XCD Energy, the new arrival on the North Slope, confirms 1.6 billion barrel prospective oil resource

Published 21-JAN-2020 13:10 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

XCD Energy’s (ASX:XCD) Project Peregrine is one of the world’s newest, highly prospective onshore oil plays, and it's nestled in one of the globe’s hot spots for oil discoveries – Alaska’s North Slope.

XCD Energy today announced the outcomes from the maiden Independent Prospective Resources Report that was recently completed by ERC Equipoise Pte Ltd (ERCE) for its 100% owned Peregrine Project.

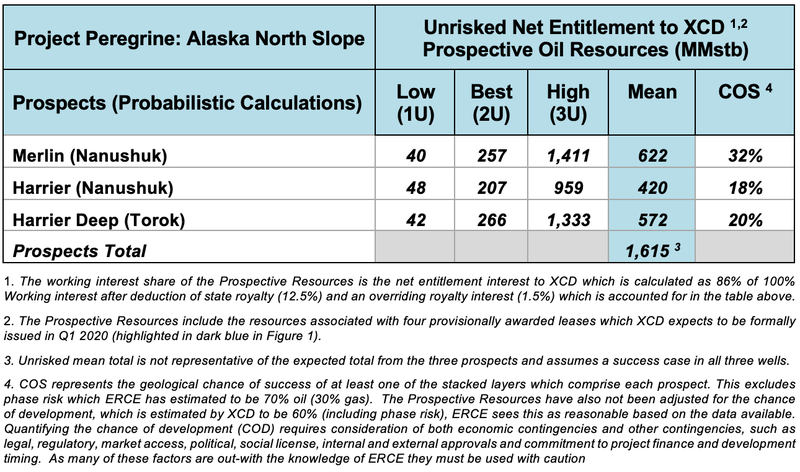

ERCE assessed a mean unrisked recoverable oil prospective resource of 1.615 billion barrels of oil net entitlement (after royalties) for Peregrine.

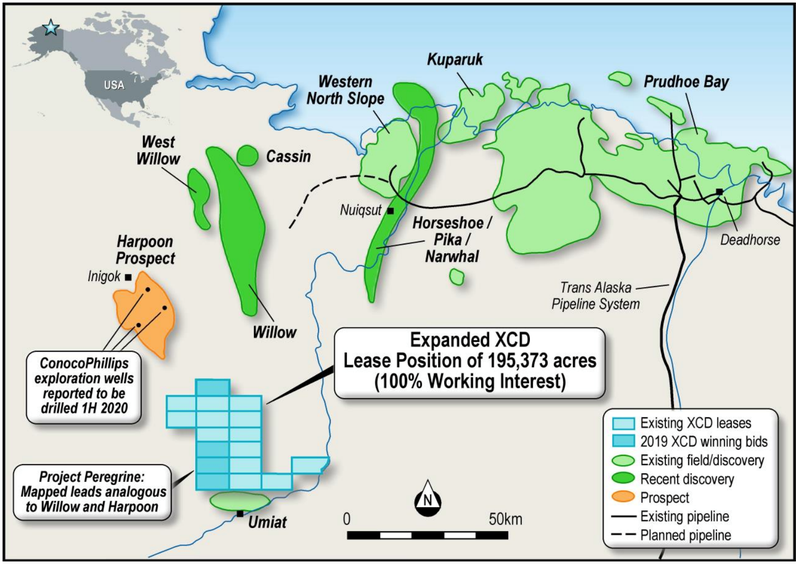

Located directly adjacent to ConocoPhillips large acreage position at its Willow discovery, XCD’s leases cover an area of 195,373 acres on the North Slope of Alaska in the National Petroleum Reserve-Alaska (NPR-A). The leases have a five to ten-year exploration period remaining, while XCD has a 100% working interest in the acreage.

ConocoPhillips’ Willow is a US$5 billion project with potential for 100,000 barrels of oil daily when it commences production in 2024-2025.

The company’s 1.6 billion barrel prospective resource is associated with three prospects – Merlin (Nanushuk formation), Harrier (Nanushuk formation), and Harrier Deep (Torok formation) at Project Peregrine:

ERCE is the largest global independently owned petroleum reserves and resources auditor, providing expert consultancy services to the upstream oil and gas industry for over 40 years.

The data used to compile the independent prospective resource report includes reprocessed 2D seismic data, basin modelling, petrophysical analysis of publicly available wells and historical geological records. Having recently secured additional leases in the NPR-A lease, ERCE integrated the new leases into the volumetric calculations and report.

XCD Energy’s wholly owned subsidiary, Emerald House LLC, was the high bidder on 45,783 acres over the four leases in the NPRA-A lease sale, while US oil major ConocoPhillips (NYSE: COP) and regional exploration pioneer Bill Armstrong’s North Slope Exploration LLC also managed to secure significant tracts.

Both the Harrier and Merlin Prospect at Peregrine are targeting the shallow Nanushuk play at around 4,300ft and 3,400ft, respectively, and can potentially be drilled using a smaller drilling rig, something that XCD is assessing. The Harrier Deep Prospect would require a standard north slope drill rig to reach the Torok target (~10,000 ft) but would intersect both the shallow Nanushuk and the deeper Torok objectives in the same wellbore.

XCD’s initial Merlin Lead is interpreted to be on the same sequence boundary west of the “break in slope” common to both Willow and Merlin

With the prospective resource complete, XCD will turn its focus to initiating a farm-out campaign, where the options available to farm-in partners will be to pursue either the two well low cost shallow Nanushuk drilling initiative or use a standard north slope drilling rig to pursue all the targets in the Harrier and Merlin Prospects.

XCD’s 100% working interest in 195,373 acres over one of the world’s newest, highly prospective onshore oil plays provides significant leverage in securing a partner. The significant size of its prospective resource at 1.6 billion barrels will also draw attention.

The company will then work towards an initial drilling program penciled in for the next northern winter, in 2021.

XCD’s Managing Director, Mr. Dougal Ferguson commented:

“This excellent result is the culmination of a substantial amount of technical work that has been undertaken over the last six months. We are now able to embark on our farm-out campaign with confidence that the size of the prize is significant enough in our lease area to attract large companies. With a raft of wells being drilled in both the NPR-A and State lands by other companies over the current Alaskan drilling season, it should be an exciting period for XCD and any success nearby will significantly upgrade our current lease position.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.