstrating the consistent high-grade nature of the Resource.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.